Quick Navigation

Overview

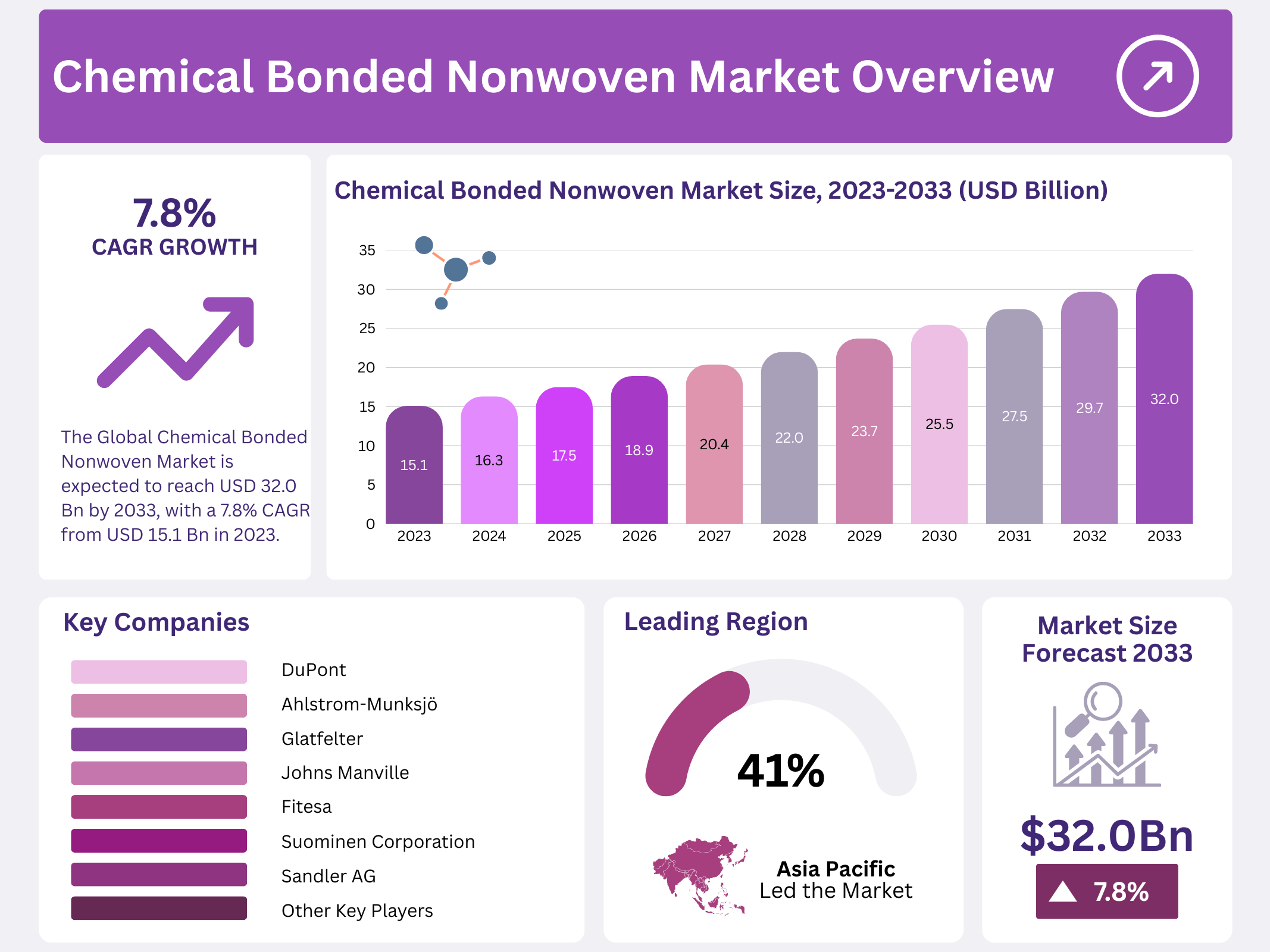

New York, NY – January 08, 2026 – The Global Chemical Bonded Nonwoven Market is experiencing significant growth and is projected to reach a value of approximately USD 32.0 Billion by 2033, up from USD 15.1 Billion in 2023, reflecting a robust compound annual growth rate (CAGR) of 7.8% during the forecast period from 2023 to 2033.

The increasing demand for chemically bonded nonwovens is driven by their widespread applications across various industries such as automotive, healthcare, consumer goods, and construction. These materials, known for their strength, durability, and versatility, have gained popularity due to their cost-effectiveness and environmentally friendly properties compared to traditional woven fabrics. The chemical-bonded nonwoven market presents ample opportunities in emerging economies, where rapid industrialization and urbanization are fueling the demand for nonwoven fabrics in various sectors.

Key growth factors include advancements in production technologies, rising demand for sustainable and eco-friendly materials, and a shift towards lightweight, high-performance materials in automotive and personal care products. Additionally, the growing healthcare sector, with increasing requirements for surgical gowns, masks, and wound care products, has been a major driver for market expansion.

Key Takeaways

- The Global Chemical Bonded Nonwoven Market is expected to reach USD 32.0 billion by 2033, with a 7.8% CAGR from USD 15.1 billion in 2023.

- Material Dominance: Polypropylene (PP) leads, capturing over 38.7% market share in 2023.

- Functional Preferences: Disposable functionality dominates, with over 65.4% market share in 2023.

- Manufacturing Processes: Drylaid processes hold over 40% market share in 2023.

- Application Diversity: Hygiene & Personal Care leads, accounting for over 37.5% market share in 2023.

- Asia Pacific dominates the Chemical Bonded Nonwoven regional market, accounting for 41.3%.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 15.1 Billion |

| Forecast Revenue (2033) | USD 32.0 Billion |

| CAGR (2024-2033) | 7.8% |

| Segments Covered | By Material Type(Polypropylene (PP), Polycarbonate (PC), Polyamide (PA), Biopolymers, Polyethylene (PE), Polyethylene Terephthalate (PET), Others), By Functionality(Disposable, Durable), By Process(Drylaid, Wetland, Spunbond, Meltblown), By Application(Hygiene & Personal Care, Medical, Household & Furnishings, Geotextiles, Filtration, Others) |

| Competitive Landscape | Freudenberg Performance Materials, Kimberly-Clark Corporation, DuPont, Ahlstrom-Munksjö, Glatfelter, Johns Manville, Fitesa, Suominen Corporation, Sandler AG, TWE Group, Berry Global Inc., Lydall Inc., Hollingsworth & Vose, Avgol Nonwovens, Mitsui Chemicals, Inc. |

Key Market Segments

By Material Type

In 2023, Polypropylene (PP) established itself as the leading material in the chemical-bonded nonwoven market, accounting for over 38.7% of total demand. Its dominant position highlights the material’s critical role in shaping overall market dynamics and reflects its widespread acceptance across multiple end-use sectors.

Polypropylene is highly preferred in chemical-bonded nonwovens due to its balanced performance characteristics, including strong tensile strength, durability, and excellent resistance to moisture. These properties make PP suitable for a broad range of applications such as hygiene products, filtration materials, automotive interiors, and industrial textiles. The material’s versatility and cost efficiency continue to reinforce its leadership position within the market.

By Functionality

In 2023, Disposable chemical-bonded nonwovens dominated the market, capturing more than 65.4% of the total share. This strong preference reflects the growing reliance on single-use products across various industries, particularly where hygiene, safety, and convenience are critical considerations.

Disposable nonwovens are widely utilized in hygiene products such as diapers and wipes, as well as in medical supplies and food packaging. Their market leadership is driven by advantages including affordability, ease of use, and compliance with hygiene standards. These factors have positioned disposable nonwovens as the preferred choice for large-scale, high-volume applications.

Although less prominent, the durable functionality segment maintained a meaningful presence in 2023. Durable chemical-bonded nonwovens are favored in applications requiring long-term performance, including automotive interiors, industrial uses, and select medical products. This segment supports market diversity by addressing demand for materials that offer enhanced strength and resistance to wear.

By Process

In 2023, Drylaid manufacturing emerged as the most widely adopted process in the chemical-bonded nonwoven market, accounting for over 40% of total production. This dominance reflects the process’s flexibility, efficiency, and suitability for large-scale manufacturing.

The drylaid process involves mechanically or pneumatically forming a fiber web that is subsequently bonded using chemical or thermal techniques. Its widespread use spans applications such as hygiene products, filtration media, and automotive components. The method’s ability to deliver consistent quality while supporting cost-effective production has contributed significantly to its market leadership.

Spunbond and meltblown processes, while representing smaller portions of the market, remain essential contributors. Spunbond nonwovens are valued for their strength and breathability in applications like geotextiles and agriculture, while meltblown nonwovens play a critical role in high-efficiency filtration, including medical masks and air filtration systems.

By Application

In 2023, Hygiene and personal care applications led the chemical-bonded nonwoven market, capturing more than 37.5% of total demand. This dominance underscores the essential role of chemical-bonded nonwovens in everyday consumer products. Chemical-bonded nonwovens are extensively used in diapers, wipes, feminine hygiene products, and adult incontinence items. Their softness, absorbency, and cost-effective production make them highly suitable for personal care applications. The segment’s strong market position reflects continued demand for reliable, comfortable, and hygienic materials that support growing consumer and healthcare needs.

Regional Analysis

The Asia Pacific region holds a dominant position in the global chemical-bonded nonwoven market, commanding the largest market size with a substantial share of 41.3%. This leadership is projected to persist, fueled by surging demand for plastics and polymers across key sectors, including construction, automotive, conductive polymers, and packaging.

The rapid expansion of polymer production in countries such as China, India, South Korea, Thailand, Malaysia, and Vietnam. These nations are scaling up manufacturing capabilities, directly boosting the supply and consumption of chemically bonded nonwovens, which rely heavily on plastic-based materials for diverse industrial and consumer applications.

In North America, steady economic development significantly influences demand for chemical-bonded nonwovens. Growth in the region’s automotive, polymer, and manufacturing sectors drives increased adoption of these materials. The ongoing evolution of industrial processes and greater integration of polymers in everyday applications further strengthen North America’s solid standing in the market.

Europe is poised for notable expansion in the chemically bonded nonwoven market throughout the forecast period. Strong demand from the textile industry remains a primary growth catalyst, as manufacturers prioritize chemically bonded nonwovens for their reliability. With industries increasingly emphasizing color consistency, performance, and quality in plastic-based products, Europe is expected to see robust market development in the coming years.

Top Use Cases

- Medical and Healthcare Products: Chemical-bonded nonwovens are extensively used in medical applications such as surgical gowns, wound dressings, masks, and bandages. These products are valued for their softness, absorbency, and ability to provide a barrier against fluids and bacteria.

- Hygiene and Personal Care: In the hygiene sector, chemical-bonded nonwovens are widely used in products like diapers, feminine hygiene items, and wet wipes. Their high absorbency and comfort make them ideal for sensitive skin applications, catering to the growing demand for personal care solutions.

- Automotive Industry: Nonwoven fabrics are increasingly used in automotive interiors, such as upholstery, headliners, and insulation panels. Their lightweight nature helps improve fuel efficiency, while their durability and noise-reducing properties enhance overall vehicle performance.

- Building and Construction: Chemical-bonded nonwovens are used in the construction industry for applications such as geotextiles, drainage systems, and insulation. These materials offer durability, moisture resistance, and support in soil stabilization, contributing to more sustainable building practices.

- Consumer Goods Packaging: Nonwoven materials are also used in the packaging of consumer goods, especially in protective wraps and bags. Their ability to offer cushioning and protection while being lightweight makes them a popular choice for packaging fragile items.

Recent Developments

- Freudenberg Performance Materials, a global leader in nonwoven fabrics, specializes in chemically bonded nonwovens for a variety of industries, including automotive, healthcare, and hygiene. Their materials are renowned for their high performance, durability, and sustainability, contributing significantly to applications in filtration, insulation, and protective clothing.

- Kimberly-Clark Corporation is a major player in the nonwoven sector, offering chemical-bonded nonwoven fabrics primarily used in hygiene products, including diapers, feminine care, and adult incontinence products. Their products are known for their comfort, absorbency, and skin-friendliness, making them a trusted brand in the personal care market.

- DuPont manufactures chemical-bonded nonwoven materials used in diverse sectors such as medical, automotive, and filtration. Known for their innovation in high-performance fabrics, DuPont’s nonwoven solutions provide superior strength, barrier properties, and reliability, particularly in protective and industrial applications like personal protective equipment (PPE).

- Ahlstrom-Munksjo specializes in fiber-based materials. Ahlstrom-Munksjö produces high-quality chemical-bonded nonwoven fabrics used in filtration, medical, and hygiene products. The company emphasizes sustainability and advanced manufacturing technologies to provide eco-friendly, high-performance materials suitable for a range of end-use applications, particularly in the healthcare sector.

- Glatfelter is a global supplier of engineered materials, including chemically bonded nonwovens. Their products are widely used in sectors like filtration, automotive, and personal hygiene. With a focus on innovation and sustainability, Glatfelter provides nonwoven fabrics that meet strict performance requirements for both industrial and consumer applications.

- Johns Manville, a part of Berkshire Hathaway, Johns Manville is a leading manufacturer of nonwoven fabrics, including chemical-bonded materials used in insulation, filtration, and automotive sectors. Their nonwoven solutions are prized for their thermal and acoustic insulation properties, helping to improve energy efficiency and reduce environmental impact.

Conclusion

The Chemical Bonded Nonwoven Market is poised for substantial growth, driven by a combination of technological advancements, expanding applications across diverse industries, and increasing demand for sustainable and high-performance materials. With its unique properties, including durability, cost-effectiveness, and versatility, chemically bonded nonwoven fabric is gaining traction in sectors such as healthcare, automotive, consumer goods, and construction.