Quick Navigation

Introduction

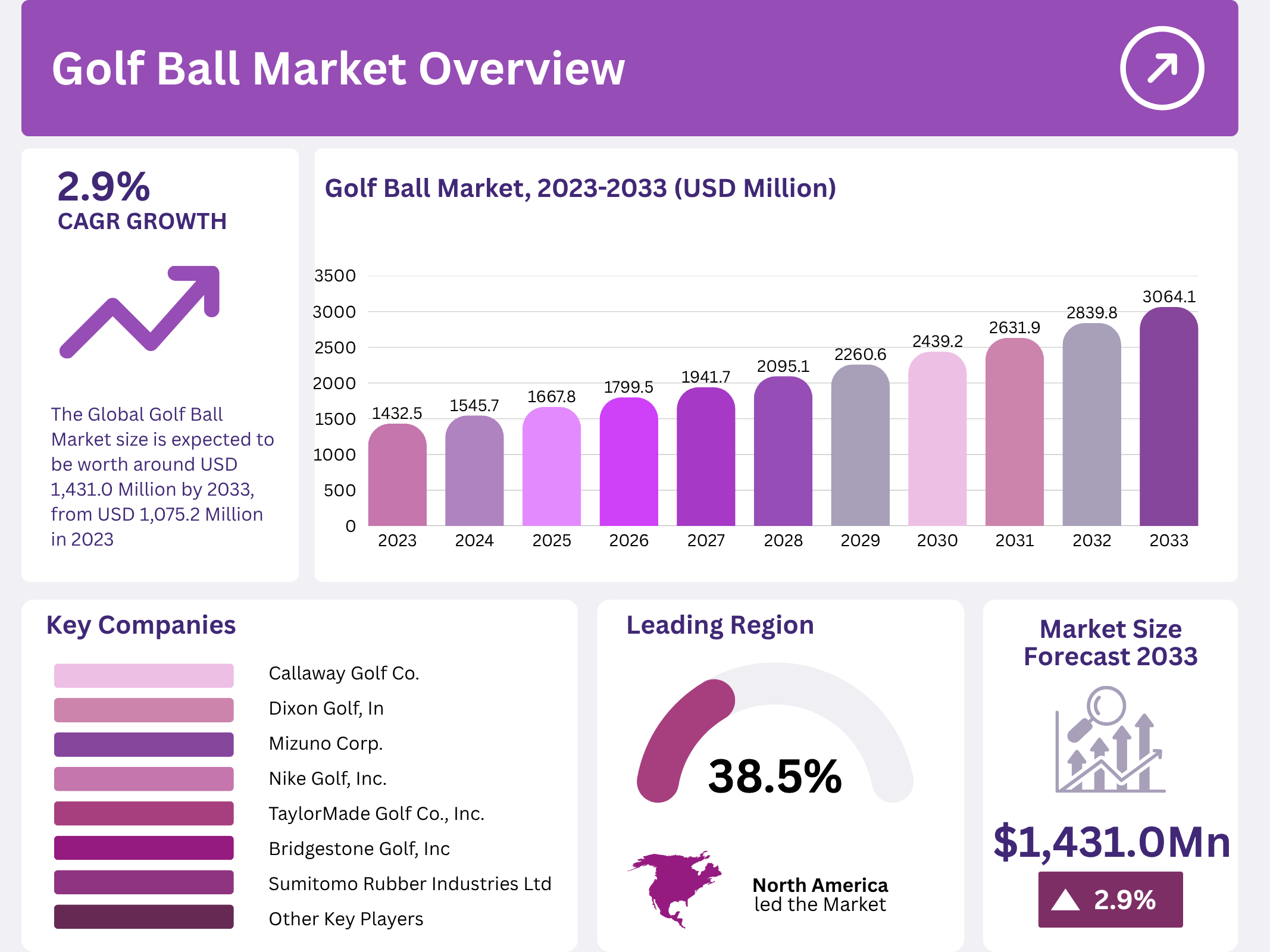

The Global Golf Ball Market is poised for steady expansion, reaching an estimated value of USD 1,431.0 Million by 2033, growing from USD 1,075.2 Million in 2023. This growth reflects a consistent CAGR of 2.9% during 2024–2033, driven by rising global participation in golf and technological innovations in golf ball manufacturing.

As golf gains popularity across diverse demographics, the demand for advanced and sustainable golf balls continues to surge. Manufacturers are investing heavily in product innovation, focusing on aerodynamics, material science, and environmentally responsible production practices to appeal to both professionals and leisure players.

Transitioning into a new decade, the market is witnessing strong momentum in North America, which captured a 38.4% share in 2023, generating USD 412.8 Million in revenue. This regional dominance is complemented by significant developments across Europe and Asia Pacific, contributing to the global expansion of the sport and related equipment markets.

Key Takeaways

- The Global Golf Ball Market size is expected to be worth around USD 1,431.0 Million by 2033, from USD 1,075.2 Million in 2023, growing at a CAGR of 2.9% during 2024–2033.

- In 2023, the 4-piece golf ball segment dominated the By Product category with a 38.3% market share.

- The Professional application segment led the market in 2023, capturing a 65.3% share.

- North America held a 38.4% market share in 2023, valued at USD 412.8 Million.

Market Segmentation Overview

By Product, the 4-piece golf ball segment leads the market, representing 38.3% of total sales in 2023. These premium golf balls provide superior control and spin for professional players, supported by multi-layer technology and advanced materials enhancing performance and precision on the course.

The 3-piece segment follows closely with a 32.1% share, offering balanced performance between distance and feel. Its versatility attracts both amateurs and semi-professionals, delivering consistency across varied playing conditions and skill levels, making it a preferred choice among seasoned enthusiasts.

Meanwhile, 2-piece golf balls captured 29.6% of the market, favored for their durability and affordability. Designed primarily for beginners, these models emphasize longer distance and reduced spin, supporting players who prioritize cost-effectiveness and straightforward performance during practice or recreational play.

By Application, the Professional segment dominates with 65.3% of the market share, driven by tournament participation and high-performance requirements. In contrast, the Leisure segment, holding 34.7%, caters to recreational players seeking user-friendly and economical options for everyday play.

Drivers

Rising Popularity of Golf: The sport’s global appeal continues to grow, with more individuals engaging in golf as a recreational and competitive activity. Post-pandemic, increased interest in outdoor sports has spurred participation, stimulating higher demand for golf balls across various regions.

Technological Innovation: Advances in golf ball aerodynamics, material composition, and manufacturing techniques have revolutionized performance. Modern designs enhance distance, control, and durability, appealing to both professionals and casual players while fostering steady market expansion.

Use Cases

Professional Golf Tournaments: High-performance golf balls are essential in professional competitions. Their multi-layer construction and optimized spin control enable elite players to execute precise shots under varying course conditions, reinforcing demand among professional athletes and event sponsors.

Recreational and Training Activities: Affordable 2-piece golf balls are widely used by leisure players and beginners during practice sessions. Their resilience and long-distance performance make them ideal for driving ranges and coaching programs, promoting consistent product turnover.

Major Challenges

High Cost of Participation: Golf’s reputation as an expensive sport poses a significant barrier. Equipment costs, club memberships, and course fees collectively restrict participation, especially in emerging markets, limiting the broader adoption of golf balls among new players.

Environmental Concerns: Golf courses often demand intensive water use and chemical maintenance, raising sustainability issues. The environmental footprint of golf ball production also draws scrutiny, pushing manufacturers toward eco-friendly innovations that may increase production costs.

Business Opportunities

Expansion in Emerging Markets: The rise of golf tourism and the construction of new courses in Asia, the Middle East, and Latin America offer fresh avenues for growth. Manufacturers can capitalize by introducing affordable, high-performance golf balls suited for diverse climates and player profiles.

Eco-Friendly Product Development: Growing environmental awareness encourages brands to create biodegradable and recyclable golf balls. Such innovations cater to eco-conscious consumers, opening niche markets and aligning with global sustainability goals.

Regional Analysis

North America: Holding a 38.4% market share and generating USD 412.8 Million in 2023, North America remains the market leader. The U.S. and Canada boast a mature golf culture, supported by a dense network of courses, professional events, and robust consumer spending on sports equipment.

Asia Pacific: This region is emerging as a high-growth market, driven by rising golf participation in China, Japan, and South Korea. Investments in new golfing infrastructure and hosting international tournaments are accelerating regional demand for premium and mid-range golf balls.

Recent Developments

- In June 2023, TaylorMade Golf Co., Inc. expanded its PIX line with the new Tour Response PIX golf ball, enhancing alignment and visibility for all players.

- In May 2023, Nike Golf, Inc. introduced the AeroReact golf balls featuring an innovative dimple pattern designed to improve aerodynamics and flight control.

- In April 2023, Bridgestone Golf, Inc. partnered with a technology firm to develop AI-enhanced golf balls that provide real-time data on spin rate and launch angle.

Conclusion

The Global Golf Ball Market is entering a transformative phase characterized by technological innovation, sustainability, and expanding global participation. As players seek superior performance and eco-friendly alternatives, manufacturers are responding with advanced, data-driven, and biodegradable golf ball solutions that redefine the modern game.

With North America maintaining its leadership and Asia Pacific emerging as a key growth region, the market’s outlook remains optimistic. Strategic collaborations, product diversification, and a focus on environmental responsibility will continue to shape the industry’s evolution through 2033 and beyond.