Quick Navigation

Overview

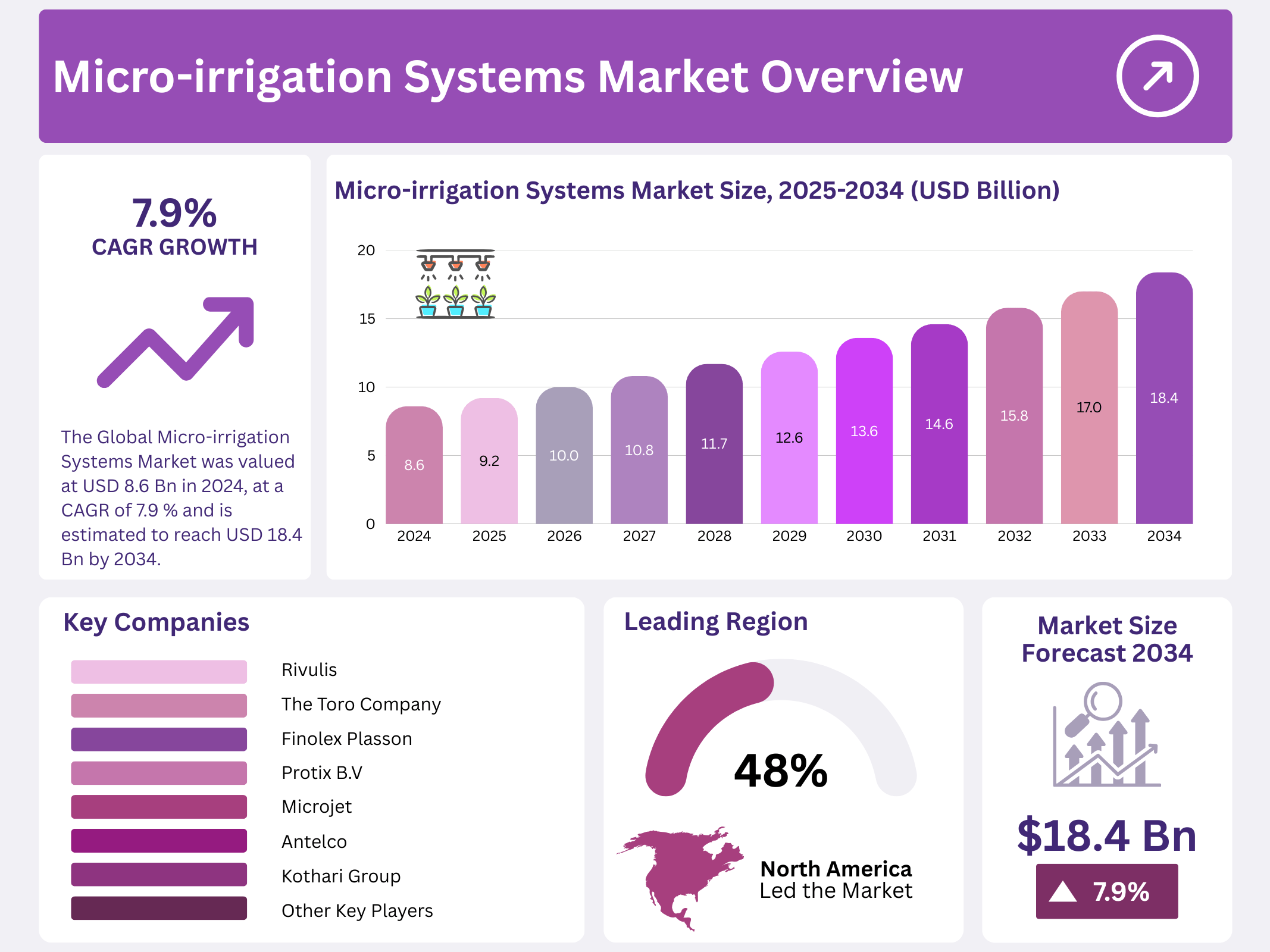

New York, NY – December 02, 2025 – The Global Micro-Irrigation Systems Market is projected to reach a value of around USD 18.4 billion by 2034, rising from USD 8.6 billion in 2024, and expanding at a CAGR of 7.9% during the forecast period from 2025 to 2034.

Micro-irrigation systems—commonly referred to as drip or trickle irrigation represent an efficient, low-pressure irrigation approach that supplies water directly to plant root zones in a slow, precise, and controlled manner. Unlike conventional irrigation methods such as flood or overhead sprinkler systems, micro-irrigation significantly reduces water losses caused by evaporation, surface runoff, and deep percolation.

These systems apply water at or below the soil surface using key components, including drip lines, emitters, filters, control valves, and pressure regulators. The technology extends beyond drip irrigation to include micro-sprinklers, mist, and fog systems, all designed to improve water and nutrient efficiency at the individual plant level.

Key Takeaways

- The Global Micro-irrigation Systems Market was valued at USD 8.6 billion in 2024, at a CAGR of 7.9 % and is estimated to reach USD 18.4 billion by 2034.

- Among types, drip irrigation accounted for the largest market share of 61.2%.

- Among crop types, field crops accounted for the majority of the market share at 46.4%.

- By application, open-field agriculture accounted for the largest market share at 68.4%.

- North America is estimated as the largest market for Micro-Irrigation Systems with a share of 48.4% of the market share.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 8.6 Billion |

| Forecast Revenue (2034) | USD 18.4 Billion |

| CAGR (2025-2034) | 7.9% |

| Segments Covered | By Type (Drip Irrigation (Surface Drip Irrigation, Sub-surface Drip Irrigation, Online Drip, Others), Sprinkler Irrigation (Micro-sprinklers, Centre Pivot, Towable Pivot, Others), Bubbler Irrigation, Others), By Crop Type (Field Crops, Orchard & Vineyards, Plantation Crops, Fruits & Vegetables, Others), By Application (Open Field Agriculture, Protected Agriculture) |

| Competitive Landscape | Jain Irrigation Systems Ltd., Nelson Irrigation, Netafim Limited, Lindsay Corporation, Rivulis, The Toro Company, Rain Bird Corporation, Finolex Plasson, Mahindra EPC Irrigation Limited, T-L Irrigation Co., Hunter Industries, Chinadrip Irrigation Equipment Co., Ltd., Antelco, Microjet, Kothari Group, Other Key Players |

Key Market Segments

Product Type Analysis

Drip Irrigation Segment Accounts for 61.2% Revenue Share

The micro-irrigation systems market is segmented by product type into drip irrigation, sprinkler irrigation, bubbler irrigation, and other systems. In 2024, the drip irrigation segment accounted for a significant 61.2% share of total market revenue. This strong position is mainly driven by its superior water-use efficiency, especially in regions facing rising water scarcity.

Drip irrigation delivers water and nutrients directly to the plant root zone, reducing water loss caused by evaporation, runoff, and over-watering. This targeted approach makes it highly suitable for high-value crops such as fruits, vegetables, and vineyards, where precise irrigation improves yield quality and consistency. In addition, increasing government incentives and subsidy programs supporting water-efficient farming practices have further encouraged the adoption of drip irrigation systems across both developed and developing economies.

Crop Type Analysis

Field Crops Lead with a 46.4% Market Share

Based on crop type, the market is categorised into field crops, orchards & vineyards, plantation crops, fruits & vegetables, and others. In 2024, field crops dominated the segment, accounting for a substantial 46.4% market share. This dominance reflects the large-scale cultivation of staple crops such as wheat, rice, maize, and pulses, particularly in water-stressed and developing agricultural regions.

Many governments, including those in India, China, and Brazil, have introduced irrigation mandates and subsidy programs to promote efficient water use in field crop production. The growing pressure to increase agricultural output while conserving limited water resources has accelerated the use of drip and sprinkler irrigation systems across extensive farmlands, supporting sustained adoption in this segment.

Application Analysis

Open Field Agriculture Emerges as the Dominant Application with 68.4% Share

By application, the micro-irrigation systems market is divided into open field agriculture and protected agriculture. In 2024, open field agriculture emerged as the dominant segment, holding 68.4% of the total market share. This leadership is largely attributed to the widespread use of micro-irrigation systems in large-scale cultivation of cereals, oilseeds, and pulses across rural and semi-arid regions.

Government-backed subsidy schemes, particularly in water-scarce countries, have played a key role in driving the adoption of micro-irrigation in open fields. Furthermore, the need to enhance irrigation efficiency, reduce water wastage, and improve crop productivity in traditional farming systems continues to strengthen demand for micro-irrigation solutions in this application segment.

Regional Analysis

In 2024, North America dominated the global micro-irrigation systems market, holding 48.4% of the total market share. This leadership position is driven by a powerful combination of technological innovation, growing concerns over water scarcity, and strong governmental support for sustainable agricultural practices. Farmers and agribusinesses across the region have rapidly embraced advanced irrigation solutions, recognising their ability to dramatically improve water-use efficiency and increase crop yields while reducing operational costs over the long term.

A notable emerging trend in North America is the integration of renewable energy—particularly solar power—with micro-irrigation systems. This development addresses both high energy costs and environmental goals, while enabling reliable irrigation in off-grid and remote areas, especially in the western United States and rural regions of Mexico.

Top Use Cases

- High-value fruits, vegetables, and orchards: Micro-irrigation delivers water slowly and directly to the plant root zone, which is ideal for crops such as grapes, tomatoes, citrus, and bananas. This focused watering keeps foliage dry, limits weed growth, and improves nutrient uptake. As a result, farmers achieve better crop quality while reducing water loss from evaporation and surface runoff.

- Field crops in water-scarce regions: In dry and semi-arid regions, micro-irrigation supports crops like cotton, sugarcane, pulses, and oilseeds by supplying consistent moisture near the roots. This method helps crops tolerate irregular rainfall, reduces dependence on excessive groundwater pumping, and allows farmers to maintain stable production even under challenging climate conditions.

- Greenhouse and protected cultivation farming: Greenhouses and shade-net farms rely on micro-sprinklers and drip systems to maintain uniform moisture levels. These systems work well with automated controls and nutrient delivery, creating stable growing conditions. This improves plant health, shortens crop cycles, and ensures consistent output for high-demand horticultural and floriculture markets.

- Smallholder farms adopting modern irrigation: Micro-irrigation systems are well-suited for small farms because they are flexible and easy to manage. Farmers can irrigate limited land efficiently, reduce labour needs, and grow higher-value crops. Over time, this approach improves farm income stability while encouraging responsible water use at the community level.

- Smart and precision-based irrigation practices: Modern micro-irrigation setups integrate with sensors and automated controllers to deliver water based on actual crop needs. This precision reduces overwatering, saves energy, and lowers operational effort. Such systems support sustainable farming practices and help farmers manage larger or scattered fields more effectively.

Recent Developments

- Jain Irrigation Systems Ltd. recently launched its “Jain Farm Automation” mobile app for remote farm control, integrating IoT sensors and AI-driven analytics for precise water and fertigation management. They are expanding solar-powered drip irrigation projects, notably in water-scarce regions of India and Africa. Their focus remains on sustainable agriculture through water-saving technologies and farmer training programs.

- Nelson Irrigation has advanced its precision irrigation with the Rotator Swing Arm product line, improving water distribution uniformity. They introduced the TR-70 rotor for large agricultural fields, enhancing efficiency. The company is also integrating remote monitoring capabilities into its control systems, allowing for data-driven irrigation scheduling and reducing operational costs for farmers.

- Netafim Limited launched the NetBeat integrated digital farming platform, which combines irrigation, fertigation, and crop management via cloud analytics. Recently acquired by Orbia, they are expanding their Drip-by-Drip sustainability strategy and have initiated large-scale precision irrigation projects in Brazil and India, focusing on sugarcane and other row crops to boost yield while conserving resources.

- Lindsay Corporation is enhancing its FieldNET platform with Zimmatic pivots, incorporating FieldNET Advisor for automated irrigation recommendations using AI and weather data. They recently partnered with Bosch to integrate in-field sensors for real-time soil moisture and crop health data, aiming to optimise water use and increase adoption of subscription-based digital services.

- Rivulis, after merging with Jain International, is focusing on expanding its Eco-Drip recycled plastic drip line and the S5 PC drip line for high salinity water. They have launched new online tools for system design and are executing large-scale irrigation modernisation projects in regions like Southern Europe and Australia, promoting water efficiency and crop resilience.

Conclusion

Micro-Irrigation Systems are shifting irrigation from rough, field-wide flooding to careful, plant-level management. They support healthier crops, better use of inputs, and more resilient farm incomes, especially in regions facing water stress. When combined with supportive policies and simple training, these systems become a practical pathway toward more efficient, climate-ready agriculture rather than a niche technology for a few large farms.