Quick Navigation

Overview

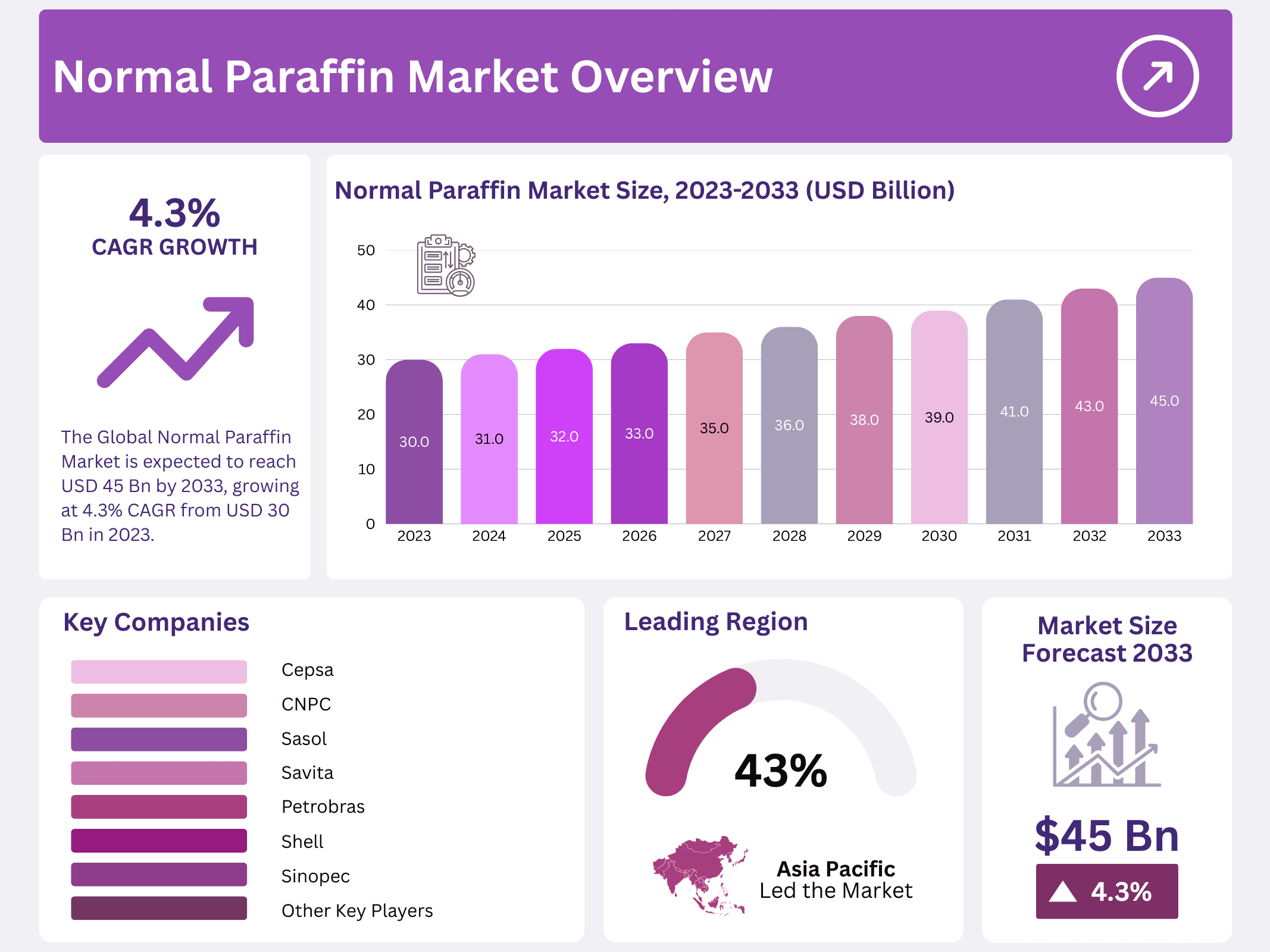

New York, NY – January 20, 2026 – The global Normal Paraffin Market is projected to reach USD 45.0 billion by 2033, rising from USD 30.0 billion in 2023 and expanding at a 4.3% CAGR during the forecast period. Normal paraffins, also known as n-paraffins or normal alkanes, are straight-chain saturated hydrocarbons with the formula CnH2n+2. These compounds are primarily extracted through the fractional distillation of petroleum or natural gas, where hydrocarbon components are separated based on their boiling points.

The production of linear alkylbenzene (LAB) is a key ingredient used to manufacture biodegradable detergents. Beyond this, normal paraffins serve essential functions as solvents in industrial cleaning agents, textile processing chemicals, metalworking fluids, and various formulations in the chemical industry. They are also used as intermediates in the creation of specialty chemicals, plasticizers, lubricants, and certain pharmaceutical products, highlighting their versatility and importance in modern industrial processes.

Market growth is driven by rising industrialization, expanding urban populations, and increasing consumption of cleaning and personal care products worldwide. Additionally, ongoing technological advancements in refining and processing have enabled the development of more efficient and sustainable production methods. With the growing global emphasis on eco-friendly chemical manufacturing, these innovations support the long-term expansion of the normal paraffin market, reinforcing its critical role in supplying essential raw materials for diverse industrial applications.

Key Takeaways

- The Global Normal Paraffin Market is expected to reach USD 45 billion by 2033, growing at 4.3% CAGR from USD 30 billion in 2023.

- The C-5 to C-9 Normal Paraffin holds a 34.5% market share in 2024, driven by extensive use in cleaning products.

- Industrial Grade secures over 45.7% market share, pivotal for manufacturing lubricants and detergents.

- Liquid Normal Paraffin holds a 59.7% market share, favored for versatility in industrial applications.

- LAB Production dominates with a 56.4% market share, crucial for biodegradable detergent manufacturing.

- Asia Pacific commands a 43% market share, driven by urbanization and infrastructure development.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 30.0 Billion |

| Forecast Revenue (2033) | USD 45.0 Billion |

| CAGR (2024-2033) | 4.3% |

| Segments Covered | By Type(C-5 to C-9, C-10 to C-13, Multicomponent, Others), By Grade(Industrial Grade, Pharmaceutical Grade, Cosmetic Grade), By Form( Liquid, Solid), By Application(Linear Alkyl Benzene Production, Fatty Alcohol Production, Metalworking Products, Detergents, Solvents, Fuel Source, Others) |

| Competitive Landscape | Apar Industries Ltd., Calumet Specialty Products Partners, Cepsa, China Petroleum & Chemical Corp, CNPC, Exxon Mobil Corporation, Farabi Petrochem, INDUSTRIAL DEVELOPMENT, JXTG Holdings, Petrobras, Royal Dutch Shell plc, Sasol, Savita, Shell, Sinopec, Sonneborn |

Key Market Segments

By Type

In 2024, the C-5 to C-9 normal paraffin category led the market with a notable 34.5% share. These light paraffins play a vital role as feedstock for petrochemicals and solvents and are widely used in consumer goods such as cleaners and personal care formulations. Their high purity, versatility, and suitability for large-scale chemical synthesis make them essential across multiple sectors. Growing industrialization in emerging economies and expanding application areas continue to support steady growth in this segment.

C-10 to C-13 normal paraffins represent the medium-chain category, forming a crucial input for detergents, lubricants, and specialty solvents. In 2024, this segment also held a sizeable share of the market. Increasing global demand for biodegradable, sustainable cleaning agents has been a major driver, supported by rising consumer awareness and regulatory push toward eco-friendly formulations. Ongoing research to optimize medium-chain paraffin performance in emerging applications is expected to further strengthen segment growth.

Multicomponent normal paraffins include blended chain lengths tailored to meet specific industrial needs. These customized formulations are used in alkylation, plasticizer production, and synthetic lubricant manufacturing. The segment witnessed strong demand in 2024 due to its high adaptability and ability to be engineered for precise chemical properties. Industries relying on flexible, application-specific paraffin blends increasingly prefer multicomponent options, contributing to their expanding market share.

By Grade

Industrial-grade normal paraffin accounted for over 45.7% of the market in 2024, maintaining its position as the most widely used grade. It is essential in producing detergents, lubricants, solvents, and various petrochemical derivatives. Its wide acceptance comes from cost-effectiveness, consistent performance, and suitability for bulk industrial processes. Rapid industrialization, especially in developing regions, continues to fuel the strong demand for this grade.

Known for its superior purity, pharmaceutical-grade normal paraffin is vital for producing ointments, laxatives, and numerous medicinal formulations. This grade’s growth is closely tied to the expanding global healthcare sector, which demands safe, high-quality raw materials. Rising healthcare investments and increasing production of medical and therapeutic products further reinforce the importance of pharmaceutical-grade paraffin in modern medicine.

Cosmetic-grade normal paraffin is widely used in beauty and personal care products—including creams, lotions, balms, and lipsticks—because of its moisturizing and texture-enhancing properties. Strong consumer spending on skincare, along with heightened interest in safe and sustainable cosmetic ingredients, continues to drive demand for this grade. Its role in improving product consistency and sensory appeal makes it indispensable for cosmetic manufacturers.

By Form

In 2024, Liquid normal paraffin dominated with more than 59.7% share. Its ease of transport, handling, and blending makes it suitable for solvents, lubricants, and chemical formulations used across automotive, manufacturing, and industrial sectors. Its versatility, efficiency in processing, and compatibility with diverse industrial systems make liquid paraffin the preferred form for large-scale operations.

Although holding a smaller share, solid normal paraffin remains essential for candles, packaging materials, pharmaceuticals, and cosmetic products. Its stable melting characteristics and uniform structure make it highly valuable in applications requiring precise thermal behavior. Its steady demand is supported by industries that rely on consistent solid-state properties for product quality and performance.

By Application

LAB production accounted for more than 56.4% of the application share, making it the leading segment. LAB is a foundational ingredient for detergents worldwide, and its demand is closely tied to hygiene, sanitation, and household cleaning needs. Rising global focus on cleanliness and clean water access continues to make LAB a central driver of normal paraffin consumption.

Normal paraffin is also critical for producing fatty alcohols, which are used extensively in detergents, cosmetics, and personal care formulations. Increasing consumer preference for biodegradable, eco-friendly, and plant-based cleaning and personal care products has boosted fatty alcohol demand. This trend aligns with regulatory encouragement for sustainable ingredient use across industries.

In metalworking, normal paraffin serves as a lubricant and coolant during machining and metal processing. Its ability to reduce friction and heat improves precision, tool life, and manufacturing efficiency. The segment is supported by ongoing growth in the automotive, machinery, and engineering industries, where high-performance lubrication is essential.

Regional Analysis

The Asia Pacific region emerged as a dominant force in the global normal paraffin market, commanding an impressive 43% share. This strong performance is largely driven by rapid industrial expansion, rising urbanization, population growth, and extensive infrastructure development across the region. These factors collectively strengthened the market landscape, positioning the Asia Pacific as a crucial contributor to global demand.

Countries such as China and India played a central role in elevating the region’s market standing. Their robust economic growth, large-scale urbanization programs, and expanding manufacturing bases have significantly boosted the consumption of normal paraffin, particularly in applications such as Linear Alkyl Benzene (LAB) production, detergents, and solvents. These developments have encouraged increased investments and the establishment of new production facilities.

The region’s strong demand for normal paraffin is supported by its broad application across industries, including pharmaceuticals, cosmetics, fuel processing, and general manufacturing. With China and India leading infrastructure and industrial growth, the Asia Pacific continues to build substantial capacity to meet rising domestic and international requirements.

Top Use Cases

- Detergent Production: Normal paraffin plays a vital role in creating linear alkyl benzene, a key ingredient for surfactants in household cleaners. This helps make detergents that break down grease and stains effectively while being kinder to the environment, meeting consumer needs for reliable and sustainable washing solutions in daily life.

- Industrial Solvents: As a stable solvent, normal paraffin is used in paints, inks, and resins to dissolve materials smoothly. It ensures even mixing and better flow, which improves the quality of coatings and prints, making it essential for industries focused on durable and precise surface applications.

- Chlorinated Paraffin Manufacturing: Normal paraffin is transformed into chlorinated versions that serve as flame retardants and plasticizers in plastics and fabrics. This boosts fire safety in items like wires and upholstery, helping industries like construction and electronics meet strict safety standards without compromising flexibility.

- Lubricants and Metalworking Fluids: In lubricants and cutting oils, normal paraffin reduces friction during machine operations. It helps prevent wear on tools and parts, leading to smoother manufacturing processes and longer equipment life, which is crucial for sectors relying on efficient and reliable machinery performance.

- Fuels and Lamp Oils: Normal paraffin acts as a clean-burning component in lamp oils and barbecue starters. It provides safe, odorless fuel for lighting and outdoor cooking, supporting household and recreational needs where easy ignition and steady flames are valued for convenience and safety.

Recent Developments

1. Apar Industries Ltd.

- Apar Industries continues to expand its transformer oils and specialty hydrocarbons segment, which includes normal paraffin. Recent developments focus on debottlenecking and optimizing operations to meet rising demand from the surfactants and oilfield chemicals sectors. The company is also enhancing its supply chain resilience for raw materials like kerosene.

2. Calumet Specialty Products Partners

- Calumet’s recent developments in normal paraffin are centered within its Specialty Products and Solutions segment. The company leverages its flexible refineries to produce high-purity solvents and base oils, with normal paraffin being a key product line for applications in cleaning agents and drilling fluids, focusing on operational efficiency and market responsiveness.

3. Cepsa

- Cepsa, a key global producer, is advancing its normal paraffin (LINEA paraffins) production as part of its “Positive Motion” strategy. Recent efforts include strengthening its integrated supply chain from raw materials to end products and innovating for biodegradable detergent applications. The company emphasizes sustainable production processes at its dedicated plants.

4. China Petroleum & Chemical Corp (Sinopec)

- Sinopec maintains its position as a leading global supplier of normal paraffin. Recent developments involve capacity optimization and technology upgrades at its major production bases to ensure a stable supply. The company is actively researching new applications in the detergent and chemical intermediate markets to drive product value and meet stringent quality specifications.

5. CNPC (China National Petroleum Corporation)

- CNPC, through its subsidiary PetroChina, focuses on technological innovation and capacity expansion in normal paraffin production. Recent activities include enhancing the purity and yield of paraffin products from its refineries to serve the growing demand for LAB (Linear Alkylbenzene) feedstock and specialty solvents, reinforcing its integrated petrochemical value chain.

Conclusion

Normal paraffin emerges as a flexible and essential material in many industries, driving innovation in cleaning, safety, and efficiency. Its ability to adapt to diverse needs highlights its strong position in the market, promising ongoing relevance as businesses seek reliable and eco-conscious solutions for everyday challenges.