Quick Navigation

Introduction

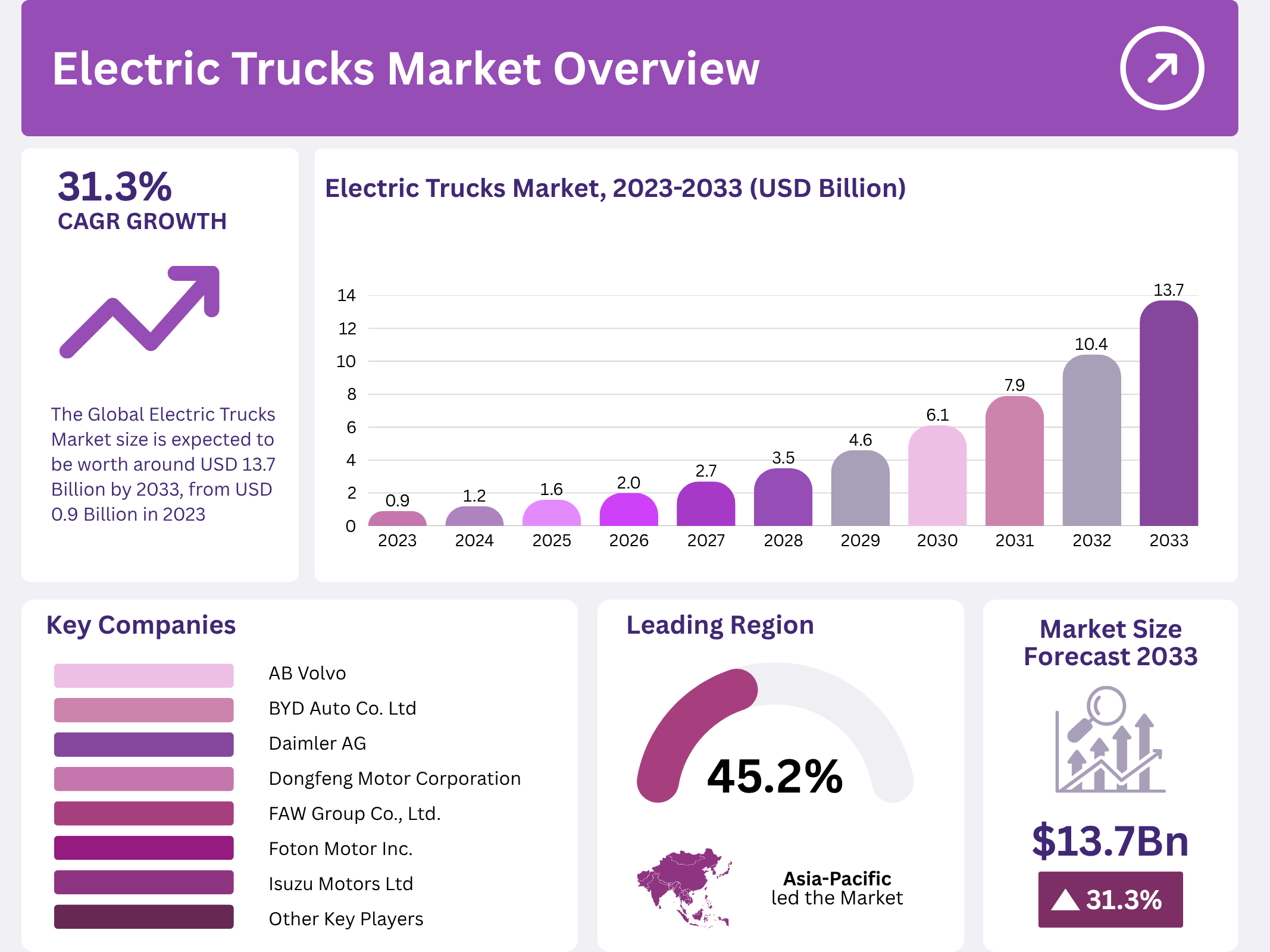

The global electric trucks market is accelerating rapidly, driven by innovation, sustainability goals, and evolving regulations. Valued at USD 0.9 billion in 2023, it is projected to reach USD 13.7 billion by 2033, registering a robust CAGR of 31.3% during the forecast period from 2024 to 2033.

Electric trucks are transforming commercial transport, offering zero-emission solutions powered by advanced battery systems. As industries transition to cleaner technologies, governments and corporations worldwide are investing heavily in electric truck fleets to meet net-zero commitments and improve operational efficiency.

Moreover, growing investments in EV infrastructure, coupled with supportive regulatory policies, are fueling adoption across all segments—from light-duty delivery vehicles to heavy-duty long-haul trucks—creating a strong foundation for sustained global growth.

Key Takeaways

- The Electric Trucks Market was valued at USD 0.9 billion in 2023, and is expected to reach USD 13.7 billion by 2033, with a CAGR of 31.3%.

- In 2023, Battery Electric Vehicles (BEV) dominated the propulsion segment with 76.3%, attributed to zero-emission policies.

- Plug-in Hybrid Electric Vehicles (PHEV) held the second-largest market share, offering versatility and range.

- Light Duty Trucks led the vehicle type segment, reflecting growing urban delivery demand.

- Medium Duty Trucks secured the second-largest share, utilized in commercial and construction sectors.

- APAC led with 45.2% share and USD 0.41 billion, driven by government initiatives and industrial growth.

Market Segmentation Overview

Propulsion Segment: Battery Electric Vehicles (BEV) dominate the segment with 76.3% market share, supported by rapid advancements in battery efficiency and growing environmental mandates. Plug-in Hybrids offer range flexibility, while Fuel Cell Electric Vehicles gain traction for long-distance applications.

Vehicle Type Segment: Light Duty Trucks lead the segment owing to increasing demand for urban logistics and last-mile delivery. Medium Duty Trucks serve as an essential link in regional distribution, while Heavy Duty Trucks are emerging as sustainable alternatives for long-haul freight transport.

Range Segment: Trucks with a range of 151-300 miles dominate the market, providing an optimal balance of range and cost efficiency. Short-range models under 150 miles cater to urban operations, while above 300 miles range vehicles are positioned for future long-haul electrification.

Drivers

1. Technological Advancements: Continuous innovations in battery chemistry, charging speed, and motor efficiency are enhancing vehicle performance, reducing costs, and making electric trucks more viable across commercial applications. These improvements are boosting fleet operator confidence and accelerating adoption rates.

2. Sustainability and Regulation: Governments are tightening emission norms and offering incentives for EV adoption. Policies from agencies such as the U.S. EPA and the European Union target drastic reductions in CO2 emissions, compelling industries to shift toward electric mobility for compliance and environmental stewardship.

Use Cases

1. Urban Logistics and Last-Mile Delivery: Electric Light Duty Trucks are widely deployed in city logistics, enabling zero-emission deliveries. Companies like Amazon and UPS are incorporating these trucks to reduce urban pollution and meet green delivery targets while optimizing cost and efficiency.

2. Long-Haul and Regional Transportation: As battery and charging technologies evolve, electric Medium and Heavy Duty Trucks are being adopted for intercity transport. Their ability to cover 300+ miles with fast charging supports logistics operations requiring consistent, sustainable, and cost-effective performance.

Major Challenges

1. High Upfront Costs: Electric trucks remain more expensive than their diesel counterparts due to the high cost of batteries and advanced components. This financial barrier deters small and mid-sized fleet operators, slowing adoption despite lower lifetime operating costs.

2. Limited Charging Infrastructure: Insufficient public and private charging networks create range and downtime concerns. Regions with inadequate infrastructure face slower adoption rates, particularly for long-haul applications that require reliable charging availability across extended routes.

Business Opportunities

1. Government Incentives and Subsidies: Incentive programs and grants worldwide are significantly reducing ownership costs. Manufacturers and fleet operators can capitalize on these benefits to expand production and adoption, particularly in emerging markets with proactive EV policies.

2. Urbanization and Smart Mobility: Rapid urbanization creates opportunities for electric trucks in smart city logistics. With cities adopting stricter emission standards, demand for compact, efficient, and zero-emission transport vehicles continues to rise, driving innovation and infrastructure development.

Regional Analysis

1. Asia Pacific (APAC): APAC leads the market with a 45.2% share, valued at USD 0.41 billion. Strong government policies in China, Japan, and South Korea, along with massive infrastructure investments, make the region a global hub for electric truck manufacturing and adoption.

2. North America and Europe: North America benefits from strong federal support and EV incentives, while Europe’s strict emission regulations foster innovation in sustainable logistics. Both regions are witnessing rapid expansion in medium and heavy-duty truck segments, supported by major OEM investments.

Recent Developments

- October 2024: Ashok Leyland delivered its first batch of AVTR 55T Electric and BOSS models to Billion Electric Mobility. The 180-truck collaboration focuses on mid-mile logistics with fast-charging systems and up to 230 km range.

- September 2024: At the AMTA Innovation Expo, the AZETEC Class 8 hydrogen fuel cell truck was launched. The CA$22 million project, developed by 15 partners, offers zero-emission, heavy-duty capability aligned with Canadian standards.

- October 2024: MAN introduced a digital support package for eTGX and eTGS models, including eManager and SmartRoute for intelligent charging and route planning, offered free for five years to enhance operational efficiency.

- October 2024: Yulu achieved EBITDA positivity with $30 million annual recurring revenue. The company plans to deploy 100,000 electric vehicles by 2025 and initiate a $100 million Series C funding round for expansion.

Conclusion

The global electric trucks market is entering a transformative phase, propelled by sustainability initiatives, regulatory support, and technological innovation. While cost and infrastructure challenges remain, rising investments and urbanization trends ensure strong growth potential. As governments and industries align toward zero-emission goals, electric trucks are set to redefine the future of freight and logistics, positioning the sector as a cornerstone of global green transportation.