Quick Navigation

Overview

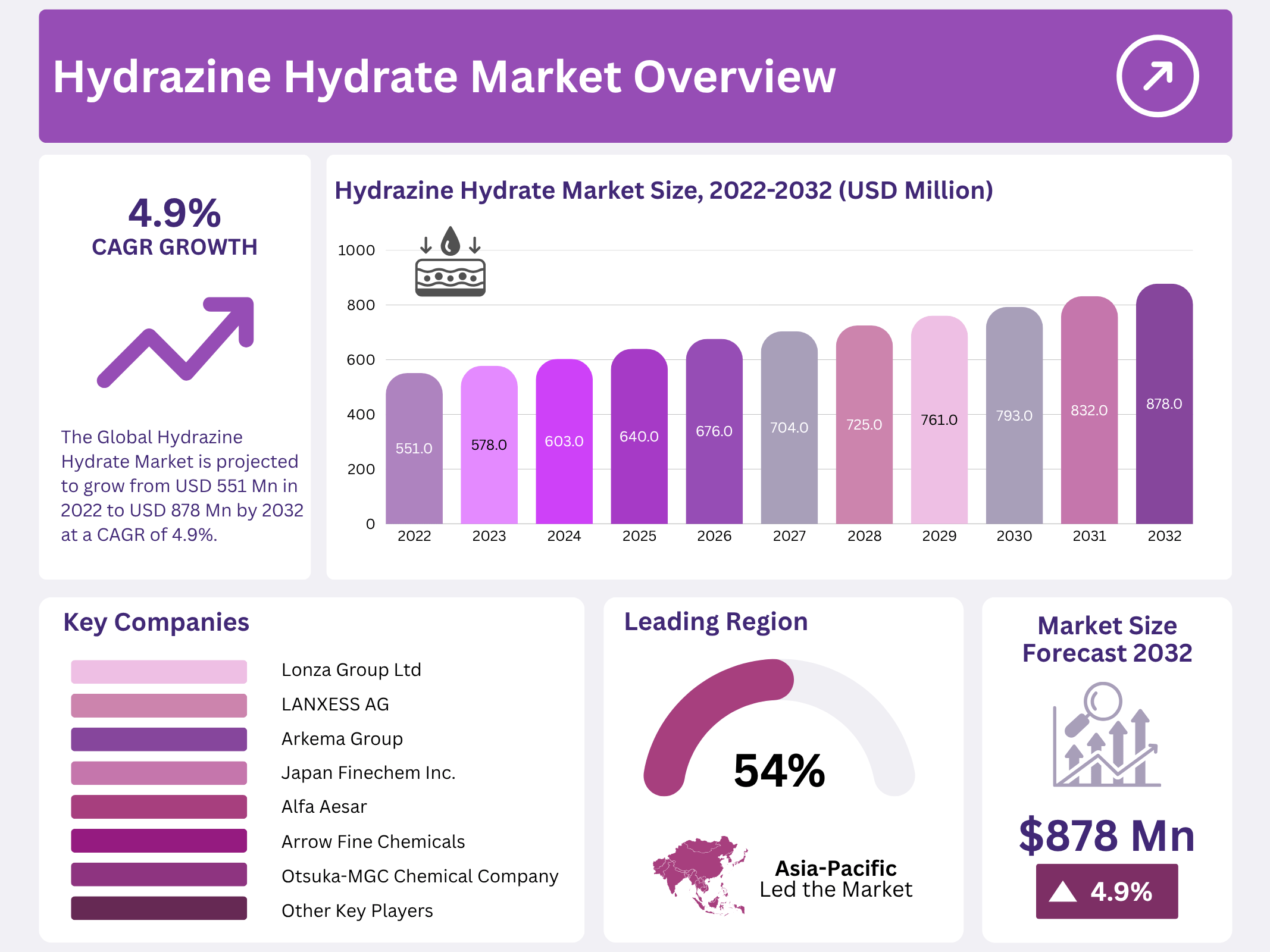

New York, NY – October 23, 2025 – The Global Hydrazine Hydrate Market was valued at USD 551 million and is projected to reach around USD 878 million by 2032, expanding at a CAGR of 4.9% between 2023 and 2032. This consistent growth reflects the material’s increasing utilization across industrial, pharmaceutical, and agricultural sectors, supported by strong demand in developing economies for high-performance chemical intermediates and treatment solutions.

Hydrazine hydrate (N₂H₄·H₂O) is a colorless, highly reactive liquid composed of hydrazine and water molecules. It is fully soluble in water, possesses a distinct pungent odor, and exhibits both basic and acidic characteristics. Its ability to act as a strong reducing agent makes it valuable in multiple chemical processes, including polymerization, fuel cell applications, and metal recovery operations.

The market’s expansion is primarily driven by rising water treatment activities aimed at industrial and domestic purification, increasing demand from the pharmaceutical industry for drug synthesis intermediates, and growing usage in agrochemical production to improve crop yield. The continuous global push for cleaner water and sustainable agricultural productivity continues to boost hydrazine hydrate consumption across diverse end-use sectors.

Key Takeaways

- The Global Hydrazine Hydrate Market is projected to grow from USD 551 million in 2022 to USD 878 million by 2032 at a CAGR of 4.9%.

- The 60–85% concentration segment held the largest revenue share in 2022 and is expected to see significant growth through 2032.

- Polymerization and blowing agents led the market in 2022, capturing the largest share among applications.

- Asia Pacific dominated with a 54% revenue share in 2022, driven by demand in the polymer and agrochemical industries in China and India.

- Growth is fueled by increasing use in industrial, pharmaceutical, and agricultural sectors, especially in developing economies.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 551 Million |

| Forecast Revenue (2032) | USD 878 Million |

| CAGR (2023-2032) | 4.9% |

| Segments Covered | By Concentration Level – 100%, 60-85%, 40-55%, and 24-35%; By Application – Water Treatment, Polymerization & Blowing Agents, Agrochemicals, Pharmaceuticals, and Other Applications |

| Competitive Landscape | Lonza Group Ltd, LANXESS AG, Arkema Group, Otsuka-MGC Chemical Company, Nippon Carbide Industries Co Inc., LCG Science Group Holdings Limited, Japan Finechem Inc., Arrow Fine Chemicals, Alfa Aesar, Other Key Players |

Key Market Segments

By Concentration Level Analysis

The 60–85% concentration segment accounted for the largest revenue share in 2022 and is projected to witness notable growth throughout the forecast period. Based on concentration, the global hydrazine hydrate market is categorized into 100%, 60–85%, 40–55%, and 24–35%.

The dominance of the 60–85% range is primarily due to its widespread use in veterinary drug manufacturing, polymerization processes, and chemical synthesis. Additionally, it serves as a blowing agent or initiator in polymer production and acts as a propellant in emergency power units (EPUs) of F-16 fighter jets and single-engine aircraft, highlighting its versatility across industrial and aerospace applications.

By Application Analysis

The polymerization and blowing agent segment dominated the global hydrazine hydrate market in 2022, accounting for the largest share among all application categories. The market is segmented into water treatment, polymerization & blowing agents, agrochemicals, pharmaceuticals, and others.

The leading position of this segment stems from hydrazine hydrate’s critical role as a foaming agent in polymer manufacturing industries. Moreover, its derivatives, including azobis isobutyronitrile and azodicarbonamide, are extensively used as polymerization initiators and low-temperature blowing agents, thereby reinforcing the segment’s growth momentum in the coming years.

Regional Analysis

The Asia Pacific region led the global hydrazine hydrate market, capturing a dominant 54% revenue share. The market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific’s growth is largely driven by rising demand in the fast-expanding polymer and agrochemical industries, particularly in China and India.

Supportive government policies and rapid urbanization, leading to the establishment of numerous industrial facilities, have further boosted the demand for hydrazine hydrate in this region. North America held the second-largest market share for hydrazine hydrate. The region’s growth is fueled by the strong presence of key manufacturers and distributors, alongside increasing demand from industries such as pharmaceuticals, agriculture, and water treatment, which is expected to drive further market expansion during the forecast period.

Top Use Cases

- Water Treatment: Oxygen Scavenger in Boilers. Hydrazine hydrate acts as a simple oxygen remover in high-pressure boilers at power plants and factories. It grabs dissolved oxygen from water to stop rust and corrosion on metal parts, keeping systems running smoothly without breakdowns. This easy process helps industries save money on repairs and ensures clean steam for daily operations.

- Pharmaceuticals: Building Block for Medicines In drug making, hydrazine hydrate serves as a key starter ingredient to create vital medicines, like those fighting tuberculosis or calming nerves. It links up with other chemicals to form complex compounds safely in labs. This role boosts health solutions worldwide, making treatments more accessible and effective for everyday wellness.

- Agrochemicals: Helper in Crop Protectors Farmers rely on hydrazine hydrate to produce herbicides, fungicides, and plant boosters that shield crops from pests and diseases. It mixes into formulas that promote healthy growth and higher yields without harming the soil much. This supports sustainable farming practices, ensuring food security in growing rural and urban areas alike.

- Polymers: Starter for Foam and Plastics Hydrazine hydrate kicks off reactions to build lightweight foams used in car seats, packaging, and insulation materials. As a gentle initiator, it creates tiny bubbles in plastics for better comfort and strength. This makes everyday products more durable and eco-friendly, meeting the rising need for smart, recyclable goods in homes and industries.

- Aerospace: Fuel for Space Missions In rockets and satellites, hydrazine hydrate powers thrusters by breaking down into hot gases for precise control during flights. Its stable liquid form stores easily and ignites reliably without extra spark. This keeps space explorations on track, enabling longer missions and safer returns for crews exploring beyond our planet.

Recent Developments

1. Lonza Group Ltd

Lonza has been strategically moving away from legacy, non-core assets, including its Hydrazine Hydrate business. In a significant recent development, the company completed the sale of its Hydrazine Hydrate operations and related assets in Seal Sands, UK, to the private equity firm First Reserve. This divestment is part of Lonza’s broader focus on its core healthcare and life sciences portfolios, effectively exiting the merchant hydrazine market.

2. LANXESS AG

LANXESS focuses on the safe production and supply of high-purity Hydrazine Hydrate, emphasizing its role as a key intermediate. Recent developments are centered on meeting stringent global regulatory demands and supply chain stability. The company highlights its commitment to responsible handling and the product’s critical applications in water treatment, agrochemicals, and pharmaceuticals, without announcing new capacity expansions, instead reinforcing its reliable producer status in a challenging market.

3. Arkema Group

Arkema’s recent strategy involves a clear shift towards sustainable and specialty materials. While historically a producer, the company has divested its Hydrazine Hydrate-related businesses. Its current focus is on developing innovative alternatives and advanced materials in segments like batteries, lightweight composites, and adhesives. Arkema’s developments are in creating eco-friendly solutions that may reduce industry reliance on traditional chemicals like hydrazine, aligning with its sustainability goals.

4. Otsuka-MGC Chemical Company

Otsuka-MGC Chemical Company, a joint venture between Otsuka Chemical and Mitsubishi Gas Chemical, remains a stable and key producer. Recent developments are not focused on capacity increases but on maintaining a secure and reliable supply chain for the Asian and global markets. The company continues to leverage its integrated production process to serve essential downstream sectors, including polymer foaming agents and pharmaceuticals, amidst a competitive landscape.

5. Nippon Carbide Industries Co., Inc.

Nippon Carbide continues to produce and supply Hydrazine Hydrate, primarily for its core business in chemical intermediates and functional materials. A key recent development is its increased focus on downstream, value-added derivatives like blowing agents and agrochemicals. The company is investing in R&D to enhance the performance and application range of its hydrazine-based products, aiming to strengthen its market position through specialization rather than commodity sales.

Conclusion

Hydrazine Hydrate is a quiet powerhouse in modern industry, blending versatility with reliability to meet diverse needs from clean water to innovative medicines. Its gentle yet effective chemistry supports greener practices in farming, manufacturing, and energy, paving the way for sustainable growth. Expect this compound to thrive amid rising global demands for efficient, eco-smart solutions that enhance daily life without added complexity.