Quick Navigation

Introduction

The global commercial refrigeration equipment market is undergoing rapid transformation. Surging demand for frozen foods and expanding retail networks are driving this growth. Businesses are increasingly seeking energy-efficient systems to lower operational costs while complying with environmental regulations.

In response, manufacturers are innovating with smart refrigeration systems. These offer remote monitoring, predictive maintenance, and IoT-based performance tracking. Such features help businesses reduce downtime and enhance energy efficiency, improving profitability.

Additionally, government initiatives across regions are accelerating equipment upgrades. Policies such as the U.S. Inflation Reduction Act and EU efficiency targets incentivize sustainable refrigeration systems. These policies aim to lower carbon emissions and energy consumption.

Rising cold storage needs in healthcare and pharmaceutical industries also support market expansion. Vaccines and sensitive medicines require precise temperature control, creating demand for advanced refrigeration technology.

As competition intensifies, companies are adopting modular and eco-friendly systems to gain market share. Flexible units that suit changing space and energy needs are especially popular among small and mid-sized enterprises.

Despite supply chain disruptions and high upfront costs, global demand continues to rise. The market is anticipated to grow at a robust pace over the next decade, underpinned by strong demand across foodservice, retail, and healthcare sectors.

Key Takeaways

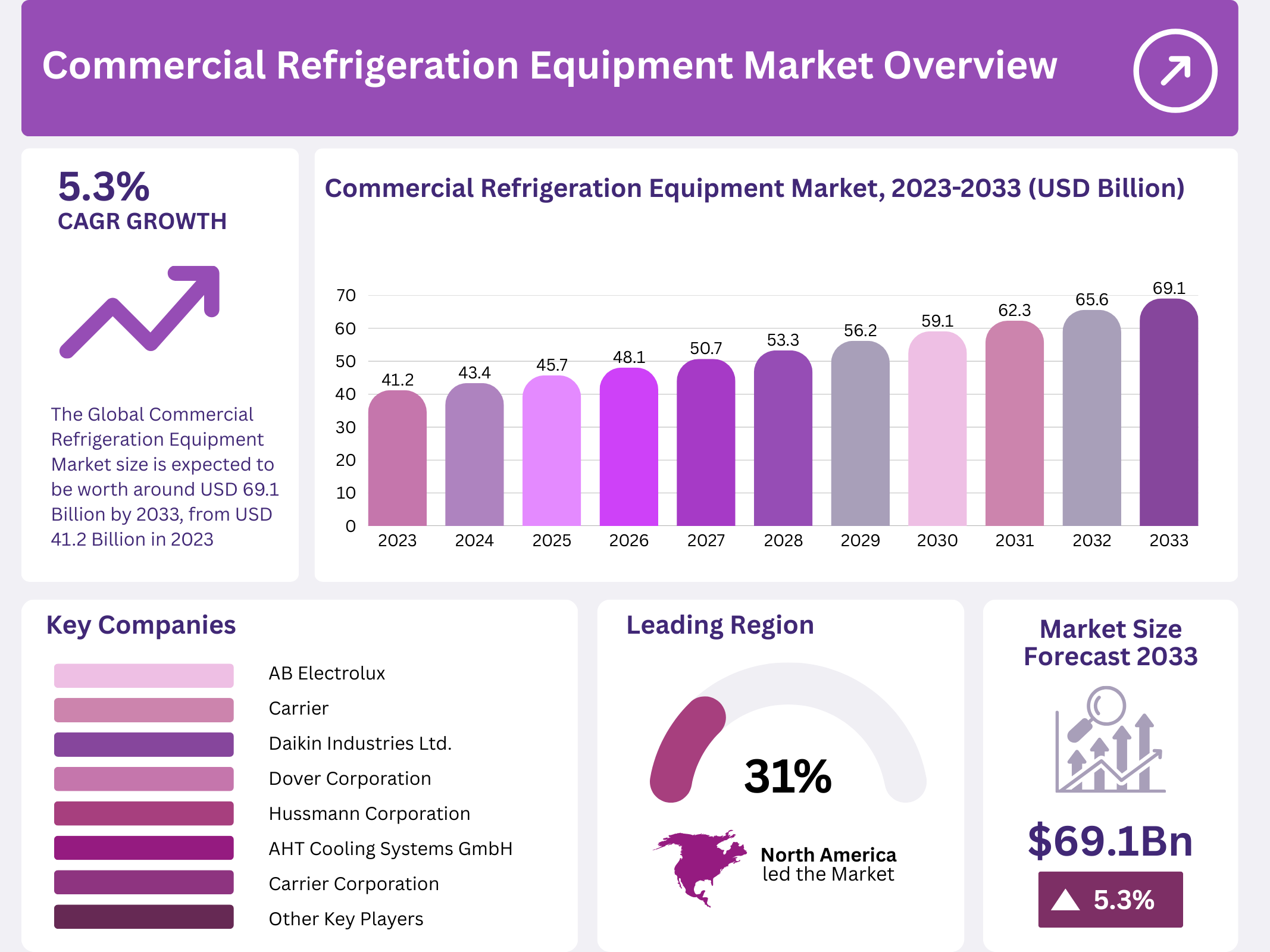

- The global commercial refrigeration equipment market was valued at USD 41.2 billion in 2023.

- It is projected to reach USD 69.1 billion by 2033, growing at a CAGR of 5.3%.

- Refrigerators & Freezers held the largest product share in 2023.

- Food Service accounted for 33.0% of application share in 2023.

- Self-Contained systems dominated with an 85% market share in 2023.

- North America led the global market with a 31.0% share in 2023.

Market Segmentation Overview

By Product

- Refrigerators & Freezers dominate due to critical use in food safety across sectors.

- Display Showcases and Beverage Coolers follow, favored in retail and hospitality.

- Transportation Refrigeration is vital for cold chain logistics, driven by food trade.

By Application

- Food Service leads with 33.0% share, supported by restaurants and cafes.

- Food & Beverage Retail uses advanced systems to minimize waste and preserve quality.

- Healthcare requires precision refrigeration for vaccines and pharmaceuticals.

By System Type

- Self-Contained systems hold an 85% share due to easy installation and low maintenance.

- Remotely Operated systems are favored in large establishments for centralized cooling.

By Capacity

- 50 to 100 Cu. Ft. units dominate, offering balance between size and storage efficiency.

- Under 50 Cu. Ft. units cater to compact outlets and specialty applications.

- Above 100 Cu. Ft. units serve wholesale and industrial food operations.

Drivers

Growing Demand for Frozen and Refrigerated Foods

As lifestyles shift toward convenience, global consumption of frozen meals and ready-to-cook products is increasing. This trend fuels demand for reliable, efficient refrigeration solutions to extend shelf life and reduce food spoilage in both retail and foodservice sectors.

Rising Energy Efficiency Regulations

Regulatory bodies such as the U.S. DOE and EU Commission are enforcing stricter energy performance standards. These policies promote sustainable refrigeration technologies and push businesses to upgrade systems, benefiting manufacturers that offer compliant and energy-saving equipment.

Use Cases

Restaurants and Foodservice Chains

Quick-service restaurants and large food chains depend on high-capacity refrigeration for ingredient preservation. Self-contained units support modular kitchen designs and ensure compliance with food safety protocols.

Pharmaceutical Cold Storage

Hospitals and drug distributors rely on specialized refrigeration to maintain cold chains for vaccines, insulin, and biologics. Temperature precision and monitoring systems are critical in ensuring product efficacy and regulatory compliance.

Major Challenges

High Initial Investment

Purchasing and installing commercial refrigeration systems can be expensive, particularly for small businesses. This upfront cost often deters adoption, especially in emerging markets where capital expenditure is limited.

Supply Chain Disruptions

Recent global events have disrupted the availability of critical components such as compressors and sensors. These shortages delay equipment manufacturing and increase costs for both vendors and end users.

Business Opportunities

Smart and IoT-Enabled Refrigeration Systems

Demand is growing for intelligent systems that allow predictive maintenance and real-time monitoring. These innovations offer significant operational savings and improve uptime, especially for multi-location retail or foodservice chains.

Growth in Emerging Economies

Urbanization and rising disposable incomes in Asia-Pacific, Latin America, and Africa are boosting the foodservice and retail sectors. These trends create fertile ground for commercial refrigeration adoption, particularly energy-efficient and modular solutions.

Regional Analysis

North America

With a 31.0% market share, North America leads the global market. Growth is fueled by dense networks of supermarkets and quick-service restaurants. Regulatory pressures and consumer demand for sustainable practices drive adoption of energy-efficient systems.

Asia Pacific

Asia Pacific is witnessing the fastest growth, supported by the booming retail sector in China and India. The expansion of cold chain infrastructure and increasing investment in food safety standards are propelling demand for commercial refrigeration systems.

Recent Developments

- In April 2024, Sollatek partnered with Soracom to integrate IoT into refrigeration units for real-time monitoring and energy efficiency.

- In April 2024, the EU enforced a 500g propane (R290) limit in systems, promoting safer, sustainable refrigerants.

- In May 2024, Lennox introduced HVAC systems with R-454B refrigerants, reducing GWP by 78%.

- In April 2024, Blue Star launched deep freezers (60–600L), focusing on energy efficiency in extreme conditions.

Conclusion

The global commercial refrigeration equipment market is poised for sustained expansion. Innovations in smart technologies, demand from foodservice and healthcare, and evolving regulatory landscapes are key growth pillars. While cost barriers and supply disruptions persist, opportunities in emerging markets and green technologies offer strong future potential. Businesses investing in energy-efficient and scalable systems will remain competitive in this evolving market landscape.