Quick Navigation

Overview

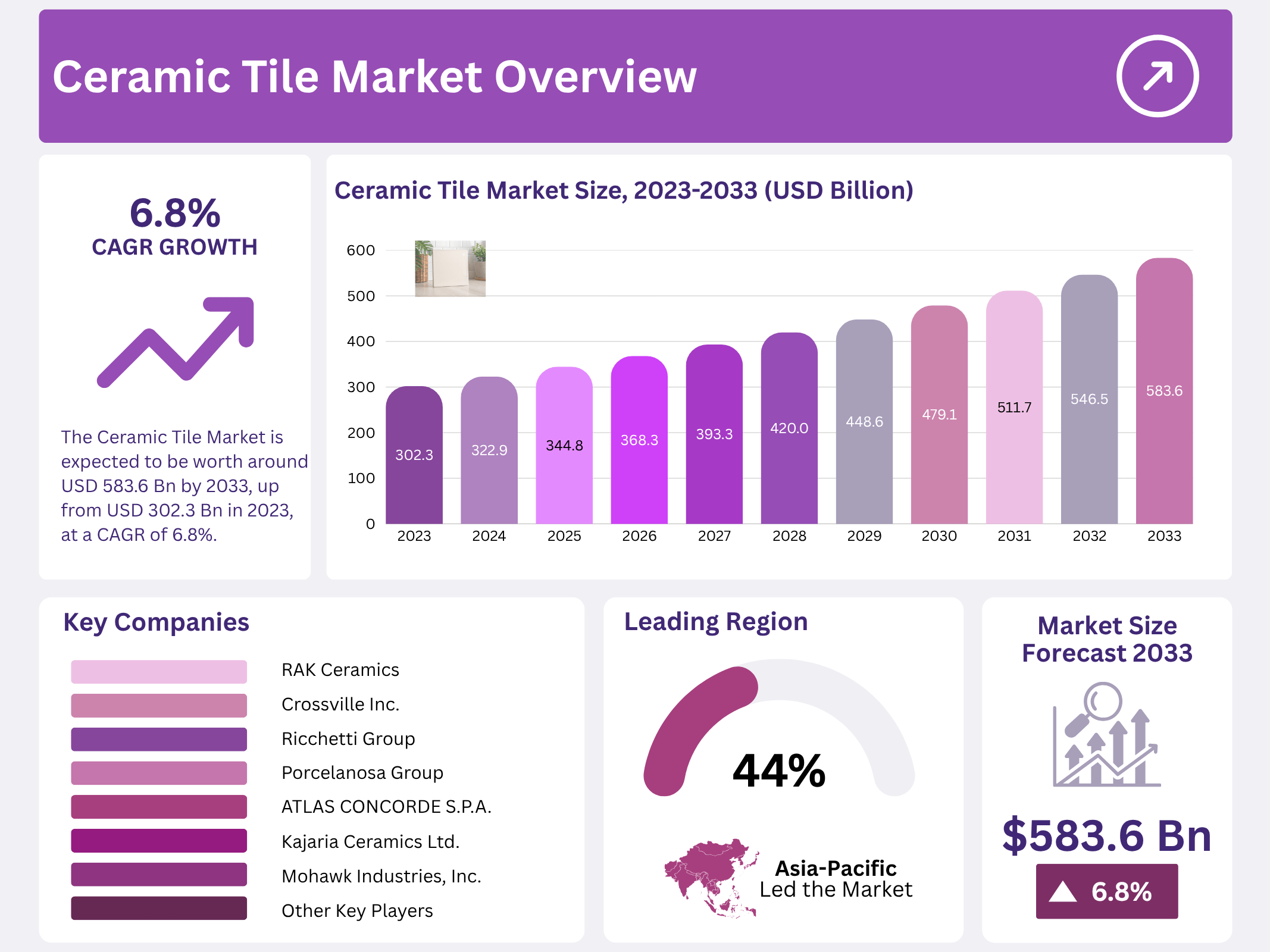

New York, NY – October 06, 2025 – The Global Ceramic Tile Market is projected to reach USD 583.6 billion by 2033, growing steadily at a CAGR of 6.8% during the forecast period from 2023 to 2033. In 2023, the market value is expected to total USD 302.3 billion, highlighting strong growth prospects over the decade.

Ceramic tile is a durable, water-resistant, and easy-to-clean material, widely used for flooring and wall applications. Produced from clay and other natural materials, it is fired in a kiln to create a strong, non-porous surface. Available in a wide range of shapes, colors, and sizes, ceramic tiles offer flexibility in design, making them suitable for both functional and aesthetic purposes.

The ceramic tiles market continues to expand as a dynamic segment within the construction and interior design industries. These tiles are extensively employed for flooring, countertops, walls, and backsplashes. Crafted from natural resources such as clay minerals and water, they undergo high-temperature processing to produce attractive, long-lasting products. This versatility and durability make ceramic tiles a cornerstone material in modern building and design projects worldwide.

Key Takeaways

- The Global Ceramic Tile Market is expected to reach USD 583.6 billion by 2033, with a steady CAGR of 6.8% from 2023 to 2033. It is estimated to be valued at USD 302.3 billion in 2023.

- The Market saw distinct trends in product segments. Porcelain Tiles emerged as the leading product type, capturing over 48.3% of the market share due to their durability, low maintenance, and design versatility.

- Among the various applications, the Floor segment dominated the market, holding more than 52.0% of the market share. Ceramic tiles are highly preferred for flooring due to their durability and aesthetic options.

- The Residential segment held the largest market share, accounting for over 58% of the market. The growth in residential construction projects and the trend of using ceramic tiles for walls, backsplashes, and countertops contributed to this dominance.

- Asia-Pacific (APAC) emerged as the dominant player in the ceramic tile market, with a market share of over 44.9% in 2023.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 302.3 Billion |

| Forecast Revenue (2033) | USD 583.6 Billion |

| CAGR (2023-2033) | 6.8% |

| Segments Covered | By Product Type(Glazed Tiles, Porcelain Tiles, Unglazed Tiles), By Application (Wall, Floor, Roof, Others), By End-Use (Residential, Commercial) |

| Competitive Landscape | Mohawk Industries, Inc., ATLAS CONCORDE S.P.A., Crossville Inc., Cerámica Saloni, Florida Tile, Inc., Guangdong Newpearl Ceramics Group Co., RAK Ceramics, Kajaria Ceramics Ltd., China Ceramics Co., Ltd., Porcelanosa Group, Ricchetti Group, Other Key Players |

Key Market Segments

Product Type Analysis

In 2023, the Ceramic Tile market showcased distinct trends across its product segments: Glazed Tiles, Porcelain Tiles, and Unglazed Tiles. Porcelain Tiles led the market, capturing a dominant share of over 48.3%. Their popularity stems from exceptional durability, low maintenance, and versatile design options, making them a top choice for both residential and commercial projects. This strong demand has prompted manufacturers to prioritize the production and marketing of porcelain tiles to leverage this high-growth segment.

Application Analysis

In terms of applications, the Ceramic Tile market in 2023 saw significant developments across Wall, Floor, Roof, and Other segments. The Floor segment emerged as the leader, holding a commanding market share of over 52.0%. Ceramic floor tiles are widely favored for their durability, ease of maintenance, and diverse design options, driving their extensive use in residential and commercial spaces. The growing focus on aesthetics and interior design in modern construction has further boosted demand, leading manufacturers to align their offerings with the thriving flooring market.

End-Use Analysis

The Ceramic Tile market, segmented by end-use into Residential and Commercial categories, was dominated by the Residential sector in 2023, which accounted for over 58% of the market share. This dominance reflects the strong demand driven by residential construction, renovation projects, and rising homeowner disposable income. Ceramic tiles are increasingly used not only for flooring but also for walls, backsplashes, and countertops in homes, fueling growth in this segment. The industry continues to focus on meeting the evolving preferences of homeowners to maintain this segment’s leadership.

Regional Analysis

The Asia-Pacific (APAC) region led the market, commanding a substantial share of over 44.9%, with demand valued at USD 135.7 billion and projected to grow significantly in the coming years. APAC’s dominance is driven by rapid urbanization, extensive construction activities, and a growing middle class with a preference for modern housing.

Countries like China and India saw heightened demand due to infrastructure development and residential projects, supported by cost-effective manufacturing and skilled labor availability. North America and Europe, as more mature markets, showed steady but slower growth. North America’s market was fueled by residential renovation and remodeling, while Europe’s growth was tempered by economic factors and market saturation in certain segments.

Latin America emerged as a growth hub, driven by investments in commercial and hospitality projects. Similarly, the Middle East and Africa showed promising expansion, propelled by increasing construction and hospitality developments. These regional variations highlight the importance of tailoring strategies to local market conditions and consumer preferences, enabling stakeholders to capitalize on opportunities in the global Ceramic Tile market.

Top Use Cases

- Residential Flooring: Ceramic tiles serve as a sturdy and stylish choice for home floors, handling daily foot traffic with ease. Their water resistance makes them perfect for kitchens and entryways, while easy cleaning keeps spaces fresh. Homeowners love the variety of patterns that match any decor, adding warmth and value to living areas without much upkeep.

- Bathroom Applications: In bathrooms, ceramic tiles cover walls and floors, offering protection against moisture and slips. They create a hygienic environment that’s simple to wipe down, ideal for showers and around tubs. With endless designs, they turn functional spaces into relaxing retreats, blending practicality with personal style for everyday comfort.

- Kitchen Backsplashes and Countertops: Ceramic tiles shine as backsplashes in kitchens, shielding walls from splashes and grease while enhancing visual appeal. Their heat-resistant suits areas near stoves, and diverse colors allow creative accents. This use combines durability with easy maintenance, making meal prep areas both safe and inviting for family gatherings.

- Commercial Spaces: Businesses use ceramic tiles in offices, malls, and hotels for durable flooring that withstands heavy use. They provide a professional look with low-maintenance hygiene, resisting stains and wear in high-traffic zones. Custom designs help create welcoming atmospheres, supporting operations while keeping costs down over time.

- Outdoor and Facade Uses: For exteriors, ceramic tiles clad building facades and patios, enduring weather with strong water resistance. They offer aesthetic versatility, mimicking natural stone for modern or traditional vibes. This application boosts curb appeal and longevity, ideal for homes and commercial properties seeking sustainable, low-fuss outdoor enhancements.

Recent Developments

1. Mohawk Industries, Inc.

Mohawk is heavily investing in sustainable manufacturing and expanding its premium, high-design offerings. Recent developments include launching new collections with integrated Crystalline Silica (0%) technology for healthier spaces and introducing advanced digital printing for realistic natural stone and wood visuals. Their focus is on innovative, durable surfaces that meet commercial and residential demands.

2. ATLAS CONCORDE S.P.A.

Atlas Concorde continues to lead in large-format porcelain slabs, frequently introducing new textures and 3D effects inspired by concrete, stone, and metal. A key development is their investment in super-efficient production lines and sustainable recycling systems. They are also expanding their international presence, particularly in the North American market, with a focus on architectural and design-driven projects.

3. Crossville Inc.

Crossville’s recent focus is on its “Eco-Terr” collection, which utilizes 20% post-consumer recycled content from its Tile Take-Back program. They have also launched a new large-format tile series with high-traction surfaces for commercial safety. Their developments emphasize creating a circular economy within the tile industry while delivering performance and aesthetic appeal for the healthcare and education sectors.

4. Cerámica Saloni, Florida Tile, Inc.

Florida Tile, under its Spanish manufacturer Cerámica Saloni, has launched the “Provenza” series, featuring European-inspired wood and stone looks with through-body color. A significant recent development is their expansion of production capacity in the U.S. to better serve the North American market. They are also enhancing their digital visualization tools to aid designers and consumers in selecting products.

5. Guangdong Newpearl Ceramics Group Co., Ltd.

Newpearl is aggressively expanding its global footprint, particularly in Southeast Asia and Africa, by establishing new overseas production bases. Their recent developments include launching ultra-thin ceramic panels for furniture and cladding applications and investing in advanced robotic production lines to boost efficiency and output. They focus on competitive, large-scale manufacturing for both domestic and international markets.

Conclusion

The Ceramic Tile Sector stands out for its blend of toughness, style, and eco-friendliness, meeting rising needs in building and renovation projects worldwide. Urban growth and design shifts drive steady demand, with innovations like varied textures keeping it fresh. Overall, it promises reliable expansion as consumers prioritize lasting, attractive solutions for homes and businesses alike.