Quick Navigation

Overview

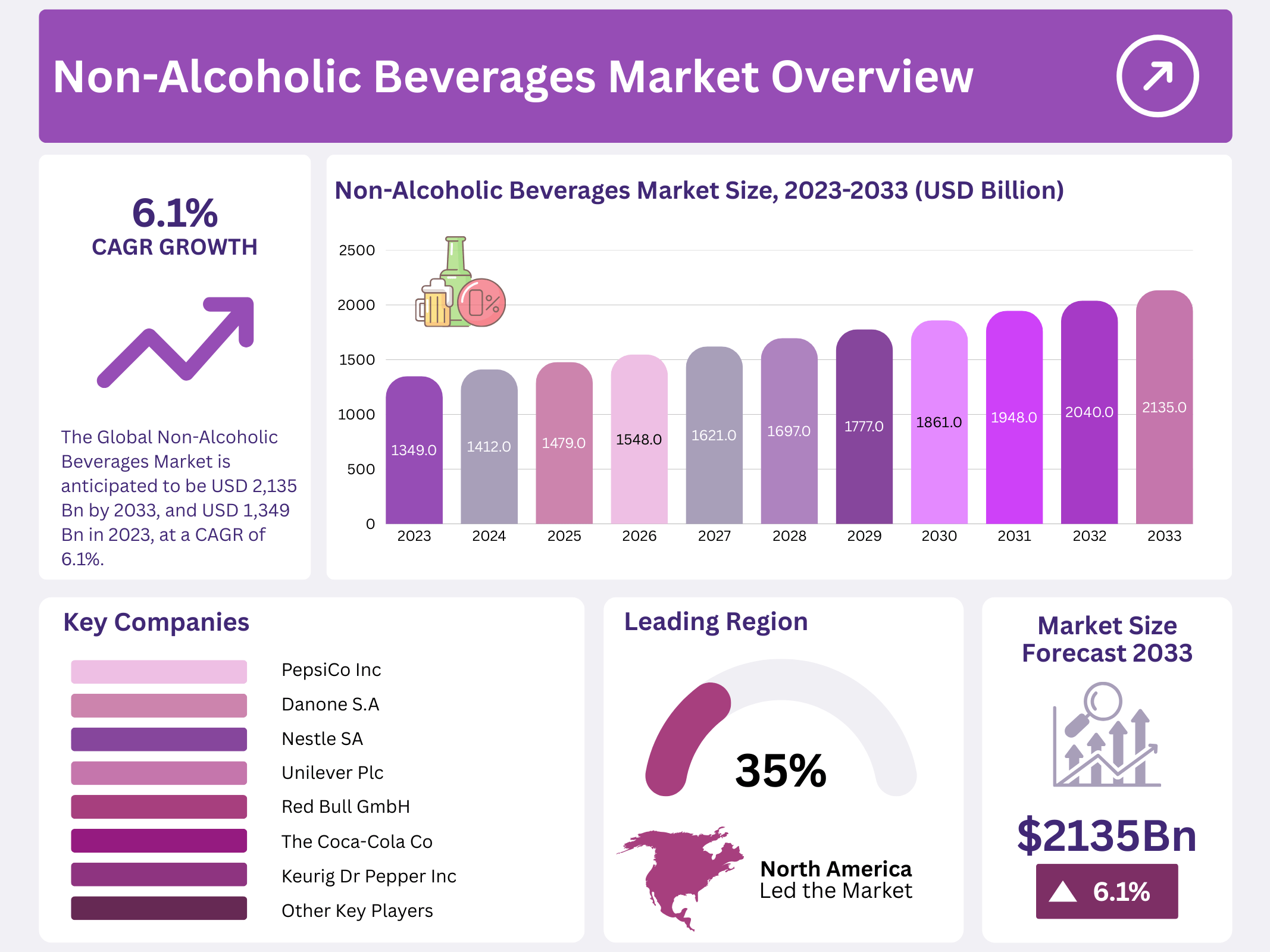

New York, NY – November 27, 2025 – The Non-Alcoholic Beverages Market is entering a phase of significant expansion, with its size projected to grow from USD 1,349 billion in 2023 to approximately USD 2,135 billion by 2033, representing a compound annual growth rate (CAGR) of 6.1% from 2025 to 2033.

This robust demand is driven by rising health awareness and shifting consumer preferences toward functional, low‑sugar, and plant‑based drinks. The market’s popularity has been reinforced by strong growth in segments like functional beverages, sparkling water, and energy drinks. Key growth factors include increasing global disposable incomes, urbanization, and extensive innovation in product offerings, such as natural sweeteners, clean labeling, and sustainable packaging.

These trends have opened opportunities for beverage producers to differentiate through health‑oriented formulations and eco‑friendly solutions. Market expansion is expected across all regions, notably in Asia‑Pacific, where demand is surging, and in developed markets of North America and Europe, where consumers increasingly value wellness-driven options. Overall, the non‑alcoholic beverages market is anticipated to deliver steady, data‑backed growth over the next decade, supported by evolving consumer behavior, technological advancements, and broadening geographic reach.

Key Takeaways

- The Global Non-Alcoholic Beverages Market is anticipated to be USD 2,135 billion by 2033. It is estimated to record a steady CAGR of 6.1% in the Forecast period 2023 to 2033. It is likely to total USD 1,349 billion in 2023.

- The Soft Drinks segment emerged as a dominant force, capturing an impressive market share of over 58.6%.

- Supermarkets & Hypermarkets stood out as the dominant force, securing a commanding market position with a share exceeding 43%.

- North America held a dominant market position in the Non-Alcoholic Beverages sector, capturing more than a 35.6% share.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 1,349 Billion |

| Forecast Revenue (2033) | USD 2,135 Billion |

| CAGR (2024-2033) | 6.1% |

| Segments Covered | By Product (Bottled Water, Soft Drinks(Carbonated Soft Drinks, Non-Carbonated Soft Drinks, Energy & Sports Drinks), Juices(Orange Juice, Apple Juice, Grapefruit Juice, Pineapple Juice, Grape Juice and Others), Ready-to-Drink (RTD) Coffee & Tea(Ready-to-Drink (RTD) Coffee, Ready-to-Drink (RTD) Tea)), By Distribution Channel (Supermarkets & Hypermarket, Convenience Stores, Online Retail, Food Service, Others) |

| Competitive Landscape | Coca-Cola Co, PepsiCo Inc, Monster Beverage Corp, Keurig Dr Pepper Inc, Fomento Economico Mexicano SAB de CV, Arizona Beverage Company, Asahi Group Holdings Ltd, Danone S.A, Nestle SA, Unilever Plc, Red Bull GmbH, Dr. Pepper Snapple Group Inc |

Key Market Segments

By Product Type Analysis

In 2023, The Global non-alcoholic beverages market showcased a dynamic product landscape, segmented to meet varying consumer preferences and lifestyles. Among these categories, soft drinks dominated the market, accounting for over 58.6% of the total share. This strong market presence is largely due to the enduring popularity of both carbonated and non-carbonated beverages within the segment.

Carbonated soft drinks, known for their fizzy texture and wide flavor range, such as cola, citrus, and fruit variants, continue to attract a large global consumer base. Their refreshing taste and high availability contribute significantly to their dominance. Non-carbonated options, including fruit juices, flavored waters, and functional beverages, are gaining popularity, particularly among health-conscious consumers seeking low-sugar and more natural alternatives.

The rising awareness about sugar intake and demand for healthier lifestyles are driving this shift in preference. Furthermore, energy and sports drinks have carved out a substantial niche within the soft drinks category. These products appeal to consumers leading active lifestyles, offering hydration and an instant energy boost, making them increasingly popular among fitness-oriented individuals.

By Distribution Channel Analysis

In 2023, distribution channels played a crucial role in shaping the accessibility and consumption of the non-alcoholic beverages market. Supermarkets and hypermarkets led the distribution network, capturing more than 43% of the global market. Their dominance is driven by the convenience of one-stop shopping, availability of a broad product range, attractive promotional pricing, and bulk purchase options, which make them the go-to destination for beverage consumers.

Convenience stores also held a strong position, offering quick access to a variety of drinks. Their extended hours and strategic locations cater to immediate consumption needs, making them ideal for on-the-go purchases. These stores are especially popular for impulse buys during daily commutes or breaks.

Regional Analysis

North America held a leading position in the global non-alcoholic beverages market, accounting for more than 35.6% of the total market share. This dominance is largely attributed to the rising demand for healthier and natural beverage options among a health-conscious population. The presence of major beverage companies in the region, which continue to invest in innovation and product development, has further strengthened North America’s market leadership. New product launches, including functional drinks and low-sugar alternatives, have played a crucial role in driving consumer interest and expanding the regional market.

In Europe, the non-alcoholic beverages market showed strong performance in 2023, supported by a growing consumer shift toward alcohol-free options. Health and wellness trends are deeply influencing purchasing behavior across the region, with increased demand for organic, natural, and functional non-alcoholic beverages. European consumers are especially inclined toward drinks that offer added benefits, such as immune support, low-calorie content, and unique flavor profiles, which is positively impacting market growth.

Top Use Cases

- Social Gatherings and Events: Non-alcoholic beverages shine at parties and celebrations, offering tasty mocktails that mimic classic cocktails without the buzz. They’re perfect for inclusive fun, letting everyone join in toasts with vibrant flavors like fruity spritzes or herbal sodas. This keeps the vibe lively while supporting sober choices, making hosts feel thoughtful and guests refreshed all night long.

- Health and Wellness Routines: These drinks fit seamlessly into daily wellness habits, packed with natural boosts like adaptogens for stress relief or vitamins for energy. People swap evening wines for calming chamomile tonics or morning juices for hydration kicks, helping maintain clear minds and steady moods. It’s an easy way to nurture body and spirit without skipping the enjoyment of a flavorful sip.

- Driving and Active Lifestyles: For those behind the wheel or hitting the gym, non-alcoholic options provide safe, energizing alternatives like sparkling waters or light fruit blends. They quench thirst during road trips or post-workout sessions, ensuring focus stays sharp and hydration levels are high. This choice empowers active days full of movement, minus any worry about impaired judgment.

- Pregnancy and Family Moments: Expectant parents and kids adore these gentle drinks, from berry-infused lemonades to creamy milk alternatives that feel special yet safe. They create joyful family rituals around meals or playtime, fostering bonding without health risks. It’s a simple swap that turns everyday routines into cherished, worry-free traditions for all ages.

- Mindful Evening Wind-Downs: As the day ends, non-alcoholic elixirs with lavender or ginger notes offer a cozy ritual to unwind, easing into restful sleep. They replace after-dinner drinks with soothing, aromatic warmth that calms the mind and body. This practice builds healthier habits, inviting relaxation that feels indulgent and restorative every single night.

Recent Developments

1. The Coca-Cola Co

Coca-Cola is aggressively expanding its coffee and premium beverage portfolio with the acquisition of the Fairlife brand, showing a strong focus on value-added dairy. They continue to innovate with new flavors across their core brands like Sprite and Fanta, while heavily investing in sustainability, aiming to make all packaging reusable. Digital acceleration through e-commerce partnerships remains a key growth driver.

2. PepsiCo Inc

PepsiCo continues to see massive growth in its non-carbonated beverage segment, particularly with Gatorade’s new electrolyte powders and functional sports drinks. The company is heavily focused on sustainability, pledging to scale regenerative farming practices. Recent product launches include nitrogen-infused Pepsi and expansions of the bubly sparkling water line, demonstrating a commitment to variety and premiumization to capture shifting consumer preferences.

3. Monster Beverage Corp

Monster Energy is significantly expanding beyond its traditional energy drink base with recent acquisitions in the alcoholic beverage space. The company continues to launch new products like Monster Energy Zero Sugar and the Reign Storm total energy drink. A key development is the ongoing integration with Coca-Cola’s distribution network, which is enhancing its global reach and operational efficiency, particularly in emerging international markets.

4. Keurig Dr Pepper Inc

Keurig Dr Pepper is focused on cross-portfolio growth, leveraging its direct-store-delivery system for brands like Canada Dry and Snapple. A major recent development is the national US launch of its ready-to-drink (RTD) coffee line under the Keurig brand, moving beyond single-serve brewers. The company is also expanding its partnership with Nutrish Beverages to grow the Protein2o water brand, tapping into the health and wellness trend.

5. Fomento Economico Mexicano SAB de CV (FEMSA)

Through its Coca-Cola FEMSA subsidiary, the world’s largest Coca-Cola franchise bottler, the company is advancing a massive digital transformation with its Spin by OXXO mobile payment and loyalty platform. FEMSA is also expanding its OXXO store chain across Latin America, which serves as a critical distribution point for its beverages. Recent efforts include bolstering its supply chain resilience and investing in sustainable packaging solutions.

Conclusion

Non-alcoholic beverages transform from simple alternatives into a vibrant cornerstone of modern lifestyles. Fueled by a wave of health awareness and creative flavors, they’re weaving into everyday moments, from bustling social scenes to quiet personal rituals. This shift highlights a broader embrace of balance and joy without compromise, promising endless innovation ahead. Brands that capture this spirit will lead a refreshing era where every sip supports well-being and connection.