Quick Navigation

Introduction

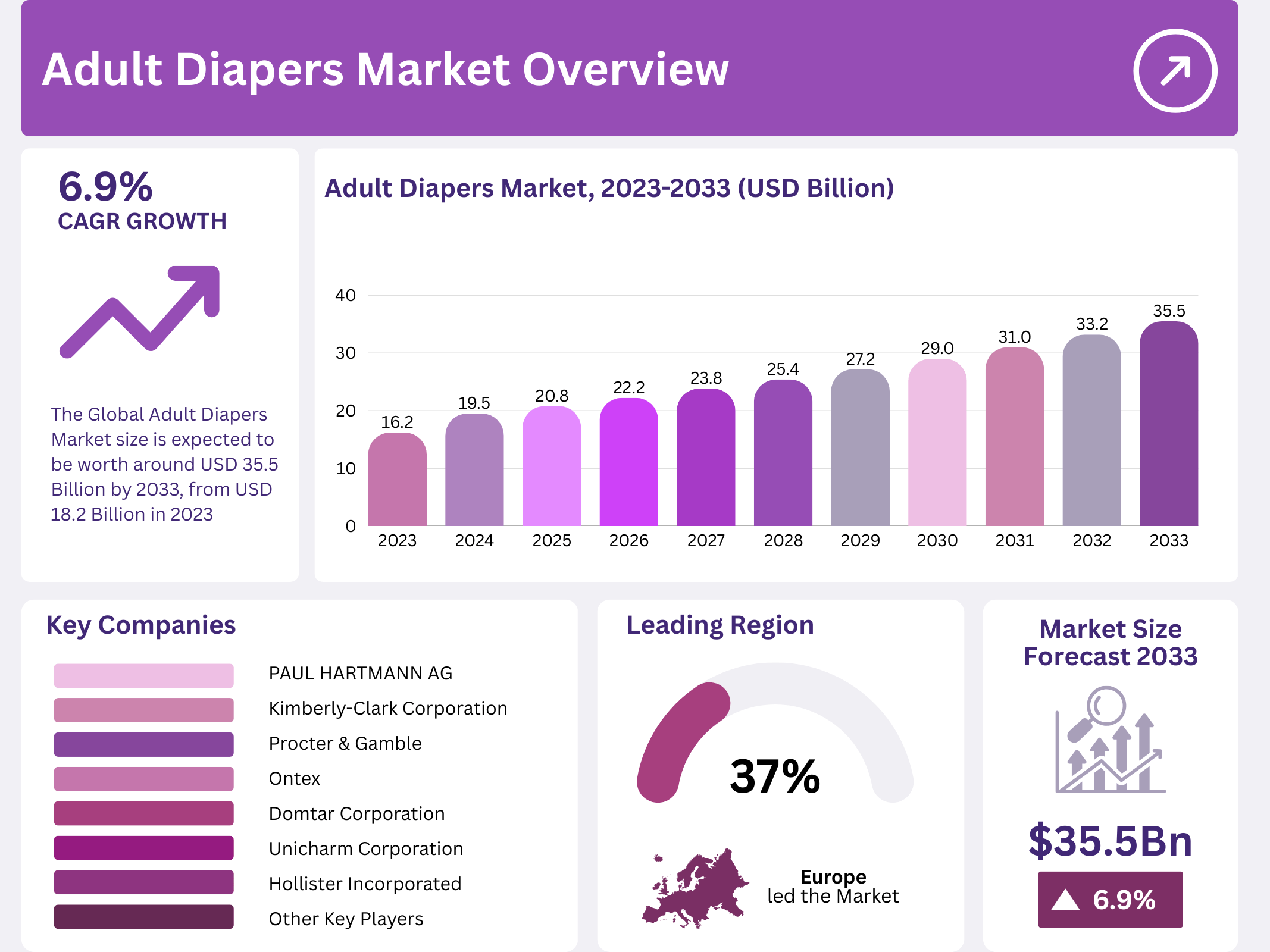

The Global Adult Diapers Market is witnessing robust expansion, expected to reach USD 35.5 billion by 2033 from USD 18.2 billion in 2023. Growing elderly populations and rising awareness about incontinence care are fueling market demand. Advancements in comfort-focused designs continue to reshape the industry.

Furthermore, companies are leveraging technology to enhance absorbency, breathability, and discretion in adult diapers. This progress aligns with the increasing global demand for elderly hygiene solutions. As the world’s aging population rises, adult diaper adoption accelerates across developed and emerging regions.

Additionally, environmental sustainability drives innovation. Manufacturers are investing in biodegradable and eco-friendly solutions to meet regulatory standards and appeal to conscious consumers. With market dynamics shifting rapidly, the adult diapers industry stands poised for sustained growth and innovation through the next decade.

Key Takeaways

- The Adult Diapers Market was valued at USD 18.2 billion in 2023 and is projected to reach USD 35.5 billion by 2033, growing at a CAGR of 6.9%.

- In 2023, the Underwear and Brief segment dominated with over 38% of revenue, driven by comfort and discreet design.

- Pads and Guards recorded the fastest growth with a CAGR of 13.4%, attributed to flexibility and convenience.

- Retail Stores held a 40.3% market share, driven by consumer trust and availability.

- Online Channels emerged as the most profitable, leveraging convenience and broad product access.

- Europe led with a 32.0% share, contributing USD 5.82 billion, due to aging demographics and advanced healthcare systems.

Market Segmentation Overview

By Type, the Underwear and Brief segment leads with over 38% of total revenue. These products provide comfort, ease of wear, and discretion. Manufacturers continue to improve design, fit, and absorbency, ensuring enhanced usability and satisfaction among consumers dealing with incontinence.

Pads and Guards demonstrate the fastest growth at a 13.4% CAGR, serving those with mild incontinence. These lightweight, flexible options are preferred for their convenience and discreet design. They offer an ideal solution for consumers seeking targeted absorbency and easy disposal without compromising comfort.

By Distribution Channel, Retail Stores dominate with a 40.3% share, offering consumers hands-on access to products and trusted purchasing experiences. Retail visibility remains critical, particularly for first-time buyers who prefer physical inspection before selecting the right incontinence care solution.

Online Channels have rapidly grown in profitability due to the rise in e-commerce platforms and discreet purchasing experiences. The convenience of doorstep delivery, privacy, and competitive pricing make online sales a crucial growth driver for adult diaper manufacturers worldwide.

Drivers

1. Expanding Aging Population: The global rise in the elderly population directly fuels market growth. With individuals aged 60 and above projected to reach 2.1 billion by 2050, the demand for adult diapers is surging. Aging populations require improved hygiene and comfort, leading to consistent product adoption.

2. Increased Awareness and Healthcare Expenditure: Awareness programs on incontinence management and improved healthcare spending are driving acceptance of adult diapers. As stigma decreases and medical support improves, hospitals, caregivers, and consumers are increasingly incorporating these products into daily health routines.

Use Cases

1. Elderly Care Facilities: Adult diapers are vital in nursing homes and assisted living centers to ensure comfort and hygiene for residents. They allow caregivers to maintain patient dignity and health efficiently, reducing risks associated with infections and poor hygiene among immobile or elderly patients.

2. Post-Surgical and Mobility Impairments: Patients recovering from surgery or those with mobility issues depend on adult diapers for convenience. These products enhance comfort and independence, offering protection against leaks and discomfort during recovery, making them indispensable for medical and home-based care.

Major Challenges

1. High Pricing and Limited Accessibility: Premium adult diapers with advanced absorbency features are costly, posing affordability challenges for elderly individuals and low-income groups. Limited rural distribution also restricts product access, particularly in developing economies, slowing potential market penetration.

2. Environmental and Social Stigma Issues: Disposable diapers contribute to significant landfill waste, with 20 billion units annually in the U.S. alone. Additionally, the stigma around adult diaper usage discourages open discussions, impacting overall demand and market expansion despite growing awareness efforts.

Business Opportunities

1. Development of Biodegradable Products: Eco-conscious consumers are demanding sustainable alternatives. Manufacturers investing in biodegradable plastics and recyclable materials can capture new market segments. These innovations not only reduce waste but also strengthen brand image and regulatory compliance.

2. Expansion into Emerging Markets: Rapid urbanization and improved healthcare infrastructure in Asia-Pacific and Latin America create vast opportunities. By localizing production and marketing strategies, companies can meet rising regional demand while catering to cultural preferences and affordability needs.

Regional Analysis

1. Europe Dominates the Market: Europe holds a 32.0% share, valued at USD 5.82 billion, due to its aging population and high healthcare standards. Strong government support, insurance coverage, and consumer preference for sustainable, high-quality hygiene products continue to drive growth across the region.

2. Asia Pacific Shows Rapid Growth: The Asia Pacific region is expanding quickly, driven by its large elderly population and increasing awareness of incontinence care. Rising disposable income, expanding healthcare systems, and cultural acceptance are accelerating adoption of adult diapers across major economies like China, Japan, and India.

Recent Developments

- May 2023: Nobel Hygiene’s Friends launched UltraThinz, India’s first slim, gender-specific disposable underpant designed for mild incontinence. The product emphasizes discretion and comfort for younger adults dealing with temporary conditions.

- June 2022: Indorama India introduced SnugFit spandex, a new hygiene-grade material improving comfort and safety in baby and adult diapers. This innovation aims to support local manufacturers and reduce import reliance.

- June 2024: First Quality and Cradles to Crayons celebrated three years of partnership, distributing over 20 million diapers in the U.S. and raising more than USD 2 million for families in need through the Cuties brand initiative.

Conclusion

The Global Adult Diapers Market stands at a pivotal growth stage, driven by demographic transitions, healthcare advancements, and sustainability trends. As aging populations expand and awareness increases, the demand for high-quality, comfortable, and eco-friendly products will continue to rise. Manufacturers focusing on innovation, affordability, and environmental responsibility are well-positioned to capture emerging opportunities and strengthen their global market presence through 2033 and beyond.