Quick Navigation

Market Overview

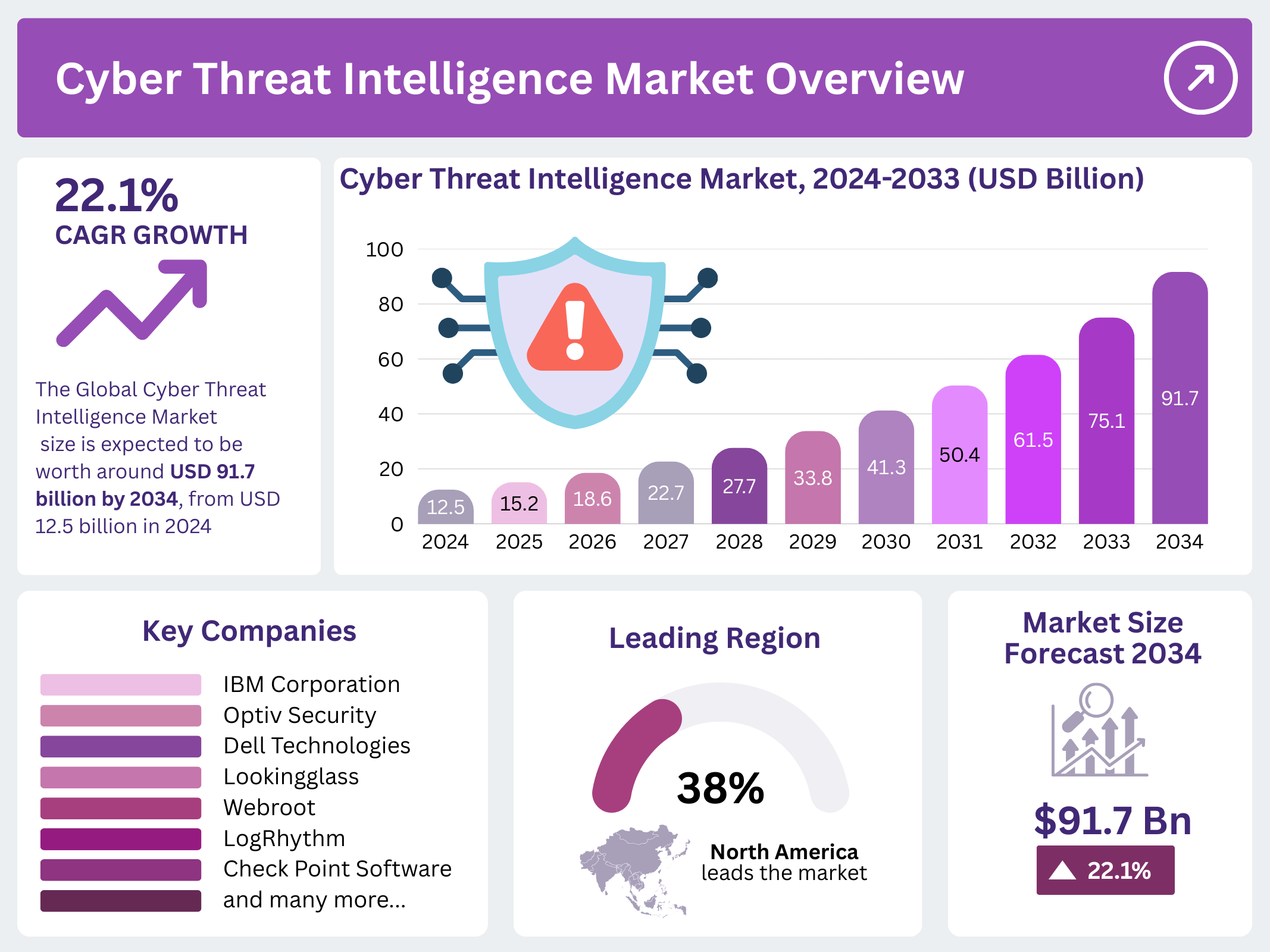

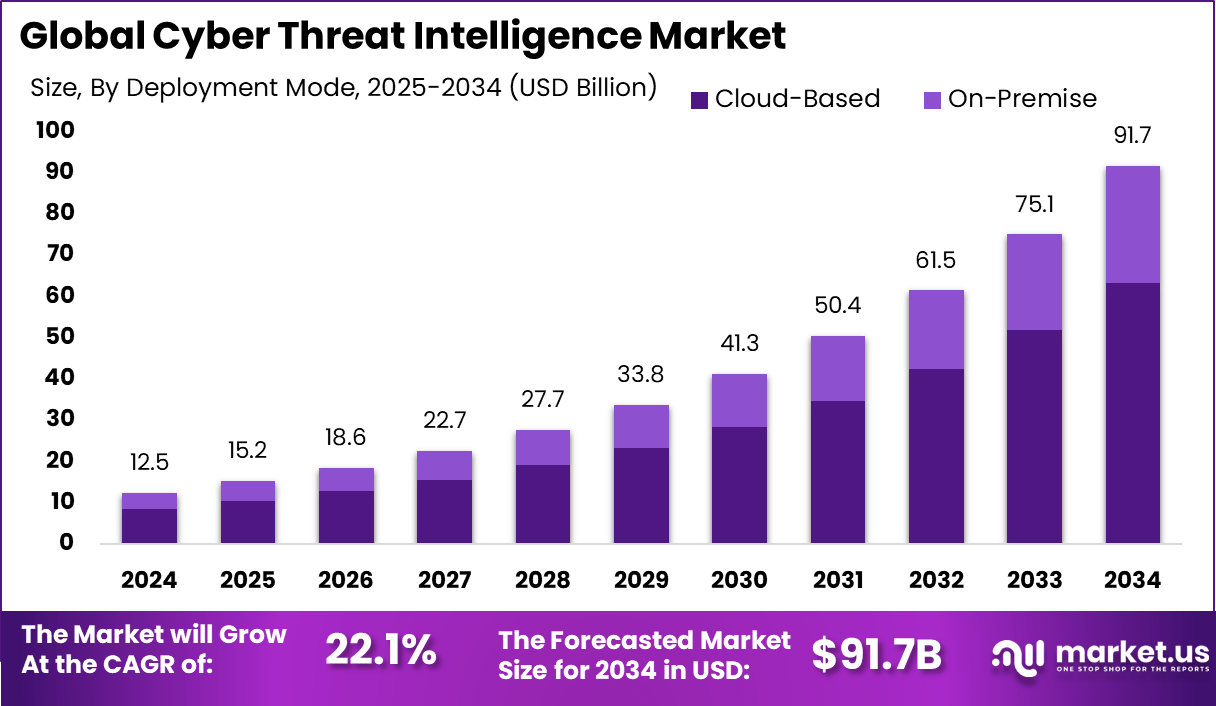

The global cyber threat intelligence (CTI) market is projected to grow from USD 12.5 billion in 2024 to USD 91.7 billion by 2034, at a CAGR of 22.1%. The surge in sophisticated cyberattacks, ransomware incidents, and nation-state threats is pushing organizations to adopt proactive intelligence-driven security solutions. Increasing cloud adoption and expanding digital ecosystems are also elevating demand for advanced threat monitoring tools.

North America dominates the market with a 38% share, driven by mature cybersecurity infrastructure and high investment levels. Strong regulatory frameworks, combined with rising awareness of real-time intelligence, are reinforcing growth across all major regions.

Key Takeaways

-

Market size: USD 91.7 billion by 2034, CAGR 22.1%.

-

North America leads with 38% share and USD 4.7 billion revenue in 2024.

-

Surge in ransomware and nation-state attacks fueling demand.

-

AI and automation reshaping real-time threat detection.

-

Regulatory compliance driving CTI adoption in enterprises.

Out-pace rivals start with our sample @ https://market.us/report/cyber-threat-intelligence-market/free-sample/

Role of AI

AI is emerging as a core enabler in the cyber threat intelligence market, providing predictive analytics, behavioral analysis, and automated threat hunting capabilities. Machine learning algorithms analyze vast datasets, identifying anomalies that human analysts might miss.

AI-driven CTI platforms offer real-time threat detection, reducing false positives and response times. Natural language processing enhances deep web and dark web monitoring, while generative AI strengthens simulation and red teaming exercises. With attackers leveraging AI for more complex exploits, the integration of AI-driven defenses is becoming indispensable. By 2030, AI-enabled CTI systems are anticipated to account for a major share of enterprise adoption.

Analyst’s Viewpoint

The cyber threat intelligence market is expected to remain one of the fastest-growing cybersecurity domains over the next decade. Enterprises across sectors such as BFSI, defense, healthcare, and IT services are shifting toward intelligence-led defense strategies to preempt advanced persistent threats. Analysts believe partnerships between public agencies and private vendors will accelerate technology adoption.

The strong investment in AI, big data, and cloud-native CTI platforms signals sustained growth momentum. However, integration complexities and a shortage of skilled threat analysts may hinder full-scale adoption. Strategic collaborations and managed services are anticipated to bridge this gap, fueling long-term market expansion.

Regional Highlights

North America dominates the CTI market with a 38% revenue share in 2024, driven by strong cybersecurity investments, government-led initiatives, and the presence of major players. Europe is witnessing rapid adoption, supported by GDPR compliance, EU cybersecurity directives, and a surge in state-sponsored attacks.

Asia Pacific is projected to grow at the fastest CAGR, fueled by digitalization, growing cybercrime incidents, and government programs like India’s Cyber Surakshit Bharat and China’s Cybersecurity Law. The Middle East & Africa region is investing in intelligence-led defense amid rising critical infrastructure attacks, while Latin America is strengthening CTI adoption in banking and e-commerce sectors.

Key Market Segmentation

-

By Component: Solutions and services offering real-time intelligence integration.

-

By Deployment: Cloud and on-premises models tailored to enterprise security needs.

-

By Application: Threat analysis, incident response, security monitoring, and risk management.

-

By End-Use: BFSI, defense, healthcare, government, IT, and telecom leading adoption.

-

By Region: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Emerging Trends

-

Rise of AI-powered threat detection and automated analysis.

-

Increasing collaboration between enterprises and government agencies.

-

Shift toward zero-trust security models supported by CTI.

-

Growth of dark web monitoring for predictive threat insights.

-

Integration of CTI with Security Information and Event Management (SIEM).

Top Use Cases

-

Real-time detection of phishing and ransomware attacks.

-

Threat intelligence sharing across defense and government networks.

-

Risk profiling and vulnerability management in enterprises.

-

Monitoring dark web marketplaces for stolen data.

-

Enhancing incident response through predictive analytics.

Major Challenges

-

High integration costs limiting SME adoption.

-

Shortage of skilled cyber threat analysts.

-

Evolving sophistication of cybercriminal tactics.

-

Regulatory complexity across multiple jurisdictions.

-

Data privacy concerns in intelligence sharing.

Attractive Opportunities

-

Expansion of managed threat intelligence services.

-

Growing demand in emerging Asia Pacific economies.

-

AI and machine learning innovations in CTI platforms.

-

Increased adoption in critical infrastructure sectors.

-

Rising collaboration for cross-border intelligence sharing.

Don’t guess! See the proof @ https://market.us/purchase-report/?report_id=149852

Business Benefits

Organizations adopting CTI gain significant business advantages, including enhanced protection against sophisticated threats and minimized risk exposure. Real-time intelligence allows enterprises to anticipate and neutralize cyberattacks before they materialize, reducing downtime and financial losses. By integrating CTI with existing security frameworks, businesses achieve improved resilience and regulatory compliance.

Additionally, proactive defense strategies foster customer trust and strengthen brand reputation in an era of growing data breaches. Enhanced situational awareness enables faster decision-making and prioritization of resources, driving operational efficiency. For sectors such as BFSI and healthcare, intelligence-driven security safeguards sensitive information, ensuring business continuity and long-term competitiveness.

Recent Developments

Recent developments include increased investment in AI-driven CTI platforms, acquisitions to expand intelligence capabilities, and rising cross-sector collaborations. Governments worldwide are emphasizing intelligence-sharing frameworks, while vendors are launching advanced dark web monitoring solutions. Strategic alliances between technology providers and cybersecurity firms are shaping the next phase of the CTI market.

Key Players Analysis

Key players such as IBM, FireEye, CrowdStrike, Cisco, and Check Point dominate the market with extensive threat intelligence portfolios and strong global presence. These companies focus on AI integration, partnerships, and acquisitions to enhance their solutions. Growing competition is driving innovation, with new entrants targeting niche CTI applications across industries.

- IBM Corporation

- Optiv Security, Inc.

- Dell Technologies, Inc.

- Lookingglass Cyber Solutions, Inc.

- Webroot Inc.

- LogRhythm, Inc.

- Check Point Software Technologies Ltd.

- McAfee LLC

- Anomali

- Farsight Security, Inc.

- Splunk, Inc.

- Juniper Networks, Inc.

- NortonLifeLock, Inc. Company Profile

- Others

Customer Insights

Customer demand for CTI solutions is driven by increasing concern over financial losses, regulatory compliance, and brand protection. Enterprises are prioritizing real-time, AI-enabled intelligence platforms over traditional reactive models. Buyers are also displaying a preference for managed services due to limited in-house expertise. Purchasing decisions are segmented by organization size, with large enterprises adopting comprehensive CTI ecosystems, while SMEs seek cost-effective, cloud-based solutions.

Industries such as BFSI and healthcare demonstrate higher willingness to invest due to data sensitivity, whereas government agencies focus on intelligence sharing. Overall, buyers emphasize speed, scalability, and integration with existing cybersecurity frameworks as key factors.

Future Outlook

The future of the CTI market is anticipated to be shaped by accelerated digital transformation, AI integration, and cross-border intelligence collaboration. As cybercriminals leverage advanced tactics, demand for proactive intelligence-driven security will intensify. Asia Pacific is projected to emerge as the fastest-growing region, supported by government-led cybersecurity initiatives and booming digital economies.

The convergence of CTI with SIEM, SOAR, and zero-trust architectures will further solidify its role in enterprise security frameworks. Continuous innovation, coupled with global regulatory enforcement, is expected to drive investments. By 2034, intelligence-led security models will become foundational, positioning CTI as a critical element of digital trust.

Conclusion

The global cyber threat intelligence market is undergoing rapid expansion, driven by escalating cyber risks, regulatory mandates, and technological advancements. With a projected CAGR of 22.1%, CTI is becoming indispensable for enterprises aiming to safeguard data, ensure compliance, and maintain customer trust. North America currently leads the market, but Asia Pacific is emerging as the growth hub for the next decade.

The integration of AI, automation, and dark web monitoring highlights the sector’s evolving sophistication. As organizations increasingly adopt intelligence-driven security models, CTI is expected to evolve into a central pillar of enterprise defense, ensuring resilience in an unpredictable threat landscape.