Quick Navigation

Overview

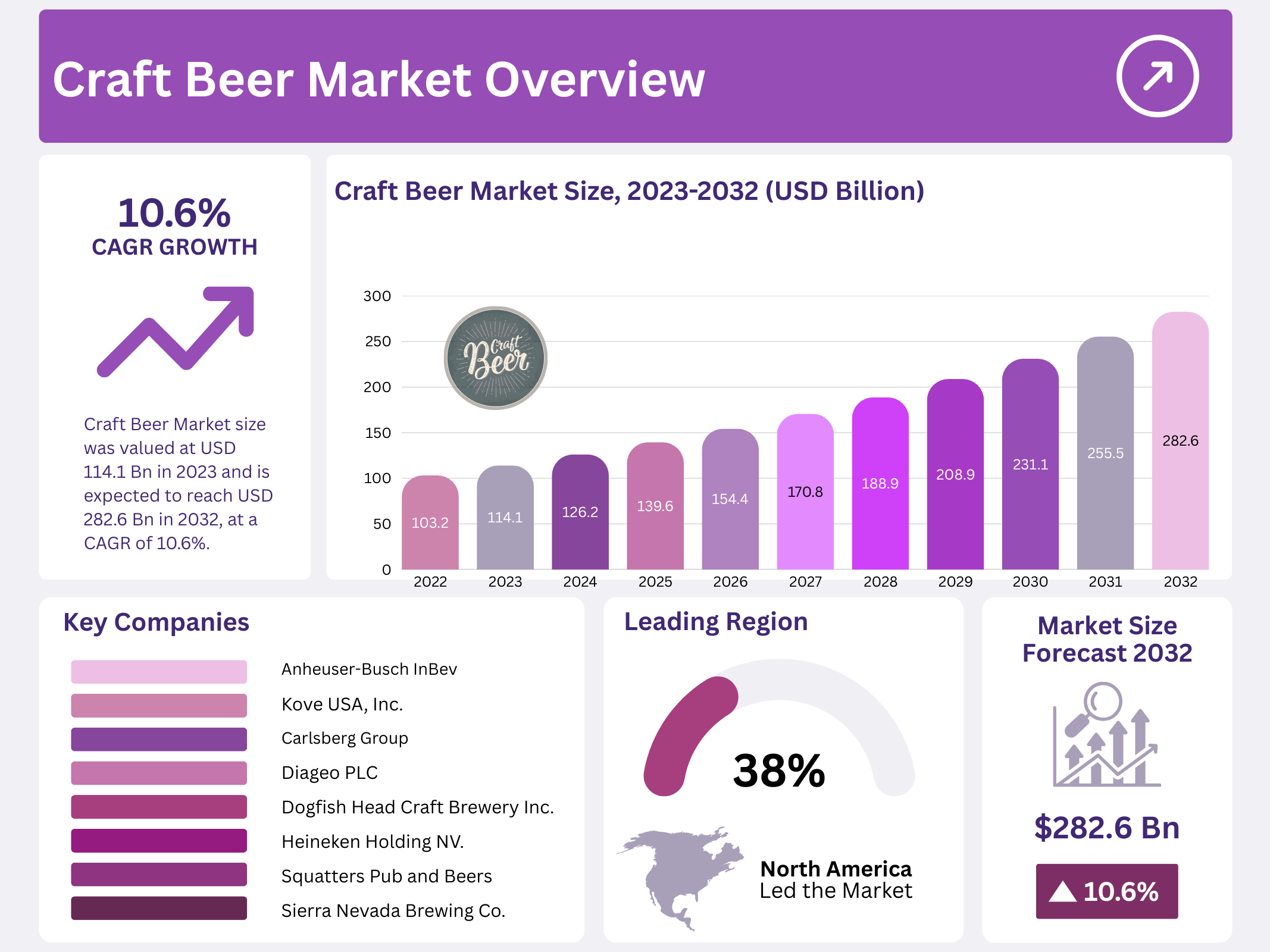

New York, NY – August 22, 2025 – The Global Craft Beer Market was valued at USD 114.1 billion in 2023 and is projected to reach USD 282.6 billion by 2032, growing at a CAGR of 10.6% from 2023 to 2032. North America leads the market, holding a 38.0% share of sales in 2023, driven by its dynamic beer culture and extensive network of craft breweries.

Craft beer, produced by small, independent breweries, emphasizes flavor, quality, and innovation over mass production. It has established a distinct segment within the broader beer industry, offering consumers a wide range of unique flavors and experiences. In the U.S., small and independent brewers produced 24.3 million barrels in 2022, with craft beer’s market share by volume rising to 13.2%, up from 13.1% the previous year. Advances in brewing technology have introduced a diverse array of products, with one standout being CBD-infused beer.

This innovative product, incorporating non-psychoactive CBD from cannabis plants, has gained significant popularity. Breweries like Long Trail Brewing Company in Vermont have introduced CBD-infused IPAs and APAs in their limited-edition offerings. These beers appeal to consumers due to their lower calorie content and the way CBD mitigates the bitterness of hops, complemented by citrusy terpene notes. The market, particularly in North America, is experiencing robust growth fueled by an abundance of flavorful options and continuous taste innovation.

Key Takeaways

- Market Developments: The Global Craft Beer Market is projected to experience compound annual growth over the period 2023-2032 at a CAGR of 10.6%.

- Product Categories: Ale beer market, lagers, stouts, and porters are popular categories within craft beer; each offering its own distinctive taste profile and brewing technique. Ales account for 32.6% market share, while Porters and Stouts follow close behind, respectively.

- Craft Beer Market Analysis by Types: In terms of types, craft beer can be broadly split between alcoholic and non-alcoholic segments, with alcohol making up over 80% of this global market.

- Distribution Channel Analysis: The craft beer can be divided into two main distribution channels – on-trade and off-trade – which together account for around 60% market share by 2023.

- North America: North America holds the largest market share 38% for craft beer sales worldwide.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 114.1 Billion |

| Forecast Revenue (2032) | USD 282.6 Billion |

| CAGR (2023-2032) | 10.6% |

| Segments Covered | By Product Type (Ale, Lager, Stout, Porter, and Other Product Types), By Type (Alcoholic and Non-Alcoholic), By Distribution Channel (On-Trade and Off-Trade) |

| Competitive Landscape | Anheuser-Busch InBev, Beijing Enterprises Holdings Limited, Carlsberg Group, Diageo PLC, Dogfish Head Craft Brewery Inc., Heineken Holding NV., Squatters Pub and Beers, Sierra Nevada Brewing Co., The Boston Beer Company Inc., United Breweries Limited, Kove USA, Inc., and Other Key Players |

Key Market Segments

By Product Type Analysis

Craft beer is categorized into ale, lager, stout, porter, and other product types. Ales dominate with a 32.6% market share and a projected growth rate of 10.7% during the forecast period. Their leadership stems from a broad spectrum of flavors and styles, from hoppy IPAs to robust stouts, appealing to diverse consumer tastes.

Ale’s shorter production cycle compared to lagers enables breweries to experiment frequently and adapt quickly to market trends. The craft beer movement’s focus on artisanal production and innovation further drives consumer interest and loyalty, cementing ales as the leading category. Lagers are also experiencing significant growth due to their crisp, clean taste and broad appeal. Craft breweries enhance lagers with unique flavors and ingredients, making them popular in hot climates and for outdoor activities.

By Type Analysis

The craft beer market splits into alcoholic and non-alcoholic segments. Alcoholic craft beer commands over 80% of the global market, reflecting traditional brewing values with small-batch, artisanal production and higher alcohol content. This resonates with beer connoisseurs who value the complexity and variety of alcoholic craft beers. The non-alcoholic segment is gaining traction due to rising health consciousness. Consumers seeking low or zero-alcohol options are drawn to non-alcoholic craft beers, which maintain the artisanal quality, unique flavors, and variety of their alcoholic counterparts.

Distribution Channel Analysis

The craft beer market is divided into on-trade and off-trade distribution channels. Off-trade, including liquor stores, supermarkets, and online retail, holds over 60% of the market share in 2023. These channels offer convenience and a wide selection, encouraging consumers to explore craft beers for home consumption. The COVID-19 pandemic accelerated this shift, as restrictions limited on-trade options like bars and restaurants. Consumers increasingly value the flexibility of enjoying craft beer at home, experimenting with diverse offerings, which strengthens the off-trade segment.

Regional Analysis

North America leads the global craft beer market with a 38% revenue share. Its dominance is rooted in a rich brewing heritage, with pioneering breweries like Sierra Nevada and Anchor Steam shaping the craft beer movement. This legacy has built credibility, refined recipes, and fostered a loyal consumer base. The region’s large and diverse market, with numerous craft breweries ranging from small local operations to established brands, caters to varied consumer preferences. The “drink local” movement further boosts demand, as consumers support neighborhood breweries, solidifying North America’s leadership in the global craft beer market.

Top Use Cases

- Social Gatherings and Events: Craft beer is popular at social events like parties and festivals due to its unique flavors and local appeal. Breweries host tastings and taproom experiences, creating a fun atmosphere that attracts millennials and Gen Z, boosting community engagement and brand loyalty.

- Health-Conscious Consumer Appeal: Low-alcohol and non-alcoholic craft beers cater to health-conscious drinkers. These options maintain rich flavors while offering moderation, appealing to those prioritizing wellness. Breweries innovate with techniques to ensure taste, driving demand among younger audiences seeking mindful drinking choices.

- Beer Tourism and Local Experiences: Craft breweries draw tourists through brewery tours, tastings, and local events. This boosts regional economies as visitors explore unique brews and taprooms. The focus on local ingredients and authentic flavors strengthens community ties and enhances the craft beer experience.

- Premium Dining and Pairing: Craft beers enhance gourmet dining by pairing with farm-to-table dishes. Their diverse flavors, like fruit-infused sours or hoppy IPAs, complement food, appealing to foodies. Restaurants and brewpubs use these pairings to elevate the dining experience, increasing sales and visibility.

- E-Commerce and Direct Sales: Craft breweries leverage e-commerce for direct-to-consumer sales, especially after relaxed regulations. Online platforms and specialty shops offer unique brews, reaching wider audiences. This trend supports small breweries, boosts convenience, and aligns with growing digital shopping habits among beer enthusiasts.

Recent Developments

1. Anheuser-Busch InBev

AB InBev is shifting its Beyond Beer strategy to focus on high-growth categories like ready-to-drink cocktails, leveraging its massive distribution network. This move comes as its traditional beer brands face market pressure. Their venture arm, ZX Ventures, continues to invest in and acquire non-alcoholic and craft brands to diversify its portfolio and capture evolving consumer tastes.

2. Beijing Enterprises Holdings Limited

Through its subsidiary, Beijing Enterprises Holdings has been expanding its premium import portfolio in China, including craft beers. The company leverages its ownership of Germany’s Hasseröder Brauerei to introduce European-style beers to the Asian market. Their strategy focuses on catering to the growing demand for diverse, high-quality alcoholic beverages among China’s middle and upper-middle-class consumers.

3. Carlsberg Group

Carlsberg is deeply investing in its “Saaz-hopped” Czech craft lager, Krušovice, promoting it heavily in European markets. The group also continues to support its craft and specialty beer division, which includes brands like Brooklyn Brewery. Their recent focus is on premiumization and sustainability, aiming for a ZERO carbon footprint at its breweries to appeal to environmentally conscious craft drinkers.

4. Diageo PLC

While not a pure-play brewer, Diageo’s recent craft development is the expansion of its Guinness Open Gate Brewery series. Following the success of its Baltimore location, Diageo opened a second large-scale Open Gate Brewery in Chicago in 2023. This allows them to experiment and launch new craft-style beers directly to consumers, strengthening the Guinness brand’s innovation credentials.

5. Dogfish Head Craft Brewery Inc.

Now fully integrated into the Boston Beer Company, Dogfish Head continues its off-centered innovations. A key recent development is the expansion of its canned cocktail line, “Dogfish Head Distilling Co.,” into new markets. They also continue to focus on unique, culinary-inspired craft beers and limited releases, maintaining their identity as innovators within the larger corporate structure.

Conclusion

The Craft Beer Market is thriving due to its focus on unique flavors, local production, and innovative trends like low-alcohol options and e-commerce. Growing consumer demand for artisanal and premium beverages, especially among younger demographics, fuels market expansion. Despite challenges like competition and rising costs, craft breweries continue to drive growth through creativity, community engagement, and health-conscious offerings, ensuring a bright future.