Quick Navigation

Introduction

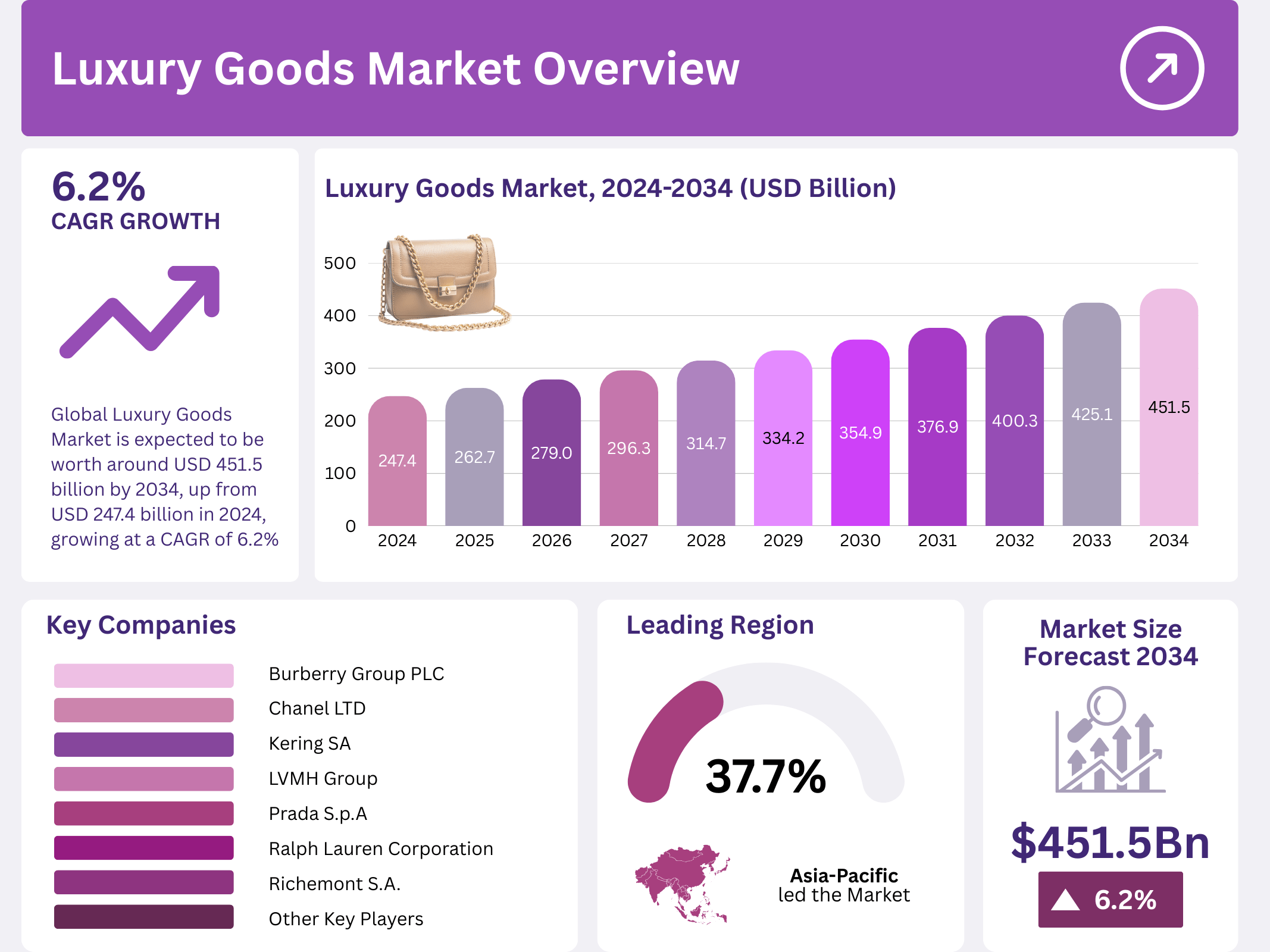

The global luxury goods market is entering a transformative decade marked by rising disposable incomes, the expansion of affluent consumer classes, and the increasing influence of digital innovation. Valued at USD 247.4 billion in 2024, the market is projected to grow at a CAGR of 6.2% from 2025 to 2034, ultimately reaching USD 451.5 billion by 2034. Asia Pacific spearheads this growth, capturing a commanding 37.7% market share worth USD 93.3 billion in 2024.

Luxury goods, encompassing apparel, handbags, footwear, jewelry, and fine accessories, continue to represent symbols of prestige, craftsmanship, and exclusivity. Shifts in consumer demographics, with younger and environmentally conscious buyers entering the market, are reshaping industry dynamics. Furthermore, the integration of sustainability, technology, and personalized shopping experiences is redefining luxury consumption worldwide.

Key Takeaways

- The global luxury goods market is expected to grow from USD 247.4 billion in 2024 to USD 451.5 billion by 2034, at a CAGR of 6.2%.

- Apparel leads the product category, holding 36.4% market share in 2024.

- Women remain the dominant end-user group with 50.1% market share in 2024.

- Retail stores account for the highest distribution share at 29.5% in 2024.

- Asia Pacific dominates the market with 37.7% share, valued at USD 93.3 billion in 2024.

- Digital transformation, sustainability, and customization are shaping the future of luxury consumption.

Drivers

- Rising global wealth: Expansion of middle and upper classes in emerging economies fuels premium consumption.

- Younger demographic demand: Gen Z and millennials prioritize luxury as lifestyle symbols, influenced by social media.

- Digital transformation: Growth in e-commerce and omnichannel platforms makes luxury goods more accessible.

- Brand heritage & exclusivity: Deep-rooted reputation of legacy brands sustains consumer trust and loyalty.

- Sustainability appeal: Eco-friendly practices resonate with environmentally conscious buyers.

- High-margin profitability: Leading brands enhance margins with premium pricing strategies and efficient operations.

Use Cases

- Apparel & Fashion: Exclusive designer clothing remains central to status expression.

- Luxury Accessories: Handbags, jewelry, and watches serve as prestige symbols and investment assets.

- Premium Automobiles: Luxury cars reinforce wealth representation among high-net-worth individuals.

- Cosmetics & Beauty: High-end skincare and fragrances appeal to younger affluent consumers.

- Bespoke Experiences: Personalized shopping journeys and limited-edition collections attract elite buyers.

- Digital Engagement: AR/VR try-ons and virtual luxury shows redefine consumer-brand interactions.

Market Segmentation Overview

In 2024, apparel dominated the luxury goods market, capturing 36.4% of revenue. High demand for designer fashion, exclusivity, and tailored products continue to propel this segment. Handbags and purses, accounting for 28.0%, remain iconic status symbols, while footwear contributed 16.2% due to its alignment with high-fashion trends. The others category, including jewelry, watches, and eyewear, held 19.4%, reflecting robust demand for complementary luxury accessories.

From an end-user perspective, women led with 50.1%, underpinned by growing purchasing power and strong demand for apparel, accessories, and cosmetics. Men accounted for 37.5%, supported by increasing interest in luxury apparel and grooming products. Kids represented 12.4%, driven by premium product lines from top brands catering to affluent parents.

In distribution, retail stores held 29.5%, supported by immersive in-store experiences. Department stores (21.0%), specialty stores (15.0%), and company websites (11.5%) continue to be strong channels, while online retailers gained traction with 17.9%, reflecting shifting consumer habits. Other niche channels, such as pop-ups and auctions, contributed 5.1%, appealing to buyers seeking exclusivity.

Major Challenges

- Economic volatility: Inflation and currency fluctuations dampen purchasing power in unstable economies.

- Geopolitical disruptions: Trade restrictions and supply chain challenges hinder market growth.

- Sustainability pressures: Rising consumer demand for eco-friendly production strains traditional supply chains.

- Counterfeit products: Imitations dilute brand equity and erode consumer confidence.

- Regional disparities: Decline in luxury spending in the Americas contrasts with strong Asia-Pacific growth.

- High competition: Both heritage and emerging brands fight for market share through aggressive innovation.

Business Opportunities

- E-commerce penetration: Expanding luxury sales across digital platforms with global reach.

- Emerging markets: Growth potential in China, India, and ASEAN countries with rising affluent populations.

- Sustainable luxury: New product lines with eco-friendly sourcing attract conscious consumers.

- Personalized services: Custom-made collections and AI-driven personalization enhance exclusivity.

- Cross-industry collaborations: Partnerships with technology and automotive companies broaden appeal.

- Experiential luxury: Travel, events, and lifestyle services emerge as lucrative extensions of luxury brands.

Regional Analysis

Asia Pacific leads the global luxury goods market with 37.7% share, valued at USD 93.3 billion in 2024. Rising disposable incomes, digital adoption, and urban luxury culture in China, Japan, and South Korea drive expansion. Premium retail infrastructure and growing Gen Z demand further reinforce this dominance.

North America, valued at USD 60.6 billion in 2024, remains a robust market due to high consumer spending and strong retail ecosystems in the US and Canada. Digital adoption and personalized luxury offerings sustain growth momentum.

Europe, with USD 71.2 billion in 2024, continues as a luxury hub, anchored by Paris, Milan, and London. Strong tourism flows and heritage brands support steady demand for apparel, jewelry, and cosmetics.

The Middle East & Africa show strong demand in GCC countries and the UAE, where affluent consumers prefer bespoke products and mall-driven luxury retail. Africa’s luxury market is gradually emerging, supported by rising urbanization.

Latin America, though impacted by economic fluctuations, demonstrates rising interest in luxury goods, with Brazil and Mexico spearheading demand. Expanding accessibility and awareness sustain the region’s potential for long-term growth.

Recent Developments

- August 2023: Ralph Lauren Corporation acquired a smaller luxury brand to strengthen its Asian market penetration.

- June 2023: Richemont launched sustainably sourced jewelry lines, targeting eco-conscious buyers.

- March 2023: Giorgio Armani partnered with a tech startup to integrate AI in design, enhancing personalization.

- FY2022: Top 100 luxury companies recorded USD 347 billion in composite sales, showcasing recovery post-pandemic.

- 2023: Bain reported an 8% decline in US luxury spending, while Asia and Saudi Arabia demonstrated strong growth.

Conclusion

The global luxury goods market is poised for sustained growth, projected to expand from USD 247.4 billion in 2024 to USD 451.5 billion by 2034. The market’s resilience lies in its ability to innovate, adapt to changing consumer values, and embrace sustainability and technology. With Asia Pacific leading global expansion and digitalization reshaping engagement, luxury brands are well-positioned to thrive in evolving consumer landscapes.

As affluent consumers demand greater exclusivity, personalization, and ethical practices, the luxury goods industry is expected to remain a cornerstone of global economic influence and cultural identity.