Quick Navigation

Introduction

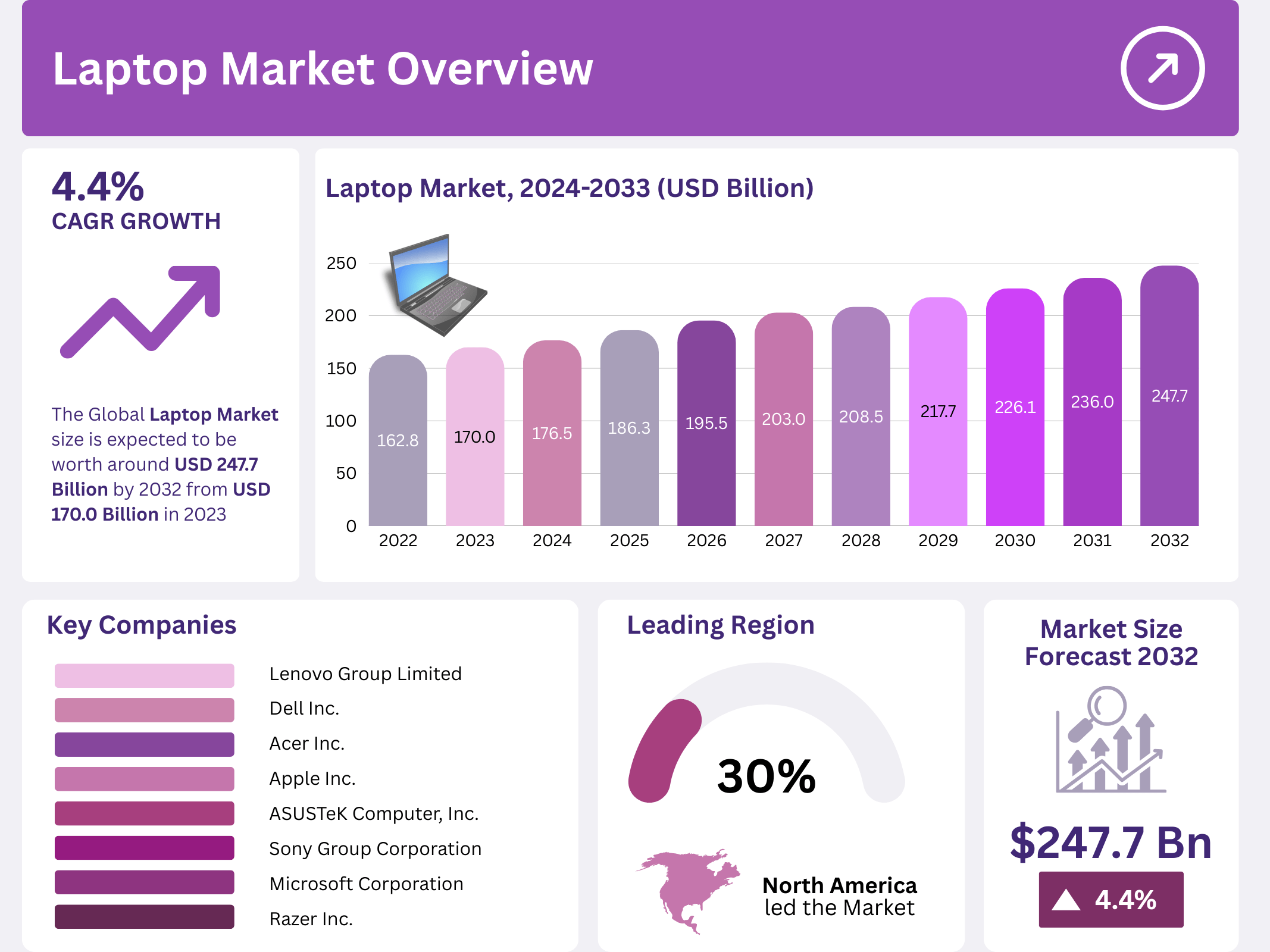

The global laptop market is on a strong upward trajectory, with increasing demand across various sectors driven by the growing reliance on digital platforms for work, education, and entertainment. As businesses and individuals increasingly seek reliable, high-performance, and portable computing solutions, the market is expected to grow significantly. According to recent reports, the market is projected to reach a value of USD 247.7 billion by 2032, up from USD 170.0 billion in 2023, growing at a CAGR of 4.4% during the forecast period from 2023 to 2033.

Key Takeaways

- The global laptop market is set to grow from USD 170.0 billion in 2023 to USD 247.7 billion by 2032, marking a CAGR of 4.4%.

- Traditional laptops continue to dominate, accounting for more than 65% of market revenue.

- Business laptops represent a significant portion of the market, contributing to 40% of total market share.

- North America holds the largest regional share, while Asia Pacific is expected to see the highest growth at a CAGR of 5.6%.

- The demand for laptops in education is expected to contribute to 20% of the market’s growth, spurred by digital learning trends.

Market Segmentation Overview

The laptop market comprises several segments based on type, screen size, end-user, and regional demand. These segments reflect the diverse consumer needs, from budget-friendly models to high-end gaming and business laptops.

By Type:

- Traditional laptops dominate the market with 65% of market share due to their proven performance, affordability, and versatility across various sectors.

- 2-in-1 laptops are gaining momentum, especially among consumers seeking flexible devices that combine the functionality of both laptops and tablets.

By Screen Size:

- Laptops with 15.0 to 16.9-inch screens represent the largest segment, holding more than 38% of the market share, offering a balance between portability and usability.

- Smaller screens, such as 11″ to 12.9″, are popular among students and professionals who prioritize portability.

By End-User:

- The business segment holds the largest share, representing 40% of total market revenue, driven by the ongoing digital transformation and remote work trend.

- The gaming segment is also growing rapidly, fueled by increased demand for high-performance laptops capable of supporting advanced gaming graphics and performance.

Drivers

- Technological Advancements: The development of faster processors, AI-powered features, enhanced battery life, and 5G connectivity is fueling the demand for high-performance laptops across various sectors. These innovations are meeting consumer needs for faster, more efficient, and portable devices.

- Shift to Hybrid Work and Education Models: The demand for laptops has surged as businesses and educational institutions continue to implement hybrid models. According to industry data, approximately 70% of organizations have adopted hybrid work, further driving laptop sales.

- Rising Demand for Gaming Laptops: The gaming laptop market continues to thrive as more consumers embrace esports and streaming, with advanced graphics capabilities and higher processing power becoming crucial for gamers.

Use Cases

- Education: Laptops are essential for remote learning and digital classrooms, particularly in the wake of the pandemic. Educational institutions across the globe are investing heavily in laptops to provide students with digital learning tools.

- Business: Laptops are integral to modern business operations, especially in hybrid work models. High-performance business laptops are in demand to support productivity, communication, and secure digital workflows.

- Gaming: The gaming industry’s rapid growth is driving the demand for specialized laptops with powerful processors, GPUs, and high-refresh-rate screens.

- Entertainment: Content creators and media professionals are increasingly using high-performance laptops for video editing, animation, and streaming.

Major Challenges

- Long Replacement Cycles: Many consumers and businesses are holding on to their laptops for longer periods, leading to slower replacement cycles. With laptops’ durability improving, many users are opting to extend the life of their devices, affecting new sales.

- Increasing Competition: The laptop market is highly competitive, with major players such as Lenovo, Dell, HP, and Apple vying for market share. Smaller and emerging brands must find ways to differentiate their products to compete effectively.

Business Opportunities

- Sustainability: With growing consumer awareness about environmental issues, there is an increasing demand for eco-friendly laptops made from sustainable materials. Companies focusing on recyclability, energy efficiency, and sustainable sourcing are poised to capture this segment.

- Emerging Markets: The growing digital infrastructure in regions such as Asia Pacific, Latin America, and Africa provides opportunities for expansion. As economies in these regions continue to grow and urbanize, demand for laptops will continue to rise.

- Product Innovation: There is ample room for innovation in the laptop market, particularly in areas like battery life, connectivity (e.g., 5G), and integration of AI capabilities. Offering devices tailored to the needs of remote work and education could be key to future growth.

Regional Analysis

- North America: The region accounts for 30% of the global laptop market, driven by strong demand from enterprises, educational institutions, and government bodies. The continued adoption of hybrid work models is further boosting demand for laptops.

- Asia Pacific: Asia Pacific is expected to see the highest market expansion due to the rapid digital transformation and increasing disposable incomes. China remains the largest market..

- Europe: Europe is experiencing robust growth driven by government investments in digital education and corporate technology upgrades. The region is also seeing a rising demand for sustainable and eco-friendly laptop options.

Recent Developments

- Lenovo launched its latest PC and Chromebook lineup in February 2023, introducing new models optimized for hybrid work environments.

- Acer unveiled its new Nitro 14 and Nitro 16 gaming laptops in April 2024, equipped with cutting-edge processors and GPUs, targeting gaming enthusiasts.

- Apple introduced its new MacBook Air models in 2024, featuring the advanced M3 chip for up to 60% faster performance compared to previous models.

Conclusion

The global laptop market is on track for substantial growth, driven by technological advancements, the shift towards hybrid work, and the increasing demand for gaming and educational solutions. Manufacturers must continue innovating to meet evolving consumer needs and capitalize on emerging market opportunities. With a projected value of USD 247.7 billion by 2032, the market is poised for a bright future, marked by new product innovations and growing regional demand.