Quick Navigation

Overview

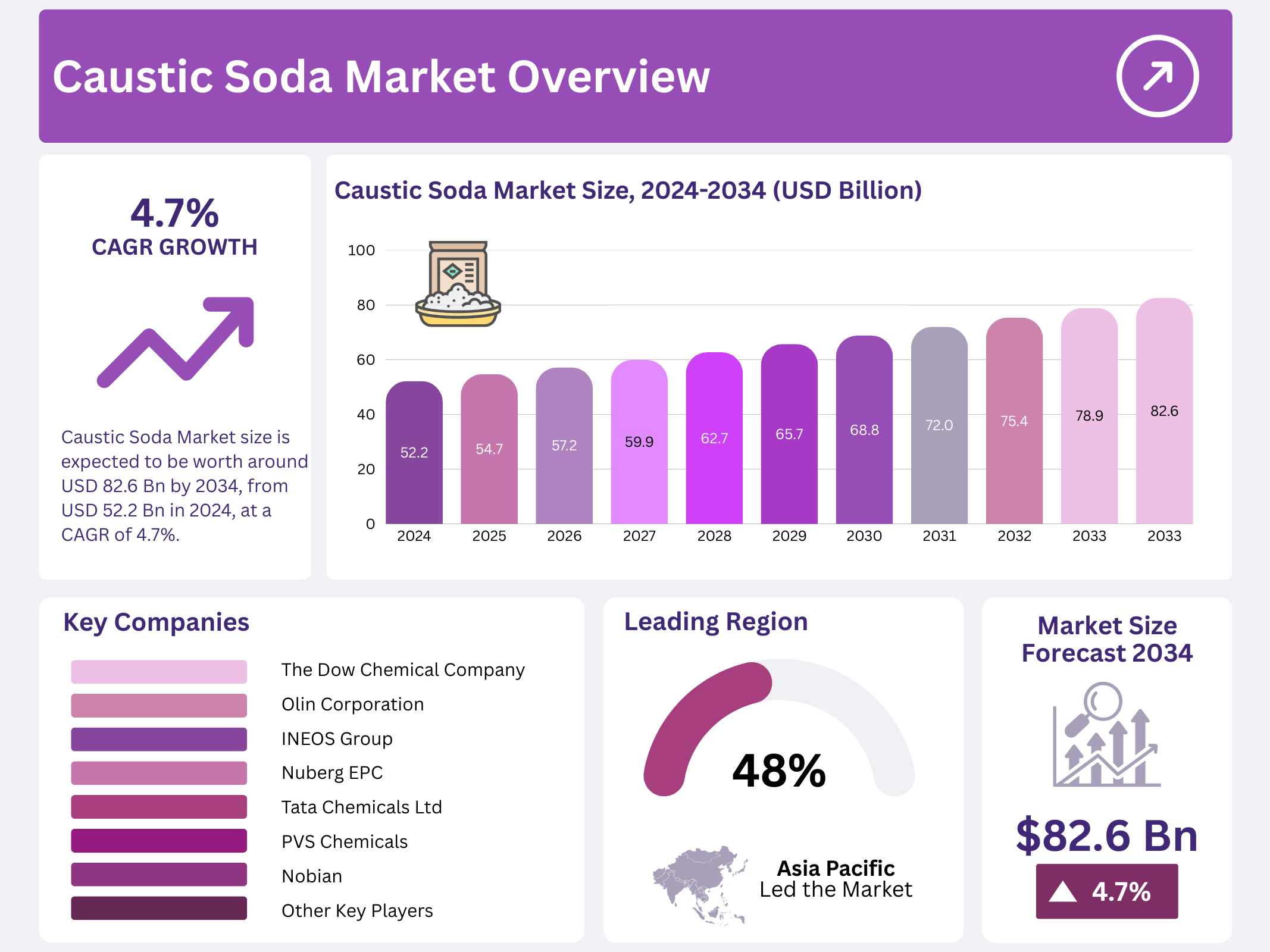

New York, NY – September 17, 2025 – The Global Caustic Soda Market is poised for substantial growth, projected to reach USD 82.6 billion by 2034 from USD 52.2 billion in 2024, reflecting a compound annual growth rate (CAGR) of 4.7% during the forecast period from 2025 to 2034.

Caustic soda, or sodium hydroxide (NaOH), is a versatile chemical compound integral to numerous industries. It is primarily produced through the Chlor-alkali process, where the electrolysis of aqueous sodium chloride (salt) solution yields chlorine gas and sodium hydroxide. This compound serves as a critical raw material in sectors such as pulp and paper, alumina, soaps and detergents, petroleum products, and chemical manufacturing, underscoring its broad industrial significance.

Caustic soda’s applications are diverse, with approximately 56% of its global production utilized across various industries, while 25% is dedicated specifically to the paper industry. The chemical sector is the largest consumer, leveraging caustic soda in the production of a wide array of chemicals. Additionally, the compound plays a vital role in the automotive, water treatment, and food and beverage industries. The rising emphasis on environmental sustainability has further boosted demand, particularly in industrial and municipal water purification processes, where caustic soda is essential for effective treatment.

The market’s growth is driven by increasing industrialization, urbanization, and expanding manufacturing sectors, particularly in emerging economies. These regions exhibit strong demand for caustic soda due to their rapid industrial development. Furthermore, technological advancements and a growing focus on green manufacturing practices are expected to propel the market forward. As industries continue to prioritize sustainable practices and efficient production methods, the caustic soda market is well-positioned for continued expansion over the forecast period.

Key Takeaways

- The Global Caustic Soda Market, valued at USD 52.2 billion in 2024, is projected to grow at a CAGR of 4.7%, reaching USD 82.6 billion by 2034.

- Among forms, solid accounted for the largest market share of 67.1%.

- Among purity, 70 to 90% accounted for the majority of the market share at 36.2%.

- By production method, membrane cells accounted for the largest market share of 57.1%.

- By application, organic chemicals accounted for the majority of the market share at 39.1%.

- Asia Pacific is estimated as the largest market for caustic soda with a share of 48.5% of the market share.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 52.2 Billion |

| Forecast Revenue (2034) | USD 82.6 Billion |

| CAGR (2025-2034) | 4.7% |

| Segments Covered | By Form (Solid, Liquid), By Purity (Up to 50%, 50 to 70%, 70 to 90%, Above 90%), By Production Method (Mercury Cell, Membrane Cell, Diaphragm Cell), By Application (Organic Chemicals, Inorganic Chemicals, Alumina, Paper & Pulp, Soaps & Detergents, Textile, Water Treatment, Pharmaceutical, Others) |

| Competitive Landscape | The Dow Chemical Company, Meghna Group of Industries, Olin Corporation, INEOS Group, Tata Chemicals Ltd, Formosa Plastics Corporation, PVS Chemicals, Westlake Corporation, Aditya Birla Chemicals, SABIC, Tosoh Corporation, Hanwha Chemical Corporation, Nouryon, Shin-Etsu Chemicals Co. Ltd, ERCO Worldwide, Nobian, Nuberg EPC, Other Key Players |

Key Market Segments

Form Analysis

Solid Segment Leads Market Share

The caustic soda market is divided by form into solid and liquid segments. In 2024, the solid segment captured a dominant 67.1% revenue share. Its preference stems from easy handling, extended shelf life, and broad applications in industries like chemicals, textiles, and paper production. Solid caustic soda’s stability during storage and transport, combined with its cost-effectiveness and versatility in manufacturing, solidifies its leading market position.

Purity Analysis

70-90% Purity Holds Largest Share

The market is segmented by purity into up to 50%, 50-70%, 70-90%, and above 90%. In 2024, the 70-90% purity range led with a 36.2% market share, driven by its extensive use in chemical manufacturing, water treatment, and paper production. This purity level strikes an optimal balance between performance and cost, making it ideal for large-scale industrial applications. Its widespread availability and adaptability further reinforce its market dominance.

Production Method Analysis

Membrane Cells Dominate Production

The market is categorized by production method into mercury cells, membrane cells, and diaphragm cells. In 2024, membrane cells accounted for a leading 57.1% market share due to their superior energy efficiency and environmental benefits. This method minimizes energy use and emissions, aligning with stringent environmental regulations. Additionally, membrane cells produce high-purity caustic soda, meeting the precise quality requirements of various industries, further cementing their dominance.

Application Analysis

Organic Chemicals Lead Market

The caustic soda market is segmented by application into organic chemicals, inorganic chemicals, alumina, paper & pulp, soaps & detergents, textiles, water treatment, pharmaceuticals, and others. In 2024, the organic chemicals segment held a commanding 39.1% market share, driven by caustic soda’s critical role in producing sodium derivatives, solvents, and plastics. Its extensive use in petrochemicals and agriculture for processes like neutralization, saponification, and chemical synthesis underscores its importance, with its versatility in chemical reactions further boosting demand.

Regional Analysis

In 2024, the Asia Pacific region led the global caustic soda market, capturing a substantial 48.5% share, fueled by robust demand across industries such as pulp and paper, textiles, alumina refining, cleaning products, and water treatment. Key contributors to this growth include China, India, Japan, and Southeast Asian nations.

China stands out as the dominant player in both production and consumption, driven by its expansive industrial base and growing manufacturing sector. Increasing urbanization and heightened awareness of hygiene and health have further boosted caustic soda use in personal care and household cleaning products. The region is a hub for established chemical, aluminum, and textile industries, which are major consumers of caustic soda due to its versatility and critical role in manufacturing processes.

In textiles, caustic soda is essential for scouring, dyeing, and finishing, improving fabric texture, color consistency, and quality. In aluminum production, particularly in China and Australia, it plays a vital role in the Bayer process for extracting alumina from bauxite ore. Additionally, the chemical industry relies heavily on caustic soda as a key raw material for producing a wide range of downstream chemicals.

Stringent government regulations on water treatment and environmental sustainability have increased caustic soda demand for municipal and industrial water purification. Furthermore, technological advancements and rising investments in sustainable manufacturing practices are shaping the future of the Asia Pacific caustic soda market, promoting greater efficiency and environmental responsibility in production.

Top Use Cases

- Soap and Detergent Manufacturing: Caustic soda acts as a key ingredient in turning fats and oils into soap through a simple chemical reaction called saponification. This makes everyday cleaning products like bars of soap and liquid detergents effective at removing grease and dirt. In the growing personal care market, it helps produce affordable, high-quality items that meet rising consumer demand for hygiene essentials, boosting sales in households worldwide.

- Pulp and Paper Production: In making paper, caustic soda breaks down wood fibers by removing tough lignin, creating smooth, strong sheets for books, packaging, and tissues. This process supports the massive paper industry, where demand for recycled and eco-friendly products is surging. As printing and wrapping needs expand with e-commerce, caustic soda ensures efficient, cost-effective output for global manufacturers.

- Water Treatment Processes: Caustic soda adjusts pH levels in water to make it safe for drinking and use in factories, while also helping remove heavy metals and impurities in wastewater. This vital role keeps rivers clean and supports urban growth. With more focus on sustainability, its use in desalination and purification plants is increasing, aiding clean water access in developing regions.

- Aluminum Extraction from Bauxite: Caustic soda dissolves bauxite ore to pull out alumina, the base for lightweight aluminum used in cars, planes, and cans. This Bayer process is essential for the metal industry, driving construction and transport booms. As electric vehicles rise, demand grows, making caustic soda a steady supplier for energy-efficient materials in a greener economy.

- Food Processing Applications: Caustic soda peels skins from fruits and veggies like tomatoes and potatoes for canning, and cures olives to reduce bitterness while keeping them crisp. It also preserves foods by stopping bacterial growth. In the expanding packaged food sector, this safe, regulated use ensures longer shelf life and quality, meeting busy lifestyles and global trade needs.

Recent Developments

1. The Dow Chemical Company

Dow is strategically expanding its caustic soda and ethylene capacity on the U.S. Gulf Coast to leverage cost-advantaged feedstocks and meet growing global demand, particularly from the alumina and water treatment sectors. This investment strengthens its integrated chlor-alkali chain and market position. The focus is on operational efficiency and supply reliability for international customers.

2. Meghna Group of Industries

Meghna Group of Industries is significantly expanding its chemical division. Through its subsidiary MChemicals, it is increasing caustic soda production capacity to solidify its position as a key domestic supplier in Bangladesh and cater to the growing demand from local industries like textiles, fertilizers, and aluminum. This expansion supports the country’s import substitution and industrial growth initiatives.

3. Olin Corporation

Olin, a leading global producer, is implementing a disciplined operating model, often idling capacity to maintain market balance and value over volume. Recent developments include managing high caustic soda prices driven by strong demand and low inventory. They are also navigating high energy costs in Europe, adjusting production rates to optimize their integrated chlor-alkali-Vinyls chain and profitability.

4. INEOS Group

INEOS Inovyn, the chlor-alkali division of INEOS, is investing in low-carbon hydrogen production at its Tavaux site in France, which is integrated with its caustic soda manufacturing. This initiative, part of its ECOVYN brand, aims to significantly reduce the carbon footprint of its caustic soda and other products, responding to increasing customer demand for sustainable chemical solutions.

5. Nuberg EPC

Nuberg EPC, a global engineering firm, is securing contracts to build caustic soda plants worldwide. A recent key development is the engineering, procurement, and construction (EPC) contract for a major chlor-alkali plant in Bangladesh, which will include substantial caustic soda production capacity. This highlights the ongoing global demand for new, modern production facilities, with Nuberg as a key technology and construction provider.

Conclusion

Caustic Soda remains a fundamental pillar of global industry, with its demand almost entirely driven by the health of major downstream sectors like alumina processing, organic chemicals, and pulp & paper production. Current market dynamics are characterized by tight supply and elevated pricing, largely influenced by high energy costs in key production regions and strong, consistent demand.