Quick Navigation

Market Overview

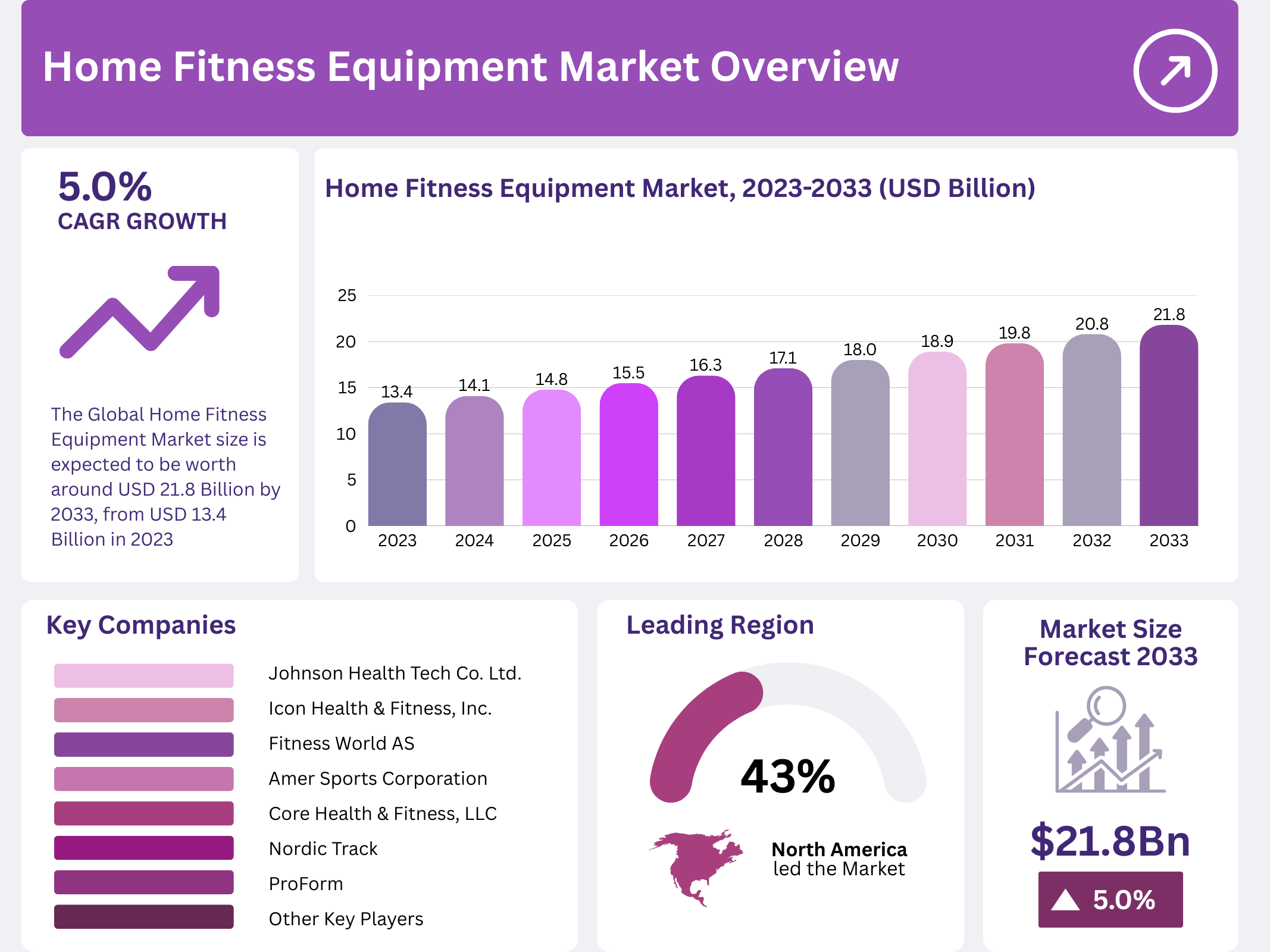

The Global Home Fitness Equipment Market reaches USD 13.4 Billion in 2023 and projects growth to USD 21.8 Billion by 2033. The market expands at a compound annual growth rate of 5.0% during the forecast period from 2024 to 2033. This growth reflects increasing consumer focus on health and convenient workout solutions.

Home fitness equipment encompasses treadmills, dumbbells, stationary bikes, and resistance training devices for personal use. Consumers adopt these products to maintain exercise routines without gym memberships. Moreover, these devices provide flexibility for varied workout preferences and scheduling needs. The equipment range spans from basic weights to advanced connected machines.

The World Health Organization targets 15% reduction in physical inactivity by 2030, creating favorable industry conditions. Additionally, the American Medical Association reports that 150-300 minutes of moderate weekly activity reduces all-cause mortality by 30%. This evidence strengthens the case for accessible home fitness solutions.

According to the Centers for Disease Control and Prevention, only 24.2% of U.S. adults meet recommended physical activity guidelines. Men achieve these standards at 30.5% compared to women at 16.5%. This gap demonstrates significant opportunity for home fitness equipment to bridge accessibility barriers for regular exercise.

Health risks from physical inactivity, including cardiovascular disease and diabetes, drive equipment demand. Consumers recognize the importance of consistent exercise for disease prevention. Therefore, home fitness devices gain popularity as practical tools for maintaining active lifestyles. The convenience factor appeals particularly to busy professionals and families.

Market competition intensifies as brands develop products for diverse fitness needs and preferences. North America and Europe show high market saturation with established consumer bases. However, emerging markets present expansion opportunities as disposable incomes rise. Additionally, growing health awareness in developing regions creates new customer segments.

Key Takeaways

- The Home Fitness Equipment Market was valued at USD 13.4 Billion in 2023 and is projected to reach USD 21.8 Billion by 2033, with a CAGR of 5.0%.

- In 2023, Cardiovascular Training Equipment leads the product segment with 35.2%, driven by home workout trends.

- In 2023, Online Platforms dominate distribution with 54%, reflecting the shift towards e-commerce for fitness.

- In 2023, Gym in Apartments holds the dominant end-user position, indicating the convenience of in-building fitness options.

- In 2023, North America dominates with 43.0% market share, influenced by health and wellness trends.

Market Segmentation Overview

Cardiovascular Training Equipment commands 35.2% market share, leading all product categories. These machines deliver comprehensive health benefits including improved heart function, enhanced metabolism, and mood elevation. Ellipticals, rowing machines, and stair climbers provide efficient full-body workouts. Their compact design suits home environments better than traditional gym setups.

Treadmills attract consumers focused on running and walking exercises for cardiovascular health. These devices offer all-weather training options within home settings. Stationary cycles provide low-impact alternatives that minimize injury risks. Consequently, they appeal to rehabilitation patients and elderly users seeking safe exercise options.

Online Platforms capture 54% of distribution channels, driven by shopping convenience and product variety. Consumers compare prices, read reviews, and access global manufacturers through digital channels. E-commerce platforms deliver competitive pricing and doorstep service for bulky fitness equipment. This distribution model aligns with modern consumer purchasing behaviors.

Offline Stores maintain relevance for customers preferring hands-on product evaluation before purchase. Physical retail locations provide immediate product familiarity and expert sales assistance. This channel serves consumers making high-investment equipment decisions. Personal interaction influences purchasing choices for complex fitness machinery.

Gym in Apartments dominates end-user segments, reflecting residential complexes adding fitness centers as tenant amenities. These communal facilities eliminate travel requirements for residents seeking convenient workout access. Property managers maintain equipment quality and variety to attract prospective tenants. This arrangement creates social exercise environments that encourage regular fitness participation.

Households represent significant market demand as families invest in personal health and wellness infrastructure. Individual consumers create dedicated workout spaces within their homes. Additionally, apartment residents without building gyms purchase equipment for private fitness areas. This segment demonstrates growing commitment to home-based health management.

Drivers

Rising health consciousness propels demand for home fitness equipment across consumer segments. People prioritize active lifestyles and invest in devices supporting regular exercise routines. Moreover, at-home workout preferences strengthen as consumers value convenience over gym commutes. This behavioral shift accelerates equipment adoption in residential settings.

Smart fitness devices integrate advanced tracking features that appeal to technology-oriented users. These connected products deliver personalized workout data and performance metrics. Consequently, tech-savvy consumers adopt intelligent equipment for customized fitness experiences. Busy professionals choose home-based solutions that eliminate travel time to external facilities.

Use Cases

Cardiovascular equipment serves users targeting heart health improvement and weight management goals. Treadmills and stationary bikes enable consistent cardio training regardless of weather conditions. These machines accommodate various fitness levels from beginners to advanced athletes. Families utilize shared equipment for diverse workout preferences.

Strength training enthusiasts employ power racks and resistance equipment for muscle building programs. These devices support progressive overload techniques essential for strength development. Additionally, compact multi-functional equipment maximizes workout variety in limited home spaces. Users combine cardio and strength training for comprehensive fitness routines.

Major Challenges

Intense market competition creates pressure on pricing strategies and profit margins. Numerous brands compete through product innovation, quality differentiation, and cost optimization. Companies struggle to maintain competitive advantages in saturated developed markets. This rivalry requires continuous investment in research and development initiatives.

Supply chain disruptions affect component availability and finished product delivery timelines. Delays impact inventory management and customer satisfaction levels. Economic uncertainty reduces consumer spending on discretionary fitness purchases during financial downturns. Additionally, rapid technological advancement demands frequent product upgrades and feature enhancements.

Business Opportunities

Emerging markets in Asia-Pacific and Latin America present substantial growth potential. Rising urbanization and expanding middle-class incomes drive fitness equipment demand in these regions. Consumers gain purchasing power for health and wellness investments. Market penetration strategies targeting developing economies offer revenue expansion opportunities.

Multi-functional equipment development addresses consumer desires for versatile single-device workout solutions. Products combining multiple exercise options appeal to space-conscious buyers. Integration with digital fitness platforms creates value through real-time data and guided workout programs. Subscription-based virtual class services generate recurring revenue streams.

Regional Analysis

North America leads with 43.0% market share, totaling USD 5.76 billion in market value. High health awareness, strong purchasing power, and at-home workout adoption drive this dominance. The United States represents the largest national market, followed by Canada’s growing fitness equipment demand. Advanced fitness technology and robust e-commerce infrastructure support market leadership.

Asia Pacific demonstrates rapid expansion fueled by urbanization and rising disposable incomes. Digital fitness platform adoption accelerates in China, India, and Japan. Europe maintains steady growth through government wellness campaigns and eco-friendly product demand. Latin America shows potential as Brazil and Mexico develop fitness culture through influencer marketing.

Recent Developments

- May 2024 – Sunny Health & Fitness launched Smart Stepper line with SunnyFit app connectivity for tracking metrics and accessing workouts across fitness levels.

- October 2024 – Echelon expanded product range with interactive at-home strength machine to boost user engagement in strength training.

- August 1, 2024 – REP Fitness entered European market with direct-to-consumer model and planned distribution centers for efficient equipment delivery.

- September 2024 – NordicTrack and ProForm introduced smart equipment lineup under iFIT with AI Coach and updated operating system.

- May 2024 – Peloton reported 17% revenue increase for Q3 2024, totaling $1.2 billion, driven by connected fitness subscriptions.

Conclusion

The Global Home Fitness Equipment Market demonstrates robust growth trajectory from USD 13.4 Billion in 2023 to projected USD 21.8 Billion by 2033. This 5.0% CAGR reflects sustained consumer commitment to convenient health solutions. Cardiovascular equipment, online distribution, and apartment gym segments lead market development.

Smart technology integration, emerging market expansion, and multi-functional product innovation create significant opportunities. However, companies navigate challenges including intense competition, supply chain complexity, and economic uncertainty. North America maintains market leadership while Asia Pacific accelerates growth through urbanization and digital platform adoption.

Industry players focus on AI-enabled devices, compact equipment designs, and subscription fitness services. These trends align with consumer preferences for personalized, space-efficient, and connected workout experiences. The market positions for continued expansion as health awareness and home fitness culture strengthen globally.