Quick Navigation

Overview

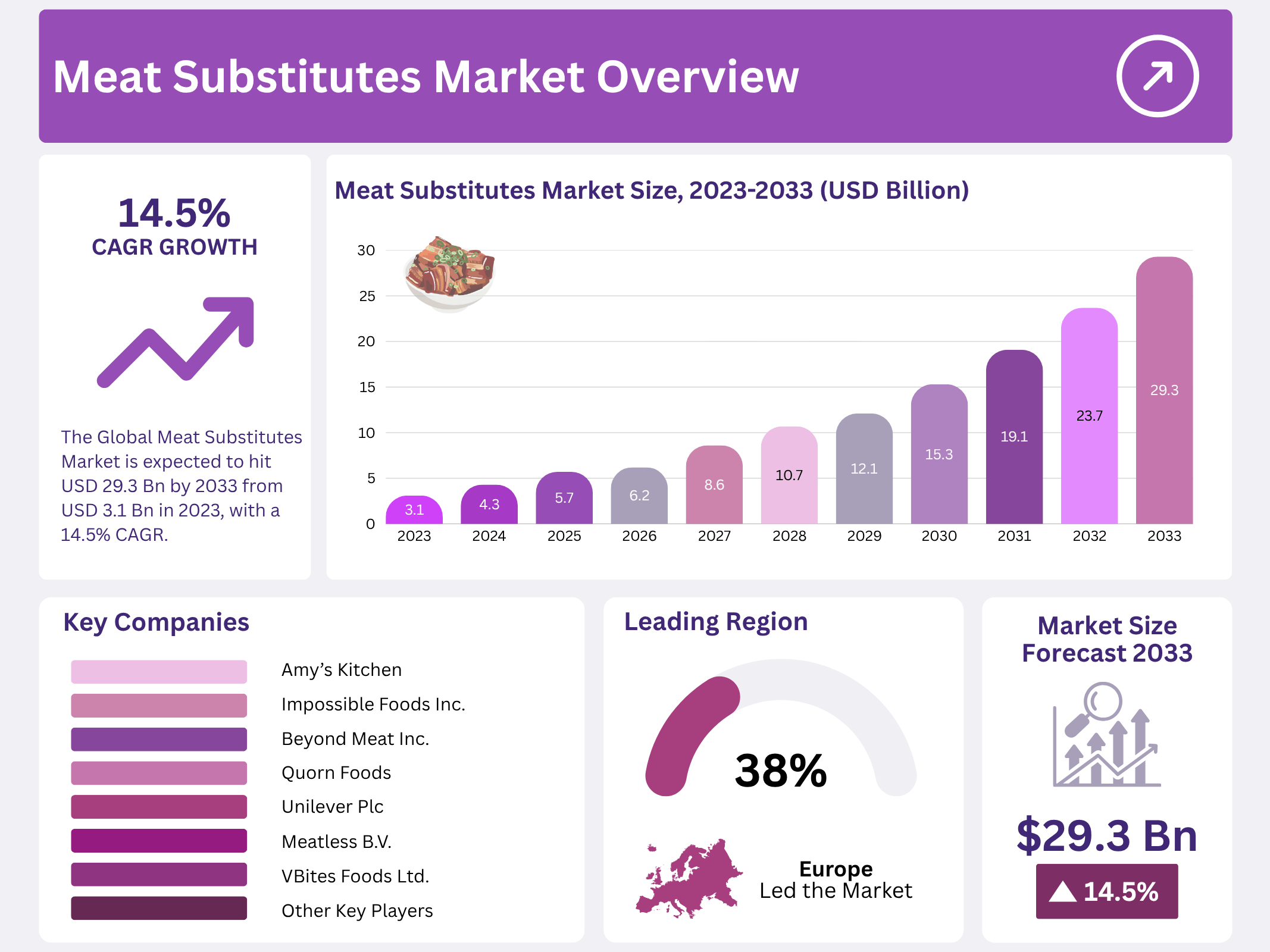

New York, NY – November 13, 2025 – The Global Meat Substitutes Market is projected to grow significantly, reaching approximately USD 29.3 billion by 2033 from USD 3.1 billion in 2023, reflecting a strong CAGR of 14.5% between 2023 and 2033. This rapid expansion highlights shifting consumer habits, where traditional meat consumption is gradually being replaced by plant-based and alternative protein options driven by health, ethical, and environmental concerns.

Growing criticism of intensive animal husbandry practices has become a major factor supporting this market’s expansion. Many consumers are becoming increasingly aware of the negative effects of large-scale livestock farming on animal welfare, biodiversity, and greenhouse gas emissions. Consequently, more people are turning toward flexitarian, vegetarian, or vegan diets that either reduce or eliminate animal product consumption, boosting the adoption of meat substitutes worldwide.

Furthermore, the COVID-19 pandemic significantly influenced consumer attitudes toward food and health. Rising awareness of personal well-being and immunity led many to seek healthier, sustainable protein sources, accelerating the global shift from conventional meat to plant-based or cultured alternatives. This transformation, backed by innovation and evolving food technologies, is expected to shape future dietary preferences and sustain long-term market growth.

Key Takeaways

- The Global Meat Substitutes Market is expected to hit USD 29.3 billion by 2033 from USD 3.1 billion in 2023, with a 14.5% CAGR.

- Plant-based proteins held 62.2% revenue share in 2023, driven by health, environment, and meat access issues.

- The retail segment led with over 47.2% market share in 2023 via supermarkets and big chains like Walmart.

- Europe dominated with 38.3% revenue in 2023, fueled by vegan/flexitarian growth and animal welfare awareness.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 3.1 Billion |

| Forecast Revenue (2033) | USD 29.3 Billion |

| CAGR (2024-2033) | 14.5% |

| Segments Covered | By Source (Plant-based Protein, Soy-based, Mycoprotein, and Other Sources), By Distribution Channel (Retail and Foodservice) |

| Competitive Landscape | Amy’s Kitchen, Impossible Foods Inc., Beyond Meat Inc., The Kellogg Company, Quorn Foods, Unilever Plc, VBites Foods Ltd., Meatless B.V., Other Key Players |

Key Market Segments

Source Analysis

In 2023, plant-based protein products accounted for 62.2% of total revenue, a dominance expected to persist through the forecast period. This growth is fueled by limited meat access in certain regions, rising environmental concerns, and increasing preference for healthier diets. Plant-based patties serve as an excellent daily protein source, particularly appealing to affluent young consumers and wellness enthusiasts.

To enhance functionality, target plant proteins are hydrolyzed and blended with ingredients like flour, food adhesives, and plant-based oils to achieve a meat-like texture. Plant-based protein inputs remain affordable and abundant, with meat substitutes primarily relying on these sources. It appeals to consumers due to its high fiber content, which aids in blood sugar and cholesterol management.

Rich in essential amino acids—nutrients scarce in many other proteins—mycoprotein stands out. Brands like Quorn offer high-protein, healthy meal options. Traditionally, vegetarians and vegans relied on limited alternatives such as mushrooms, cottage cheese, and soya chunks. Jackfruit has emerged as a versatile newcomer, prized for its texture and superfood status due to its extensive nutritional benefits.

Distribution Channel Analysis

In 2023, the retail segment dominated with over 47.2% market share, encompassing supermarkets, hypermarkets, convenience stores, departmental stores, and mini-markets. These outlets attract consumers through discounts and promotions. Major brands often launch products via large chains like Walmart and Target to maximize reach.

Global lockdowns during the COVID-19 pandemic initially reduced sales in these channels. However, economic reopening and a resurgence in socializing—centered on parties and gatherings—are expected to drive recovery and growth. The food service sector is propelled by demand for customized, innovative menus, allowing consumers to tailor meals based on budget, dietary needs, and taste preferences.

Demand for plant proteins remains strong across channels. Retailers stock a wide array of plant-based options, while restaurants introduce innovative plant-protein dishes. This enthusiasm spans vegetarians, non-vegetarians, and flexitarians, who embrace products like meat-like plant-protein burgers and meal kits.

Regional Analysis

Europe led the global meat substitutes market in 2023, capturing 38.3% of total revenue. Demand spans all age groups, driven by a growing vegan and flexitarian population and heightened awareness of animal welfare. Germany, with its advanced processing capabilities, offers meatless alternatives on par with those in the U.S. A key example is McDonald’s partnership with Nestlé to launch the Vegan Burger in Germany, aligning European and American preferences for plant-based options.

The COVID-19 pandemic accelerated health and food safety concerns across Asia, prompting consumers to embrace diets that support wellness and sustainability. The region presents significant opportunities for innovative, flavorful meat alternatives positioned as premium, everyday choices.

Top Use Cases

- Vegan Burger Delight: Busy families love swapping beef patties with plant-based ones made from peas or soy. These burgers grill up juicy and flavorful, letting everyone enjoy barbecues without meat. Kids get protein-packed meals that taste familiar, while parents feel good about healthier, eco-friendly choices that cut down on animal farming worries.

- Stir-Fry Surprise: Home cooks turn tofu or tempeh into quick stir-fries that mimic chicken strips. Tossed with veggies and sauce, they absorb bold Asian flavors effortlessly. This easy weeknight option keeps dinners exciting and nutritious, helping flexitarians ease into more plant foods without missing the chewy bite of real meat.

- Taco Night Twist: Lentils or jackfruit fill tacos just like ground beef, adding a shredded texture that’s perfect for spicy fillings. Top with fresh salsa and cheese alternatives for a fun, customizable meal. It’s a hit at gatherings, appealing to all diets and making Mexican nights lively while boosting fiber for better digestion.

- Falafel Feast: Chickpea-based falafel balls replace meatballs in wraps or salads, offering a crispy, nutty crunch. Fried or baked, they pack protein and pair with yogurt dips for Middle Eastern vibes. This versatile pick suits lunchboxes or parties, drawing in vegetarians who crave hearty bites without the heaviness of animal proteins.

- Nugget Nostalgia: Mycoprotein or seitan nuggets bake up like chicken ones, ideal for kids’ snacks or game-day apps. Dipped in sauces, they deliver that satisfying crunch and chew. Wellness fans appreciate the gut-friendly fiber, turning snack time into a simple way to swap out processed meats for cleaner, feel-good fuel.

Recent Developments

1. Amy’s Kitchen

Amy’s Kitchen continues to focus on its core strength of clean-label, organic frozen meals. A key recent development is the strategic decision to streamline its product portfolio. In 2023, the company announced it would discontinue several items, including its veggie burger, to concentrate resources on its best-performing products and improve supply chain efficiency. This move aims to strengthen its market position in the competitive frozen food aisle.

2. Impossible Foods Inc.

Impossible Foods is aggressively expanding into the grocery retail sector with new product innovations. A major 2023 launch was Impossible Savory Chicken Sausage and Impossible Chicken Nuggets, marking its entry into the poultry alternative category. The company continues to focus on making its products more accessible and affordable, leveraging its flagship Impossible Beef to compete directly with animal meat on price and availability in supermarkets.

3. Beyond Meat Inc.

Beyond Meat is pursuing a dual strategy of product innovation and health-focused reformulation. In 2024, it launched its fourth-generation Beyond Burger and Beyond Beef, touted to have less saturated fat, fewer calories, and a cleaner ingredient list. Simultaneously, the company is navigating a challenging market, implementing cost-reduction plans and focusing on securing profitability through its core retail and foodservice partnerships amid shifting consumer demand.

4. The Kellogg Company

Following its corporate split, the plant-based business, including the MorningStar Farms and Incogmeato brands, now resides under Kellanova. A key recent development is the brand refresh and recipe improvement for the iconic MorningStar Farms line in 2023, aiming to improve taste and texture. Kellanova is leveraging its massive distribution network to maintain its stronghold as a leading, accessible meat substitute brand in the frozen food section.

5. Quorn Foods

Quorn is emphasizing its unique mycoprotein ingredient as a point of differentiation, highlighting its sustainability and nutritional credentials. Recent developments include a major marketing campaign, “The Power of Mycoprotein,” to educate consumers on its low-fat, high-fiber, and high-protein benefits. The company is also innovating within its core categories, launching new vegan-friendly and “Crispy” product lines in key markets to cater to the demand for convenient, family-friendly options.

Conclusion

Meat Substitutes evolve from niche items to everyday staples, driven by smart innovations that match real meat’s appeal. They’re reshaping how we eat by blending health perks, eco-friendliness, and tasty options into busy lives. Looking ahead, expect wider adoption as more folks seek balanced, kind-to-the-planet choices, paving the way for a vibrant, inclusive food scene where everyone finds something delicious and good for them.