Quick Navigation

Introduction

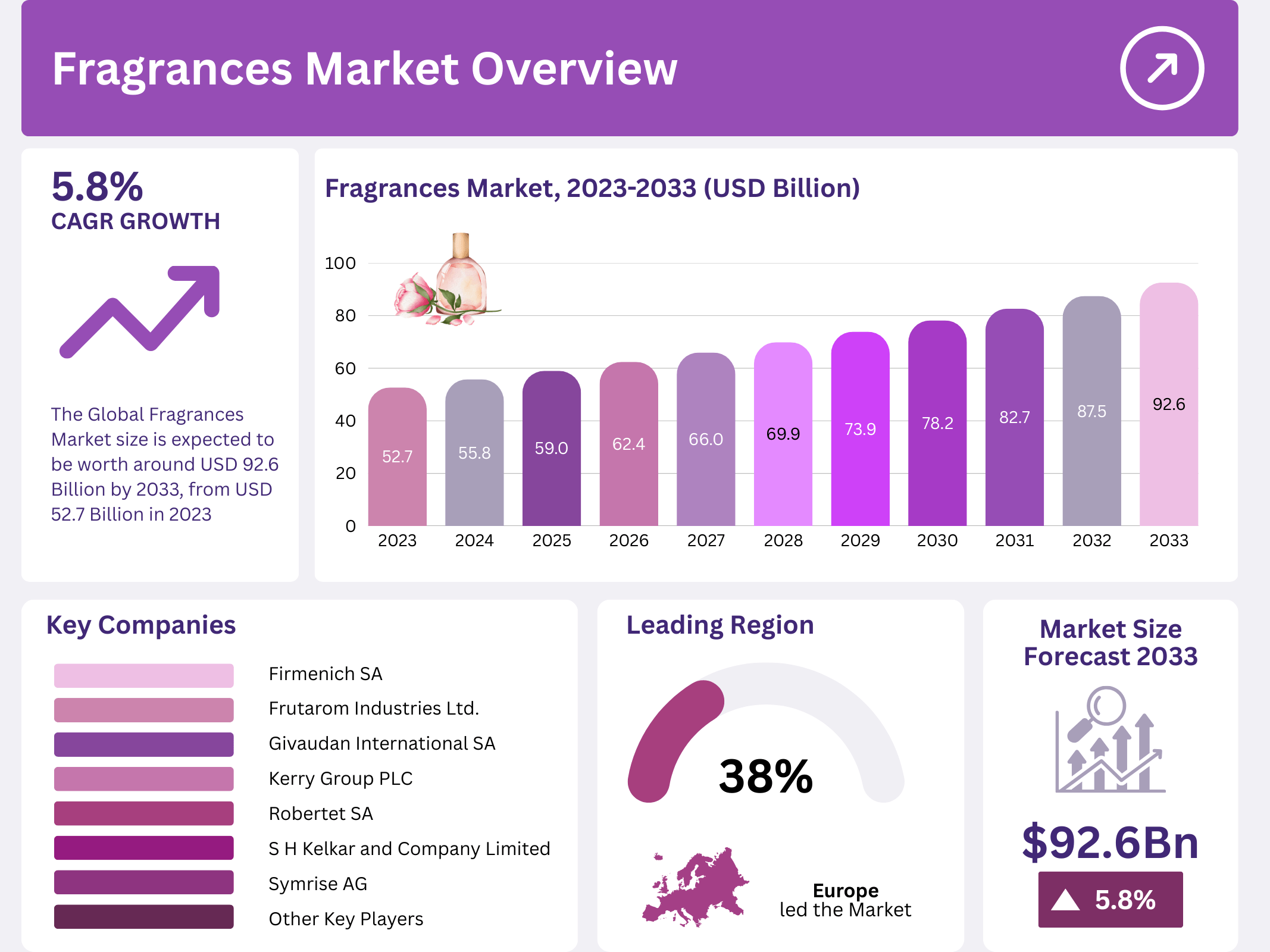

The Global Fragrances Market is projected to reach USD 92.6 Billion by 2033, growing from USD 52.7 Billion in 2023. This represents a compound annual growth rate (CAGR) of 5.8% from 2024 to 2033. Fragrances are aromatic compounds used in a variety of personal care products, perfumes, and household items. The market encompasses both luxury and mass-market offerings, with an increasing preference for eco-friendly and personalized scents.

The fragrance market continues to grow rapidly, driven by evolving consumer preferences and rising disposable incomes. Innovations in natural and sustainable ingredients, along with the increasing demand for luxury and personalized perfumes, are expected to further fuel market expansion. As sustainability becomes a major consumer focus, eco-conscious fragrance production is likely to gain even more prominence.

Key Takeaways

- The Global Fragrances Market was valued at USD 52.7 Billion in 2023 and is expected to reach USD 92.6 Billion by 2033, with a CAGR of 5.8% from 2024 to 2033.

- Synthetic Fragrances dominate the type segment with 58% share in 2023 due to cost-effectiveness and wide availability.

- Food & Beverages leads the application segment with 32% share, driven by increasing demand for flavored products.

- Europe is the dominant region, holding 38% share in 2023 due to its heritage in perfumery and the high demand for luxury fragrances.

Market Segmentation Overview

By Type

In 2023, the Synthetic Fragrances segment accounted for 58% of the market share, driven by cost-effectiveness, consistency, and a wide variety of available scents. Synthetic fragrances are produced using man-made compounds, ensuring a stable scent profile, which is essential for large-scale production. In contrast, the Natural Fragrances segment appeals to a niche group of consumers who are more health-conscious and prefer organic, eco-friendly products.

By Application

The Food & Beverages segment leads the fragrance market with 32% share in 2023. Fragrances in food and beverage products enhance sensory appeal, which directly influences consumer purchasing decisions. Other significant application segments include Cosmetic and Personal Care, Home Care, and Fabric Care, each playing a role in elevating everyday products through the use of fragrances.

Drivers

Rising Disposable Incomes

One of the key drivers of the global fragrance market is the rising disposable incomes, especially in emerging markets like Asia-Pacific and Latin America. As more consumers have the ability to spend on luxury goods, including perfumes and personal care products, demand for premium and high-quality fragrances continues to rise.

Evolving Consumer Preferences

The demand for fragrances is also being driven by evolving consumer preferences. Personal grooming and self-care are becoming increasingly important to consumers, particularly younger generations. The trend toward premium, niche, and personalized fragrances reflects these evolving preferences, with consumers seeking unique scent experiences that align with their identities.

Use Cases

Personalized Fragrances

The demand for personalized fragrances has risen, as consumers are increasingly looking for products that cater to their unique tastes. AI-powered scent customization platforms are allowing brands to create personalized experiences for customers, increasing consumer engagement and satisfaction.

Eco-friendly Products

Eco-conscious fragrances, which use sustainable ingredients and environmentally friendly production methods, are gaining significant traction. Brands that prioritize sustainability are likely to see increased demand, particularly as consumers become more aware of the environmental and ethical implications of their purchases.

Major Challenges

Regulatory Restrictions

The fragrance market faces challenges posed by regulatory restrictions. Stringent regulations on the use of certain synthetic chemicals and allergens create compliance barriers for manufacturers. These regulations increase costs and can limit the development of new fragrance formulations.

Safety Concerns

Safety concerns also challenge the fragrance market, especially regarding allergens and potential skin irritants. Consumers are more cautious about the chemicals used in fragrances, prompting demand for hypoallergenic and dermatologically tested products. This has led to an increased focus on transparency and safety in product labeling.

Business Opportunities

Growth in Emerging Markets

Emerging markets, particularly in Asia-Pacific and Latin America, present significant growth opportunities. As disposable incomes rise and consumers seek more luxury products, the demand for fragrances in these regions is expanding. The proliferation of e-commerce platforms further enables fragrance brands to reach new customers.

Gender-neutral Fragrances

There is growing demand for gender-neutral fragrances that appeal to a broader demographic. These unisex products cater to consumers who prefer versatility and inclusivity in their fragrance choices. Brands can capitalize on this trend by offering fragrances that do not cater to traditional gender stereotypes.

Regional Analysis

Europe

Europe remains the dominant region in the fragrance market, holding 38% of the market share in 2023. The region’s long-standing heritage in perfumery, coupled with a preference for high-quality, natural, and eco-friendly products, drives significant consumer demand. France’s key role in both consumption and production solidifies Europe’s strong position.

Asia-Pacific

Asia-Pacific is expected to be the fastest-growing region in the fragrance market, driven by rising incomes and a growing middle class. Countries like China and India are increasingly adopting Western beauty standards, including personal grooming and luxury perfumes. Urbanization and the shift toward premium products contribute to this trend.

Recent Developments

- Titan’s SKINN fragrance brand launched the 24Seven line in September 2024, offering affordable luxury scents and targeting younger consumers.

- Liberty’s LBTY fragrance brand expanded with three new scents—Ianthe Oud, Hera Reigns, and Vine Thief in October 2024, continuing its global expansion strategy.

- Kylie Cosmetics entered the Indian fragrance market in October 2024, launching its first fragrance line to diversify the brand’s offerings.

- Bottega Veneta reentered the fragrance market with a new line of five perfumes, inspired by Venice, in October 2024.

Conclusion

The global fragrance market is poised for continued growth, driven by rising disposable incomes, evolving consumer preferences, and growing demand for luxury and sustainable products. As the market continues to evolve, emerging trends like personalized and eco-friendly fragrances will offer unique opportunities for innovation. However, challenges such as regulatory restrictions and safety concerns must be addressed to ensure sustainable growth in the coming years. With major players like Givaudan, Firmenich, and Symrise leading the market, the future of the fragrance industry looks promising, especially as emerging markets become increasingly significant contributors to global demand.