Quick Navigation

Introduction

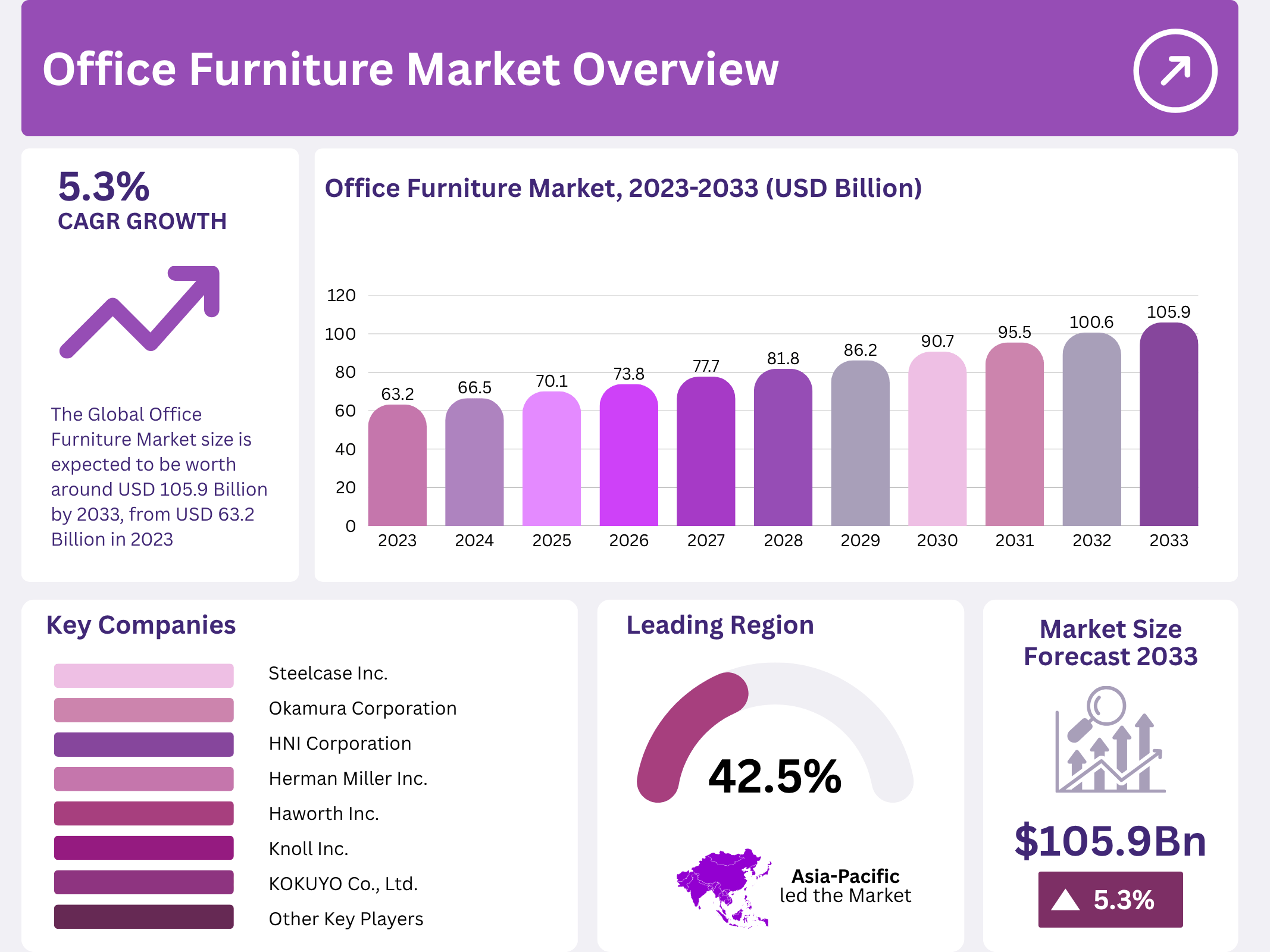

The Global Office Furniture Market size is expected to be worth around USD 105.9 Billion by 2033, from USD 63.2 Billion in 2023, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033.

The global office furniture market continues to expand, driven by evolving workplace trends and rising investments in ergonomic and modular designs. As hybrid work becomes the new standard, companies are rethinking their office layouts, fueling demand for flexible furniture solutions. Additionally, coworking spaces contribute significantly to this renewed momentum.

Moreover, the market benefits from the resurgence in office visitation worldwide. With organizations prioritizing employee comfort and productivity, modern office setups increasingly incorporate sustainable, durable, and customizable furniture. This shift further accelerates market growth across regions and industry verticals.

Key Takeaways

- The Office Furniture Market was valued at USD 63.2 Billion in 2023 and is expected to reach USD 105.9 Billion by 2033, with a CAGR of 5.3%.

- In 2023, Wood is the leading material type with 40%, due to its aesthetic and durability advantages.

- In 2023, Economic price range dominates at 37%, reflecting demand for affordable office solutions.

- In 2023, Offline Retail Stores hold 60% of the distribution, highlighting the preference for in-person furniture purchases.

- In 2023, the Asia Pacific region leads with 43.0%, driven by expanding commercial spaces.

Market Segmentation Overview

By product type, the market spans storage units, seating, desks and tables, workstations, and other categories. As businesses modernize their workspaces, seating and workstation segments gain momentum, particularly due to ergonomic innovations. This transition supports enhanced productivity and comfort across varied workplace environments.

By material type, the dominance of wood at 40% underscores its appeal for long-term durability and aesthetic value. Meanwhile, metal and plastic offerings continue to grow as companies seek modern, lightweight, and cost-effective solutions. Glass-based furniture also emerges gradually within sleek, contemporary office designs.

By price range, the economic segment leads with 37%, driven by SMEs and startups prioritizing affordability. Medium-range furniture attracts buyers seeking a balance of value and durability, while premium offerings appeal to corporates emphasizing brand image and long-lasting quality.

By distribution channel, offline retail retains a commanding 60% share due to the need for physical interaction with furniture. Businesses value the ability to assess ergonomics and material quality firsthand. Concurrently, online channels are expanding quickly with competitive pricing and detailed product insights.

Drivers

The rising demand for ergonomic furniture significantly accelerates market growth. Organizations increasingly prioritize employee well-being, investing in height-adjustable desks, lumbar-support chairs, and modular designs. These ergonomic advancements promote productivity and reduce workplace fatigue, strengthening long-term demand.

Additionally, the rapid expansion of coworking spaces fuels the need for flexible, adaptable furniture. These work environments require reconfigurable units that suit diverse users and activities. As coworking networks grow globally, manufacturers respond by introducing multifunctional, space-efficient furniture lines.

Use Cases

One key use case emerges in hybrid work environments where companies retrofit offices with modular, ergonomic setups. Adjustable desks and collaborative furniture support seamless transitions between individual tasks and group activities, enabling more productive work models.

Another use case involves home office setups. As remote work expands, employees invest in compact desks, ergonomic chairs, and storage furniture to create dedicated work environments. This trend continues to bolster demand for functional, space-saving solutions tailored to home settings.

Major Challenges

High costs associated with quality office furniture pose a major challenge, particularly for small and medium-sized enterprises. Premium raw materials such as steel and hardwood contribute to rising production expenses, limiting accessibility for budget-conscious buyers.

Supply chain disruptions also hinder market performance. Fluctuating availability of raw materials delays manufacturing timelines and raises operational costs, affecting product delivery schedules. This instability impacts buyer confidence and purchasing cycles across regions.

Business Opportunities

The growing shift toward home office setups provides substantial business opportunities. Furniture brands can expand product lines tailored for compact home spaces, offering ergonomic and affordable options to remote professionals and freelancers worldwide.

Additionally, sustainability-focused innovations create new market prospects. As businesses adopt eco-friendly practices, demand rises for recycled materials, modular construction, and energy-efficient manufacturing. This shift encourages producers to invest in green product development.

Regional Analysis

Asia Pacific dominates the market with a 43.0% share, driven by rapid urban development, commercial expansion, and a rising number of SMEs. Countries such as China and India experience strong demand for ergonomic and cost-efficient office furniture, fueling continuous regional growth.

North America also demonstrates robust expansion due to increasing adoption of flexible workplace models and advanced ergonomic solutions. With high corporate investment in employee wellness, the region continues to prioritize modern, tech-enabled office environments.

Recent Developments

- MillerKnoll reported renewed demand for office furniture in August 2024, marking its first organic order growth in two years.

- Godrej & Boyce launched the ‘Move Up’ ergonomic office table in February 2022, targeting remote workers.

- IKEA released its MITTZON office system in March 2024, featuring 85 ergonomic and flexible furniture products.

- HON introduced the Sculpt table series in September 2024, designed for multifunctional corporate environments.

Conclusion

The global office furniture market is set for sustained growth as organizations adapt to hybrid work models, prioritize ergonomics, and embrace sustainable solutions. With rising demand from coworking spaces, home offices, and expanding commercial sectors, manufacturers continue to innovate. As a result, the industry remains poised for dynamic expansion through 2033.