Quick Navigation

Introduction

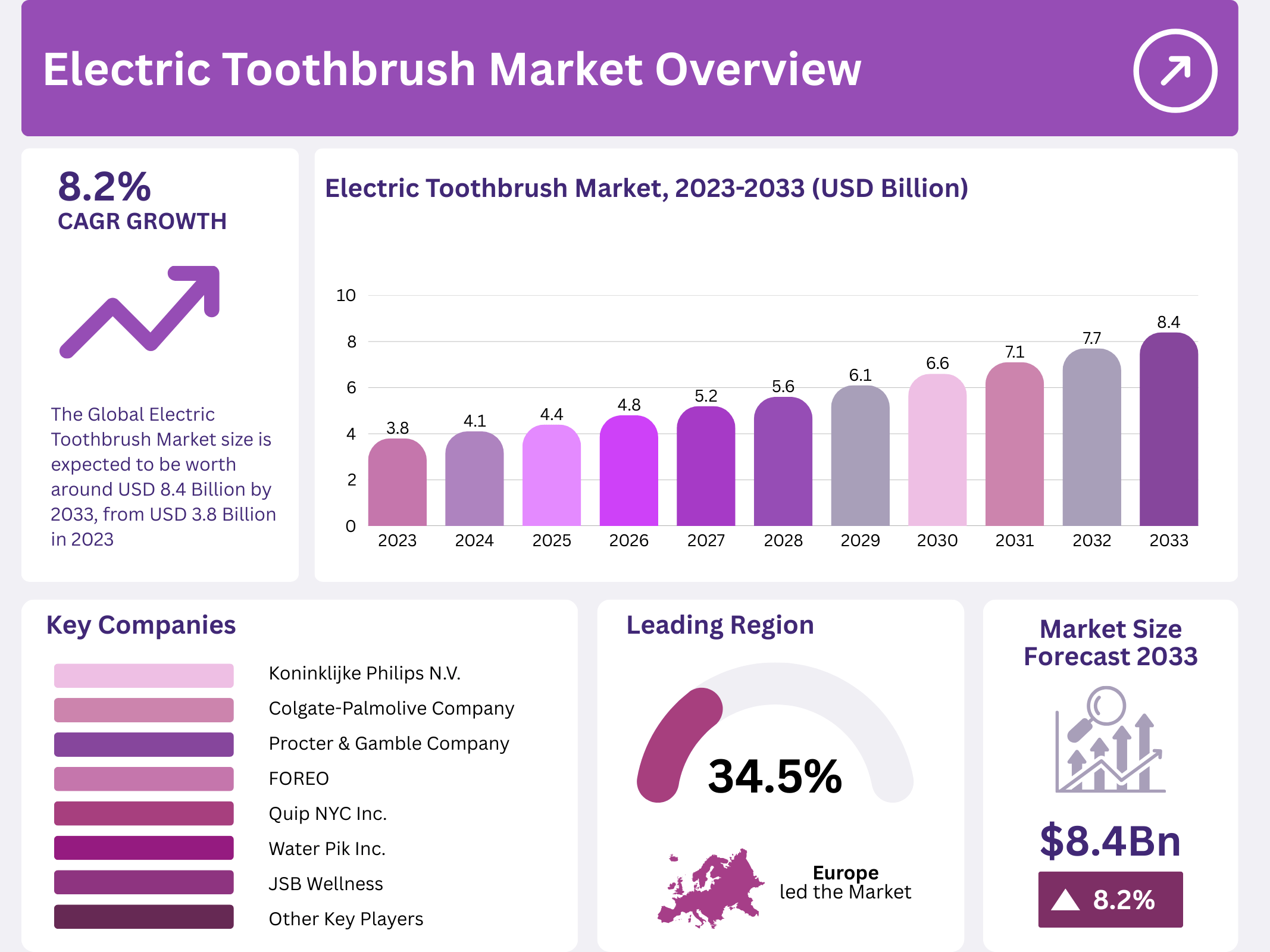

The Global Electric Toothbrush Market is witnessing robust expansion, driven by technological advancements and heightened oral health awareness. Valued at USD 3.8 billion in 2023, the market is projected to reach USD 8.4 billion by 2033, growing at a steady CAGR of 8.2% during the forecast period.

Electric toothbrushes have revolutionized oral hygiene by offering superior plaque removal and gum protection compared to manual counterparts. These devices utilize vibration and oscillation mechanisms, supported by smart features such as timers and sensors, fostering better dental care habits among users.

Driven by increasing preventive healthcare awareness, government campaigns, and advanced innovations, the market is experiencing rising adoption globally. Key players like Philips Sonicare and Oral-B continue to shape the landscape through high-performance technologies and innovative designs that cater to diverse demographics.

Moreover, the integration of digital technologies such as AI-enabled monitoring systems and subscription-based models has further transformed the consumer experience. This evolution positions the electric toothbrush market as a vital segment within the global healthcare and wellness industry.

While developed regions such as Europe and North America show maturity, emerging markets in Asia-Pacific are becoming key growth hubs due to rising disposable incomes and improved healthcare awareness. These dynamics set the stage for continued innovation and sustainable growth in the years ahead.

Ultimately, the electric toothbrush market reflects a paradigm shift toward smarter, preventive, and eco-conscious oral care solutions—bridging technology, wellness, and sustainability for a healthier future.

Key Takeaways

- The Electric Toothbrush Market was valued at USD 3.8 Billion in 2023 and is expected to reach USD 8.4 Billion by 2033, with a CAGR of 8.2%.

- In 2023, Rechargeable type dominated with 71.5% due to efficiency and environmental benefits.

- In 2023, Soft Bristles led the bristle segment with 62.3%, attributed to gentleness on gums.

- In 2023, Sonic technology held the largest share at 53%, offering superior cleaning capabilities.

- In 2023, Adults dominated the end-user segment with 75.5%, showing preference for advanced oral care products.

- In 2023, Europe held the dominant regional share at 34.5%, reflecting high awareness and disposable income.

Market Segmentation Overview

By Type: The rechargeable electric toothbrush segment holds 71.5% market share, driven by sustainability and convenience. Consumers prefer rechargeable models for long-term cost savings and eco-friendliness, while battery-operated brushes appeal to users prioritizing portability and affordability.

By Bristle: Soft bristles dominate with 62.3% due to their gentle action and safety for sensitive gums. Meanwhile, nanometer bristles are gaining attention for their superior precision in cleaning hard-to-reach areas, signaling a potential growth trend in the coming years.

By Technology: Sonic technology leads with 53% share, credited to high-frequency vibrations that deliver enhanced plaque removal. In contrast, rotation-based toothbrushes remain favored for affordability and simplicity, particularly in cost-conscious consumer segments.

By Distribution Channel: Online retail accounts for 75.5% of sales, fueled by e-commerce growth, competitive pricing, and consumer convenience. However, supermarkets and pharmacies continue to play crucial roles by offering in-person assistance and immediate product availability.

By End-User: Adults represent 75.5% of the total market, influenced by growing oral health consciousness and dentist recommendations. The children’s segment, though smaller, is expanding rapidly with innovative designs and kid-friendly features promoting early hygiene habits.

Drivers

Rising Demand for Personalized Oral Care: Consumers increasingly seek tailored solutions with features like multiple brushing modes and real-time feedback. This personalization enhances brushing effectiveness and user engagement, fostering long-term adoption of premium electric toothbrushes.

Growth in Preventive Healthcare: As oral hygiene becomes integral to overall wellness, preventive care products are gaining momentum. Government initiatives and dental endorsements further encourage electric toothbrush usage, highlighting their benefits in reducing gum diseases and cavities.

Use Cases

Professional Dental Care at Home: Electric toothbrushes replicate clinic-level cleaning efficiency, helping users maintain professional-grade hygiene daily. Features like pressure sensors and smart timers ensure optimal brushing techniques and improved oral health outcomes.

Child Oral Hygiene Education: Brands design electric toothbrushes for children using fun visuals and mild vibrations to make brushing engaging. Parents leverage these tools to instill consistent hygiene habits from an early age, promoting lifelong dental care awareness.

Major Challenges

Complexity and Maintenance: Many consumers find electric toothbrushes cumbersome due to charging requirements and technical settings. This complexity hinders adoption among older users and those accustomed to manual brushes.

Market Saturation in Developed Regions: North America and Europe have high penetration levels, leaving limited room for growth. Established players face difficulty differentiating their products, intensifying price competition and slowing expansion.

Business Opportunities

Subscription-Based Consumables: Regular brush head delivery services are emerging as profitable models. They ensure consistent product use while enhancing customer loyalty and generating recurring revenue streams for brands.

Eco-Friendly Product Innovations: The demand for sustainable materials is driving new opportunities. Companies developing biodegradable brush heads or energy-efficient models can attract environmentally conscious consumers and comply with green regulations.

Regional Analysis

Europe Leads with 34.5% Market Share: Europe’s dominance stems from strong healthcare infrastructure, consumer awareness, and disposable incomes. Government policies emphasizing preventive care further stimulate demand for high-quality oral hygiene devices.

Asia-Pacific Exhibits Rapid Growth: With increasing urbanization and disposable incomes, Asia-Pacific is witnessing accelerated adoption. Expanding e-commerce networks and health awareness campaigns make this region a focal point for future investments.

Recent Developments

- Suri (October 2024): Launched a sustainable electric toothbrush with recyclable, plant-based heads and UV-C self-cleaning travel case, emphasizing hygiene and portability.

- Oclean (July 2024): Released its first AI-integrated model, X Ultra, featuring real-time brushing feedback and a 30-day battery life for enhanced user convenience.

- Laifen (September 2024): Introduced the world’s first titanium electric toothbrush at IFA 2024, designed for superior durability and deep-cleaning performance using sonic technology.

Conclusion

The Global Electric Toothbrush Market continues to evolve as consumers increasingly value hygiene, convenience, and technology-driven oral care. With projected growth from USD 3.8 billion in 2023 to USD 8.4 billion by 2033, the sector stands at the forefront of preventive healthcare innovation.

As advancements in AI, sustainability, and subscription services shape future trends, companies focusing on personalization, eco-friendliness, and affordability will secure a competitive advantage. Emerging markets, particularly in Asia-Pacific, present untapped potential for global expansion and investment opportunities.

Ultimately, the electric toothbrush industry represents a convergence of health, technology, and sustainability—paving the way for smarter, cleaner, and more accessible oral care solutions worldwide.