Quick Navigation

Introduction

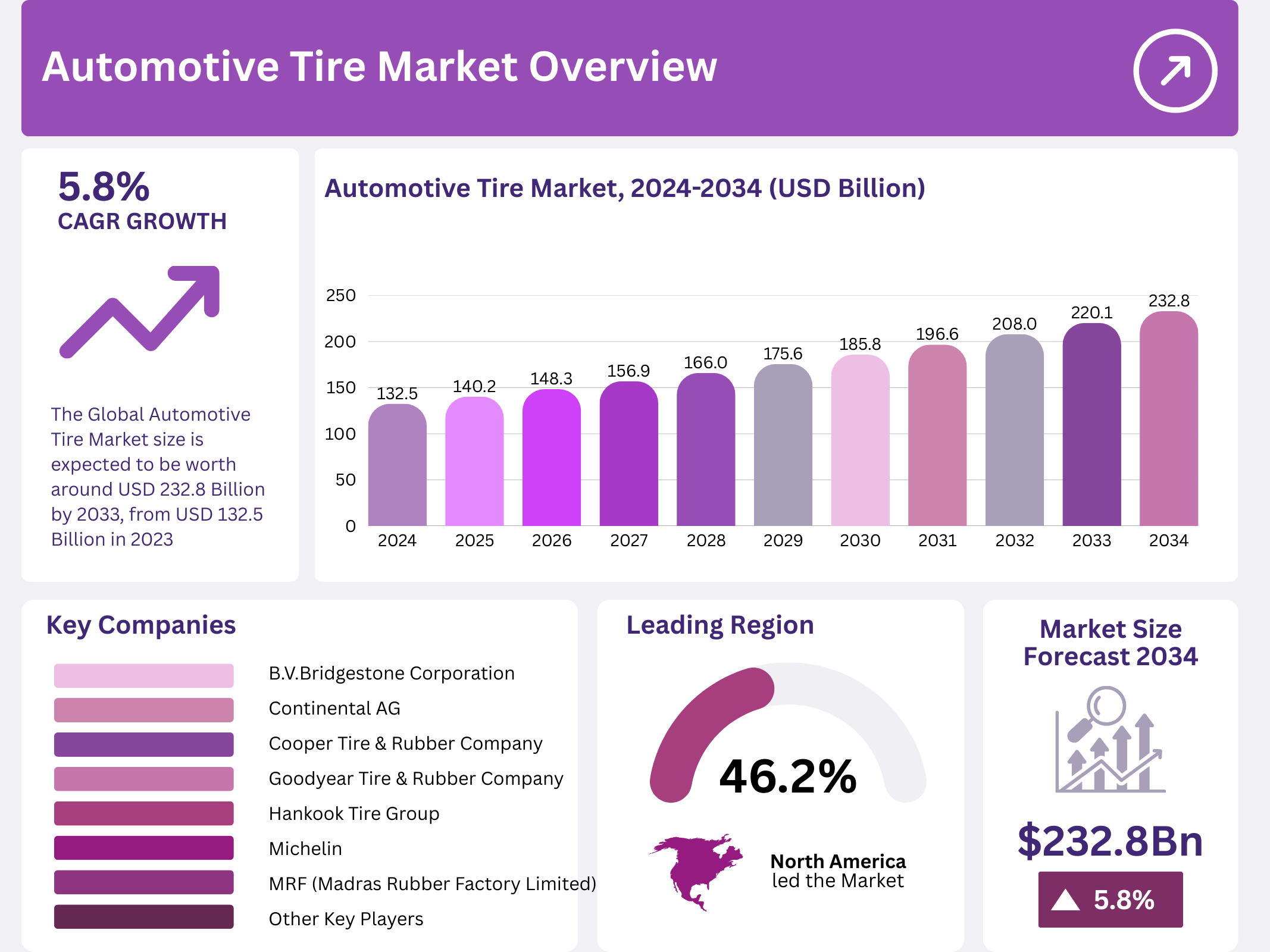

The global automotive tire market demonstrates remarkable expansion potential, projected to reach USD 232.8 billion by 2033 from USD 132.5 billion in 2023. This trajectory represents a compound annual growth rate of 5.8% throughout the forecast period. Consequently, industry stakeholders are positioning themselves strategically to capitalize on emerging opportunities.

Rising vehicle ownership rates fundamentally drive market momentum, particularly in developed economies where penetration remains exceptionally high. Notably, 91.7% of U.S. households possessed at least one vehicle in 2022, establishing a robust foundation for sustained demand. Furthermore, this widespread adoption creates continuous replacement cycles that benefit both manufacturers and distributors alike.

Market dynamics reflect increasing consumer sophistication regarding tire performance, safety standards, and environmental sustainability. Additionally, technological innovations enable manufacturers to develop advanced products incorporating smart features and eco-friendly materials. Therefore, competition intensifies as leading companies invest substantially in research and development initiatives to maintain competitive advantages.

Government regulations significantly influence market evolution through stringent safety requirements and environmental mandates. Moreover, these regulatory frameworks compel manufacturers to innovate continuously, developing sustainable solutions that meet evolving standards. Subsequently, periodic tire updates and replacements become necessary, generating consistent revenue streams for industry participants.

The aftermarket segment commands considerable market share at 62.8%, driven by replacement demand and upgrade preferences among vehicle owners. Meanwhile, original equipment manufacturers maintain foundational importance by establishing quality benchmarks for new vehicles. Thus, both channels contribute synergistically to overall market vitality and sustainable growth trajectories.

Strategic collaborations between tire manufacturers and automotive producers strengthen supply chain efficiency and product customization capabilities. Furthermore, expansion into emerging markets presents substantial opportunities as developing economies experience rising disposable incomes and urbanization trends. Ultimately, these converging factors position the automotive tire market for sustained expansion throughout the forecast period.

Key Takeaways

- Automotive Tire Market was valued at USD 132.5 billion in 2023 and is expected to reach USD 232.8 billion by 2033, with a CAGR of 5.8%

- In 2023, All-season tires dominate the tire type segment with 55.4% due to their year-round utility

- In 2023, 16 to 18 inches rims lead the rim size segment with 31.6% because they balance performance and aesthetics

- In 2023, Passenger cars are the predominant vehicle type with 61.3%, reflecting their massive global usage

- In 2023, Aftermarket distribution holds the majority with 62.8%, driven by the demand for replacements and upgrades

- In 2023, North America dominates with 46.2%, equivalent to USD 61.2 billion, highlighting its strong market presence

Market Segmentation Overview

Season Tire Type Segmentation

All-season tires capture 55.4% market share owing to their versatility across diverse weather conditions without seasonal replacement requirements. These tires feature optimized tread patterns enabling adequate performance in mild winter, wet, and dry environments simultaneously. Consequently, cost-conscious consumers prioritize all-season options that eliminate frequent tire changes while maintaining acceptable safety standards.

Summer and winter tires serve specialized purposes within specific climatic conditions, offering superior performance characteristics for their respective environments. However, their seasonal limitations restrict broader market adoption compared to universally applicable all-season alternatives. Nevertheless, regions experiencing extreme weather conditions maintain consistent demand for these specialized tire categories throughout respective seasons.

Rim Size Distribution

The 16-18 inch rim size segment commands 31.6% market share, striking optimal balance between aesthetic appeal and functional performance. This size range accommodates diverse vehicle types from sedans to SUVs, aligning perfectly with modern design preferences. Furthermore, manufacturers favor these dimensions for their adaptability and consumer acceptance across multiple vehicle segments and price points.

Smaller rims below 15 inches primarily equip economical vehicles, offering cost efficiency and fuel economy benefits despite limited aesthetic appeal. Conversely, larger rims exceeding 19 inches cater to luxury and performance vehicles, enhancing handling capabilities while commanding premium pricing. Thus, specialized applications and higher costs constrain market penetration relative to mid-sized alternatives.

Vehicle Type Analysis

Passenger cars dominate with 61.3% market share, reflecting their ubiquitous role as primary transportation worldwide for millions of consumers. Frequent replacement cycles driven by wear patterns and technological upgrades sustain continuous demand within this substantial segment. Additionally, varying consumer preferences regarding performance, comfort, and price sensitivity create diverse product requirements across passenger vehicle categories.

Commercial vehicles encompass light and heavy variants, each demanding specialized tire characteristics suited to operational requirements and load capacities. Light commercial vehicles require durable solutions handling frequent stops and variable loads throughout urban logistics operations. Meanwhile, heavy commercial vehicles necessitate robust high-mileage tires supporting substantial weight during long-haul transportation activities.

Distribution Channel Dynamics

The aftermarket channel leads with 62.8% share, driven by continuous replacement demand throughout vehicle lifespans and consumer preferences for value-oriented upgrades. Vehicle owners frequently seek aftermarket alternatives offering superior performance or competitive pricing compared to original equipment specifications. Moreover, extensive product selection and dealer networks enhance aftermarket accessibility and consumer convenience significantly.

Original equipment manufacturers establish foundational quality standards by equipping new vehicles with tires meeting rigorous safety and performance specifications. Although commanding smaller market share, OEM channels ensure initial installations align with manufacturer requirements and regulatory compliance. Subsequently, aging vehicles transition toward aftermarket solutions as owners prioritize cost-effectiveness and performance enhancements over original specifications.

Drivers

Increasing Vehicle Production Drives Market Growth: Global vehicle production expansion directly correlates with heightened tire demand as manufacturers produce increasing quantities of automobiles annually. Emerging economies experiencing rising vehicle ownership rates amplify this growth trajectory substantially. Advanced manufacturing technologies enable tire producers to meet escalating demand efficiently while achieving economies of scale that reduce costs. Strategic partnerships between tire companies and vehicle manufacturers ensure steady supply of model-specific tires, fostering robust market growth through increased production volumes and expanded geographic presence.

Technological Advancements Enhance Market Appeal: Continuous innovation in tire technology drives consumer interest through improved safety features, enhanced performance characteristics, and sustainable materials integration. Run-flat tire adoption illustrates this trend, offering continued mobility after punctures while reducing accident risks from sudden failures. Smart tire technologies incorporating real-time monitoring sensors align with connected vehicle trends, attracting tech-savvy consumers. These technological improvements justify premium pricing while expanding addressable market segments through differentiated value propositions.

Use Cases

Urban Mobility and Daily Commuting: Passenger vehicles dominate urban transportation networks, requiring reliable tires that withstand daily commuting demands across varied road conditions. All-season tires particularly suit metropolitan environments where weather conditions fluctuate throughout the year without reaching extreme temperatures. Consumers prioritize durability, fuel efficiency, and quiet operation for daily driving scenarios. This use case generates consistent replacement demand as urban driving patterns accelerate tire wear through frequent starts, stops, and cornering maneuvers.

Commercial Transportation and Logistics: Heavy and light commercial vehicles constitute critical infrastructure for goods transportation, requiring specialized tires supporting substantial loads across extended distances. Fleet operators prioritize tire longevity, load capacity, and cost-per-mile performance when selecting products. Long-haul trucking demands high-mileage tires withstanding highway conditions, while urban delivery vehicles require durable solutions managing frequent stops and variable loads. This commercial segment drives substantial tire volume despite representing fewer vehicles than passenger car categories.

Major Challenges

High Raw Material Costs Restrain Market Growth: Volatile pricing for essential materials including natural rubber, synthetic compounds, and steel significantly impacts manufacturer profitability and pricing strategies. Exchange rate fluctuations complicate cost management for companies relying on imported materials from international suppliers. Stringent regulatory standards governing material quality add production expenses while intense competition prevents easy cost transfer to consumers. Material scarcity occasionally disrupts supply chains, affecting production schedules and delivery commitments, thereby constraining overall market growth potential.

Supply Chain Disruptions Challenge Market Stability: Natural disasters, geopolitical tensions, and pandemic events interrupt raw material flows and finished product distribution unpredictably. Transportation cost increases from logistical inefficiencies strain profit margins while dependence on global suppliers creates vulnerability to trade policies and tariffs. Demand fluctuations complicate inventory management, potentially causing excess stock or shortages. These supply chain uncertainties introduce operational unpredictability that hinders consistent market expansion and strategic planning capabilities.

Business Opportunities

Expansion in Emerging Markets Provides Growth Potential: Developing economies like India and Brazil present substantial opportunities as rising disposable incomes enable increased vehicle ownership rates. Urbanization trends accelerate vehicle usage, boosting tire sales volumes significantly. Establishing manufacturing facilities in these regions reduces production and logistics costs while improving market responsiveness. Government incentives and infrastructure improvements support automotive sector growth, positioning tire manufacturers to capitalize on expanding middle-class populations seeking personal transportation solutions.

Sustainable and Smart Tire Technologies Create Differentiation: Growing environmental consciousness drives demand for tires incorporating recycled materials, renewable resources, and reduced carbon footprints. Continental’s UltraContact NXT exemplifies this trend, containing up to 65% sustainable materials attracting environmentally conscious consumers. Smart tire technologies with integrated sensors enable predictive maintenance and real-time performance monitoring, aligning with autonomous and connected vehicle trends. These innovations justify premium pricing while addressing regulatory sustainability requirements and consumer preferences simultaneously.

Regional Analysis

North America Dominates with Strong Infrastructure: North America commands 46.2% market share valued at USD 61.2 billion, driven by mature automotive sectors and extensive distribution networks ensuring widespread product availability. High disposable incomes and quality preferences boost premium tire sales while government regulations promoting road safety and environmental sustainability support market growth. Major manufacturer presence and technological leadership in tire innovation reinforce the region’s competitive positioning. Advanced infrastructure and sophisticated consumer demands establish North America as the market’s dominant force.

Asia Pacific Demonstrates Rapid Expansion: The Asia Pacific region experiences accelerating growth fueled by increasing vehicle production in manufacturing powerhouses like China and India. Rising consumer demand from expanding middle classes drives tire sales across diverse vehicle segments. China’s position as leading tire exporter with USD 19.6 billion in exports during 2022 illustrates regional manufacturing capabilities and global competitiveness. Urbanization trends and infrastructure investments create favorable conditions for sustained market expansion throughout the forecast period.

Recent Developments

- In February 2024, AutoNation expanded its mobile service and parts business following its USD 190 million acquisition of RepairSmith Inc., aligning mobile repair services with standalone used-vehicle operations

- In February 2024, Sentury Tire USA launched the Bandit light truck tire line under its Delinte brand, designed specifically for SUVs, CUVs, and light trucks with five product variants covering diverse applications

- In June 2023, Continental introduced the UltraContact NXT tire containing up to 65% renewable, recycled, and mass balance certified materials, with renewable content reaching 32% and recycled materials comprising 5%

Conclusion

The automotive tire market demonstrates compelling growth prospects supported by increasing vehicle production, technological innovations, and expanding geographic opportunities. Achieving projected USD 232.8 billion valuation by 2033 requires addressing raw material cost volatility and supply chain vulnerabilities while capitalizing on emerging market expansion. Strategic investments in sustainable technologies, smart tire features, and manufacturing efficiency will differentiate leading competitors. Ultimately, companies balancing innovation, cost management, and market responsiveness will capture disproportionate value throughout this dynamic industry’s evolution.