Quick Navigation

Introduction

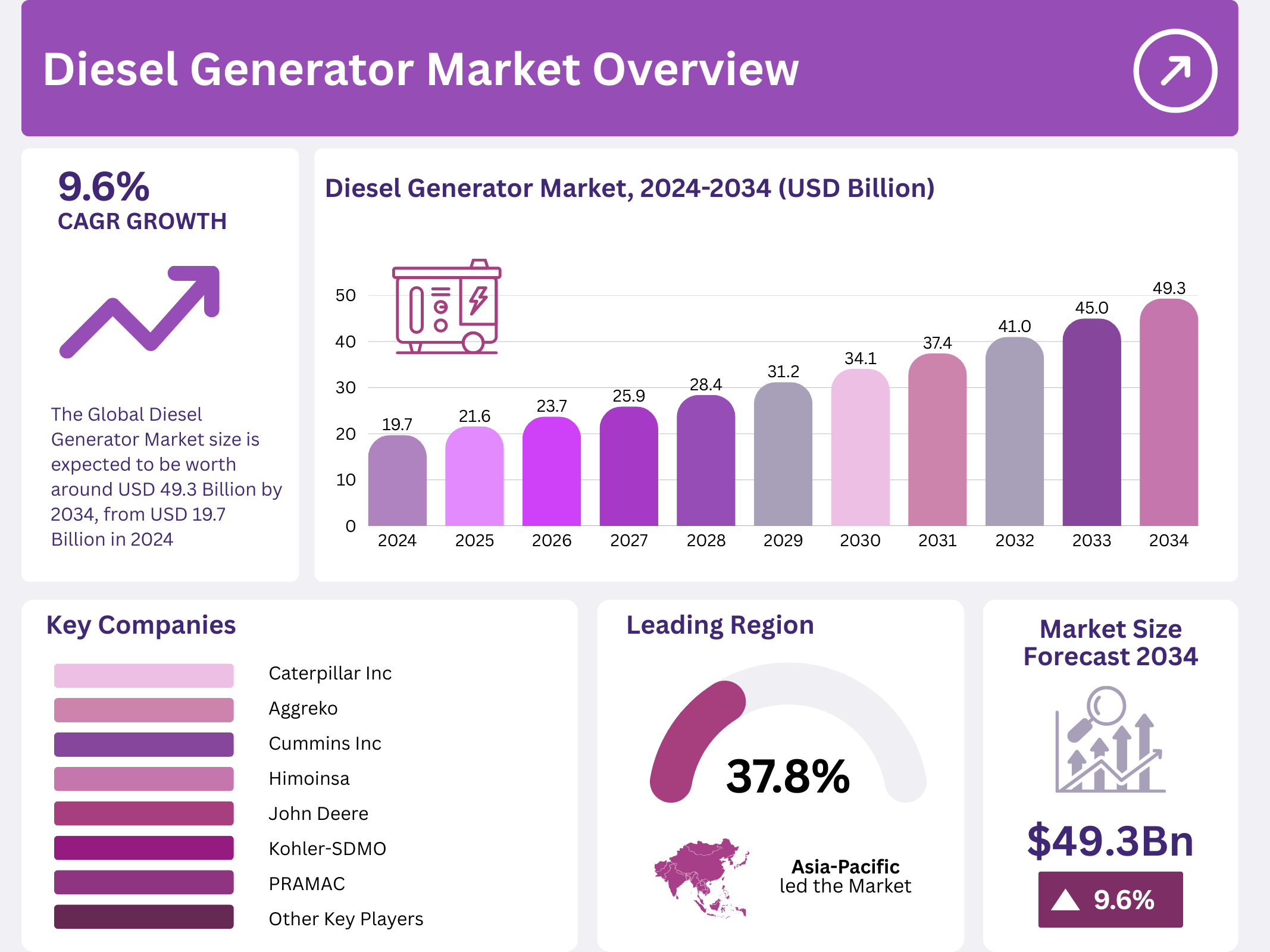

The Global Diesel Generator Market is projected to reach USD 49.3 Billion by 2034, up from USD 19.7 Billion in 2024, reflecting a strong CAGR of 9.6% between 2025 and 2034. This growth highlights the essential role diesel generators play in maintaining energy reliability across sectors.

As industries expand and global power demands surge, diesel generators serve as critical backup and primary power sources. They support operations in healthcare, construction, data centers, and telecom sectors where consistent energy supply is vital to avoid costly disruptions.

Technological advancements are reshaping the market, with manufacturers focusing on improving fuel efficiency and cutting emissions. Innovations such as hybrid diesel-solar systems are gaining traction, reflecting the market’s transition toward sustainability while maintaining power dependability.

Furthermore, global energy data emphasizes the continuing need for resilient backup power. The U.S. Energy Information Administration (EIA) reported total primary energy consumption of 100.41 quadrillion Btu in 2022, reinforcing the role of diesel generators in meeting energy security needs during outages or in off-grid areas.

In this dynamic environment, rising demand from commercial, industrial, and infrastructure sectors, combined with evolving emission norms, positions the Diesel Generator Market for sustained expansion and innovation over the next decade.

Key Takeaways

- Global Diesel Generator Market expected to reach USD 49.3 Billion by 2034 at a 9.6% CAGR.

- Generators below 75 Kva dominate with 46.8% share due to affordability and versatility.

- Stationary generators lead with 67.9% market share, driven by industrial and infrastructure projects.

- Continuous Load applications hold 53.6% share, vital for healthcare, data centers, and manufacturing.

- Commercial sector leads with 51.3% market share, ensuring reliable power for hospitals and offices.

- Asia Pacific dominates with 37.8% share, led by rapid industrialization in China and India.

Market Segmentation Overview

By Power Rating: Diesel generators below 75 Kva capture 46.8% of the market, serving residential, telecom, and healthcare sectors. Their low cost and compact design make them ideal for small to medium-scale applications where flexibility and affordability are essential.

Higher-capacity generators ranging from 75–750 Kva cater to large industrial plants, mining operations, and infrastructure projects. Though niche, they deliver consistent high-power output where continuous heavy-duty performance is critical.

By Portability: Stationary diesel generators dominate with 67.9% share. They are essential for commercial and industrial operations requiring long-term reliability and uninterrupted power. Portable units, however, are gaining traction in construction, events, and emergency relief due to their flexibility.

By Application: Continuous Load applications account for 53.6% of the market, reflecting growing demand from sectors that cannot afford downtime. Standby and peak load applications also play significant roles, providing emergency and supplemental power during surges or outages.

By End User: The Commercial sector holds a leading 51.3% share, underscoring reliance on diesel generators in retail centers, hospitals, and offices. Industrial users follow closely, while the Agriculture sector benefits from off-grid power for irrigation and processing.

Drivers

Growing Demand for Backup Power Supply: Frequent power outages continue to fuel diesel generator demand. In the U.S., over 3,500 outages were recorded in 2015, highlighting grid instability. Diesel generators’ fast start-up capability ensures consistent operations during disruptions.

Expansion of the Telecom Sector: With the proliferation of mobile networks and data centers, telecom towers rely heavily on diesel backup systems. Companies like American Tower and Crown Castle operate thousands of sites requiring continuous power, boosting generator sales globally.

Use Cases

Healthcare and Data Centers: Hospitals and data centers depend on continuous power to protect lives and digital assets. Diesel generators provide immediate energy backup during outages, ensuring uninterrupted medical care and secure data management.

Mining and Construction: In remote mining and construction zones without grid access, diesel generators power heavy machinery and site infrastructure. Their robustness and mobility make them indispensable for field operations and large-scale industrial activities.

Major Challenges

Noise and Emission Concerns: Diesel generators emit nitrogen oxides, carbon dioxide, and particulate matter, prompting stricter global regulations. For example, Japan aims to cut NOx emissions by 50% by 2023, increasing compliance costs and limiting market growth in urban areas.

Rise of Renewable Energy: The global shift to renewables, as seen in the UK where renewables supplied 20% of electricity in 2019, reduces dependency on diesel generators. Solar and wind energy with storage systems offer cleaner, quieter, and long-term cost-effective solutions.

Business Opportunities

Emission Regulation Compliance: Stricter emission standards present opportunities for innovation. India’s target to reduce industrial emissions by 30–35% by 2030 is driving adoption of new low-emission diesel generators, encouraging manufacturers to invest in sustainable designs.

Growing Manufacturing Sector: Post-pandemic industrial recovery increases power reliability needs. China’s manufacturing PMI rising to 50.2 in 2020 reflects a broader rebound, spurring investments in backup power to prevent operational losses and production downtime.

Regional Analysis

Asia Pacific: Holding 37.8% market share valued at USD 7.2 Billion, Asia Pacific dominates due to fast industrialization and infrastructure growth in China and India. Frequent power disruptions and off-grid areas amplify the region’s dependence on diesel generators.

North America and Europe: North America’s market benefits from aging grids and residential demand for standby power, while Europe focuses on integrating generators with renewables. Both regions emphasize emissions control, promoting hybrid and eco-friendly generator technologies.

Recent Developments

- Cummins India received CPCB IV+ certification for emission-compliant gensets, effective from July 2023.

- Vice Chief Naval Staff initiated a 2 MW Diesel Generator start on the Nistar vessel at Hindustan Shipyard Limited.

- Loop Energy and MYNT partnered in May 2023 to manufacture hydrogen-electric power generators in Australia.

Conclusion

The Diesel Generator Market stands at the forefront of global energy reliability, offering crucial power solutions amid rising electricity demand and infrastructure expansion. While challenges from emissions and renewables persist, opportunities in innovation, hybrid integration, and sustainability will shape its future.

With major players like Caterpillar Inc, Cummins Inc, and Generac Power Systems advancing cleaner technologies, the market is evolving into a more efficient and eco-conscious ecosystem. As global power security remains essential, diesel generators will continue to play a pivotal role in ensuring uninterrupted energy across industries worldwide.