Quick Navigation

Introduction

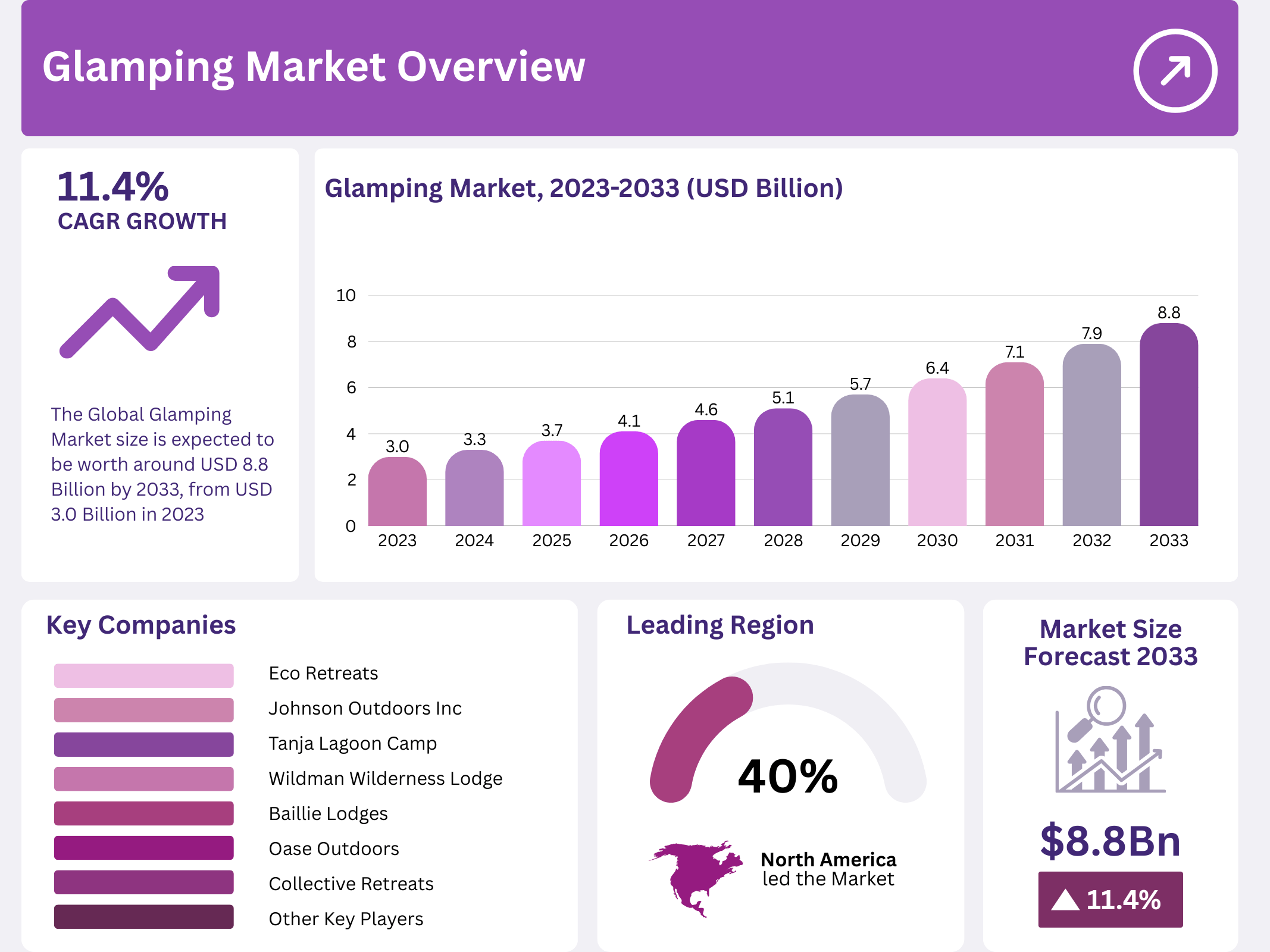

The global glamping market demonstrates remarkable expansion potential, with valuations projected to surge from USD 3.0 billion in 2023 to USD 8.8 billion by 2033. This growth trajectory reflects a compound annual growth rate of 11.4% throughout the forecast period. Such momentum underscores shifting consumer preferences toward experiential luxury travel.

Glamping, combining glamorous accommodations with camping adventures, revolutionizes outdoor tourism by delivering premium comfort within natural environments. Modern travelers increasingly seek unique experiences that balance environmental immersion with upscale amenities. This fusion attracts demographics ranging from millennials to families desiring memorable outdoor stays without sacrificing convenience.

Market dynamics reveal significant opportunities across diverse accommodation types including cabins, tents, yurts, and treehouses. Each option caters to distinct traveler preferences while maintaining luxury standards. The industry benefits from growing environmental consciousness, with 81% of travelers preferring sustainable accommodations according to 2022 surveys.

Geographic distribution shows North America commanding 40% market share, followed by expanding presence across Europe and Asia-Pacific regions. Emerging markets present substantial growth potential as middle-class populations increase disposable income. Government initiatives supporting rural tourism further accelerate market development through infrastructure investments and promotional campaigns.

Consumer behavior patterns indicate strong demand from the 18-32 age group, representing 40% of market engagement. This demographic prioritizes Instagram-worthy experiences and sustainable travel options. Furthermore, 80% of leisure travelers incorporated camping or glamping into their 2022 trips, demonstrating mainstream acceptance.

Industry players continuously innovate by integrating eco-friendly technologies, wellness services, and digital booking platforms. These enhancements improve accessibility while addressing environmental concerns. The market’s evolution reflects broader tourism trends emphasizing authenticity, sustainability, and personalized experiences that resonate with contemporary travelers seeking meaningful connections with nature.

Key Takeaways

- The Glamping Market was valued at USD 3.0 Billion in 2023 and is expected to reach USD 8.8 Billion by 2033, with a CAGR of 11.4%

- In 2023, Cabins & Pods dominate the type segment with 43.9%, favored for comfort and experience

- In 2023, 4-Persons capacity is the dominant size, accommodating group travel preferences

- In 2023, 18-32 Years age group leads at 40%, highlighting millennial interest in glamping experiences

- In 2023, North America leads with 40.0% market share, reflecting growing demand for alternative travel options

Market Segmentation Overview

Type Segment

Cabins and Pods capture 43.9% market share, dominating through superior comfort and privacy offerings. These structures incorporate full kitchens, modern bathrooms, and quality bedding that appeal to luxury-seeking travelers. Their robust construction withstands harsh climates while blending seamlessly into natural surroundings.

Tents provide upgraded traditional camping with proper beds and electrical amenities, attracting adventure enthusiasts. Yurts deliver unique cultural experiences combining rustic charm with luxury elements. Treehouses offer elevated perspectives and novelty appeal, particularly resonating with families and romantic getaways seeking distinctive accommodations.

Size Segment

Four-person accommodations dominate the market by perfectly serving small families and friend groups. This configuration provides comfortable sleeping arrangements and adequate living space for extended stays. The versatility makes it ideal for various travel scenarios without compromising comfort or privacy.

Two-person options cater specifically to couples and solo travelers seeking intimate retreats. Larger configurations accommodate special events including family reunions, weddings, and corporate retreats. These diverse size offerings ensure market accessibility across different traveler needs and group compositions.

Age-Group Segment

The 18-32 years demographic commands 40% market share, driven by desires for Instagram-worthy and unique travel experiences. This group values environmental sustainability combined with aesthetic appeal and digital connectivity. Glamping perfectly balances adventure with comfort while maintaining social media appeal.

The 33-50 years segment shows strong interest through families and professionals seeking convenient escapes. Older demographics appreciate accessibility and comfort, enabling nature enjoyment without traditional camping’s physical demands. This multi-generational appeal strengthens overall market stability and growth potential.

Drivers

Rising Demand for Nature-Based Experiences: Travelers increasingly prioritize meaningful nature interactions while maintaining modern comfort standards. According to Kampgrounds of America, 80% of leisure travelers chose camping or glamping for trips in 2022, with 40% of all leisure trips involving camping activities. This preference shift reflects broader movements toward experiential travel that emphasizes environmental connection.

Glamping uniquely satisfies this demand by combining outdoor immersion with luxury amenities, creating memorable experiences that traditional accommodations cannot replicate. The trend particularly resonates with consumers seeking authentic connections to natural environments without sacrificing convenience or comfort.

Sustainable Tourism Popularity: Environmental consciousness significantly influences travel decisions, with 81% of travelers preferring sustainable accommodations and 63% actively avoiding unsustainable destinations according to 2022 Booking.com surveys. Glamping aligns perfectly with these values by offering eco-friendly accommodation options that minimize environmental impact.

Many sites incorporate solar power, recycled materials, and sustainable waste management systems. Government support reinforces this trend, exemplified by the European Union’s Horizon 2020 program allocating over €80 million toward sustainable tourism promotion. Thailand’s initiative closing 40% of marine parks during low seasons demonstrates commitment to ecosystem protection while maintaining tourism viability.

Use Cases

Wellness Tourism and Retreats: Glamping sites increasingly integrate wellness services including yoga sessions, meditation programs, and spa amenities to attract health-conscious travelers. This combination creates holistic experiences appealing to consumers seeking physical and mental rejuvenation within natural settings.

The wellness tourism segment continues expanding as travelers prioritize self-care and stress reduction. Glamping venues situated in serene environments provide ideal backdrops for wellness activities while maintaining luxury standards. This use case particularly attracts professionals seeking short escapes and individuals pursuing lifestyle balance through nature-based wellness programs.

Adventure Tourism Integration: Glamping complements adventure activities including hiking, kayaking, wildlife tours, and outdoor sports perfectly. Sites strategically positioned near national parks and adventure destinations provide comfortable basecamp alternatives for activity-focused travelers.

Under Canvas exemplifies this approach by offering luxury tents near major U.S. national parks, combining comfort with adventure accessibility. This integration attracts nature lovers and outdoor enthusiasts who desire premium accommodations after engaging in physical activities. The model successfully balances rustic adventure appeal with contemporary comfort expectations, expanding glamping’s market reach significantly.

Major Challenges

High Cost Barriers: Premium pricing for luxury tents, cabins, and treehouses limits accessibility for budget-conscious travelers, restricting potential market expansion. Establishing glamping sites requires substantial investment in quality infrastructure, sustainable amenities, and location development.

These costs translate to higher nightly rates compared to traditional camping options. Economic uncertainty further compounds this challenge by affecting consumer travel budgets during downturns. Competition from traditional hotels and resorts offering similar luxury at competitive prices creates additional pressure. Providers must balance premium positioning with value perception while maintaining profitability and quality standards.

Seasonal and Geographic Limitations: Weather dependency restricts year-round operations for many glamping sites, limiting potential revenue streams during off-peak seasons. Adverse weather conditions can disrupt travel plans and make sites inaccessible, affecting consumer confidence and booking patterns.

Establishing sites in remote areas presents infrastructure challenges requiring significant investment in water, electricity, and waste management systems. Environmental regulations and permit compliance add complexity and costs to site development. Limited awareness in certain regions hampers expansion efforts, requiring substantial marketing investments to build consumer understanding and interest in glamping concepts.

Business Opportunities

Emerging Market Expansion: Asia-Pacific and Latin America regions present substantial growth opportunities driven by rising middle-class incomes and increased domestic tourism. Countries including China, Australia, Brazil, and Mexico show particular promise for glamping investments.

These markets feature diverse natural landscapes suitable for various glamping configurations while demonstrating growing interest in luxury outdoor experiences. Governments in emerging regions increasingly support rural tourism initiatives, creating favorable conditions for glamping development. Lower market saturation compared to North America and Europe enables early movers to establish strong positions and brand recognition.

Digital Platform Integration: Development of sophisticated online booking platforms creates opportunities by simplifying consumer access to glamping experiences. Digital marketing through Instagram and YouTube showcases picturesque locations, inspiring travel and increasing reservations.

These platforms enable smaller operators to compete effectively by reaching targeted demographics efficiently. Integration of virtual tours, customer reviews, and seamless booking processes reduces barriers to entry for potential guests. Technology adoption also facilitates dynamic pricing strategies, inventory management, and customer relationship development. Social media promotion particularly resonates with younger demographics, driving awareness and market expansion.

Regional Analysis

North America Leadership: North America dominates with 40% market share valued at USD 1.20 billion, driven by strong outdoor tourism culture and high disposable incomes. The United States leads regional contribution with Canada showing rising interest in luxury camping experiences. Diverse natural landscapes, well-developed infrastructure, and growing eco-friendly travel preferences support sustained growth.

The region benefits from established marketing channels and digital booking platforms that enhance accessibility. Rising wellness retreat trends and technological facility enhancements position North America for continued market expansion. Strong consumer awareness of sustainable tourism further reinforces the region’s dominant position.

Asia-Pacific Growth Potential: Asia-Pacific experiences rapid expansion fueled by rising middle-class income, increased domestic tourism, and diverse natural landscapes. China and Australia lead market development through significant investments in unique glamping sites. The region’s moderate market saturation compared to developed markets presents substantial opportunities for new entrants

Government support for rural tourism initiatives accelerates infrastructure development in previously underserved areas. Growing environmental consciousness among Asian consumers aligns with glamping’s sustainable positioning. Cultural interest in nature-based experiences combined with increasing international tourism creates favorable conditions for sustained regional growth.

Recent Developments

- November 2024: Tamil Nadu Tourism Development Corporation (TTDC) finalized glamping campsites in Jawadhu Hills, promoting tourism through luxury outdoor accommodations and adventure sports as part of broader initiatives attracting visitors to lesser-known regions

- September 2024: Galloway Glamping launched in Scotland’s Dark Sky Park with £25,000 Start Up Loan support, offering eco-friendly timber-frame pods equipped with hot tubs and fire pits for nature lovers and stargazing enthusiasts

- October 2024: Kampgrounds of America (KOA) announced fall camping promotion offering discounted rates and special events across campgrounds, encouraging year-round outdoor activity among families and adventure seekers

- June 2024: LuxeGlamp EcoResorts opened bubble glamping resort in Munnar, Kerala, featuring transparent bubble tents with panoramic tea plantation and mountain views, targeting eco-tourists and adventure travelers

Conclusion

The glamping market’s projected growth from USD 3.0 billion to USD 8.8 billion reflects fundamental shifts in travel preferences toward experiential luxury and environmental sustainability. Strong performance across diverse segments demonstrates broad consumer appeal spanning multiple demographics and accommodation types. North America’s leadership position combined with emerging market potential creates balanced growth opportunities globally.