Quick Navigation

Overview

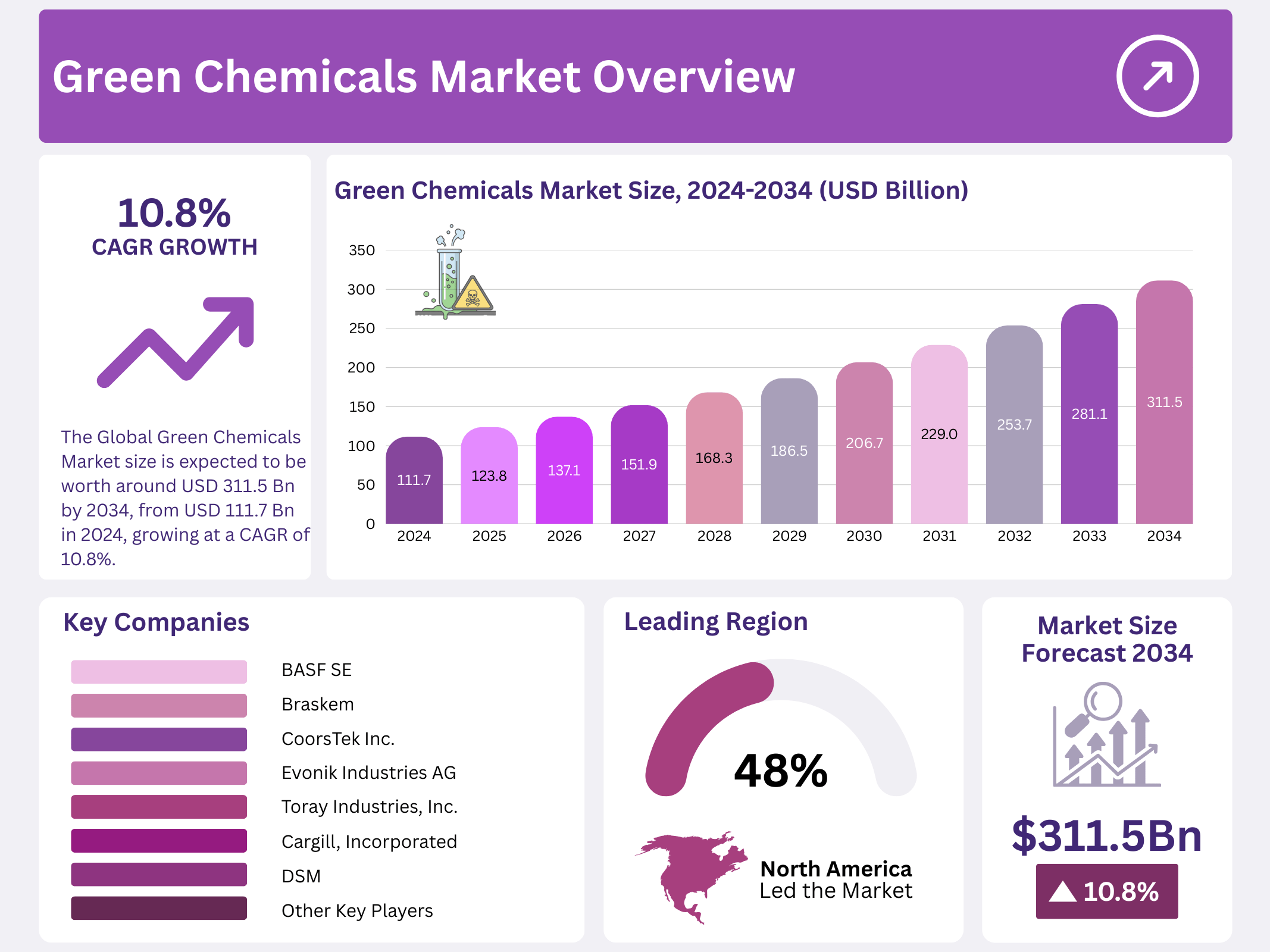

New York, NY – December 26, 2025 – The Global Green Chemicals Market is on a strong upward trajectory, expected to reach USD 311.5 billion by 2034, rising from USD 111.7 billion in 2024 at a CAGR of 10.8%. In India, the green chemicals concentrates sector is undergoing rapid transformation as industries adopt eco-friendly formulations such as bio-based colorants, additives, and functional agents. These sustainable solutions are increasingly used across packaging, textiles, agriculture, and coatings, reflecting a broader market shift toward low-impact materials.

India’s chemical industry remains a vital pillar of the national economy, contributing about 7% of GDP and providing employment to more than 5 million people. The wider industry is projected to grow from USD 220 billion in 2022 to USD 300 billion by 2030, supported by rising domestic demand and stronger sustainability priorities. Government policies play a crucial role in this growth, with the National Chemical Policy encouraging green chemistry adoption and the National Action Plan on Climate Change promoting energy efficiency and sustainable agricultural practices that indirectly boost demand for green chemical concentrates.

A strong push toward renewable energy further accelerates this sector’s expansion. In 2024, 46.3% of India’s total installed energy capacity came from renewable sources, with an ambitious goal of 500 GW by 2030. This shift provides a cleaner, more sustainable feedstock base for green chemical manufacturing and aligns India with global decarbonization trends. Together, these developments position the country as a rising hub for green chemical innovation and industrial sustainability.

Key Takeaways

- The Green Chemicals Market size is expected to be worth around USD 311.5 billion by 2034, from USD 111.7 billion in 2024, growing at a CAGR of 10.8%.

- Plant-Based held a dominant market position, capturing more than 76.1% share in the global green chemicals market.

- Biopolymers held a dominant market position, capturing more than a 39.2% share in the global green chemicals market.

- Chemical held a dominant market position, capturing more than a 37.3% share in the global green chemicals market.

- North America retained a dominant position in the green chemicals market, holding approximately 48.2% of global revenues, equivalent to USD 53.8 billion.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 111.7 Billion |

| Forecast Revenue (2034) | USD 311.5 Billion |

| CAGR (2025-2034) | 10.8% |

| Segments Covered | Based on Product Type (Biopolymers, Bio-alcohols, Bio-organic Acids, Bio-ketones, Platform Chemicals, Others), Based on Source (Plant-Based, Animal-Based, Microorganisms), Based on End-Use (Chemical, Food And Beverages, Pharmaceuticals, Automotive And Transportation, Paints And Coatings, Packaging, Building And Construction, Textiles And Apparel, Electronics And Consumer Goods, Personal Care And Cosmetics, Others) |

| Competitive Landscape | BASF SE, Braskem, Arkema, Evonik Industries AG, Toray Industries, Inc., Cargill, Incorporated, Mitsubishi Chemical Group Corporation, Archer Daniels Midland, DSM, PTT Global Chemical, Corbion N.V., BioAmber, Inc., DuPont, Novozymes A/S, Amyris, Inc., SABIC, POET, LLC, Valero Energy Corporation, Green Plains Inc., Other Key Players |

Key Market Segments

By Product Type Analysis

Plant-Based Green Chemicals dominated the market in 2024, holding a strong 76.1% share. Their leadership comes from rising global demand for natural, renewable raw materials sourced from agricultural biomass, starches, sugars, and plant-derived oils. These sources continue to replace fossil-based inputs in the production of biopolymers, bio-alcohols, and other green chemical intermediates.

Industries such as packaging, textiles, and personal care are increasingly shifting toward plant-based formulations to meet sustainability goals and reduce environmental impact. Growing consumer awareness and supportive government policies have further strengthened this segment. Moving into 2025, plant-based chemicals are expected to stay ahead as investments in bio-refineries increase and applications expand across both industrial and consumer-focused sectors.

By Source Analysis

Biopolymers led the global green chemicals market in 2024, securing a 39.2% share. This strong performance reflects the accelerating demand for eco-friendly packaging, compostable materials, and renewable alternatives to traditional plastics. Key materials such as PLA, PHA, and starch-based polymers gained traction because of their biodegradability and lower carbon footprint.

Supportive regulations—especially those targeting the reduction of single-use plastics—helped drive wider adoption across food, agriculture, and consumer goods sectors. By 2025, biopolymers are expected to maintain steady growth as more companies redesign product portfolios to align with sustainability mandates and meet rising consumer expectations.

By End-Use Analysis

The Chemical sector was the leading end-use segment in 2024, accounting for a 37.3% share of overall green chemical consumption. Its dominance is tied to the growing integration of bio-based feedstocks into solvents, surfactants, resins, and other specialty chemical formulations. As companies work to cut emissions and comply with stricter environmental regulations, demand for cleaner and renewable inputs continues to rise.

This transition is reshaping traditional chemical manufacturing, with producers increasingly reformulating legacy products to incorporate sustainable alternatives. The segment is expected to expand further as more industries adopt low-carbon production practices and governments reinforce green-chemistry initiatives.

Regional Analysis

North America continues to lead the global green chemicals market with a strong 48.2% share, valued at USD 53.8 billion in 2024. This leadership reflects the region’s steady shift toward sustainable production methods and the growing use of clean, bio-based chemical alternatives across industries.

North America maintained its dominant position by championing eco-friendly innovations such as biodegradable plastics, bio-based solvents, and non-toxic feedstocks. Much of this progress is driven by the United States, where regulatory support and investment incentives accelerate the adoption of greener chemistries across packaging, coatings, agriculture, and specialty chemicals.

State-level policies further strengthen this momentum. California’s long-standing Green Chemistry Initiative, established through AB 1879 and SB 509, remains one of the most influential frameworks. By requiring safer chemical evaluations and greater transparency in supply chains, these policies encourage companies to redesign products around renewable and biodegradable materials, reinforcing North America’s position as a global frontrunner in sustainable chemical development.

Top Use Cases

- Biodegradable Packaging Materials: Green chemicals are used to make bio-based plastics, coatings, and barrier layers for food and consumer packaging. They help brands reduce reliance on fossil-based polymers and improve end-of-life options like composting or easier recycling. This is common in films, trays, paper coatings, and multilayer packaging designs.

- Low-Toxicity Industrial Solvents: Many factories are replacing harsh petrochemical solvents with bio-based or safer “green” solvents in cleaning, extraction, and formulation work. These solvents can lower worker exposure concerns and reduce harmful emissions during use. Typical applications include inks, paints, coatings, electronics cleaning, and parts degreasing.

- Eco-Friendly Surfactants for Personal Care: Green surfactants and biosurfactants are increasingly used in shampoos, body washes, and household cleaners. They deliver foaming and cleansing while aiming for better biodegradability and a gentler skin feel. This supports “clean label” product positioning and helps formulators meet stricter ingredient expectations across retail channels.

- Crop Protection and Farm Inputs: Green chemicals support agriculture through biopesticides, bio-based adjuvants, and more biodegradable supporting chemistries. These solutions are designed to reduce long-lasting residues and focus on targeted performance. Use cases include pest and disease management, seed treatments, and improving how active ingredients spread and stick to plants.

- Sustainable Coatings, Adhesives, and Additives: Green chemicals are used as binders, plasticizers, and functional additives in coatings and adhesives for packaging, construction, and consumer goods. They can help lower odor, reduce hazardous components, and support compliance with safety standards. This is relevant in labels, laminations, wood products, and protective coatings.

Recent Developments

1. BASF SE

BASF is advancing its “ChemCycling” project, converting plastic waste into pyrolysis oil for new chemicals. They have also committed to achieving net-zero CO₂ emissions, with a major focus on scaling up green hydrogen production and using renewable feedstocks for key products like super-absorbent polymers.

2. Braskem

Braskem, a biopolymers leader, is expanding its “I’m green” bio-based polyethylene portfolio, sourced from sugarcane. A key 2023 development is a partnership to study constructing a bio-based ethylene plant in Thailand, aiming to significantly increase the global supply of renewable chemicals and circular solutions.

3. Arkema

Arkema is strategically shifting its portfolio to specialty materials, heavily investing in bio-based alternatives. A major 2024 milestone is the scheduled start-up of its new plant in Singapore, which will double global production capacity for its flagship bio-based polyamide 11, derived entirely from castor oil.

4. Evonik Industries AG

Evonik is developing sustainable solutions through biotechnology. A key initiative is the partnership with Siemens Energy to construct a pilot plant for converting CO₂ and water into specialty chemicals using artificial photosynthesis and bacteria. They are also expanding production capacities for renewable surfactants.

5. Toray Industries, Inc.

Toray is leveraging its polymer expertise for decarbonization. Recent highlights include developing the world’s first 100% bio-based adipic acid for nylon, derived from sugar. They are also commercializing green hydrogen-related materials, including membranes for water electrolysis, to support the energy transition.

Conclusion

Green chemicals are moving from niche to mainstream because they solve real problems in manufacturing and consumer products. They help companies reduce environmental impact, improve safety profiles, and respond to tighter regulations and customer expectations. As supply chains mature, adoption should expand further across packaging, cleaning, personal care, agriculture, and industrial formulation.