Market Overview

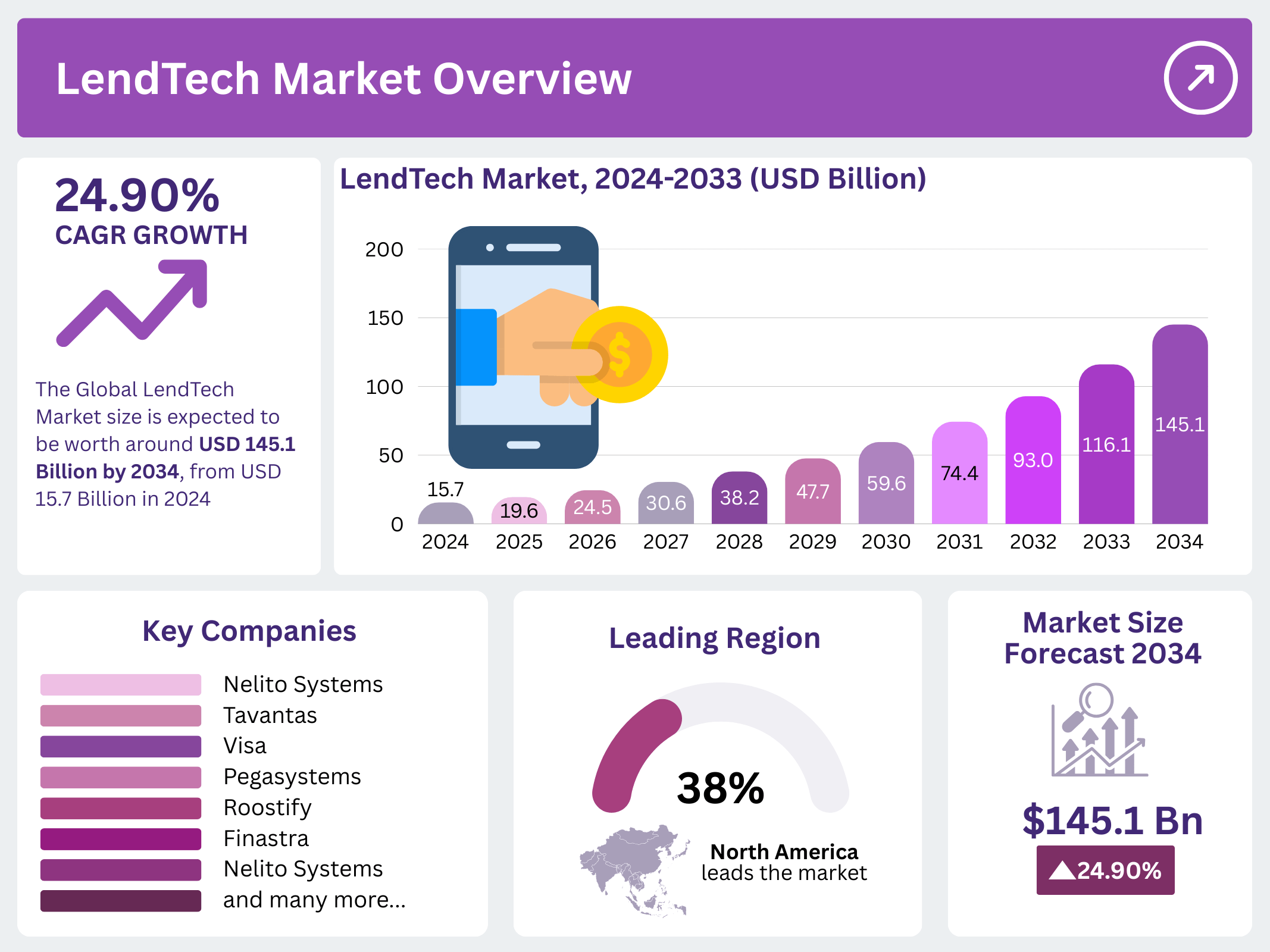

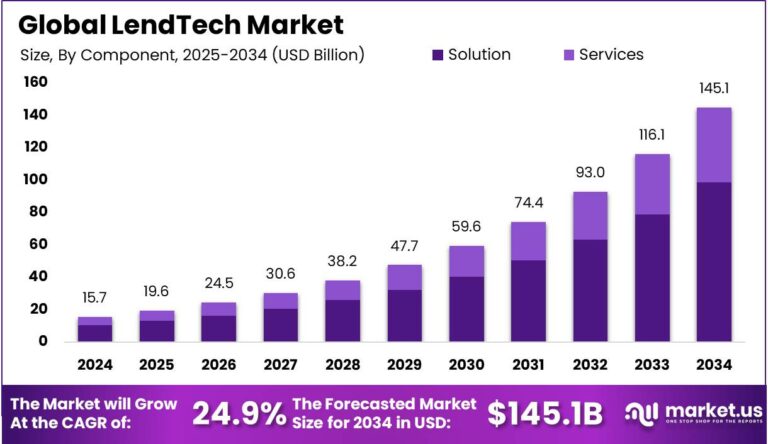

The Global LendTech Market is expected to experience significant growth, reaching USD 145.1 Billion by 2034, up from USD 15.7 Billion in 2024, representing a CAGR of 24.90% during the forecast period from 2025 to 2034. LendTech, the fusion of lending and technology, is transforming the financial industry by providing faster, more efficient, and personalized lending services. In 2024, North America holds a dominant position, capturing over 38% of the market share, contributing approximately USD 5.9 Billion in revenue, driven by technological advancements, digital transformation in finance, and rising demand for alternative lending solutions.

Key Takeaways

-

The LendTech Market is expected to grow at a CAGR of 24.90%, reaching USD 145.1 Billion by 2034.

-

North America holds a dominant share of over 38% in 2024, contributing USD 5.9 Billion in revenue.

-

Digital lending platforms are improving accessibility, efficiency, and customer experience in the lending process.

-

The rise of alternative lending, including peer-to-peer lending and blockchain-based systems, is reshaping the market.

-

LendTech adoption is accelerating in sectors like fintech, retail, and real estate, providing new opportunities for lenders and borrowers.

Outpace rivals start with our sample @ https://market.us/report/lendtech-market/free-sample/

Role of AI

AI is playing a crucial role in the LendTech market by enhancing lending decision-making, reducing risks, and improving customer experiences. Through AI-powered algorithms, lenders can analyze vast amounts of financial data, assess creditworthiness, and offer personalized loan recommendations. AI also helps automate the loan approval process, making it faster and more efficient. Machine learning models are increasingly being used to detect fraud, identify patterns, and predict borrower behavior, improving the accuracy of risk assessments. As AI adoption in LendTech grows, it will continue to shape the future of lending by making it more data-driven, inclusive, and efficient.

Analyst’s Viewpoint

The LendTech market is poised for significant growth, fueled by the increasing digitization of the financial services industry. The integration of advanced technologies such as AI, blockchain, and data analytics into lending platforms is driving innovation and transforming traditional lending models. As demand for quicker, more personalized lending services grows, digital-first solutions will play a central role in meeting consumer and business needs. The market will continue to expand as more consumers and businesses embrace alternative lending options, creating substantial growth opportunities for LendTech providers. However, the need for regulatory frameworks and security standards will also be critical for the market’s long-term success.

Regional Highlights

North America is leading the LendTech Market with over 38% of the market share in 2024, generating approximately USD 5.9 Billion in revenue. The region’s dominance is driven by a robust fintech ecosystem, widespread adoption of digital lending platforms, and a favorable regulatory environment. Europe is also seeing significant growth, with countries like the UK and Germany increasingly adopting LendTech solutions. The Asia Pacific region is expected to witness the fastest growth, fueled by the increasing demand for digital lending in emerging economies like India and China, where digital finance solutions are rapidly gaining traction.

Key Market Segmentation

-

By Technology: AI, Blockchain, Big Data Analytics, Cloud Computing – These technologies enable faster, smarter, and more efficient lending solutions.

-

By Application: Personal Loans, Business Loans, Mortgages, Student Loans – Various types of loans are being increasingly digitized for ease of access and management.

-

By End-User: Fintech, Banks, Credit Unions, Retailers, Peer-to-Peer Lending Platforms – Different industries are embracing LendTech solutions to enhance their lending operations.

-

By Region: North America, Europe, Asia Pacific, Rest of the World – North America leads, but Europe and Asia Pacific are expected to grow rapidly.

Emerging Trends

-

Peer-to-Peer Lending: The rise of decentralized lending platforms that connect borrowers directly with investors.

-

Blockchain-Based Lending: Using blockchain technology to provide secure, transparent, and efficient loan transactions.

-

AI-Driven Risk Assessment: The use of AI to enhance credit scoring and predict borrower behavior for better risk management.

-

Embedded Lending Solutions: Integrating lending options into e-commerce, retail, and financial services for seamless customer experiences.

-

Sustainable Lending: Lenders focusing on eco-friendly or socially responsible loans, aligning with ESG criteria.

Top Use Cases

-

Consumer Loans: Providing personalized loan offers for individuals based on AI-powered credit assessments.

-

Business Financing: LendTech platforms enabling faster and more accessible loans for SMEs.

-

Real Estate Financing: Digital mortgage and home loan solutions enhancing the home buying process.

-

Micro-Lending: Facilitating small loans with minimal documentation, especially in emerging markets.

-

Invoice Financing: Providing businesses with immediate cash flow by financing their outstanding invoices.

Major Challenges

-

Regulatory Compliance: Ensuring LendTech solutions comply with regional and global financial regulations.

-

Data Security: Safeguarding sensitive financial and personal data from cyber threats and breaches.

-

Consumer Trust: Building trust with consumers who may be wary of non-traditional lending platforms.

-

Technological Barriers: Overcoming challenges related to integration with legacy systems and achieving interoperability.

-

Market Competition: Competing with established financial institutions and other digital lending startups in a rapidly growing market.

Attractive Opportunities

-

Expanding into Emerging Markets: Digital lending solutions offer great potential in underbanked regions of Asia, Africa, and Latin America.

-

AI Integration: Developing more sophisticated AI models for risk assessment, loan origination, and fraud detection.

-

Blockchain for Transparency: Leveraging blockchain to offer secure and transparent lending processes.

-

Partnerships with Traditional Banks: Collaborating with established financial institutions to integrate LendTech solutions into their operations.

-

Niche Lending: Focusing on specific loan products such as student loans, small business loans, or eco-friendly financing options.

Don’t miss out—get the report today @ https://market.us/purchase-report/?report_id=140324

Business Benefits

Adopting LendTech solutions allows businesses to streamline their lending processes, reduce operational costs, and offer more personalized services to customers. By leveraging AI, blockchain, and cloud computing, businesses can improve efficiency, enhance customer satisfaction, and increase profitability. Additionally, digital lending platforms provide businesses with access to a broader customer base and enable faster loan disbursement. Furthermore, LendTech solutions help businesses reduce fraud risk, automate loan origination, and improve compliance with regulatory standards, contributing to long-term growth and success.

Recent Developments

-

The launch of blockchain-based lending platforms offering greater transparency and security.

-

AI-driven credit scoring models becoming more widely adopted for quicker and more accurate loan approvals.

-

Expansion of LendTech solutions to emerging markets with a focus on underbanked populations.

-

Increasing partnerships between LendTech startups and traditional financial institutions to expand their customer base.

-

Rising adoption of cloud-based lending platforms for scalability and flexibility.

Key Players Analysis

Key players in the LendTech market include a mix of established financial institutions and new fintech startups. These companies are focusing on developing AI-driven lending solutions, blockchain-based platforms, and cloud infrastructure to offer faster, more secure, and efficient loan products. Partnerships with traditional banks and digital payment providers are also common, helping expand the reach and adoption of LendTech solutions across diverse market segments.

- Nelito Systems Ltd.

- Tavantas

- Visa, Inc.

- Pegasystems Inc.

- Roostify, Inc.

- Finastra

- Nelito Systems Pvt. Ltd.

- Newgen Software Technologies Limited

- American Express Company

- Fiserv Incorporation Company Profile

- Q2 Software, Inc.

- Nelito Sysrems Pvt Ltd.

- Other Key Players

Customer Insights

Customers in the LendTech market are increasingly seeking faster, more personalized lending experiences. With growing digitalization, customers demand seamless, paperless processes and quick loan approvals. Many consumers are attracted to alternative lending models that offer more flexible terms, such as peer-to-peer lending or micro-lending. Additionally, customers value transparency in pricing and a simplified application process. As the LendTech market grows, consumers will continue to prioritize user-friendly platforms that offer lower interest rates, quicker responses, and more control over their borrowing experiences.

Future Outlook

The future of the LendTech Market looks incredibly bright, driven by the growing adoption of AI, blockchain, and digital platforms in the financial services sector. As consumers and businesses increasingly embrace digital lending, the market will see continued innovation and new revenue streams. The integration of advanced technologies, coupled with the expansion into emerging markets, will help create new growth opportunities. Over the next decade, LendTech is set to redefine the lending landscape, providing more accessible, efficient, and personalized financial services.

Conclusion

The LendTech Market is rapidly evolving, with technology reshaping how loans are originated, processed, and repaid. As the market grows, businesses in the financial services industry will need to adopt innovative lending solutions that leverage AI, blockchain, and cloud computing. North America currently leads the market, but significant growth is expected globally, especially in emerging markets. The future of LendTech presents immense opportunities for both consumers and businesses, making it an essential sector for investors and financial institutions to watch. The continued expansion of LendTech will redefine the future of lending, offering more efficient, transparent, and accessible solutions.