Quick Navigation

Overview

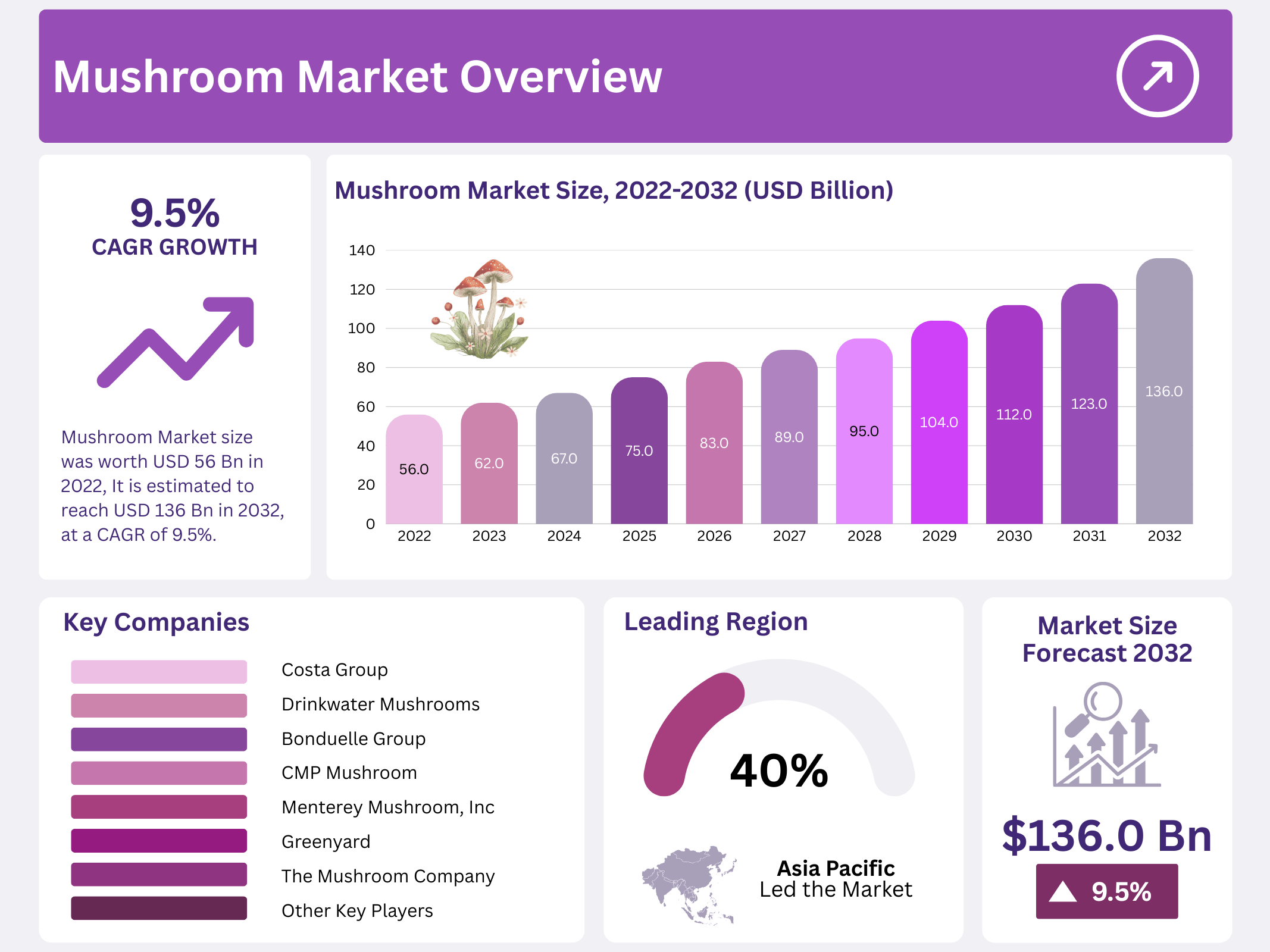

New York, NY – September 04, 2025 – In 2022, The Global Mushroom Market was valued at USD 56.0 billion and is projected to reach USD 136.0 billion by 2032, growing at a CAGR of 9.5% from 2023 to 2032. Though not plants, mushrooms, and toadstools, edible fungi from classes like Agaricomycetes and Ascomycota are commonly considered vegetables. Mushrooms are an underappreciated food with a long history in traditional and folk medicine, valued for their healing and cleansing properties. Low in calories, they contain modest amounts of fiber and various nutrients.

The most compelling attributes of mushrooms lie in their non-nutritive compounds, such as polysaccharides, polyphenols, carotenoids, and indoles, which exhibit antioxidant, anti-inflammatory, and anticancer effects in cell and animal studies. The growing vegan population’s demand for protein-rich diets is expected to be a primary driver of the mushroom market during the forecast period.

Recognized as a superfood, mushrooms are rich in four key nutrients—selenium, vitamin D, glutathione, and ergothioneine. These nutrients help combat oxidative stress and reduce the risk of chronic conditions like cancer, heart disease, and dementia. Additionally, their robust umami flavor allows for a 30–40% reduction in salt content in dishes, promoting healthier eating.

Key Takeaways

- The Mushroom Market is projected to grow at a 9.5% CAGR from 2023 to 2032.

- Button mushrooms are expected to gain market share due to nutritional benefits and cost-effective production.

- Fresh mushrooms are seeing increased demand driven by consumer preference for organic, unprocessed foods.

- Supermarkets and hypermarkets in Europe and North America will drive growth due to convenience and variety.

- Population growth, health consciousness, and demand for organic products are key market drivers.

- Challenges include market competition, seasonal supply variations, and regulatory hurdles.

- Trends show rising demand for functional and medicinal mushrooms and sustainable cultivation practices.

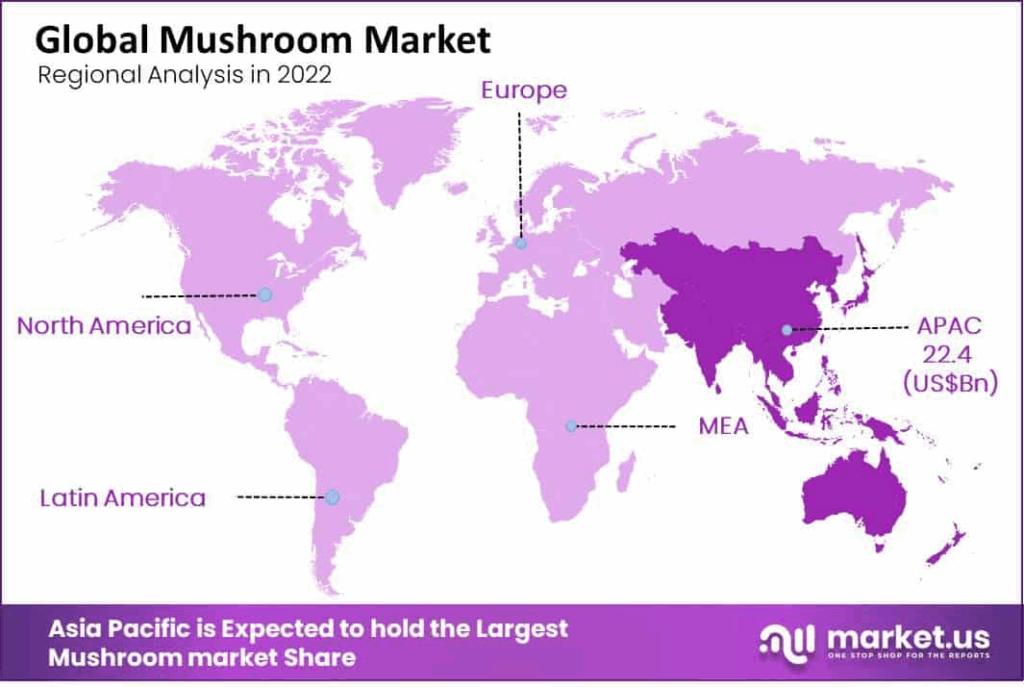

- The Asia Pacific region is anticipated to hold a 40% share of the global mushroom market.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 136.0 Billion |

| Forecast Revenue (2032) | USD 56.0 Billion |

| CAGR (2023-2032) | 9.5% |

| Segments Covered | By Type (Button, Shiitake, Oyster, and Other types), By Form (Fresh, Processed), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Specialty Stores, Online Stores), By End-user (Food, Pharmaceutical, Cosmetics) |

| Competitive Landscape | Costa Group, Drinkwater Mushrooms, Bonduelle Group, CMP Mushroom, Menterey Mushroom, Inc., Greenyard, The Mushroom Company, Monaghan Group, Shanghai Fengke Biological Technology Co., Ltd, OKECHAMP S.A., and Other Key Players |

Key Market Segments

By Type

Button mushrooms dominate the market due to their nutritional benefits, shorter spore incubation time, and lower cost compared to competitors, driving market growth throughout the forecast period. Meanwhile, the oyster mushroom segment is poised for significant growth, fueled by their delicate texture and mild-savory flavor, popular in cuisines across China, Japan, and Korea. Oyster mushrooms also contain benzaldehyde, a natural antibacterial compound, increasing their demand in pharmaceutical applications.

By Form

Fresh mushrooms lead the market as consumers increasingly prioritize organic, unprocessed foods for maximum health benefits. Despite challenges with shorter shelf life, advancements in modified atmosphere packaging have boosted fresh mushroom demand. Processed mushrooms, including dried, frozen, canned, pickled, and powdered forms, are expected to grow rapidly. These forms extend shelf life, and the rising use of mushroom powders and extracts in food and cosmetics is projected to drive market growth.

By Distribution Channel

Supermarkets and hypermarkets hold the largest share, particularly in developed regions like Europe and North America, due to their wide product range and ease of purchase. Online stores, however, are expected to see rapid growth, driven by convenience and competitive pricing, encouraging global consumers to buy fresh produce online.

By End-User

The food sector accounts for the largest market share, with mushrooms used in fresh and processed forms by restaurants, food service providers, and households. Low in salt, gluten, cholesterol, and fat, mushrooms are rich in proteins, vitamins, and minerals, appealing to health-conscious consumers. The trend toward natural, nutrient-rich foods is driving demand, with companies like FreshCap Mushrooms Ltd. launching mushroom-infused functional beverages.

The pharmaceutical sector is also expected to grow significantly, leveraging mushrooms’ bioactive compounds like triterpenes, polysaccharides, and polyphenols for products targeting conditions such as diabetes, cancer, and immunity. In cosmetics, mushrooms’ antioxidant, anti-aging, and skin-brightening properties are increasing their use in natural skincare products.

Regional Analysis

Asia Pacific leads with a 40% share and a USD 22.4 Billion market value.

The Asia Pacific region is projected to account for 40% of the mushroom market during the forecast period, driven by traditional medical systems like Ayurveda and Chinese medicine, which utilize mushrooms for their nutritional and immunity-boosting benefits.

Europe, heavily reliant on mushrooms, benefits from high per capita income in developed nations, fueling demand for exotic, gourmet mushrooms. North America is expected to experience strong growth, with rising consumer interest in premium, natural, and organic products, alongside increasing veganism, boosting demand for mushrooms as meat substitutes in food and dietary supplements.

Top Use Cases

- Nutritional Food Source: Mushrooms are packed with proteins, vitamins, and minerals, making them a popular choice for health-conscious consumers. They’re low in calories and fat, ideal for vegan and vegetarian diets. Their versatility in dishes like soups, salads, and stir-fries drives demand in households and restaurants, boosting the edible mushroom market.

- Medicinal Supplements: Functional mushrooms like reishi, lion’s mane, and cordyceps are used in supplements for their health benefits. They support immunity, cognitive health, and stress relief. The growing interest in natural remedies and wellness products fuels demand for mushroom-based capsules, powders, and teas in the health supplement industry.

- Sustainable Packaging: Mushrooms are being explored for eco-friendly packaging solutions. Mycelium, the root structure of mushrooms, is used to create biodegradable materials. These sustainable alternatives to plastic are gaining traction as companies and consumers prioritize environmentally friendly products, driving innovation in the mushroom-based material market.

- Meat Alternatives: Mushrooms like shiitake and oyster are used as plant-based meat substitutes due to their texture and umami flavor. With rising veganism and demand for sustainable foods, mushrooms are increasingly featured in burgers, sausages, and other meat-free products, appealing to health-conscious and eco-friendly consumers.

- Cosmetic Applications: Mushrooms are used in cosmetics for their anti-aging, antioxidant, and moisturizing properties. Extracts from mushrooms like reishi and chaga are added to creams, serums, and masks. The growing demand for natural and organic beauty products is pushing the use of mushrooms in the cosmetics industry.

Recent Developments

1. Costa Group

Costa Group has expanded its mushroom production with a new state-of-the-art facility in Guyra, NSW. This significant investment focuses on increasing capacity for both conventional and specialty mushrooms, leveraging advanced technology to improve yield and efficiency. This expansion strengthens their position in the Australian fresh produce market, catering to growing consumer demand.

2. Drinkwater Mushrooms

Drinkwater Mushrooms continues to focus on sustainable, UK-based farming. A key recent development is their ongoing investment in energy-efficient technologies to power their extensive mushroom-growing tunnels. This initiative aims to reduce their carbon footprint while maintaining a consistent, year-round supply of fresh mushrooms for their retail and foodservice customers across the country.

3. Bonduelle Group

Bonduelle is strategically pivoting towards plant-based food solutions, impacting its mushroom segment. Their recent Hello Future 2027 plan emphasizes accelerated growth in branded, value-added products, including ready-to-eat meals and canned vegetables. This likely involves innovating with mushroom-based products to align with global trends in healthy and sustainable eating.

4. CMP Mushroom

CMP Mushrooms, a major Canadian producer, is focused on operational expansion. A key development is their ongoing growth strategy to increase production capacity. This includes adopting more efficient composting techniques and modern farming technologies to enhance yield and meet rising demand, solidifying their leadership in the North American market for fresh and processed mushrooms.

5. Menterey Mushroom, Inc

Menterey Mushroom, a US-based specialty grower, is capitalizing on the gourmet mushroom trend. Their recent developments involve expanding their product range of exotic varieties like Lion’s Mane and Maitake, supplied to high-end restaurants and farmers’ markets. They emphasize organic practices and local sourcing, aligning with consumer demand for unique, functional, and sustainably grown gourmet foods.

Conclusion

The Mushroom Market is growing rapidly due to its diverse applications in food, health, sustainability, and cosmetics. Rising consumer awareness of mushrooms’ nutritional and medicinal benefits, along with the shift toward plant-based and eco-friendly products, drives demand. Innovations in cultivation and product development further support market expansion, making mushrooms a key player in multiple industries.