Quick Navigation

Introduction

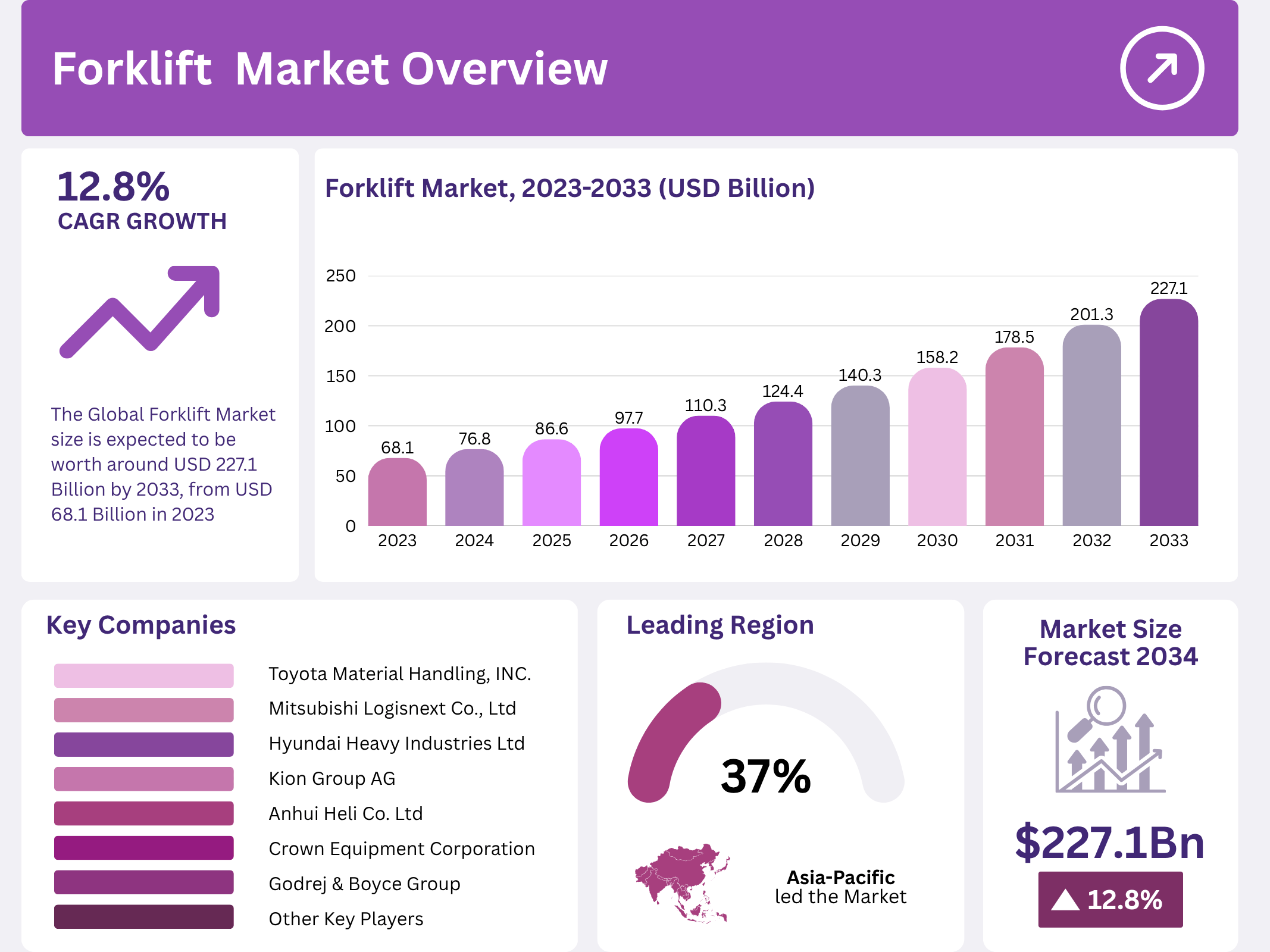

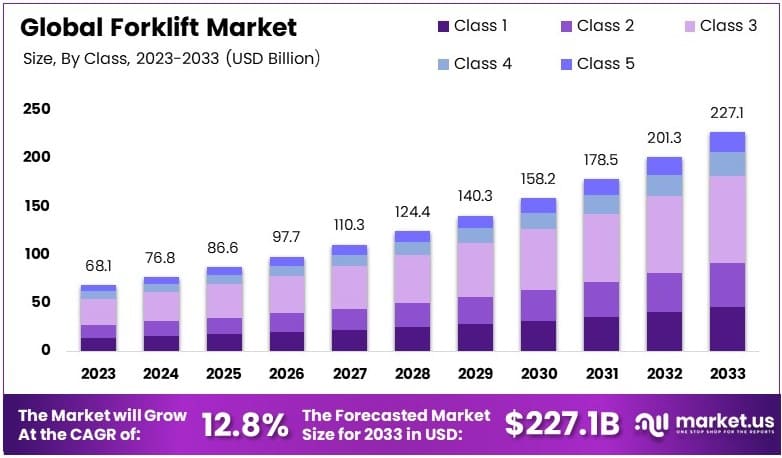

The Global Forklift Market is witnessing remarkable growth, driven by rapid industrialization and the rise of e-commerce worldwide. Valued at USD 68.1 Billion in 2023, the market is projected to reach around USD 227.1 Billion by 2033, growing at a CAGR of 12.8% during 2024–2033.

Forklifts, as essential tools for material handling, have become integral to modern logistics and manufacturing. They enable efficient movement of heavy goods in warehouses, factories, and retail facilities. As sustainability gains momentum, electric and hydrogen-powered forklifts are transforming industrial operations globally.

Additionally, technological advancements and automation trends are reshaping the market landscape. With increased adoption of smart and energy-efficient forklifts, industries are enhancing productivity while reducing emissions, marking a pivotal shift toward sustainable logistics solutions.

Key Takeaways

- The Forklift Market was valued at USD 68.1 Billion in 2023 and is expected to reach USD 227.1 Billion by 2033, with a CAGR of 12.8%.

- In 2023, Class III dominates the type segment with 39.70%, due to its versatility in various warehouse operations.

- Electric power source leads with 66.5%, reflecting the shift towards sustainable and efficient energy solutions.

- Retail & Wholesale holds the largest application share, emphasizing forklifts’ role in supply chain management.

- Asia Pacific dominates with 37.0% of the market, highlighting its expanding logistics and manufacturing sectors.

Market Segmentation Overview

By class, Class III forklifts lead the market with 39.70% share, favored for their power, maneuverability, and efficiency. These forklifts support medium-duty tasks across warehouses and distribution centers, contributing significantly to material handling efficiency and operational flexibility worldwide.

By power source, electric forklifts dominate with 66.5% share, driven by the global shift toward eco-friendly solutions. Their lower maintenance needs, reduced emissions, and quiet operation make them ideal for indoor use. Improved lithium-ion battery performance further fuels their rapid adoption.

By application, the Retail & Wholesale segment leads the market. The boom in e-commerce and omnichannel retailing drives warehouse expansion and automation. Forklifts play a critical role in handling large volumes of goods, ensuring efficient stacking, movement, and order fulfillment operations.

Drivers

Rising E-commerce and Warehousing Activities: The exponential growth in e-commerce has intensified demand for efficient material handling. Warehouses now require advanced forklifts to manage inventory and streamline logistics operations, supporting faster delivery times and improving storage management efficiency globally.

Technological Innovation and Energy Efficiency: The integration of automation, IoT, and energy-efficient technologies is transforming forklift operations. Electric and hydrogen-powered models offer cleaner alternatives, while connected systems improve safety, predictive maintenance, and data-driven performance optimization in warehouses and manufacturing facilities.

Use Cases

Warehouse Automation: Modern warehouses increasingly deploy automated forklifts for seamless integration with Warehouse Management Systems (WMS). These forklifts enhance order accuracy, reduce labor dependency, and improve space utilization, making them indispensable for large-scale logistics centers and fulfillment hubs.

Manufacturing Operations: Forklifts play a crucial role in manufacturing plants for moving raw materials and finished products efficiently. Their precision, load capacity, and reliability streamline production lines and material handling, enabling consistent workflow and minimizing downtime during industrial operations.

Major Challenges

High Maintenance and Operational Costs: Regular servicing, parts replacement, and energy consumption significantly increase forklift operating costs. For small and medium-sized enterprises, these expenses pose financial strain, potentially slowing adoption of advanced forklift technologies and limiting market expansion.

Intense Market Competition: The forklift industry faces fierce competition from established players and emerging manufacturers. Price wars, high R&D costs, and aggressive marketing strategies reduce profit margins. Companies must continuously innovate to differentiate their products and maintain profitability amid this rivalry.

Business Opportunities

Expansion in Emerging Economies: Developing regions such as Asia-Pacific and Latin America present lucrative opportunities due to rapid industrialization and urbanization. Investments in infrastructure, manufacturing, and logistics are accelerating forklift adoption, offering growth prospects for both global and regional market players.

Government Incentives for Industrial Growth: Various governments offer tax benefits, subsidies, and grants to promote industrial development. These policies encourage businesses to adopt modern, energy-efficient forklifts. Moreover, sustainability regulations support the transition to electric and hydrogen models, aligning with green logistics initiatives.

Regional Analysis

Asia Pacific: The Asia Pacific region dominates the market with a 37.0% share, driven by strong industrial growth, logistics expansion, and e-commerce activities. Nations like China, India, and Japan lead in manufacturing and infrastructure development, significantly boosting forklift demand across diverse applications.

North America and Europe: North America benefits from the expansion of automated warehouses and adoption of electric forklifts. Meanwhile, Europe’s market thrives on sustainable practices and regulatory emphasis on low-emission equipment. Both regions witness strong demand for intelligent, connected forklifts with enhanced operational safety.

Recent Developments

- In November 2024, Goscor Lift Trucks supplied 44 Bobcat lithium-ion forklifts to Access World in Durban, reducing carbon emissions by 3,080 tons—equivalent to planting 50,935 trees.

- In October 2024, JLT Mobile Computers upgraded its JLT1214™ Series with faster processors, improved wireless connectivity, and better durability for enhanced warehouse performance.

- In August 2024, Alta Equipment Group Inc. reported revenue of USD 488.1 million for Q2, with USD 175.6 million contributed by material handling equipment sales.

Conclusion

The Global Forklift Market is evolving rapidly, propelled by technological advancement, sustainability goals, and the e-commerce boom. As automation reshapes industrial operations, forklifts are transitioning into smart, connected assets. With growing investments and government support, the market’s future outlook remains robust and transformative.

Electric and hydrogen-powered forklifts are set to redefine logistics efficiency while aligning with global carbon reduction targets. Emerging markets, continuous innovation, and the integration of IoT technologies will sustain long-term growth, solidifying forklifts’ essential role in the global supply chain ecosystem.