Quick Navigation

Overview

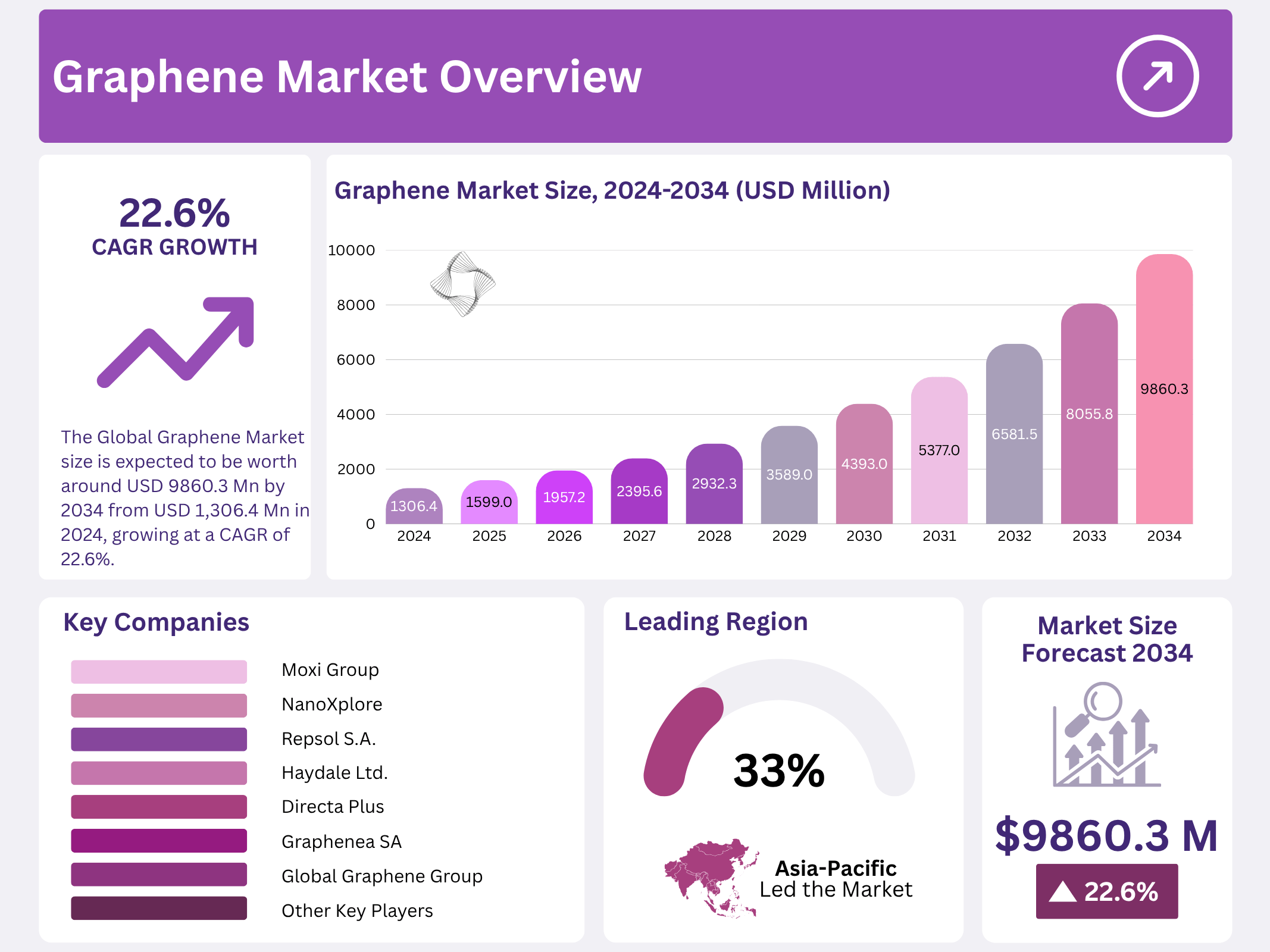

New York, NY – October 07, 2025 – The Global Graphene Market is projected to reach USD 9,860.3 million by 2034, rising from USD 1,306.4 million in 2024, growing at a CAGR of 22.6% from 2025 to 2034. Graphene, composed of a single layer of carbon atoms in a hexagonal lattice, is celebrated for its exceptional strength, conductivity, and flexibility. These characteristics have positioned it as a transformative material across industries such as electronics, automotive, energy, and healthcare, driving rapid global adoption and research investment.

A major factor boosting market expansion is the growing demand for energy-efficient and high-performance technologies. Graphene enhances the capacity and charge speed of batteries and supercapacitors, making it essential in the electric vehicle (EV) and renewable energy sectors. As the EV market heads toward USD 823 billion, graphene-based materials enable lighter, longer-lasting, and faster-charging energy storage systems, addressing the core needs of sustainable mobility.

Looking ahead, technological innovation and diversified applications will continue to propel growth. One key area of promise lies in flexible electronics, including wearable devices, sensors, and smart textiles, where graphene’s conductive and flexible nature can revolutionize design possibilities. Its role in next-generation displays, sensors, and conductive fabrics signals a major leap toward integrating advanced materials into everyday consumer technology, marking graphene as a cornerstone of future innovation.

Key Takeaways

- The Global Graphene Market size is expected to be worth around USD 9860.3 Million by 2034 from USD 1,306.4 Million in 2024, growing at a CAGR of 22.6%.

- Multilayer Graphene held a dominant market position, capturing more than a 68.0% share.

- Graphene Powder held a dominant market position, capturing more than a 46.9% share of the overall graphene market.

- Automotive held a dominant market position, capturing more than a 30.9% share of the graphene market.

- Asia-Pacific (APAC) region emerged as the dominant player in the graphene market, capturing over 33.5% of the market share. Asia Pacific was valued at USD 437.6 Million in 2024.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1306.4 Million |

| Forecast Revenue (2034) | USD 9860.3 Million |

| CAGR (2025-2034) | 22.6% |

| Segments Covered | By Type (Multilayer Graphene, Monolayer Graphene), By Product Type (Graphene Powder, Graphene Sheet, Graphene Ink, Graphene Nanoplatelets, Others), By End-Use (Automotive, Aerospace, Energy And Power, Construction, Healthcare, Electronics, Others) |

| Competitive Landscape | NanoXplore, Repsol S.A., Graphenea SA, Directa Plus, Haydale Ltd., Global Graphene Group, Ningbo Morsh Technology, Moxi Group, The Sixth Element (Changzhou) Materials Technology Co., Ltd, Avanzare Innovación Tecnológica, Xiamen Knano Graphene Technology, Others |

Key Market Segments

By Type

In 2024, Multilayer Graphene led the graphene market, commanding over 68.0% of the total share. Its exceptional electrical, thermal, and mechanical properties make it a preferred choice for applications in electronics, energy storage, automotive, aerospace, and construction. The robust and stable structure of multilayer graphene enables it to endure high stresses, enhancing its suitability for demanding industries.

Monolayer Graphene, while holding a smaller share, exhibited consistent growth in 2024. Its high surface area and superior conductivity drive its use in nanoelectronics and sensors. With ongoing advancements in production techniques, the market for monolayer graphene is projected to grow rapidly in the coming years.

Product Type Analysis

Graphene Powder dominated the market in 2024, accounting for over 46.9% of the market share. Its versatility and ease of integration make it ideal for energy storage (batteries and supercapacitors), coatings, and composites, owing to its high surface area and conductivity. Graphene Sheets secured the second-largest share, valued for their mechanical strength, flexibility, and conductivity. They are widely used in flexible electronics, sensors, and transparent conductive films.

Graphene Ink saw increased adoption in 2024, particularly in printed electronics and sensors. Its ability to print conductive patterns on various substrates supports applications in printed circuits, displays, and energy-efficient devices.

Graphene Nanoplatelets, though a smaller segment, played a key role in high-strength composites and coatings, contributing to the market’s diversity.

End-Use Analysis

The Electronics sector led the graphene market in 2024, capturing over 30.9% of the market share. Graphene’s excellent conductivity and flexibility drive its use in flexible displays, touchscreens, transistors, and sensors, outperforming traditional materials.

The Automotive industry also held a significant share, leveraging graphene to reduce vehicle weight, enhance strength, and improve battery performance for electric vehicles. In the Aerospace sector, graphene’s high strength-to-weight ratio supported its use in lightweight composites, coatings, and advanced materials, improving fuel efficiency and reducing costs.

The Energy & Power sector increasingly utilized graphene in 2024 for advanced batteries and supercapacitors, capitalizing on its performance-enhancing properties. In Construction, graphene enhanced the strength, durability, and thermal conductivity of materials like concrete and coatings, driving its growing adoption.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region dominated the graphene market, holding over 33.5% of the share, with a market value of USD 437.6 million. Strong manufacturing capabilities in electronics and automotive industries, coupled with government-backed R&D, fueled this growth. APAC is expected to maintain its lead in the forecast period.

North America and Europe, with mature markets, exhibited steady growth. Latin America showed potential in composites, while the Middle East and Africa saw gradual adoption across sectors. These regional trends highlight the need for tailored strategies to capitalize on unique market opportunities globally.

Top Use Cases

- Electronics: Graphene’s superior electrical conductivity and flexibility make it ideal for creating advanced devices like flexible screens and fast transistors. As a market research analyst, I see it replacing traditional materials in smartphones and wearables, enabling thinner, more efficient gadgets that bend without breaking, driving innovation in consumer tech for better user experiences.

- Energy Storage: In batteries and supercapacitors, graphene boosts charging speed and energy holding capacity due to its high surface area. From my analysis, this use case supports electric vehicles and renewable energy systems, making power sources lighter and more reliable, which is key for sustainable transport and grid stability.

- Biomedical: Graphene aids drug delivery and biosensors with its biocompatibility and thin structure for precise targeting. As an analyst, I note its potential in health diagnostics and tissue engineering, improving treatments like cancer therapies and implants, fostering growth in medical tech for personalized and effective healthcare solutions.

- Composites: Added to materials like concrete or plastics, graphene enhances strength and lightness for durable products. My research highlights applications in automotive and aerospace parts, reducing weight while increasing toughness, which lowers fuel use and costs, positioning it as a game-changer for eco-friendly manufacturing industries.

- Water Filtration: Graphene membranes filter impurities efficiently due to their nanoscale pores and durability. Analyzing trends, this application promises clean water access in purification systems, addressing global scarcity issues by enabling faster, more effective desalination and wastewater treatment, vital for environmental sustainability and public health.

Recent Developments

1. NanoXplore

NanoXplore is scaling up its graphene-enhanced plastic compounds, “GrapheneBlack,” for the automotive sector. A key development is their 2023 partnership with Martinrea International to launch VoltaXplore, aiming to produce graphene-enhanced silicon-anode batteries for EVs. This focuses on significantly improving battery energy density and charging rates, positioning NanoXplore as a key supplier in the electric vehicle supply chain beyond its thermoplastic composites.

2. Repsol S.A.

Repsol has advanced its graphene-enhanced asphalt, “GrapheneRoad,” successfully concluding real-world pilot tests on public roads in Spain. This innovation, developed with partners, demonstrates increased durability, resistance to deformation, and improved safety. This forms a key part of Repsol’s circular economy strategy, as the asphalt incorporates modified bitumen from recycled materials, aiming to reduce maintenance costs and the carbon footprint of road infrastructure.

3. Graphenea SA

Graphenea continues to lead in high-quality, monolayer graphene production. A recent focus is the expansion of its Graphene Oxide (GO) and Reduced Graphene Oxide (rGO) offerings for the biomedical and sensor markets. They are heavily involved in European R&D projects, developing graphene-based biosensors for pathogen detection and advancing flexible electronics. Their consistent, wafer-scale CVD graphene production remains critical for industrial and research clients worldwide.

4. Directa Plus

Directa Plus’s recent strategy emphasizes its G+ graphene-based textiles and environmental solutions. They launched a new line of workwear with advanced thermal regulation and partnered with brands for sustainable apparel. Simultaneously, they are deploying their “Plasma” technology for recycling tires and recovering raw materials, a process enhanced by G+ graphene. This underscores their dual focus on high-performance textiles and circular economy applications for end-of-life products.

5. Haydale Ltd.

Haydale is progressing its functionalized graphene and nano-materials for the aerospace and composite sectors. A key 2023 development was receiving further funding from the UK’s SPRINT program to collaborate with Luxinar on developing graphene-enhanced ceramic composites for laser machinery. This aims to improve thermal management and durability. Haydale continues to leverage its plasma functionalization technology to enhance material properties in resins, inks, and elastomers for industrial partners.

Conclusion

Graphene stands out as a transformative material with vast potential across industries, from powering efficient electronics to advancing medical breakthroughs and strengthening composites. As a market research analyst, I observe its unique strength, conductivity, and versatility fueling ongoing innovations, overcoming production hurdles to enable sustainable solutions and open new markets for future growth.