Quick Navigation

Overview

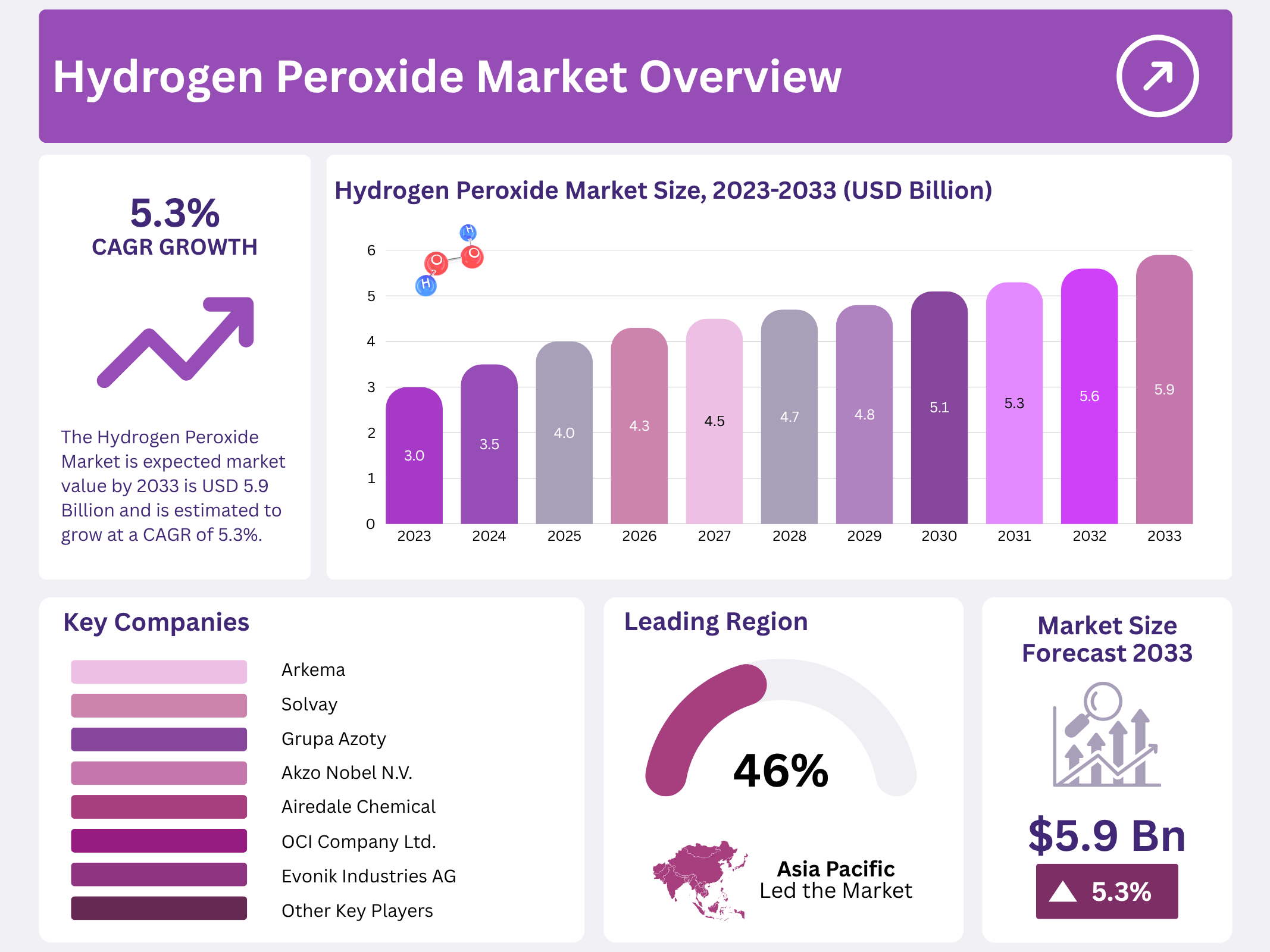

New York, NY – November 18, 2025 – The Global Hydrogen Peroxide industry was valued at USD 3.0 billion in 2023 and is set for steady expansion. With an estimated compound annual growth rate (CAGR) of 5.3% from 2023 to 2033, the market is forecast to touch USD 5.9 billion by the end of the assessment period, reflecting growing demand across healthcare, food processing, electronics, and environmental applications.

Hydrogen peroxide is well-recognized as a common antiseptic, widely used in hospitals, clinics, and home first-aid care. Its antimicrobial activity makes it suitable for cleaning and disinfecting minor skin injuries such as cuts, scrapes, and abrasions, helping lower the risk of bacterial infection. The healthcare sector continues to adopt it owing to its affordability, wide availability, and effectiveness.

Beyond wound care, it is also used as a mild oral rinse to soothe mouth irritation or reduce excess mucus. When applied, hydrogen peroxide releases oxygen and creates a noticeable foaming action. This reaction helps lift and remove dead skin cells or debris from the affected area, supporting improved hygiene and faster surface-level cleansing. Hydrogen peroxide releases oxygen and creates a noticeable foaming action.

Key Takeaways

- The Hydrogen Peroxide Market is expected market value by 2033 is USD 5.9 billion and is estimated to grow at a CAGR of 5.3%.

- Bleaching Dominance holds a 36.4% market share, extensively used in the medical, pulp and paper, and textile industries.

- The Pulp and Paper Industry Accounts for 34.2% of the market due to its chlorine-free properties, enhancing paper quality and lowering production costs.

- Asia-Pacific holds the largest market share, 46.5% attributed to increased penetration in chemical formulators and personal-care products.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 3.0 Billion |

| Forecast Revenue (2033) | USD 5.9 Billion |

| CAGR (2024-2033) | 5.3% |

| Segments Covered | By Function (Disinfectant, Bleaching, Oxidant, Others), By Application (Pulp And Paper, Chemical Synthesis, Wastewater Treatment, Mining, Food And Beverages, Personal Care, Healthcare, Textiles, Others) |

| Competitive Landscape | Evonik Industries AG, Taekwang Industrial, CO., LTD., Arkema, Grupa Azoty, Solvay, Akzo Nobel N.V., Gujarat Alkalies & Chemicals Ltd., National Peroxide Limited, OCI Company Ltd., Airedale Chemical |

Key Market Segments

Function Analysis

Bleaching emerged as the leading function segment by volume in 2023, commanding a 36.4% market share. Hydrogen peroxide is a preferred bleaching agent across multiple industries, including pulp and paper, textiles, and healthcare. In healthcare, it is widely used in dental bleaching, mouthwashes, hair bleaching products, and oral hygiene formulations.

The textile industry consumes the largest volumes within this segment due to its effectiveness in brightening fabrics, removing stains from both natural and synthetic fibers, and enhancing mechanical properties during fabric processing. The disinfectant segment is projected to register the fastest volume CAGR during the forecast period. Heightened global hygiene awareness, particularly following the widespread flu outbreaks in early 2023, significantly boosted demand for hydrogen peroxide-based disinfectants.

This surge drove increased production of surface cleaners (indoor and outdoor), floor cleaners, hand sanitizers, and other sanitizing products. The sustained focus on infection prevention and public health is expected to maintain strong growth momentum in this segment in the coming years.

Application Analysis

The pulp and paper segment dominated the market by volume, accounting for a 34.2% share. As a chlorine-free bleaching agent, hydrogen peroxide is indispensable in this industry. It significantly improves pulp brightness, enhances chemical and mechanical properties of paper, and delivers superior printability while reducing overall production costs. Its environmental advantages, ease of use, and biodegradability have further accelerated its adoption as mills transition away from traditional chlorine-based processes.

The healthcare application segment is forecast to record the highest volume CAGR of 4.6% over the forecast period. Rapid expansion in the production of disinfectants, sterilants, and sanitizing products by major multinational companies—coupled with growing consumer awareness of hygiene essentials—continues to fuel demand in hospitals, clinics, and household settings.

Wastewater treatment represents another high-growth application area. Hydrogen peroxide effectively lowers Chemical Oxygen Demand (COD) and Biological Oxygen Demand (BOD) through advanced oxidation processes, enabling the removal of toxic organic compounds and making water safe for discharge or reuse. Its versatility—whether used in direct oxidation, enhanced Fenton processes, or as a supplemental oxygen source—has made it a preferred choice in municipal and industrial wastewater treatment facilities worldwide.

Regional Analysis

Asia Pacific dominated the global hydrogen peroxide market in 2023, accounting for 46.5% of total revenue. The region’s leadership is driven by strong demand from chemical formulators, personal care products, and healthcare industries. Countries such as China, India, and South Korea have emerged as key manufacturing hubs for multinational companies, attracted by low land costs, abundant raw material availability, favorable trade balances, and supportive industrial policies.

North America is the largest regional market for hydrogen peroxide in wastewater treatment, primarily due to the widespread prevalence of water-borne contaminants and stringent regulatory requirements. In the United States alone, over 34 billion gallons of wastewater are treated daily to ensure safe drinking water. Strict mandates for phosphorus removal, oxidation of organic compounds, and elimination of toxic pollutants have significantly boosted hydrogen peroxide consumption in municipal and industrial wastewater treatment facilities.

Europe has witnessed robust growth in hydrogen peroxide demand, fueled by the expanding personal care and cosmetics sector. The product’s excellent antimicrobial and oxidizing properties make it indispensable in hair care formulations, skin care products, lotions, and disinfectants. Rising consumer focus on personal hygiene and grooming, particularly in the U.K., France, Italy, and Germany, has further accelerated adoption.

Top Use Cases

- Bleaching Agent in Textiles and Paper: Hydrogen peroxide serves as a gentle yet powerful whitener for fabrics and pulp, helping manufacturers achieve bright, clean results without relying on harsher chemicals. This makes it ideal for producing everyday items like clothing and packaging materials, supporting sustainable production trends where consumers prefer non-toxic processes that preserve material quality over time.

- Disinfectant in Healthcare Settings: In hospitals and clinics, hydrogen peroxide effectively kills germs on surfaces and tools, ensuring safe environments for patients and staff. Its broad action against bacteria and viruses fits the push for reliable, residue-free cleaning solutions, especially in high-traffic areas, aligning with growing hygiene standards that prioritize quick, safe decontamination without irritating sensitive spaces.

- Household Cleaner for Surfaces: Homeowners use diluted hydrogen peroxide to wipe down counters, sinks, and appliances, tackling stains and odors while leaving no strong smells behind. This simple swap from traditional cleaners appeals to eco-conscious families seeking affordable, multi-purpose options that fizz away grime safely, boosting their popularity in daily routines for fresh, germ-free living spaces.

- Water Treatment Aid: Municipal facilities add hydrogen peroxide to purify wastewater by breaking down pollutants and controlling odors, making it a go-to for cleaner rivers and safer drinking supplies. This application supports community health initiatives, as it offers a low-impact method to handle everyday waste, fitting the global shift toward greener urban infrastructure that minimizes environmental strain.

- Personal Care Whitener: In oral rinses and hair treatments, hydrogen peroxide gently lightens teeth or tints strands, giving users a brighter smile or custom shade at home. Its mild oxidizing power suits beauty routines focused on natural-looking results, riding the wave of self-care products that deliver visible improvements without aggressive formulas, appealing to those valuing subtle, safe enhancements.

Recent Developments

1. Almond Breeze

Almond Breeze is not a manufacturer of Hydrogen Peroxide. It is a brand of almond milk owned by Blue Diamond Growers. This appears to be an error in the provided company list, as it has no association with the chemical industry or hydrogen peroxide production, supply, or application.

2. Evonik Industries AG

Evonik is expanding its hydrogen peroxide production in Asia to meet growing demand, particularly from the electronics and water treatment sectors. The company is focusing on debottlenecking existing plants and implementing digitalization for greater efficiency and supply security. Their “Asset Improvement Program” aims to optimize their global H₂O₂ network, ensuring reliable delivery to key markets and developing sustainable production processes for the future.

3. Taekwang Industrial Co., LTD.

Taekwang Industrial, through its chemical division, is a major hydrogen peroxide producer in South Korea. A key recent development is its strategic focus on supplying the high-purity hydrogen peroxide required for the semiconductor industry. The company is investing to ensure it meets the stringent quality standards needed for etching and cleaning silicon wafers, capitalizing on the robust electronics market in the region.

4. Arkema

Arkema has recently spun off its Hydrogen Peroxide-to-UDP (Urinary Diversion Pouch) business, part of its specialty activities, to focus more on its core advanced materials segment. While remaining a major producer, its recent strategy involves optimizing its product portfolio. The company emphasizes the use of hydrogen peroxide in sustainable applications, such as the production of bio-based materials and as an environmentally friendly oxidizing agent.

5. Grupa Azoty

Grupa Azoty, a key chemical producer in Central Europe, is focusing on securing its position in the hydrogen peroxide market. Recent developments include operational optimizations at its production facilities in Poland to enhance output and reliability. The company is also exploring the integration of its H₂O₂ production within its broader chemical complex to improve cost-effectiveness and supply stability for the pulp, paper, and textile industries.

Conclusion

Hydrogen Peroxide is a cornerstone chemical with enduring versatility across industries. Its natural breakdown into water and oxygen positions it as a go-to for eco-conscious applications, from whitening textiles to purifying water supplies. Emerging trends in electronics and healthcare amplify its role in clean, efficient processes, while shifts toward sustainable manufacturing drive broader adoption.