Quick Navigation

Introduction

The global kaolin market continues to strengthen as industries increasingly adopt high-performance mineral solutions. As demand evolves, manufacturers prioritize advanced kaolin grades to boost efficiency and sustainability in core applications. Moreover, technological upgrades are reshaping production capabilities, enabling enhanced product consistency across major industrial sectors.

Additionally, expanding applications in ceramics, paper, plastics, and coatings are accelerating market penetration worldwide. Rising adoption in emerging economies further supports this upward trend. Furthermore, continuous innovation in refining techniques helps companies achieve higher product purity, reinforcing kaolin’s competitive advantage in multiple end-use industries.

Simultaneously, shifting consumer and industrial requirements are driving rapid transformations within the market. As sectors aim for lightweight, eco-friendly, and high-durability materials, kaolin emerges as a key enabler. Consequently, opportunities for specialty and value-added kaolin products continue to broaden across regions.

Moreover, strategic investments, mergers, and expansions by leading players underscore the market’s growth momentum. The integration of advanced mineral solutions supports manufacturers in improving operational performance and meeting stringent global quality standards. Hence, the industry outlook remains highly promising through the forecast period.

Key Takeaways

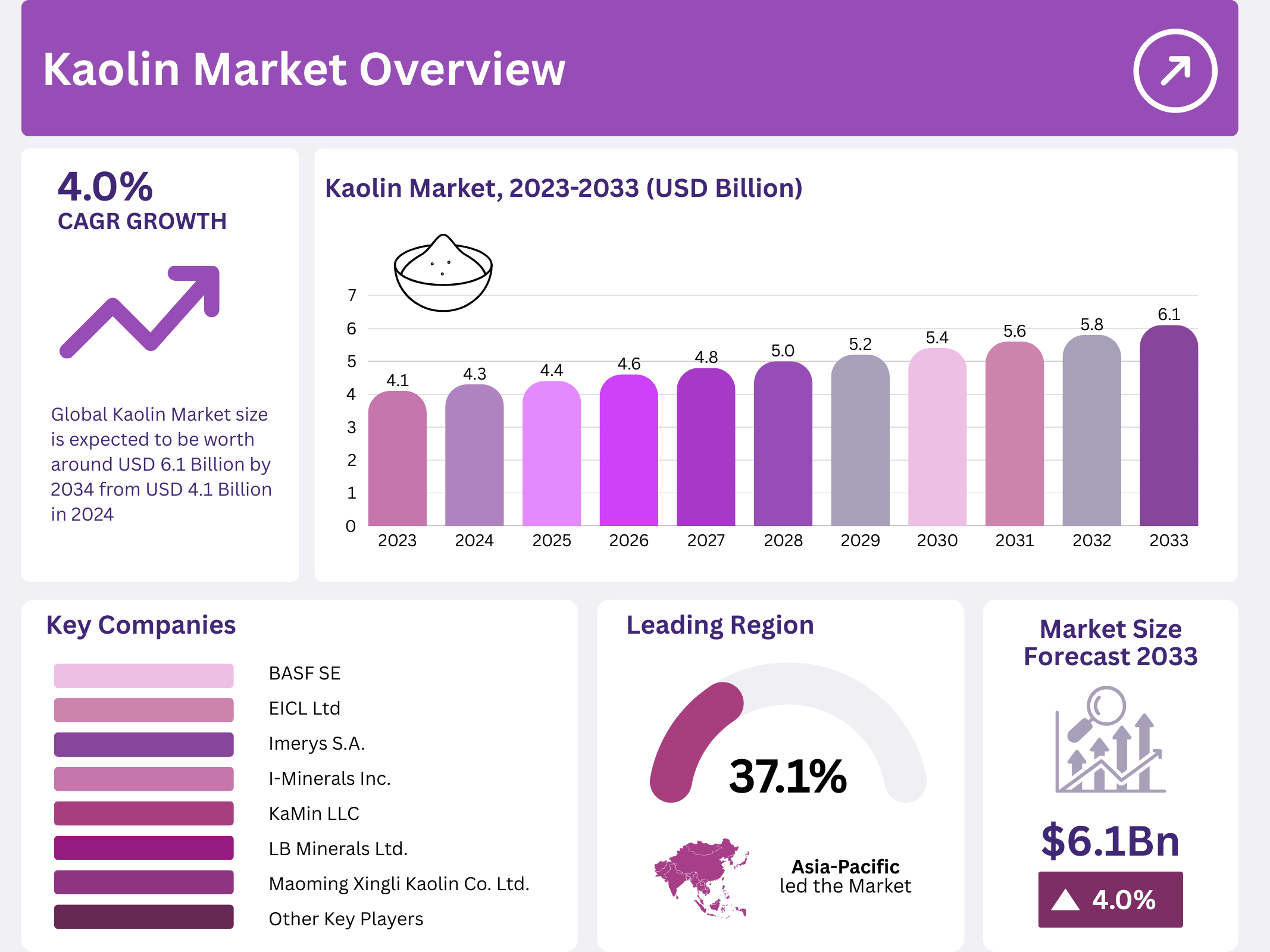

- The Global Kaolin Market is projected to grow from USD 4.1 Billion in 2024 to USD 6.1 Billion by 2034, at a CAGR of 4.0%.

- Calcined Kaolin leads the market with a dominant share of 41.2% in 2024 due to its superior physical properties and widespread use in various industries.

- The Paper segment holds the largest market share, accounting for 32.5% in 2024, driven by its critical role in enhancing paper brightness, smoothness, and printability.

- The APAC region dominates the global Kaolin market with a 37.1% market share in 2024, driven by industrial growth and demand in countries like China and India.

Market Segmentation Overview

Within the grade segment, calcined kaolin maintains strong dominance as industries seek its enhanced brightness and performance characteristics. Additionally, hydrous kaolin continues to grow steadily due to its versatility and suitability for paper, paints, and adhesives.

Moreover, delaminated and surface-treated kaolin segments expand as specialty applications increase across coatings and plastics. Structured kaolin remains essential for formulations requiring improved rheology and durability, particularly in premium coating solutions.

By application, the paper industry secures the leading share, relying heavily on kaolin for filler and coating enhancements. In parallel, the ceramics sector benefits from kaolin’s purity and heat resistance, making it a staple for tiles, porcelain, and sanitaryware production.

Furthermore, paints and coatings increasingly integrate kaolin to improve opacity and film strength. Plastics, rubber, cosmetics, pharmaceuticals, and fiberglass applications follow, leveraging kaolin’s reinforcing and absorbent properties to elevate product performance.

Drivers

A major market driver is the rising demand for high-quality paper products across emerging economies. Kaolin is extensively used as both a filler and coating agent, significantly improving opacity, brightness, and print quality. As environmentally conscious, recyclable paper solutions gain traction, kaolin’s importance continues to accelerate worldwide.

Additionally, growth in construction and ceramics manufacturing substantially boosts market expansion. Kaolin’s ability to enhance strength, whiteness, and durability makes it indispensable for sanitaryware, fine china, and architectural ceramics. The proliferation of advanced ceramic technologies further strengthens demand.

Use Cases

Kaolin plays a crucial role in premium coatings, enabling smooth finishes and improved pigment suspension. Manufacturers rely on its rheological properties to boost paint durability and reduce cracking, supporting high-performance architectural and automotive coatings.

In plastics manufacturing, kaolin functions as a reinforcement filler, elevating dimensional stability and chemical resistance. This makes it ideal for packaging, consumer goods, and automotive components where strength-to-weight optimization is essential.

Major Challenges

One key challenge is the increasing adoption of calcium carbonate substitutes such as GCC and PCC in the paper industry. These alternatives offer competitive pricing and similar performance attributes, posing a significant restraint on kaolin consumption.

Another challenge stems from the rise in recycled paper usage, which reduces the demand for traditional fillers. As sustainability initiatives expand globally, reliance on virgin kaolin-based additives may continue to decline in specific applications.

Business Opportunities

Growing applications in the ceramics industry present sizable opportunities, particularly as emerging economies invest heavily in infrastructure and interior design. Advanced ceramics used in electronics and specialty components also open new technological avenues for high-purity kaolin.

Expanding demand for eco-friendly coatings and sustainable packaging enables manufacturers to innovate kaolin formulations tailored for green applications. Developments in 3D printing and composite materials further widen the opportunity landscape.

Regional Analysis

The APAC region leads the global market, supported by rapid industrialization and substantial growth in construction, ceramics, and packaging sectors. China and India, in particular, drive consumption through robust manufacturing ecosystems and expanding export capabilities.

North America and Europe maintain steady demand, driven by advanced paper, coatings, and pharmaceutical industries. Emerging markets in Latin America, the Middle East, and Africa exhibit gradual growth as infrastructure projects and industrial capacity scale upward.

Recent Developments

- In 2025, PQ completed the acquisition of Sibelco Group’s specialty silicate business in Sweden, expanding its expertise and customer reach across Nordic markets.

- In 2025, Imerys acquired Chemviron’s diatomite and perlite assets in France and Italy, strengthening its life sciences and filtration materials portfolio.

Conclusion

The global kaolin market enters a period of steady advancement powered by industrial diversification, technological innovation, and increasing sustainability priorities. As demand rises across paper, ceramics, coatings, plastics, and healthcare applications, kaolin’s versatility ensures robust long-term relevance. With major players investing in processing upgrades and regional expansions, the market is poised for consistent growth through 2034.