Quick Navigation

Overview

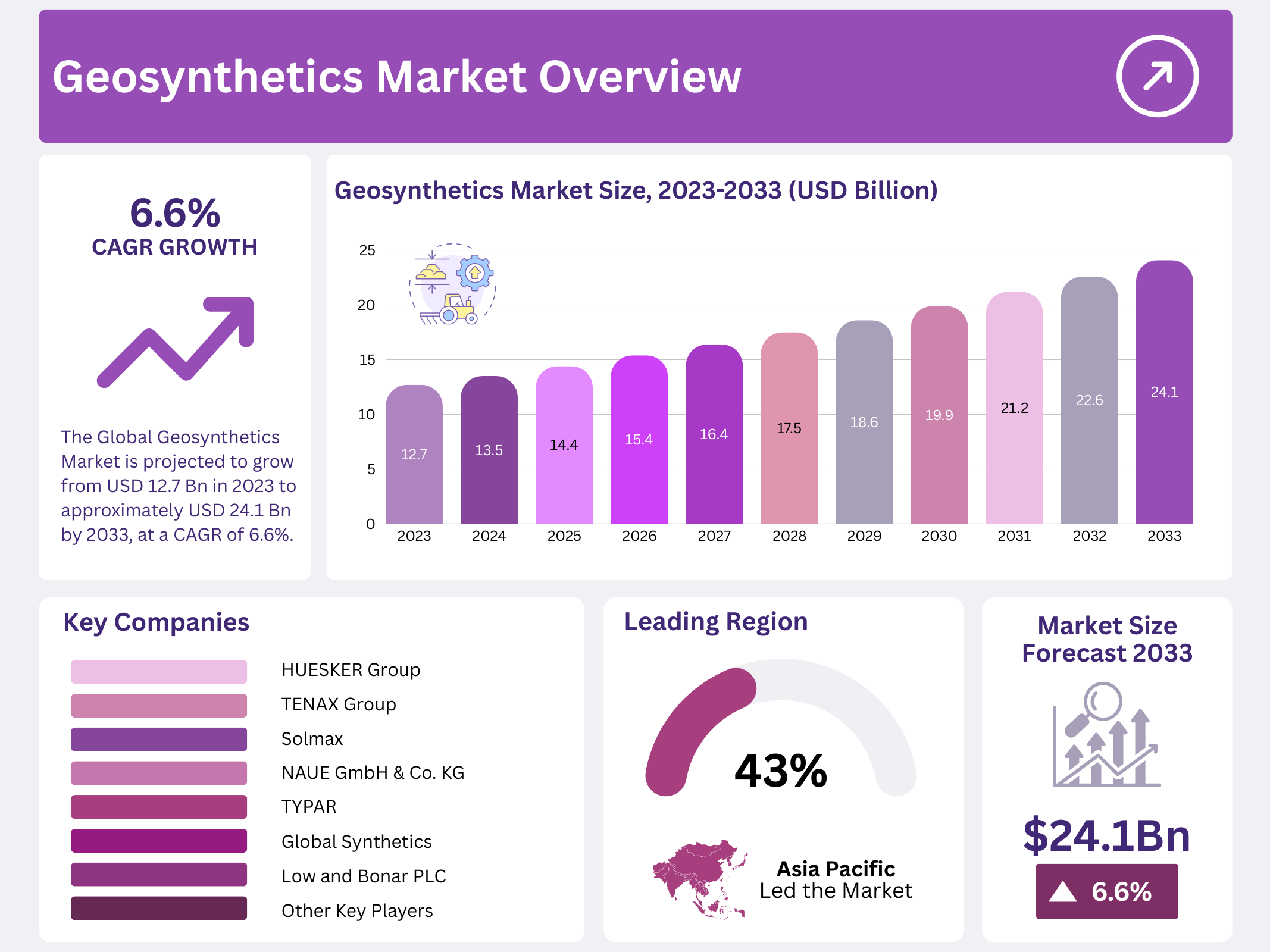

New York, NY – December 26, 2025 – The global Geosynthetics Market is witnessing steady growth driven by rising infrastructure and construction activities worldwide. The market size is expected to reach around USD 24.1 billion by 2033, growing from USD 12.7 billion in 2023. This expansion reflects a solid CAGR of 6.6% during the forecast period from 2023 to 2033, supported by increasing demand for durable and cost-effective ground stabilization solutions.

Geosynthetics refers to a broad range of engineered products designed to stabilize soil and improve ground performance. These materials are mainly used to address civil engineering and geotechnical challenges such as erosion control, drainage, reinforcement, and separation. Common geosynthetic products include geonets, which help manage fluid flow and improve structural stability in construction projects.

These products are typically manufactured using polymers such as polystyrene, polypropylene, polyvinyl chloride, and polyester. Due to their strength, flexibility, and resistance to environmental stress, geosynthetic systems are widely applied in roads, railways, landfills, retaining structures, and other large-scale civil engineering projects. Their ability to extend infrastructure life while reducing maintenance costs continues to drive market adoption globally.

Key Takeaways

- The Global Geosynthetics Market is projected to grow from USD 12.7 billion in 2023 to approximately USD 24.1 billion by 2033, at a steady CAGR of 6.6% during the forecast period (2023–2033).

- Geosynthetics captured a dominant 45.7% share of the global market in 2023 due to superior performance over traditional materials.

- Waste Management was the leading application segment in 2023, accounting for 34.8% of the market share.

- Asia Pacific held the largest regional share in 2023 with 43.8% of global revenue.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 12.7 Billion |

| Forecast Revenue (2033) | USD 24.1 Billion |

| CAGR (2024-2033) | 6.6% |

| Segments Covered | By Product (Geotextiles, Geomembranes, Geogrids, Geonets, and Other Products), By Application (Separation, Reinforcement, Filtration, Drainage, and Barrier) |

| Competitive Landscape | Propex Operating Company LLC, AGTU America, Tensar International Corporation, Officine Maccaferri S.p.A., PRS Geo-Technologies, Koninklijke Ten Cate N.V., HUESKER Group, Fibertex Nonwovens A/S, TENAX Group, Low and Bonar PLC, GSE Holdings, Inc., Solmax, NAUE GmbH & Co. KG, Global Synthetics, TYPAR |

Key Market Segments

Product Analysis

In 2023, the Geosynthetics Market held a strong 45.7% share of the global market, driven by its superior performance and clear functional benefits compared with traditional materials. Geotextiles, one of the key product categories, are manufactured using synthetic fabrics such as polypropylene (PP) and polyester, which offer durability, flexibility, and cost efficiency across civil engineering applications.

Geomembranes are expected to record steady revenue growth from 2023 to 2032. This growth is supported by rising awareness of their role as floating covers for reservoirs, where they help control water evaporation and limit the release of volatile organic compound (VOC) emissions. In addition, increasing demand for efficient drainage and containment solutions continues to strengthen the adoption of geomembranes in infrastructure and environmental projects.

Geogrids are gaining wider use due to their high bearing capacity, particularly in railway lines and road construction projects. They are also commonly applied in the construction of retaining walls that support bridge abutments and railway bridges. Geonets further contribute to market growth, as they are used in landfill leachate collection, foundation wall drainage systems, road drainage, and methane gas management. Their ability to slow surface runoff is expected to drive higher adoption in erosion control applications.

By Application

In 2023, Waste Management emerged as the leading application segment, accounting for a substantial 34.8% market share. This dominance reflects the extensive use of geosynthetics in landfill liners, leachate management systems, and environmental protection projects.

The application segment is broadly categorized into reinforcement, drainage, separation, filtration, and barrier functions. Geosynthetics such as geotextiles and geomembranes are widely used to separate different material layers, helping maintain structural integrity and extend infrastructure life. Growing investment in road construction and repair activities across developing economies is expected to support further growth during the forecast period.

Reinforcement applications, particularly in road construction, use geosynthetics and geogrids to strengthen sub-soil and improve shear and tensile strength. Filtration applications allow liquids to pass through geosynthetics while retaining soil particles, while drainage remains a critical function in nearly all geotechnical structures, supporting consistent market expansion.

Regional Analysis

In 2023, the Asia Pacific region dominated the global geosynthetics market, accounting for 43.8% of total revenue. This leadership is driven by rapid urbanization, extensive infrastructure development, and rising demand for soil reinforcement—particularly in foundation work for residential buildings—in emerging economies such as China and India.

Europe ranked as the second-largest market, supported by stringent EU construction directives that mandate the use of geosynthetics in infrastructure projects. Additionally, Germany’s rigorous waste management policies in both municipal and industrial sectors have further propelled adoption in the region.

In South America, particularly in developing economies like Brazil, the market is poised for strong growth due to expanding infrastructure initiatives. Enhanced water management practices are also expected to drive regional demand.

The offshore oil and gas sector’s expansion in countries including Brazil, Argentina, and Venezuela has positively influenced market growth across Latin America.

Meanwhile, the geosynthetics market is experiencing robust momentum in Africa and the Middle East. Over the forecast period, increased civil and commercial construction activities—such as stadiums, hotels, and other large-scale projects—will fuel continued expansion in these regions.

Top Use Cases

- Soil Reinforcement and Stabilization: Geosynthetics help strengthen weak soil in construction sites and make the ground more stable for building roads, embankments, and retaining walls. They act like an internal support matrix, improving load distribution and preventing soil movement, which enhances safety and lowers long-term maintenance needs in infrastructure projects.

- Erosion Control and Slope Protection: In projects near rivers, hills, or slopes, geosynthetics prevent soil from washing away due to rain, wind, or water flow. By holding the soil in place and encouraging vegetation growth, these materials reduce the risks of landslides and preserve landscape integrity, making them key for sustainable land management and environmental protection.

- Drainage and Water Management Systems: Geosynthetics are used to manage excess water in construction and environmental projects. They allow water to flow through while stopping soil particles from clogging systems, improving drainage under roads, around structures, and in landfills. This helps reduce flooding and maintains long-lasting infrastructure performance.

- Containment and Barrier Applications: Certain geosynthetics serve as barriers to prevent liquids or gases from leaking into the environment. They line landfills, reservoirs, and waste containment areas to stop harmful materials from seeping into soil or groundwater. This containment function is important for environmental safety and regulatory compliance in waste and water management.

- Separation and Filtration Between Materials: In layered construction work like road bases and pavements, geosynthetics separate different material layers to stop them from mixing. They filter water while keeping soil particles in place, which enhances structural integrity and extends the life of roads, airport surfaces, and foundations. This separation function reduces project costs and improves performance.

Recent Developments

1. Propex Operating Company LLC

Propex continues to expand its product line with a focus on sustainable solutions. Recent developments include innovations in woven and nonwoven geotextiles for filtration and separation, with an emphasis on recycled materials. Their research targets enhanced durability and performance in challenging environmental applications, supporting infrastructure and erosion control projects.

2. AGTU America

AGTU America has been advancing its geosynthetic clay liner (GCL) technology. Recent efforts focus on improving hydraulic barrier performance and installation efficiency for landfills and containment projects. They are integrating advanced polymer blends to enhance self-healing properties and long-term chemical resistance in composite liner systems.

3. Tensar International Corporation

Tensar, a leader in geogrid technology, recently launched the TriAx Geogrid series with enhanced stiffness and aperture stability for heavy-duty stabilization. Their development focuses on digital tools like the TensarSoil design software, integrating data-driven solutions for more efficient and resilient earth reinforcement in roadways and foundations.

4. Officine Maccaferri S.p.A.

Maccaferri has developed advanced geosynthetic solutions like MacMat and ParaLink, combining geotextiles with erosion control and reinforcement functions. Recent innovations include sustainable materials for green infrastructure and climate-resilient designs. Their focus is on integrated systems for slope stabilization, channel protection, and coastal defense.

5. PRS Geo-Technologies

PRS specializes in geocell confinement technology. Recent developments include the Neoloy Geocells made from a novel polymeric alloy, offering high strength and long-term creep resistance. They focus on applications for heavy-load support, slope protection, and sustainable road construction, promoting cost-effective and durable ground stabilization.

Conclusion

Geosynthetics have become essential tools in modern construction and environmental engineering because they solve a variety of problems linked to soil, water, and material behaviour. They improve structural stability, manage fluids, protect landscapes from erosion, and contain harmful substances. By offering reliable, cost-effective solutions, these materials help engineers build safer, longer-lasting, and more sustainable infrastructure projects.