Quick Navigation

Overview

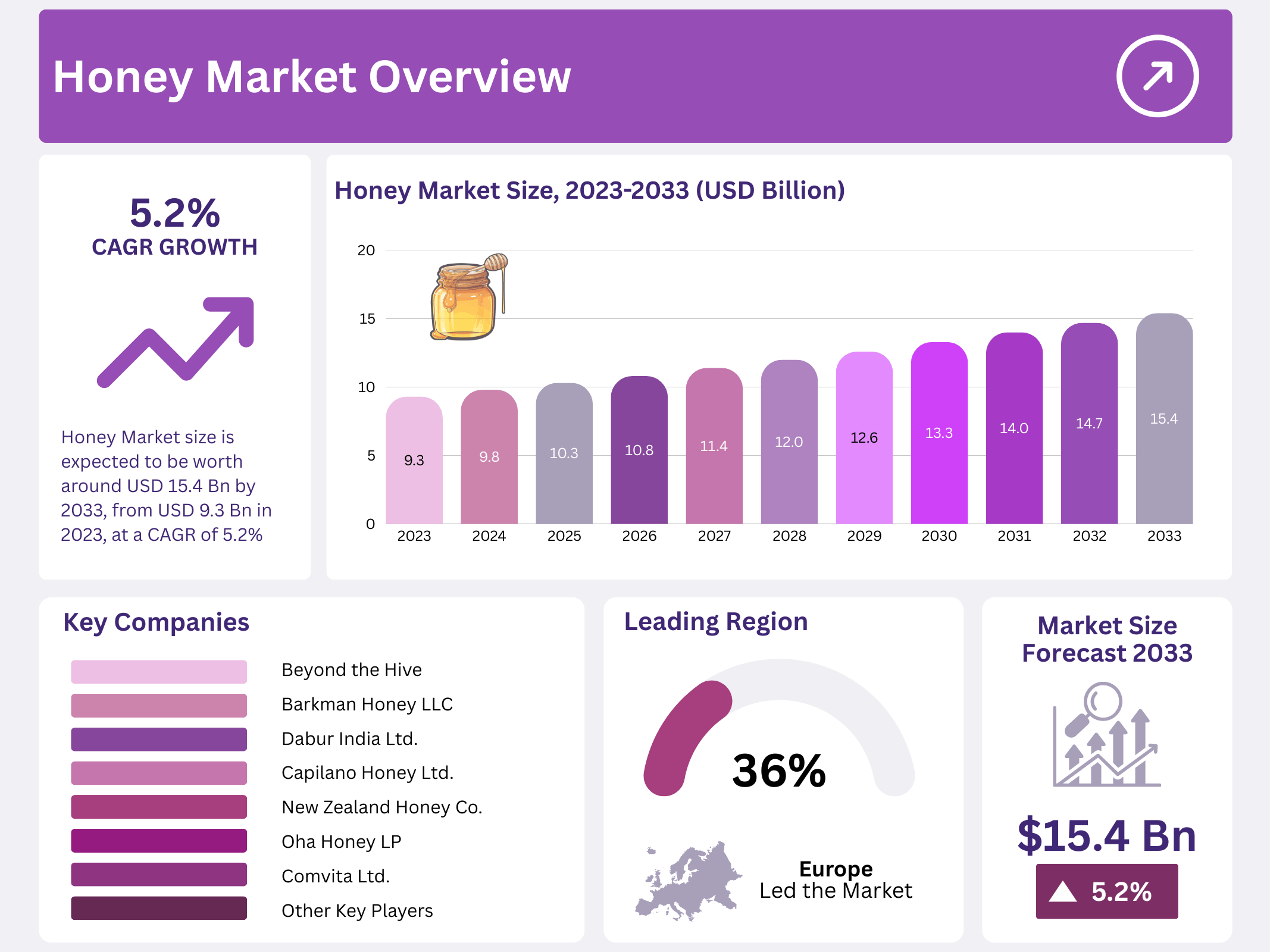

New York, NY – August 29, 2025 – The Global Honey Market is projected to grow from USD 9.3 billion in 2023 to approximately USD 15.4 billion by 2033, achieving a compound annual growth rate (CAGR) of 5.2% over the forecast period.

Honey, valued for its rich content of vitamins, minerals, and antioxidants, is increasingly favored as a natural sweetener. A key driver of market growth is the rising demand for nutritious food products, fueled by growing consumer awareness of honey’s health benefits and the importance of healthy lifestyles. Consumers are increasingly choosing natural options like honey over refined white sugar.

Post-pandemic, the demand for immunity-boosting products continues to drive market profitability. Honey consumption is linked to health benefits such as improved blood sugar regulation, reduced cholesterol levels, and enhanced lipid metabolism. With rising cases of diabetes, obesity, and high cholesterol, consumers are seeking natural, nutritious alternatives to artificial sweeteners, further boosting the demand for honey.

Key Takeaways

- The Global Honey Market is projected to grow from USD 9.3 billion in 2023 to USD 15.4 billion by 2033, with a CAGR of 5.2%.

- Conventional honey held a 78.6% market share in 2023 due to lower cost and wider availability.

- Food and Beverage applications accounted for 65.3% of the honey market share in 2023.

- Hypermarkets and supermarkets held a 38.6% market share in distribution channels in 2023.

- Europe led the market with a 36.7% revenue share in 2023.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 9.3 Billion |

| Forecast Revenue (2033) | USD 15.4 Billion |

| CAGR (2023-2033) | 5.2% |

| Segments Covered | By Processing (Organic, Conventional), By Product Type (Alfalfa, Acacia, Wildflower, Buckwheat, Clover honey, Others), By Application (Food and Beverages, Personal Care, Pharmaceutical, Others), By Distribution Channel (Hypermarkets and supermarkets, Convenience Stores, Online, Others) |

| Competitive Landscape | Beyond the Hive, Barkman Honey LLC, Dabur India Ltd., Capilano Honey Ltd., New Zealand Honey Co., Streamland Biological Technology Ltd., Oha Honey LP, Billy Bee Honey Products, Comvita Ltd., Gold Honey Inc., Honey Limited, Dutch Gold Honey Inc., Comvita Food Ltd., Comvita China Ltd., Other Key Players |

Key Market Segments

Processing Segment

In 2023, the conventional honey segment commanded a dominant 78.6% revenue share in the honey market, driven by its affordability and widespread availability compared to organic honey. This segment is projected to maintain its lead throughout the forecast period, fueled by the introduction of new flavors and exotic additives.

Propelled by millennials’ increasing preference for healthier food options. The growing popularity of plant-based natural sweeteners is expected to further accelerate market growth for honey-based sweeteners. However, the prevalence of contaminated products in local and global markets poses challenges for producers of high-quality, pure honey, impacting their profitability.

By Product Type

Gained traction for its light color and mild, delicate flavor, appealing to consumers seeking a subtle honey taste. Led the market in 2023 with a 32.4% share, favored for its dark color and robust, molasses-like flavor, catering to those preferring intense honey profiles. It rose in popularity due to its gentle, floral flavor, making it a preferred choice for consumers seeking fragrant options. Attracted consumers with its complex, robust flavor derived from diverse nectar sources, offering a rich honey experience. Remained a staple for its classic, mild, and sweet flavor, appealing to those who favor traditional honey tastes. Encompasses niche honey types with unique flavors, catering to specialized consumer preferences.

By Application

Food & Beverages dominated with a 65.3% market share in 2023, driven by honey’s widespread use as a natural sweetener and flavor enhancer in various products. Gained prominence due to honey’s moisturizing and nourishing properties, making it a popular ingredient in skincare and haircare products. Leveraged honey’s antimicrobial and soothing qualities for use in medicinal products like cough syrups and wound dressings.

Distribution Channels

Hypermarkets and supermarkets captured the largest revenue share in 2023 at 38.6%, bolstered by increased product visibility through major retailers like Costco and Walmart. Consumers’ preference for inspecting products before purchase has driven sales through these channels. Fueled by shifting consumer preferences toward convenience, better product visibility, and home delivery. Online platforms offer enhanced customer service, easy navigation, and flexible return/exchange options, further boosting their growth.

Regional Analysis

Europe: Held the largest revenue share in 2023 at 36.7%, driven by rising disposable incomes, urbanization, and evolving lifestyles. The region’s food and beverage sector alone was valued at USD 3.4 billion in 2023, with significant growth expected over the forecast period.

Asia Pacific: Forecasted to achieve the highest CAGR from 2023 to 2032, propelled by increasing consumer demand for healthy and flavorful foods, a growing millennial population, and established market players like Jedwards International, Inc., Koru Natural, and Pacific Resources International. Rising honey consumption and production further support regional market expansion.

Top Use Cases

- Food and Beverage Sweetener: Honey is a natural sweetener used in drinks like tea and smoothies, and in foods like baked goods and sauces. Its unique flavors, like clover or buckwheat, enhance taste while offering health benefits, driving its popularity as a healthier alternative to sugar in recipes.

- Skincare and Cosmetics: Honey’s antimicrobial and moisturizing properties make it a key ingredient in skincare products like face masks, creams, and lotions. It helps soothe skin, reduce inflammation, and promote healing, appealing to consumers seeking natural, organic beauty solutions.

- Pharmaceutical Applications: Honey is used in cough syrups and wound dressings due to its antibacterial and healing properties. Its natural preservatives help treat sore throats and minor burns, making it a valuable ingredient in health products for natural remedy seekers.

- Nutritional Supplements: Honey is added to energy bars, health drinks, and supplements for its antioxidants and nutrients. Its natural energy boost and immune-supporting qualities attract health-conscious consumers, especially in organic and functional food markets.

- Beverage Innovation: Honey is used in craft beers, meads, and flavored cocktails, appealing to younger audiences. Its versatility in adding unique sweetness and depth to beverages drives innovation in the alcohol and non-alcoholic drink sectors.

Recent Developments

1. Beyond the Hive

Beyond the Hive has focused on combating adulteration through advanced testing and consumer education. They emphasize traceability, promoting their single-origin and raw honey products as superior, pure alternatives to mass-market blends. Their development lies in leveraging technology for transparency, directly connecting conscious consumers with trusted beekeepers and high-integrity honey.

2. Barkman Honey LLC

Barkman Honey is expanding its production capabilities with a new, state-of-the-art facility in Hesston, Kansas. This strategic investment significantly increases their capacity for processing, packaging, and warehousing. The development aims to enhance efficiency, meet growing demand, and strengthen its position as a leading supplier of bulk and private-label honey products in North America.

3. Dabur India Ltd.

Dabur has heavily invested in combating honey adulteration. They implemented the Nuclear Magnetic Resonance (NMR) testing technology for all their honey, a first in India. This move, coupled with marketing campaigns like RealVsFake, aims to build consumer trust and differentiate their branded products in a market plagued with sugar syrup adulteration, reinforcing their commitment to purity.

4. Capilano Honey Ltd.

Following a brand refresh to Hive & Wellness Australia, the company’s key development is the launch of Hive+, a new range of functional honey products. These include infused varieties like Manuka Honey with Turmeric and Propolis, targeting the health and wellness sector and moving beyond traditional honey to offer added benefits to consumers.

5. New Zealand Honey Co.

The New Zealand Honey Co. is expanding its presence in key international markets, particularly North America and Asia. Their recent development focuses on launching new, premium Manuka honey products with higher Unique Manuka Factor (UMF) ratings. This strategy targets the luxury wellness segment, emphasizing their authentic New Zealand origin and the potent health attributes associated with high-grade Manuka honey.

Conclusion

Honey’s versatility fuels its growing demand across food, cosmetics, and health industries. As consumers prioritize natural, organic products, honey’s health benefits, like antioxidants and antimicrobial properties, boost its appeal. With rising trends in wellness and sustainable sourcing, the honey market is set to expand, offering opportunities for innovation and increased market share.