Quick Navigation

Overview

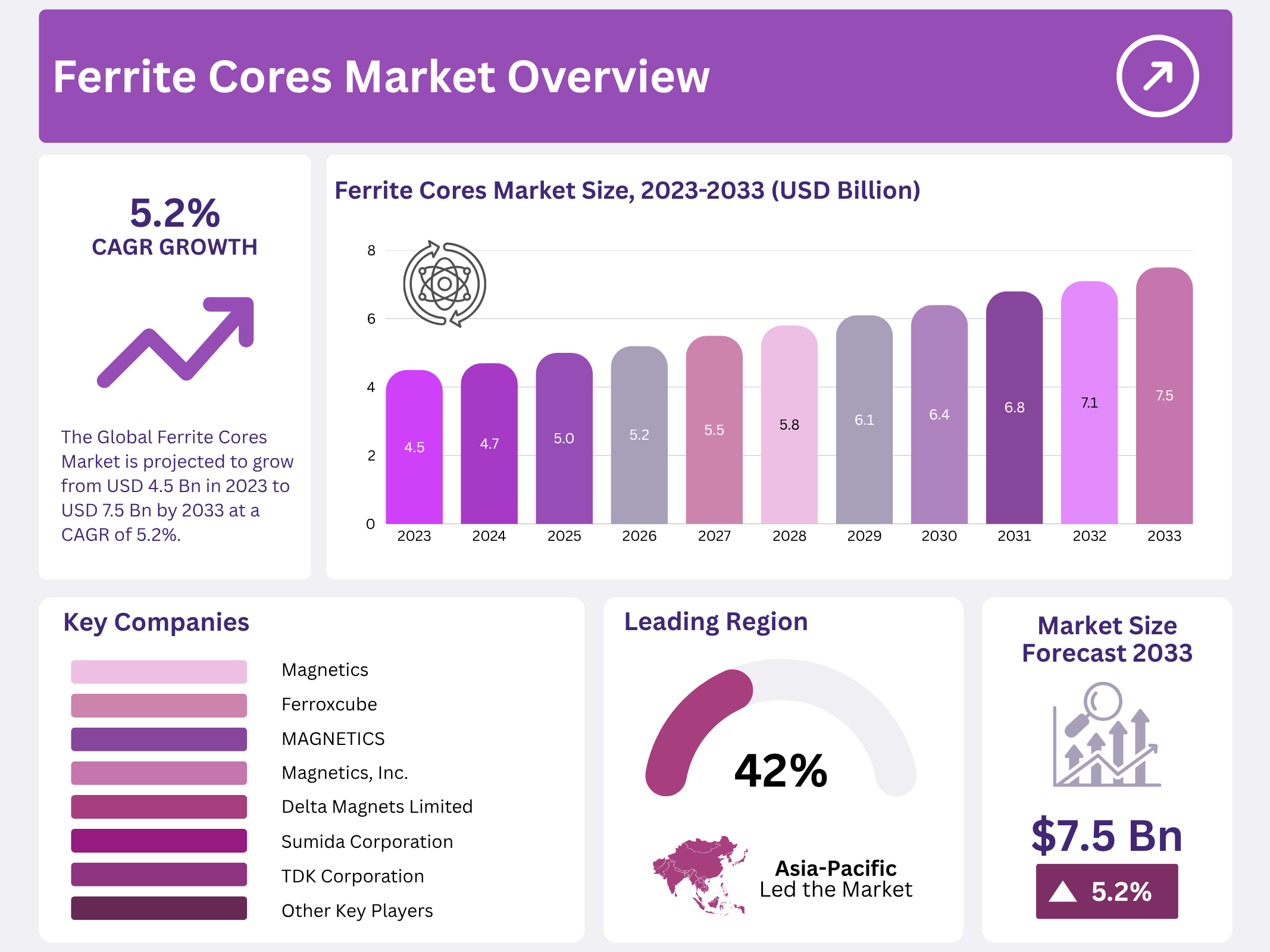

New York, NY – November 05, 2025 – The Global Ferrite Cores Market is projected to reach approximately USD 7.5 billion by 2033, up from USD 4.5 billion in 2023, expanding at a CAGR of 5.2% from 2023 to 2033. Ferrite cores are magnetic components made from ceramic compounds of iron oxide blended with metals like manganese, zinc, or nickel.

These materials exhibit exceptional magnetic permeability and low electrical conductivity, making them ideal for minimizing electrical losses while improving magnetic coupling. They are widely used in transformers, inductors, and chokes within electronic devices such as power supplies, telecommunications systems, and audio equipment.

Ferrite cores play a vital role in reducing electromagnetic interference (EMI) and ensuring efficient signal transmission. Available in various geometries—including toroidal, cylindrical, and E-shaped forms—ferrite cores are well-suited for high-frequency and radio frequency (RF) applications due to their superior resistance to eddy current losses and stable magnetic performance across demanding operational environments.

Key Takeaways

- The Global Ferrite Cores Market is projected to grow from USD 4.5 billion in 2023 to USD 7.5 billion by 2033 at a CAGR of 5.2%.

- Soft Ferrite Cores held 70.6% market share in 2023 due to superior magnetic properties and high-frequency flexibility.

- Manganese-Zinc (Mn-Zn) Ferrite Cores dominated with 65.8% share in 2023 for high magnetic permeability in transformers and inductors.

- Transformers led applications with a 48.6% share in 2023, essential for energy conversion and power transmission.

- Power Generation and Distribution was the top end-use segment with a 33.5% share in 2023, driven by transformer reliability in grids.

- Asia Pacific led the Styrenic Polymers market with over 42.6% revenue share in 2023 due to renewable energy policies.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 4.5 Billion |

| Forecast Revenue (2033) | USD 7.5 Billion |

| CAGR (2024-2033) | 5.2% |

| Segments Covered | By Type(Soft Ferrite Cores, Hard Ferrite Cores), By Material(Manganese-Zinc (Mn-Zn) Ferrite Cores, Nickel-Zinc (Ni-Zn) Ferrite Cores), By Application(Transformers, Inductors, Antennas, Others), By End-Use(Consumer Electronics, Automotive, Power Generation and Distribution, Healthcare, Others) |

| Competitive Landscape | TDK Corporation, Murata Manufacturing Co., Ltd., Ferroxcube, Magnetics, Hitachi Metals, Ltd., Samsung Electro-Mechanics, Sumida Corporation, Fair-Rite Products Corp., MAGNETICS, Cosmo Ferrites Limited, Kaschke Components GmbH, VACUUMSCHMELZE GmbH & Co. KG, Delta Magnets Limited, Magnetics, Inc., Fenghua Advanced Technology |

Key Market Segments

By Type

In 2023, Soft Ferrite Cores commanded the ferrite cores market with a dominant 70.6% share. Their superior magnetic properties enable high-efficiency performance in transformers and inductors, while excellent flexibility in high-frequency operations makes them ideal for a wide range of electronic devices.

Hard Ferrite Cores, with a smaller share, excel in niche applications requiring exceptional durability and resistance to demagnetization. They remain essential in industries demanding stable, robust magnetic components. Overall, market preferences favor soft ferrite cores for their versatility in modern electronics, yet hard variants ensure a balanced ecosystem addressing specialized needs.

By Material

In 2023, Manganese-Zinc (Mn-Zn) Ferrite Cores led the market, capturing 65.8% share. Renowned for high magnetic permeability, they dominate in transformers, inductors, and other applications needing versatile electromagnetic performance. Nickel-Zinc (Ni-Zn) Ferrite Cores, holding a lesser portion, specialize in high-frequency scenarios, such as RF transformers, where superior frequency response is critical. The landscape highlights Mn-Zn’s broad dominance due to its efficiency across devices, complemented by Ni-Zn’s role in targeted high-frequency solutions for a fully adaptive market.

By Application

In 2023, Transformers dominated the ferrite cores market with 48.6% share, underscoring their essential contribution to energy conversion, power transmission, and distribution through optimal magnetic efficiency. Inductors followed closely, leveraging ferrite cores for energy storage in magnetic fields vital for circuit stability in coils, chokes, and electronic systems.

Antennas and emerging applications add further diversity, supporting signal transmission in communication devices and evolving tech. This segmentation affirms transformers as the core driver, while inductors, antennas, and others highlight ferrite’s adaptable role in powering innovative electronics.

By End-Use

In 2023, Power Generation and Distribution topped the end-use segments with a 33.5% share, driven by ferrite cores’ critical function in transformers for reliable grid-level energy transmission. Inductors maintained strong relevance in consumer electronics, enhancing circuit reliability and performance.

Antennas and additional sectors, including communication tech, demonstrate growing adoption for efficient signal handling.

The market underscores power systems as the primary arena, with inductors and antennas reinforcing ferrite cores’ cross-industry versatility in foundational and advanced applications.

Regional Analysis

Asia Pacific (APAC) led the Styrenic Polymers market, capturing over 42.6% of global revenue. This dominance stems from strong regulatory backing for renewable energy, especially in the US and Canada, where government incentives and policies have elevated Power Purchase Agreements (PPAs) as a preferred mechanism for producers and consumers alike.

North America maintained a mature position, highlighted by record PPA activity, nearly 20 GW signed in 2022, reflecting its advanced renewable energy infrastructure and technological leadership. Europe, however, posted the fastest growth. Poised to overtake North America in market share, the region is propelled by rigorous environmental regulations and aggressive EU renewable targets.

Europe recorded a landmark year with over 16.2 GW in contracted renewable power via PPAs, with projections exceeding 20 GW in 2024. This surge is fueled by rising corporate sustainability commitments, as companies increasingly adopt PPAs to meet carbon reduction goals and secure long-term clean energy supply.

Top Use Cases

- Power Supply Conversion: Ferrite cores are fundamental in switch-mode power supplies found in everything from phone chargers to industrial servers. They enable efficient power conversion at high frequencies, minimizing energy lost as heat. This allows for smaller, lighter, and more power-dense adapters and converters, directly supporting the global trend towards device miniaturization and improved energy efficiency in electronics.

- Electromagnetic Interference Suppression: They are critical for electromagnetic compatibility by suppressing electronic noise. Ferrite beads and cores, often seen as cylindrical clips on cables, absorb high-frequency interference. This prevents devices from disrupting each other, ensuring the reliable operation of everything from consumer electronics to complex automotive systems, and helping products pass strict international electromagnetic interference regulations.

- High-Frequency Communications: In telecommunications infrastructure, such as 5G base stations and network routers, ferrite cores are used in components like transformers and inductors. They manage signal integrity and power at very high frequencies with minimal loss. This capability is essential for maintaining strong, clear data transmission over networks, supporting the ever-increasing global demand for faster and more reliable data.

- Electric Vehicle Power Systems: The electric vehicle revolution relies heavily on ferrite cores. They are key components in onboard chargers, DC-DC converters, and motor drive inverters. Their ability to handle high power levels efficiently at elevated temperatures is crucial for maximizing driving range and reducing charging times, making them an unsung hero in the advancement of clean transportation technology.

- Renewable Energy Integration: Ferrite cores enable the efficient conversion and management of power in renewable energy systems. Solar inverters and wind turbine converters handle the variable high-frequency power from solar panels and generators, converting it into stable grid-compatible electricity. Their high efficiency is vital for maximizing the energy harvest and improving the overall return on investment for green energy projects.

Recent Developments

1. TDK Corporation

TDK continues to innovate in high-frequency, high-power applications. Recent developments include new MnZn and NiZn ferrite grades optimized for wide-bandgap semiconductors (SiC/GaN), enabling higher efficiency and power density in EV chargers, solar inverters, and data center power supplies. Their focus is on low core loss and superior performance at elevated temperatures. New surface-mount power inductors using these advanced materials are also a key focus.

2. Murata Manufacturing Co., Ltd.

Murata’s recent advancements focus on ferrite materials for miniaturization and noise suppression in high-frequency circuits. They have developed new multilayer ferrite chip beads and common-mode chokes that offer superior impedance characteristics in the GHz range, critical for 5G infrastructure, automotive ADAS, and high-speed data lines. Their research also targets low-loss power supply inductors for compact mobile devices and IoT modules, emphasizing efficiency in a small footprint.

3. Ferroxcube

Ferroxcube, a leading ferrite specialist, has recently expanded its portfolio with new high-permeability and high-saturation flux density (Bs) materials. Their latest developments include cores specifically engineered for resonant LLC converters in server PSUs and high-performance solar inverters. They also emphasize improved thermal performance and reduced power loss for industrial induction heating and EV applications, providing extensive application notes and simulation models to support designers.

4. Magnetics

Magnetics focuses on custom ferrite solutions and recently highlighted advancements in their material consistency and manufacturing processes. They offer a wide range of toroids, E-cores, and pot cores with tight tolerances for critical applications in aerospace, medical, and military power magnetics. Their development work includes specialized low-loss ferrites for high-frequency switch-mode power supplies (SMPS) and high-permeability materials for broadband and pulse transformers, ensuring reliable performance.

5. Hitachi Metals, Ltd.

Following its corporate transition to Proterial, the company continues its legacy in ferrite development. Recent R&D targets nanocrystalline and amorphous soft magnetic materials alongside advanced ferrites. Key developments include low-loss MnZn cores for high-frequency power conversion and high-Bs materials for compact motors and renewable energy systems. The focus is on improving efficiency and power density for next-generation automotive and industrial equipment.

Conclusion

The Ferrite Core Market is robust and intrinsically linked to high-growth technological sectors. Its indispensable role in enabling power efficiency, high-frequency operation, and electronic stability ensures continued demand. As industries like electric vehicles, renewable energy, and advanced telecommunications expand, the need for advanced ferrite materials will only intensify, securing their position as a foundational component in the modern electronic ecosystem.