Quick Navigation

Overview

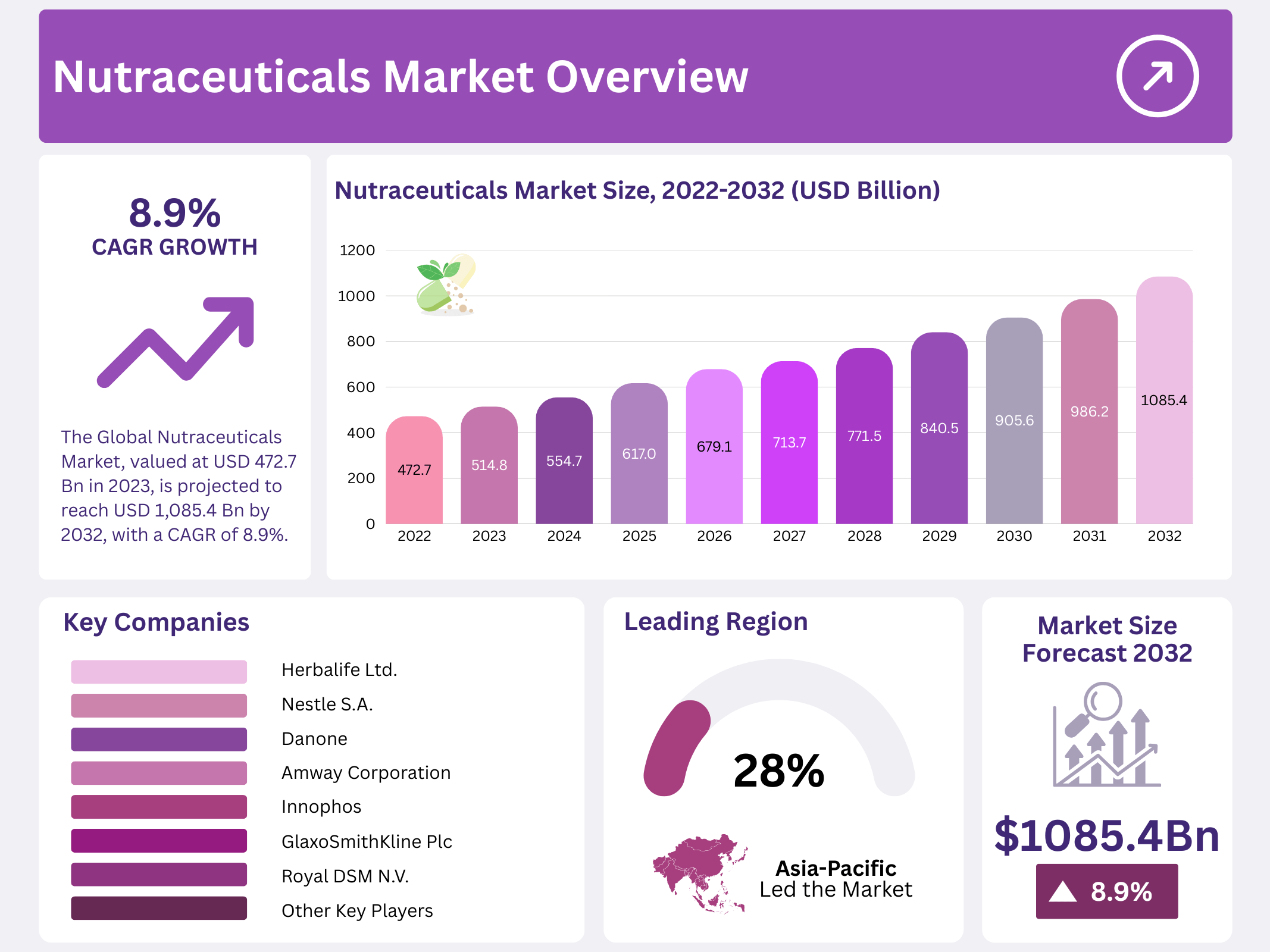

New York, NY – September 30, 2025 – The Global Nutraceuticals Market, valued at USD 472.7 billion in 2023, is projected to expand significantly and reach USD 1,085.4 billion by 2032, reflecting a strong CAGR of 8.9% during the forecast period. Nutraceuticals, an umbrella term for food-derived products that deliver health benefits beyond their nutritional value, have become central to preventive healthcare and lifestyle-driven nutrition.

Nutraceuticals encompass functional foods, dietary supplements, and pharmaceuticals, each offering unique benefits in supporting overall health, managing medical conditions, and even helping to prevent the onset of chronic diseases. Their foundation lies in natural origins, bioactive compounds, and pharmacological relevance, which makes them increasingly appealing in both developed and emerging markets.

The sector’s rapid expansion is closely tied to the growing consumption of functional foods and dietary supplements. With the rising prevalence of cardiovascular conditions, diabetes, and malnutrition, dietary supplements have gained traction as part of medical nutrition strategies. Governments and healthcare organizations are also endorsing nutraceutical-based interventions, given their role in alleviating healthcare system burdens.

A major driver of this growth is the global shift toward preventive healthcare. With healthcare costs climbing worldwide and populations aging at unprecedented rates, consumers are actively seeking food products that promote wellness and longevity. Functional foods, enriched with vitamins, probiotics, omega-3 fatty acids, and other bioactive ingredients, are viewed positively for their tangible contributions to better health outcomes.

The expanding geriatric demographic plays a crucial role in fueling demand. Older adults, particularly those above 60 years who currently account for more than 10% of the world’s population (UN World Population Prospects, 2022), are more inclined toward nutraceuticals to maintain immunity, bone health, and cognitive functions. As healthcare expenditures rise globally, especially in regions like North America, Europe, and parts of Asia-Pacific, nutraceuticals offer a cost-effective solution to manage health proactively.

Key Takeaways

- The Global Nutraceuticals Market, valued at USD 472.7 billion in 2023, is projected to reach USD 1,085.4 billion by 2032, with a CAGR of 8.9%.

- Functional foods dominate, driven by rising demand for prebiotics and probiotics, especially in sports nutrition and bakery products.

- Tablets and capsules lead due to ease of use and ability to mask unpleasant tastes, holding significant revenue in 2021.

- Online marketplaces gain traction for nutraceutical sales, offering convenience, discounts, and a wide product selection.

- Asia Pacific holds a 28.4% market share, fueled by health awareness, aging populations, and urbanization.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 472.7 Billion |

| Forecast Revenue (2032) | USD 1,085.4 Billion |

| CAGR (2022-2032) | 8.9% |

| Segments Covered | By Type – Dietary Supplements, Functional Beverages, and Functional Food; By Form – Capsules, Liquid and Gummies, Tablets and Soft Gels, Powder, and Other Forms; By Sales Channel – Speciality Stores, Supermarkets/Hypermarkets, Convenience Stores, Drug Stores/Pharmacies, Online Retail Stores, and Other Sales Channels. |

| Competitive Landscape | Herbalife Ltd., Nestlé S.A.. Danone, Amway Corporation, Archer Daniels Midland Company, Innophos, GlaxoSmithKline Plc, Royal DSM N.V., Abbot Laboratories, Arkopharma Laboratories S.A., Bactolac Pharmaceuticals, Inc., and Other Key Players |

Key Market Segments

By Type Analysis

The functional foods segment holds a dominant share of the nutraceuticals market and is poised for significant growth, driven by rising demand for prebiotics and probiotics. The COVID-19 pandemic heightened focus on preventive healthcare, particularly among those with weakened immunity, boosting the popularity of these products.

The dietary supplements segment is expected to see robust growth, driven by the expanding working population and rising energy demands among millennials and Gen-Z. Shifts toward sedentary lifestyles are increasing the need for dietary supplements, with dietary fibers projected to grow at the highest CAGR due to their prevalence in breakfast foods.

The functional beverages segment is experiencing rapid growth as health-conscious consumers shift to low-calorie, low-sugar options like sodas, soft drinks, and colas. Sports drinks are particularly popular among athletes and active individuals, with millennials driving demand due to their purchasing power, interest in sports, and fitness trends. Major brands are further supporting this segment by introducing low- and no-sugar functional beverages to maintain market leadership.

By Form Analysis

Tablets and capsules dominate the nutraceuticals market, particularly for vitamins, due to their ease of consumption and ability to mask unpleasant tastes and odors with sugar or film coatings. In 2021, this segment captured a significant revenue share, and its convenience continues to drive growth.

The liquid and gummies segment is expected to grow substantially over the forecast period. Liquid nutraceuticals, including sodas, soft drinks, colas, and sports drinks, are gaining traction among athletes and physically active individuals. Millennials, with their high purchasing power and enthusiasm for sports and fitness, are key drivers of this market.

By Sales Channel Analysis

Online retail marketplaces are increasingly popular for nutraceutical purchases, offering convenience, competitive pricing, discounts, free shipping, and a wide product selection. These platforms connect consumers and merchants without the need for physical warehousing, supporting steady growth in the sector.

Supermarkets and hypermarkets are also expected to see growth during the forecast period, serving as key distributors of healthy food products. Rising consumer awareness of health and nutrition has increased demand for foods rich in biologically active compounds, particularly antioxidants, which help combat oxidative stress. This trend extends beyond food to pharmacies and drugstores, where new and novel antioxidant sources are gaining attention.

Regional Analysis

The Asia Pacific region led the nutraceuticals market with a 28.4% revenue share, driven by increasing consumer awareness of nutraceuticals and growing health concerns. Factors such as an aging population, changing lifestyles, and rapid urbanization are fueling demand for healthier eating options. The use of nutraceuticals in food fortification is expected to significantly boost market growth.

Rising awareness of nutritional enrichment in countries like India and China, coupled with the anticipated expansion of retail sectors in emerging markets such as China, Indonesia, Malaysia, and India, will enhance product accessibility. Vitamins, crucial for disease prevention and wound healing, are in high demand due to their role in supporting overall health, further driving growth in the region.

North America ranks as the second-largest market for nutraceuticals, propelled by growing consumer awareness of the health and nutritional benefits these products offer for disease prevention and health enhancement. Functional foods, beverages, energy drinks, fortified dairy products, and nutritional supplements are key drivers of demand. These products not only improve health but also contribute to economic development by reducing healthcare costs.

However, the market faces challenges from country-specific regulations and the need to verify health claims. The European nutraceuticals market is expanding due to a rising focus on preventive healthcare and an aging population, which has increased demand for dietary supplements. Regional key players are introducing innovative products to strengthen their market presence, further supporting growth.

Top Use Cases

- Immune System Boost: People today face more stress and busy lives, weakening their body’s defenses. Nutraceuticals like probiotics and vitamins from natural foods help build stronger immunity. They work by supporting gut health and fighting off everyday germs. This makes them a go-to choice for staying healthy year-round, especially during cold seasons, offering a simple way to feel more protected without heavy meds.

- Heart Health Support: Busy diets full of processed foods can strain the heart over time. Nutraceuticals such as omega fatty acids from fish or plants help keep blood vessels clear and steady heartbeats. They reduce swelling and improve flow, making it easier for folks to enjoy active days. This use case appeals to those wanting natural steps to guard against common heart worries.

- Weight Management Aid: With desk jobs and quick eats on the rise, keeping a healthy weight feels tough. Nutraceuticals with fibers and plant extracts promote fullness and steady energy, curbing snack urges. They team up with balanced meals to ease portion control. It’s a gentle nudge for everyday folks chasing wellness without strict diets or gym extremes.

- Cognitive Function Enhancement: As life speeds up, sharp thinking and clear memory matter more. Nutraceuticals like antioxidants from berries or herbs shield brain cells from daily wear. They boost focus and mood, helping with work or learning tasks. This fits busy pros and students seeking natural lifts for mental edge without caffeine crashes.

- Sports Performance Boost: Active lifestyles demand quick recovery and sustained energy for workouts. Nutraceuticals with proteins and electrolytes from natural sources fuel muscles and cut fatigue. They speed healing after exercise, letting athletes push harder safely. It’s perfect for gym enthusiasts or weekend warriors aiming for better results through smart, food-based fuel.

Recent Developments

1. Herbalife Ltd.

Herbalife is aggressively expanding its premium Herbalife Nutrition brand into new markets, particularly focusing on personalized nutrition and healthy aging. Recent launches include targeted supplements for cellular health, energy, and gut health. They are leveraging their direct-selling network to provide personalized coaching, integrating digital tools to tailor product recommendations and strengthen customer loyalty in the competitive wellness space.

2. Nestlé S.A.

Through its Health Science unit, Nestlé is pioneering science-backed medical nutrition and consumer health solutions. Key developments include the launch of Biosthetik, a range of premium dermanutrients for skin and hair health, and expanding its probiotic portfolio for metabolic wellness. Nestlé is investing heavily in research on targeted nutrient formulations to bridge the gap between food and pharma, focusing on conditions like gut health and healthy aging.

3. Danone

Danone continues to lead in specialized nutrition, particularly gut and immune health, through its probiotic and synbiotic innovations. A major focus is expanding its plant-based and sustainable nutrition offerings. Recent developments include new formulations for its flagship brands like Activia and Evian, with added probiotics and minerals, emphasizing that health and sustainability are interconnected drivers of their long-term nutraceutical strategy.

4. Amway Corporation

Amway is doubling down on its core Nutrilite brand, emphasizing traceability and scientific validation. A key recent development is the Nutrilite Harvest campaign, which highlights its seed-to-supplement process using organic farms. They have launched new products like Body Balance, a probiotic and greens powder, focusing on holistic wellness and leveraging digital platforms to enhance the distributor and customer experience with personalized health assessments.

5. Archer Daniels Midland Company (ADM)

ADM is a key B2B supplier, driving innovation in functional food ingredients. Recent developments focus on probiotics, prebiotics, and plant-based proteins. They launched new heat-stable probiotic strains for wider food applications and expanded their production capacity for alternative proteins. ADM’s strategy leverages consumer insights to help brands create products supporting gut health, immune function, and mental well-being, positioning itself as an essential partner in the nutraceutical supply chain.

Conclusion

Nutraceuticals as a bright spot in today’s wellness world, blending tasty foods with smart health perks. They’re riding waves of folks wanting natural fixes for daily ups and downs, from peppy energy to calm minds. With more people eyeing prevention over cures, these gems open doors for fresh ideas in everyday eats and drinks. Looking ahead, expect a boom in tailored picks that fit personal vibes, making health feel fun and reachable for all. This shift promises a lively future where good living starts right from the plate.