Quick Navigation

Overview

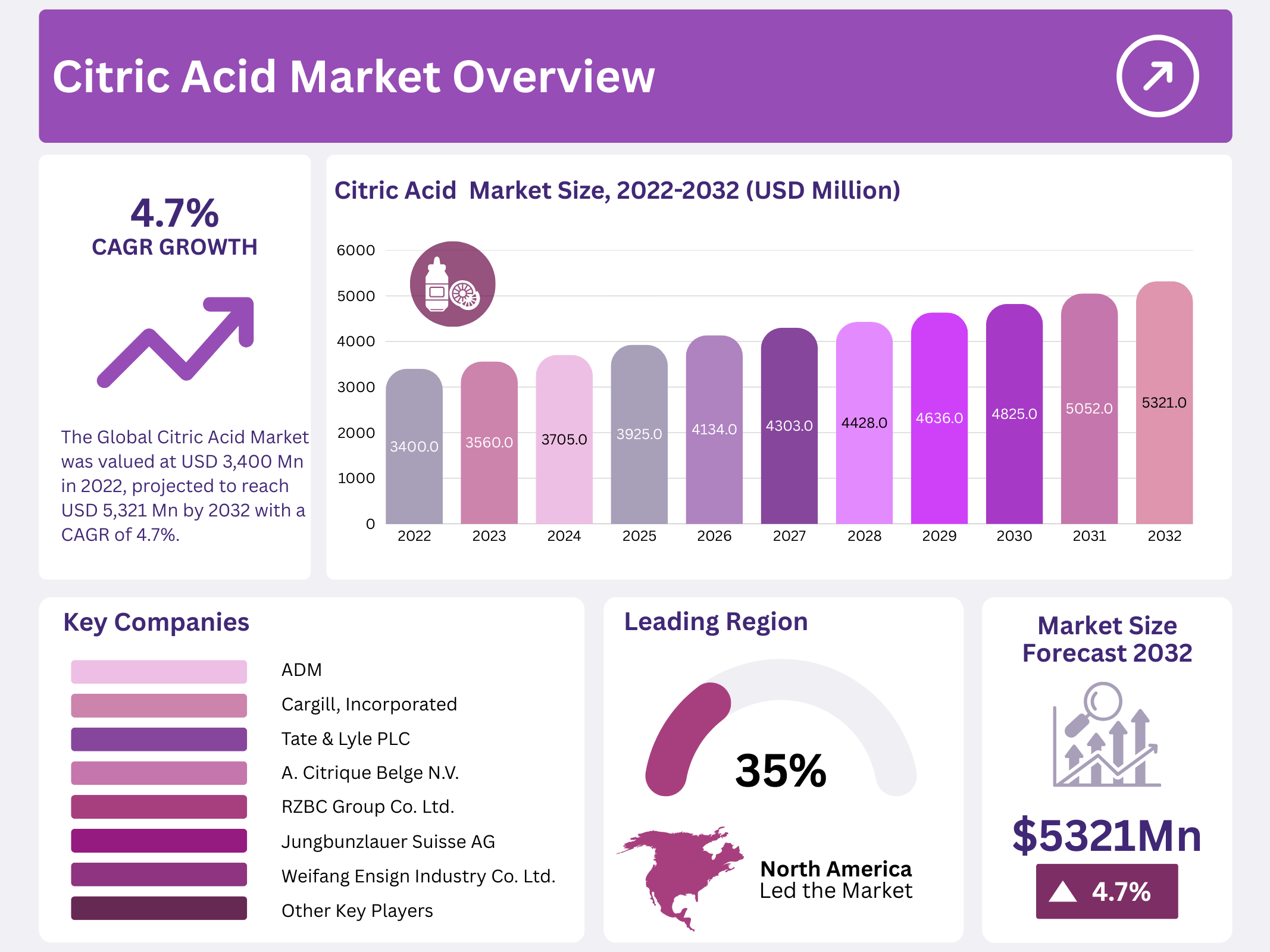

New York, NY – December 09, 2025 – In 2022, the global Citric Acid Market was valued at USD 3,400 million and is projected to reach USD 5,321 million by 2032. The market is expected to grow at a CAGR of 4.7% between 2023 and 2032. This growth is mainly driven by rising demand across the food, beverage, pharmaceutical, and personal care industries, where citric acid is widely used for its safety and functionality.

Citric acid is a weak natural organic acid found in citrus fruits such as lemons, limes, and oranges. It is commonly used as a food preservative and additive, helping to maintain product freshness and stability. In beverages, it prevents degradation and supports emulsion preservation. Growing consumption of processed foods and condiments, along with rising demand for products made from safe and natural ingredients, is strongly supporting market growth.

Beyond food and beverages, citric acid is increasingly used in personal care and pharmaceutical products due to its compatibility with clean-label formulations. Manufacturers use citric acid to meet consumer demand for safe, affordable, and acceptable products. Its wide application includes cleaners and detergents, coatings, adhesives, plastics, inks, clinical nutrition, pharmaceuticals, pet food, and animal feed, making it a versatile ingredient across multiple industries.

Key Takeaways

- The Global Citric Acid Market was valued at USD 3,400 Mn in 2022, projected to reach USD 5,321 Mn by 2032 with a CAGR of 4.7%.

- Powder form dominated in 2022 with around 65% revenue share, but liquid form is gaining traction, especially in food and cleaning uses.

- The Food & Beverage segment led the market in 2022 with approximately 35% share, driven by demand for preservation in processed foods.

- North America held the largest revenue share of about 35% in 2022, supported by major players like Pfizer, Cargill, DuPont, and ADM.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 3,400 Million |

| Forecast Revenue (2032) | USD 5321 Million |

| CAGR (2023-2032) | 4.7% |

| Segments Covered | By Form – Anhydrous and Liquid, By Application – Food and Beverages, Detergents and Cleaners, Pharmaceuticals, Personal Care, and Cosmetics |

| Competitive Landscape | Archer Daniels Midland Company, Cargill Incorporated, Tate & Lyle PLC, Jungbunzlauer Suisse AG, Cofco Biochemical (Anhui) Co. Ltd., Huangshi Xinghua Biochemical Co. Ltd., RZBC Group Co. Ltd., Weifang Ensign Industry Co. Ltd., Gadot Biochemical Industries Ltd., S.A. Citrique Belge N.V., and Other Key Players |

Key Market Segments

By Form Analysis

Powder Segment Held the Largest Market Share

Based on form, the product is mainly available in powder and liquid formats. In terms of revenue, the powder segment dominated the market in 2022, accounting for about 65% share. However, its share is expected to decline gradually over the forecast period due to the rising adoption of liquid variants, particularly in food & beverage applications and cleaning formulations.

Powder form remains widely used as a substitute for lemon juice or vinegar in cooking. It is also effective as a binding and chelating agent to remove and prevent limescale buildup in boilers and evaporators. Additionally, it is used in water treatment processes to improve the cleaning performance of laundry soaps and detergents.

The powder form is extensively utilized in the food & beverage industry for flavoring and preservation. It also functions as a stabilizing agent in ice cream, helping prevent fat separation. Commonly sold in retail stores, it is often marketed as an acid salt due to its close resemblance to table salt.

The liquid segment finds growing use in dairy and processed food products due to its advantages in texture modification, flavor enhancement, and pH control. It is also applied in the oil industry as an iron control additive, where it helps maintain the pH of acidizing fluids and reduces iron precipitation.

By Application Analysis

Food & Beverages Segment Led the Market in 2022

By application, the citric acid market is segmented into food & beverages, pharmaceuticals, personal care, and others. Among these, the food & beverage segment dominated the market in 2022 with a share of around 35% and is expected to maintain steady growth during the forecast period. This growth is largely supported by the increasing demand for freshness preservation in packaged and processed foods.

Citric acid is widely used by food manufacturers in products such as sorbets, ice creams, soft drinks, and ready-to-drink beverages. Its ability to enhance acidity helps limit microbial growth while improving overall taste and flavor profiles. This makes it a preferred ingredient across multiple food categories.

Furthermore, citric acid is highly valued for its ability to lower pH levels, enhance palatability, and improve antioxidant performance. Its long shelf life when stored in original containers further supports its widespread use as a flavoring, preservative, and coloring agent in the food & beverage industry.

Regional Analysis

North America dominated the global citric acid market in 2022, accounting for the largest revenue share of around 35% during the forecast period. This strong market position is mainly supported by the presence of major industry participants such as Pfizer, Cargill Incorporated, DuPont, and ADM, which continue to strengthen regional production capacity and product availability.

The increasing prevalence of digestive health issues in the U.S., including chronic diarrhea, gastroesophageal reflux disease (GERD), and long-term constipation, has contributed to higher demand for citric acid–based supplements. Citric acid is widely used to enhance mineral bioavailability, which helps improve nutrient absorption and overall digestive health.

Furthermore, supportive government initiatives, widespread nutritional deficiencies, and rising health awareness among consumers are encouraging higher intake of nutrient-rich fruits and functional foods. This trend is further boosting the adoption of citric acid–containing products across food, beverage, and dietary supplement applications in North America.

Top Use Cases

- Food and Beverages: Citric acid acts as a natural acidifier and flavor enhancer in sodas, juices, candies, and jams, giving that tangy zing we love while keeping products fresh by stopping spoilage. It also stabilizes pH levels and boosts shelf life without harsh chemicals, making snacks and drinks safer and tastier for everyday enjoyment in busy households.

- Pharmaceuticals: In medicines and supplements, citric acid serves as a buffer to control pH, helps dissolve active ingredients for better absorption, and acts as an antioxidant to maintain stability during storage. This makes pills and syrups more effective and gentle on the stomach, supporting health routines from vitamins to pain relievers with a reliable, natural formulation.

- Cosmetics and Personal Care: Citric acid balances pH in shampoos, lotions, and creams to match our skin’s natural acidity, preventing irritation while gently exfoliating dead cells for a smoother glow. As a chelator, it grabs metal ions that dull products, ensuring long-lasting freshness in everyday beauty items like face washes and hair conditioners.

- Cleaning and Detergents: This powerhouse breaks down hard water stains and mineral buildup in household cleaners, dish soaps, and laundry boosters, offering an eco-friendly scrub without toxic fumes. It softens fabrics and shines surfaces effortlessly, turning routine chores into quick wins for greener homes and sparkling results on tiles or appliances.

- Industrial Processes: In manufacturing, citric acid chelates metals during electroplating to prevent rust and ensure smooth finishes on electronics or car parts, while in leather tanning, it softens hides for durable goods. Its versatile binding power streamlines production lines, cutting waste and boosting quality in factories, making everything from tools to textiles.

Recent Developments

1. Archer Daniels Midland Company

ADM has recently expanded its fermentation-based product portfolio, including citric acid, through increased capacity and sustainability initiatives. The company focuses on optimizing its production processes to improve efficiency and reduce environmental impact, supporting the growing demand in food, beverage, and industrial applications. ADM leverages its integrated supply chain to ensure a reliable supply.

2. Cargill, Incorporated

Cargill continues to invest in its bioindustrial segment, with citric acid being a key product. Recent developments highlight a focus on sustainable and traceable supply chains, responding to consumer demand for cleaner labels. The company is also innovating with citric acid applications in product preservation and flavor enhancement for the food and pharmaceutical industries.

3. Tate & Lyle PLC

Tate & Lyle has strengthened its citric acid position following the acquisition of a significant stake in the China-based citric acid producer, Qianhai. This strategic move aims to diversify and secure its global supply chain, enhancing its ability to serve customers in the food, beverage, and industrial sectors with a broader portfolio of sustainable solutions.

4. Jungbunzlauer Suisse AG

Jungbunzlauer focuses on sustainable citric acid production from non-GMO substrates. A recent key development is the substantial investment in its Pernhofen production site to increase capacity and energy efficiency. The company emphasizes its “green” production process and carbon-neutral status, catering to the European market’s demand for environmentally responsible ingredients.

5. Cofco Biochemical (Anhui) Co. Ltd.

As a leading global producer, Cofco Biochemical continuously expands its citric acid and citrate capacity. Recent reports indicate ongoing optimization of fermentation technology and by-product utilization to improve yield and sustainability. The company is strengthening its market position by focusing on cost-competitive production and serving the growing Asia-Pacific demand.

Conclusion

Citric Acid is a versatile workhorse in today’s green economy, effortlessly blending into our daily lives from kitchen staples to high-tech gadgets with its safe, natural punch. With rising calls for clean labels and sustainable sourcing, it’s stepping up in eco-friendly formulations that dodge synthetic pitfalls, promising smoother innovations across sectors. Heading forward, expect this humble citrus star to fuel smarter, healthier products—reminding us that simple ingredients can drive big, bright changes for a fresher world.