Quick Navigation

Introduction

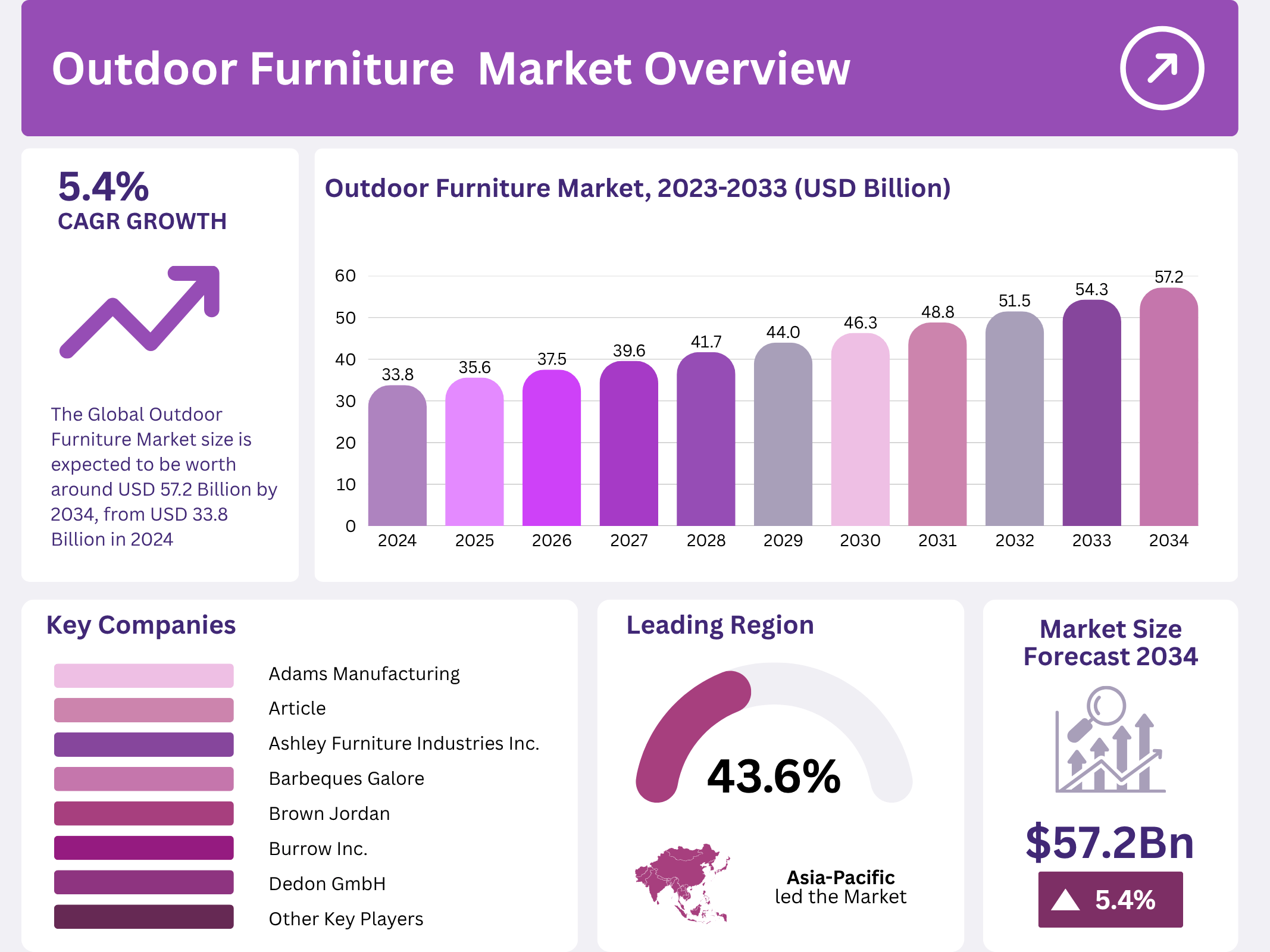

The Global Outdoor Furniture Market is projected to reach USD 57.2 billion by 2034, growing from USD 33.8 billion in 2024 at a CAGR of 5.4%. This growth is fueled by increasing consumer interest in outdoor living spaces and a strong preference for stylish, durable, and sustainable designs.

The market continues to expand as homeowners and commercial establishments invest in modern outdoor environments. Driven by urbanization, rising disposable incomes, and eco-conscious lifestyles, outdoor furniture is becoming an integral part of residential and hospitality design trends globally.

Furthermore, technological integration and sustainability trends are reshaping consumer expectations. Manufacturers are responding with smart, weather-resistant, and environmentally responsible furniture that enhances comfort and functionality in open-air spaces.

Key Takeaways

- The global outdoor furniture market is projected to grow from USD 33.8 billion in 2024 to over USD 57.2 billion by 2034, expanding at a CAGR of 5.4%.

- Seating Sets lead the market with a dominant share of 37.4% in 2024, driven by demand for comfortable and stylish outdoor living.

- Wood remains the dominant material, capturing 42.3% of the 2024 market share due to its durability and timeless appeal.

- Residential outdoor furniture holds the largest share at 63.4% in 2024, supported by home improvement trends.

- Home Centers dominate distribution with 35.2% share, offering competitive prices and wide product ranges.

- Asia Pacific leads with 43.6% market share in 2024, driven by rapid urbanization and middle-class growth.

Market Segmentation Overview

The product landscape is led by Seating Sets, which capture over 37.4% of the market. These modular and multifunctional sets dominate due to the rising demand for stylish, comfortable seating solutions suitable for patios, balconies, and gardens. Their adaptability ensures consistent growth across residential and hospitality spaces.

By material, Wood holds the largest share of 42.3% in 2024. Its natural aesthetic, durability, and eco-friendly characteristics make it a preferred choice. Rising demand for sustainable products and improved weather-resistant coatings further enhance its long-term appeal in the outdoor furniture industry.

The Residential segment accounts for 63.4% of market share, as homeowners invest heavily in outdoor spaces for leisure and entertainment. This trend is bolstered by post-pandemic lifestyle changes and the desire for multifunctional spaces that combine comfort, nature, and social interaction.

By distribution, Home Centers lead with a 35.2% share. Their success stems from product variety, accessibility, and affordability. Consumers favor these retail formats for the convenience of one-stop shopping, supported by expanding e-commerce integration.

Drivers

A key driver for the market is the rising demand for outdoor living spaces. As more consumers transform balconies, patios, and gardens into functional extensions of their homes, the need for quality, durable, and stylish outdoor furniture continues to grow. The integration of indoor-outdoor design further boosts adoption.

Another major driver is increased focus on sustainability. With eco-conscious consumers demanding responsibly sourced materials, brands are producing furniture using recycled plastics, FSC-certified wood, and low-emission manufacturing methods. This shift is helping companies align with global green initiatives and attract a new demographic of eco-aware buyers.

Use Cases

In residential applications, outdoor furniture is increasingly used to create relaxation and socialization zones. From family gatherings to private retreats, consumers value modular, weather-resistant designs that blend functionality with aesthetics, enhancing their living experiences.

In commercial sectors, particularly in hospitality and restaurants, outdoor furniture plays a crucial role in customer experience. Luxury resorts, cafes, and hotels are investing in stylish and durable furnishings to provide inviting, comfortable, and brand-aligned outdoor environments.

Major Challenges

The high cost of premium materials like teak, wrought iron, and synthetic rattan remains a major challenge. While these ensure durability and elegance, they significantly raise the final product price, restricting affordability for mid-income consumers in emerging markets.

Another pressing challenge is volatility in raw material and shipping costs. Global supply chain disruptions and inflation have increased production expenses. These fluctuations often translate to higher retail prices, discouraging large-scale adoption among budget-conscious buyers.

Business Opportunities

A growing opportunity lies in the eco-friendly furniture market. Manufacturers investing in recyclable materials, biodegradable components, and sustainable production processes can gain a competitive edge. With consumers prioritizing sustainability, this segment is expected to see exponential growth over the next decade.

Another promising avenue is the integration of smart technology. Furniture embedded with wireless charging, solar lighting, and climate control is attracting tech-savvy consumers. These innovations not only enhance user experience but also increase the perceived value of modern outdoor furniture.

Regional Analysis

The Asia Pacific region leads the global outdoor furniture market with a commanding 43.6% share in 2024, valued at approximately USD 14.7 billion. Rapid urbanization, expanding disposable incomes, and a strong housing sector drive growth across China, Japan, and India.

Meanwhile, North America and Europe collectively hold significant market shares. In North America, the U.S. drives demand for sustainable and premium-grade furniture, reflecting mature consumer preferences. Europe follows closely with countries like Germany, France, and Italy leading in outdoor design innovation and sustainability initiatives.

Recent Developments

- In 2024, Herman Miller launched a new bamboo-based material for its Eames Lounge Chair, reinforcing its eco-friendly design commitment.

- RH (NYSE: RH) introduced the 2024 Outdoor Sourcebook with over 40 new premium furniture designs crafted from teak and aluminum.

- Wayfair Inc. (NYSE: W) reported strong Q3 2024 performance, expanding its market presence and focusing on long-term profitability.

- Twin Star Home acquired Grand Basket in 2024 to strengthen its wicker furniture portfolio and boost its e-commerce platform.

Conclusion

The Outdoor Furniture Market is witnessing robust expansion, supported by evolving consumer lifestyles, sustainability trends, and technological innovation. With Asia Pacific at the forefront and global brands embracing eco-conscious manufacturing, the sector is set for long-term growth. As outdoor living becomes integral to modern homes, this market will continue to thrive through 2034.