Quick Navigation

Overview

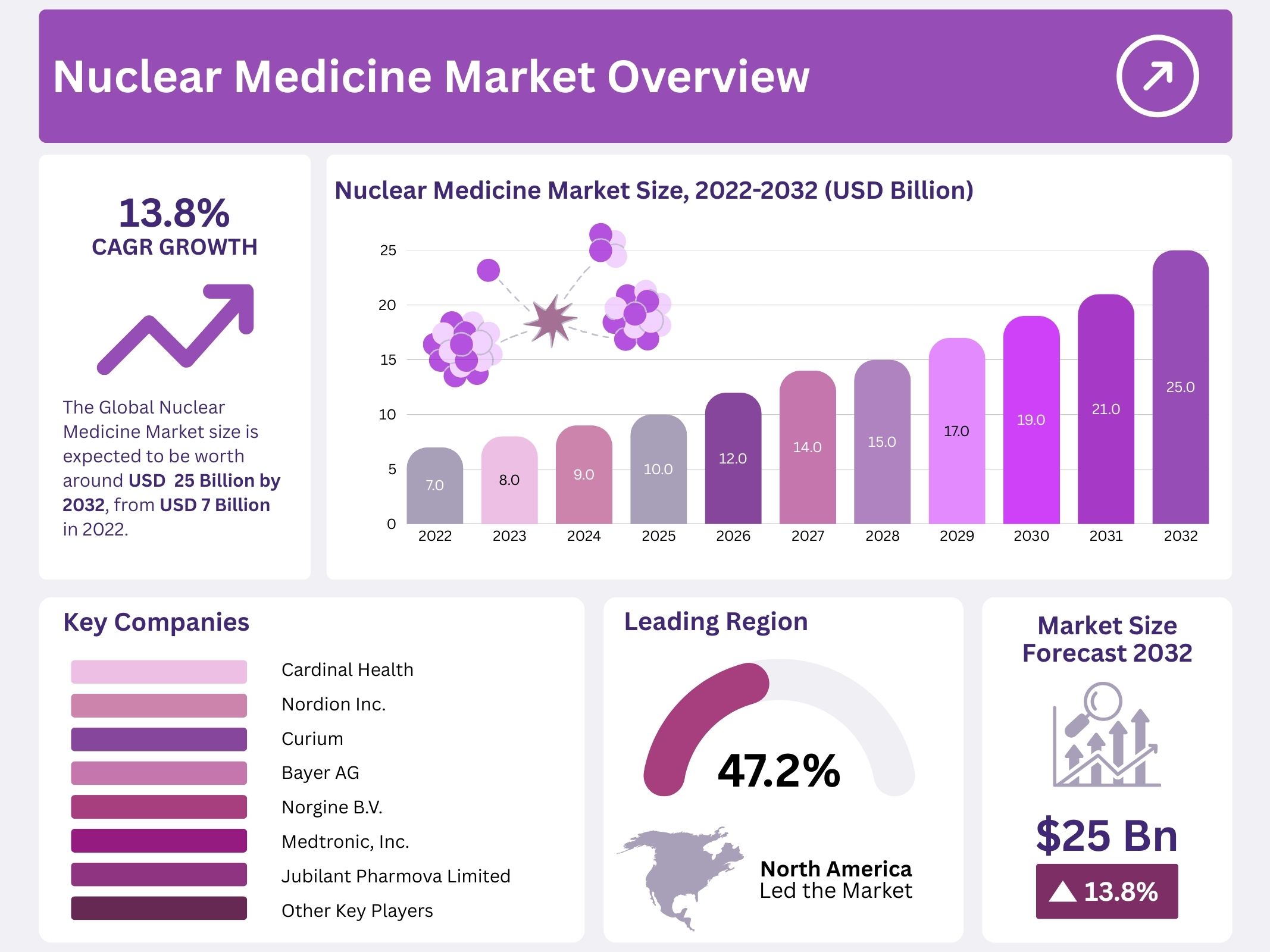

The Global Nuclear Medicine Market was valued at USD 7 billion in 2022 and is projected to reach around USD 25 billion by 2032, advancing at a CAGR of 13.8%. The growth is attributed to favorable reimbursement policies, government initiatives, and technological innovation. For example, the U.S. Centers for Medicare & Medicaid Services (CMS) supports non-HEU Tc-99m radiopharmaceuticals, enabling greater access to diagnostic procedures. Despite the COVID-19 outbreak, nuclear reactors remained operational, underscoring the critical role of this industry in healthcare infrastructure and uninterrupted supply of isotopes.

The rising prevalence of chronic and oncological diseases is a significant driver of demand. Cancer, cardiovascular disorders, and neurological conditions are increasing worldwide, leading to higher utilization of PET and SPECT imaging. These technologies are vital for early diagnosis, staging, and treatment monitoring. Alongside this, a rapidly growing geriatric population—more susceptible to such diseases—further strengthens the adoption of nuclear medicine procedures. This trend is expected to support long-term demand across diagnostic and therapeutic applications.

Advancements in radiopharmaceuticals are reshaping the market, with a growing emphasis on theranostics. The development of isotopes such as Ga-68, F-18, and Lu-177 enables precise tumor targeting and personalized therapies. These innovations align with the broader shift toward precision medicine, where treatments are designed based on molecular-level imaging. As personalized care becomes more common, nuclear medicine is positioned as a key enabler of tailored diagnostic and therapeutic solutions.

Technological progress in imaging modalities is another critical factor. Hybrid systems like PET/CT, PET/MRI, and SPECT/CT improve both anatomical and functional imaging. These systems offer enhanced diagnostic accuracy and efficiency, leading to better clinical outcomes. Hospitals and research centers are increasingly adopting these technologies to meet rising patient needs and to improve diagnostic precision, which accelerates the acceptance of nuclear medicine across multiple clinical settings.

The market is also supported by expanding therapeutic applications and infrastructure investments. Targeted radionuclide therapies (TRT) using isotopes like Lutetium-177 and Iodine-131 are increasingly used for prostate cancer, thyroid disorders, and neuroendocrine tumors. However, the short half-life of isotopes continues to pose challenges, prompting investments in local cyclotron and reactor facilities. These developments ensure a stable isotope supply and reduce reliance on imports. Collectively, rising government support, industry collaborations, and expanding applications are expected to sustain strong growth in the nuclear medicine market through 2032.

Key Takeaways

- The global nuclear medicine market is projected to reach nearly USD 25.0 billion by 2032, advancing steadily at a compound annual growth rate of 13.80%.

- Therapeutic radiopharmaceuticals have emerged as the leading category, contributing approximately 55.4% of the total revenue share in the nuclear medicine industry.

- Oncology applications dominate the market landscape, holding nearly 34% of the revenue share, driven by the rising global prevalence of cancer and early detection benefits.

- North America was the leading regional market in 2022, capturing around 47.2% of the overall share, supported by advanced healthcare infrastructure.

- The Asia-Pacific region is forecasted to witness the fastest growth, propelled by expanding healthcare access, rising cancer incidence, and increasing adoption of nuclear medicine technologies.

- Government initiatives to enhance accessibility and a robust pipeline of innovative radiopharmaceutical products are significantly driving the global nuclear medicine market expansion.

- Favorable reimbursement policies in the United States, particularly for radiopharmaceuticals, are positively influencing patient adoption and driving steady market growth.

- The adoption of advanced imaging modalities, including PET/PET-CT and SPECT-CT systems, continues to accelerate, boosting diagnostic accuracy and fueling global market expansion.

- The launch of new therapeutic and diagnostic radiopharmaceuticals is driving global demand, with diagnostic applications expected to dominate future growth trajectories.

- Oncology remains the leading therapeutic application due to increasing cancer prevalence and the benefits of early detection facilitated by advanced nuclear medicine technologies.

- Hospitals and clinics currently serve as the primary end-users, while diagnostic centers are showing significant potential for future market growth and adoption.

- In India, the cost of nuclear medicine treatments typically ranges from approximately USD 3,312 to USD 23,850, depending on procedure and treatment type.

Regional Analysis

North America held the largest share of the global nuclear medicine market in 2022, accounting for 47.2%. The dominance of the region is supported by a high volume of nuclear medicine procedures and significant investments in research and development activities. A well-established healthcare infrastructure also plays a critical role in this growth. For instance, in January 2021, Eckert and Ziegler announced plans for a cGMP facility in Boston, U.S., dedicated to manufacturing radiopharmaceuticals, which strengthens supply capabilities for commercial and late-stage investigational radioisotopes.

The Asia-Pacific (APAC) region is projected to record the fastest growth during the forecast period. Rising demand for nuclear medicine therapies and increasing availability of advanced treatment facilities contribute to this expansion. An example includes the opening of a private nuclear medicine center by Penang Adventist Hospital in northern Malaysia. Such developments are anticipated to boost adoption across the region. However, affordability challenges persist, as advanced nuclear therapies remain costly for populations in lower-income groups across emerging markets.

The high treatment cost associated with nuclear medicine may hinder growth in APAC and other emerging economies. For example, in India, therapies using Lutetium-177, Yttrium-90, and Iodine-131 are priced around USD 5,962, USD 3,312, and USD 23,850, respectively. These expenses pose a significant burden for patients in countries with lower healthcare expenditure. Despite these limitations, growing clinical adoption and regional investments indicate strong long-term potential for nuclear medicine. Market penetration is expected to increase gradually as governments and healthcare providers focus on expanding access.

Segmentation Analysis

Therapeutic radiopharmaceuticals held the largest market share, accounting for 55.4% of the total revenue. The growth of this segment is attributed to the comparative effectiveness of these treatments, their clinical advantages, and the increasing interest of market players. A strong pipeline of clinical trials supports this momentum, including Phase III studies announced by GE Healthcare and Lantheus Medical Imaging, Inc. for coronary artery disease diagnosis using Flurpiridaz 18F. These advancements highlight the sector’s dominance in therapeutic applications within nuclear medicine.

On the other hand, diagnostic radiopharmaceuticals are anticipated to capture a significant market share in the near future. Their growth is linked to rising cancer imaging procedures, higher procedural volumes worldwide, and frequent new product launches. Notably, the approval of Gallium 68 PSMA-11 by the U.S. Food and Drug Administration for prostate cancer PET imaging demonstrates ongoing innovation. Such developments are expected to support sustained expansion of diagnostic radiopharmaceuticals across various medical conditions globally.

From an application perspective, oncology dominated with 34% of revenue share. The increasing prevalence of cancer and the rising importance of early detection have fueled this growth. Oncology is one of the most common areas for nuclear medicine imaging and therapy, with a strong pipeline of targeted radiopharmaceutical products. Hospitals and clinics also drive market expansion due to high procedural volumes and efficiency in handling these products. Diagnostic centers are projected to record the fastest CAGR, supported by expanding facilities and higher patient volumes across European healthcare systems.

Key Players Analysis

The nuclear medicine market is experiencing increasing consolidation as leading players pursue mergers and acquisitions to strengthen their presence in key regions. For example, in June 2021, Curium announced the acquisition of the Austrian-based pharmaceutical company IASON. This acquisition was aimed at expanding Curium’s footprint in Europe. Such strategic moves are expected to enhance product availability, improve supply networks, and provide companies with a competitive edge in emerging and economically favorable markets, thereby supporting long-term market expansion.

Key players are actively investing in collaborations and geographic expansions to secure their position in the global landscape. Bracco Imaging S.P.A and its subsidiary Bracco Diagnostic Inc. continue to expand their research and diagnostic solutions. Similarly, Cardinal Health, Inc. and Siemens Healthineers AG are strengthening their product portfolios through new developments and partnerships. These initiatives are helping companies maintain strong positions in the nuclear medicine market by addressing growing demand for diagnostic imaging and advanced treatment options.

In addition to these leaders, several specialized companies are contributing significantly to market growth. Eckert & Ziegler Group and Nordion, Inc. remain important suppliers of medical isotopes, ensuring reliable distribution to healthcare facilities. NTP Radioisotopes SOC LTD and Medtronic, Inc. also play critical roles by advancing radioisotope production and integrating nuclear medicine technologies into medical devices. Together, these prominent companies are driving innovation, improving access to nuclear medicine, and supporting the development of advanced diagnostic and therapeutic solutions worldwide.

Market Key Players

- Lantheus Medical Imaging Inc.

- Cardinal Health

- Nordion Inc.

- Curium

- Bayer AG

- Norgine B.V.

- Medtronic Inc.

- Jubilant Pharmova Limited

- Other Key Players.

Conclusion

The global nuclear medicine market is set for strong growth, driven by rising cases of cancer and chronic diseases, a growing elderly population, and continuous innovation in imaging and therapeutic solutions. The adoption of advanced radiopharmaceuticals and hybrid imaging systems is improving accuracy, early detection, and personalized treatment, making nuclear medicine a key part of modern healthcare. Expanding therapeutic applications, government support, and increasing investments in infrastructure are further strengthening the industry. While high treatment costs and isotope supply challenges remain, ongoing collaborations and technological progress are expected to overcome these barriers, ensuring steady growth and wider adoption of nuclear medicine worldwide.

Get in Touch with Us:

Market.us (Powered By Prudour Pvt. Ltd.)

Address: 420 Lexington Avenue, Suite 300, New York City, NY 10170, United States.

Contact No: +1 718 874 1545 (International), +91 78878 22626 (Asia).

Email: [email protected]

View More

Telemedicine Market || Precision Medicine Market || Genomic Medicine Market || Nanomedicine Market || AI In Medicine Market || AI In Precision Medicine Market || AI In Telemedicine Market || Geriatric Medicines Market || Traditional Chinese Medicine Market || Photomedicine Market