Quick Navigation

Overview

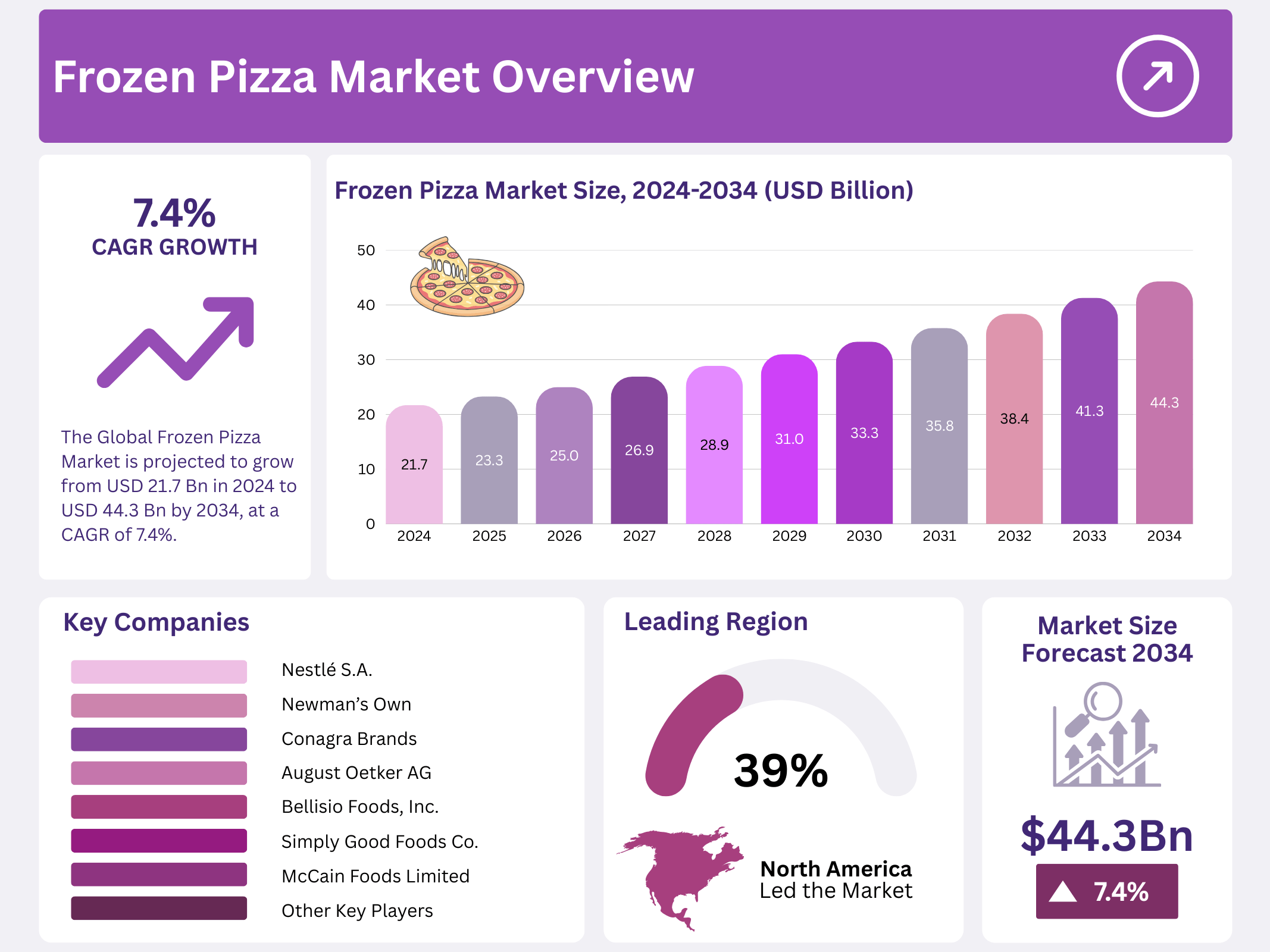

New York, NY – December 12, 2025 – The Global Frozen Pizza Market is projected to reach USD 44.3 billion by 2034, rising from USD 21.7 billion in 2024 and expanding at a CAGR of 7.4% between 2025 and 2034. This growth reflects the rising consumer preference for convenient meal options that fit fast-paced lifestyles. Frozen pizza has become a staple in many households due to its long shelf life, easy preparation, and wide variety of choices.

Frozen pizza is made using a pre-prepared crust, sauce, cheese, and assorted toppings, then partially cooked and frozen to maintain freshness. It is available in multiple styles, sizes, and flavor profiles, making it a versatile product suitable for diverse consumer preferences. Its popularity continues to expand across retail stores and online channels as manufacturers innovate with new formats and premium ingredients.

In recent years, there has been a noticeable shift toward healthier frozen pizza options, driven by rising awareness of dietary needs and wellness-focused eating. Consumers increasingly seek gluten-free, vegan, and low-carb alternatives, with offerings such as cauliflower crusts and plant-based toppings gaining momentum. These innovations cater to individuals with celiac disease, gluten intolerance, and those pursuing plant-forward diets, helping broaden the market’s appeal.

Key Takeaways

- The Global Frozen Pizza Market is projected to grow from USD 21.7 billion in 2024 to USD 44.3 billion by 2034, expected to expand at a CAGR of 7.4% from 2025 to 2034.

- Thin-Crust Type frozen pizza accounted for the majority of the market share with 42.1%.

- Non-vegetarian frozen pizza accounted for the largest market share of 61.6%.

- Meat-based toppings are expected to account for the largest market share in 2024, with 56.4%.

- The Large-sized frozen pizza is more popular among consumers, and thus, it holds a 53.3% revenue share.

- The Supermarkets and Hypermarkets segment is anticipated to account market share of 53.5%.

- North America held the largest market share at 39.1%. North America’s dominance is attributed to a strong cultural affinity for pizza.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 21.7 Billion |

| Forecast Revenue (2034) | USD 44.3 Billion |

| CAGR (2025-2034) | 7.4% |

| Segments Covered | By Type (Non-vegetarian Frozen Pizza, and Vegetarian Frozen Pizza), By Crust Type (Thin Crust, Thick Crust, Stuffed, and Other Crust Types), By Toppings (Meat, Vegetables, Cheese, and Other Toppings) By Size (Regular, Large, and Extra-large) By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, and Others) |

| Competitive Landscape | Dr. August Oetker AG, Conagra Brands, Bellisio Foods, Inc., Freiberger Lebensmittel GmbH, Newman’s Own, Nestlé S.A., Simply Good Foods Co., Monte Pizza International B.V., McCain Foods Limited, LLC, and Other Manufacturers |

Key Market Segments

Crust Type Analysis

Thin Crust Frozen Pizzas Dominate Due to Their Crispy Texture and Perceived Health Benefits

The frozen pizza market is segmented by crust type into thin crust, thick crust, stuffed crust, and others. Thin crust holds the leading position, capturing 42.1% of the market share in 2024. Compared to thick or stuffed varieties, thin-crust pizzas typically have lower calorie content and less dough.

Health and wellness trends play a key role in this preference, as consumers increasingly choose thinner options to enjoy pizza with reduced calories and carbohydrates. Many also favor the satisfying crispiness that thin crust delivers when reheated, creating an appealing contrast with melty cheese and flavorful toppings.

Type Analysis

Non-Vegetarian Frozen Pizzas Lead the Market, Driven by Strong Consumer Popularity

The global frozen pizza market is divided by type into non-vegetarian and vegetarian varieties. Non-vegetarian options command the largest revenue share at 61.6% in 2024. Featuring popular meat toppings like pepperoni, sausage, and chicken, non-vegetarian pizzas are viewed as a classic choice in many regions and cultures. In Western markets with high frozen pizza consumption, meat-based diets remain common, boosting demand. The broad availability of diverse meat combinations further appeals to a wide audience.

Toppings Analysis

Meat Toppings Drive Growth with Diverse and Flavorful Options

By toppings, the market includes meat, vegetables, cheese, and others. Meat toppings hold the dominant share at 56.4% in 2024. Classic meat choices such as pepperoni, sausage, and ham deliver rich, savory flavors that many consumers find satisfying and indulgent. The wide variety of meat options and combinations caters to hearty preferences, contributing to higher sales.

Size Analysis

Large Frozen Pizzas Preferred for Versatility and Convenience in Group Settings

The market is segmented by size into regular, large, and extra-large. Large-sized pizzas are the most popular, accounting for 53.3% of the revenue share. Larger sizes provide ample space for multiple toppings and flavor varieties on a single pizza, accommodating diverse preferences in families or groups. They offer practical benefits for busy households by reducing meal preparation frequency and minimizing packaging waste compared to buying several smaller pizzas.

Distribution Channel Analysis

Supermarkets and Hypermarkets Lead Due to Extensive Assortment and Competitive Pricing

Distribution channels include supermarkets/hypermarkets, convenience stores, specialty stores, online retail, and others. Supermarkets and hypermarkets capture the largest revenue share at 53.5% in 2024. These outlets offer a wide selection of frozen pizza brands, from budget-friendly to premium, enabling one-stop shopping. Their scale enables better supplier negotiations for lower prices, along with frequent promotions, discounts, and loyalty programs that appeal to value-seeking consumers.

Regional Analysis

North America holds the largest share of the global frozen pizza market, accounting for 39.1% in 2024. This dominance is strongly linked to the region’s long-standing cultural affinity for pizza, particularly in the United States, where frozen pizza has become a household staple. The fast-paced lifestyles of many consumers across the region further fuel demand, as frozen pizza offers a quick, convenient, and affordable meal solution that fits seamlessly into busy daily routines.

The region also benefits from a highly developed and efficient retail infrastructure. Supermarkets, hypermarkets, warehouse clubs, and convenience stores offer extensive frozen food sections, making frozen pizza widely accessible to consumers. This strong distribution network, combined with high product visibility and frequent promotional activities, supports the steady growth of frozen pizza sales across North America.

In addition, shifting consumer preferences toward healthier and more premium frozen food options are shaping the market. Health-conscious buyers are increasingly choosing pizzas featuring organic ingredients, vegetable-rich toppings, low-carb or whole-grain crusts, and plant-based cheeses. Manufacturers have responded by expanding their product lines to include gluten-free, vegan, and protein-rich varieties, allowing the market to appeal to both traditional consumers and those seeking better-for-you alternatives.

Top Use Cases

- Quick Home Dinners: Busy families often turn to frozen pizza for effortless weeknight meals. With minimal prep, it bakes up hot and ready in under half an hour, letting everyone enjoy a shared favorite without the hassle of chopping veggies or rolling dough. This simple solution fits perfectly into packed schedules, keeping dinner fun and stress-free.

- On-the-Go Snacks: College students and young professionals grab frozen pizza slices for portable fuel during late-night study sessions or quick breaks. Easy to portion and reheat, it delivers that comforting cheesy bite anytime, anywhere, making it a reliable pick-me-up that satisfies cravings without slowing down a hectic day.

- Meal Prep and Batch Cooking: Home cooks stock up on frozen pizzas to streamline weekly meal planning. They portion them out for grab-and-go lunches or freeze extras for future dinners, saving time on busy mornings. This smart approach turns a single purchase into multiple easy meals, blending convenience with smart budgeting.

- Catering and Event Food: Hosts rely on frozen pizza for casual gatherings like game nights or backyard barbecues. It feeds a crowd affordably, with options to customize toppings on the spot, creating a laid-back vibe. Quick to bake in batches, it keeps guests happy and the party flowing smoothly.

- Emergency and Backup Supplies: Households keep frozen pizza in the freezer as a go-to for unexpected guests or last-minute dinners. When plans change, or energy is low, it steps in as a no-fuss savior, offering reliable comfort food that restores normalcy fast. It’s the ultimate safety net for everyday surprises.

Recent Developments

1. August Oetker AG

The German market leader focuses on premiumization and sustainability. Recent launches include the “Die Backfrische” line, emphasizing an extra-crispy crust, and plant-based pizza varieties under the “Pizza Vegetale” brand. Packaging is being converted to 100% recyclable materials, and the company invests heavily in modernizing its European production facilities to improve efficiency and reduce its carbon footprint.

2. Conagra Brands

Through its Birds Eye brand, Conagra expanded its Veggie Made platform into frozen pizza with a veggie-crust lineup, combining vegetable content with popular flavors like Four Cheese. This innovation targets health-conscious consumers seeking added nutrition. Conagra also continues to leverage data analytics to optimize its supply chain and promotional strategies for its frozen portfolio amid inflationary pressures.

3. Bellisio Foods, Inc. (dba The Jacquies Food Company)

Bellisio, owner of the Michelina’s and Boston Pizza brands, is driving growth through value-oriented innovation. Recent developments include new premium “Authentics” recipes under the Michelina’s label and the launch of single-serve Boston Pizza frozen entrees in retail. The company strategically focuses on affordability and quality to capture market share as consumers seek budget-friendly meal solutions

4. Freiberger Lebensmittel GmbH

The family-owned German manufacturer is expanding its “Pizza à la Grandma” (Pizza nach Oma Art) line, focusing on high-quality, artisanal ingredients and bold flavors. It has also introduced a “Low Carb” pizza range to cater to dietary trends. Internationally, Freiberger is actively pursuing growth in European and selected Asian markets, emphasizing its traditional baking methods and German engineering.

5. Newman’s Own

The philanthropy-focused brand continues to align its frozen pizza offerings with consumer wellness trends. It has reformulated several products to remove artificial colors and flavors, emphasizing clean-label ingredients. All profits continue to fund charitable donations. Their lineup, including thin-crust options, maintains a commitment to quality ingredients that support both consumer health and social causes.

Conclusion

Frozen Pizza is evolving into a versatile hero for modern life, blending old-school comfort with fresh twists like plant-based toppings and crispy crusts. It thrives on our love for quick, tasty eats that fit rushed routines, while brands push boundaries with gourmet flavors and healthier choices to keep it exciting. Looking ahead, this category promises steady appeal, adapting to diverse tastes and lifestyles to remain a freezer staple that brings people together effortlessly.