Quick Navigation

Overview

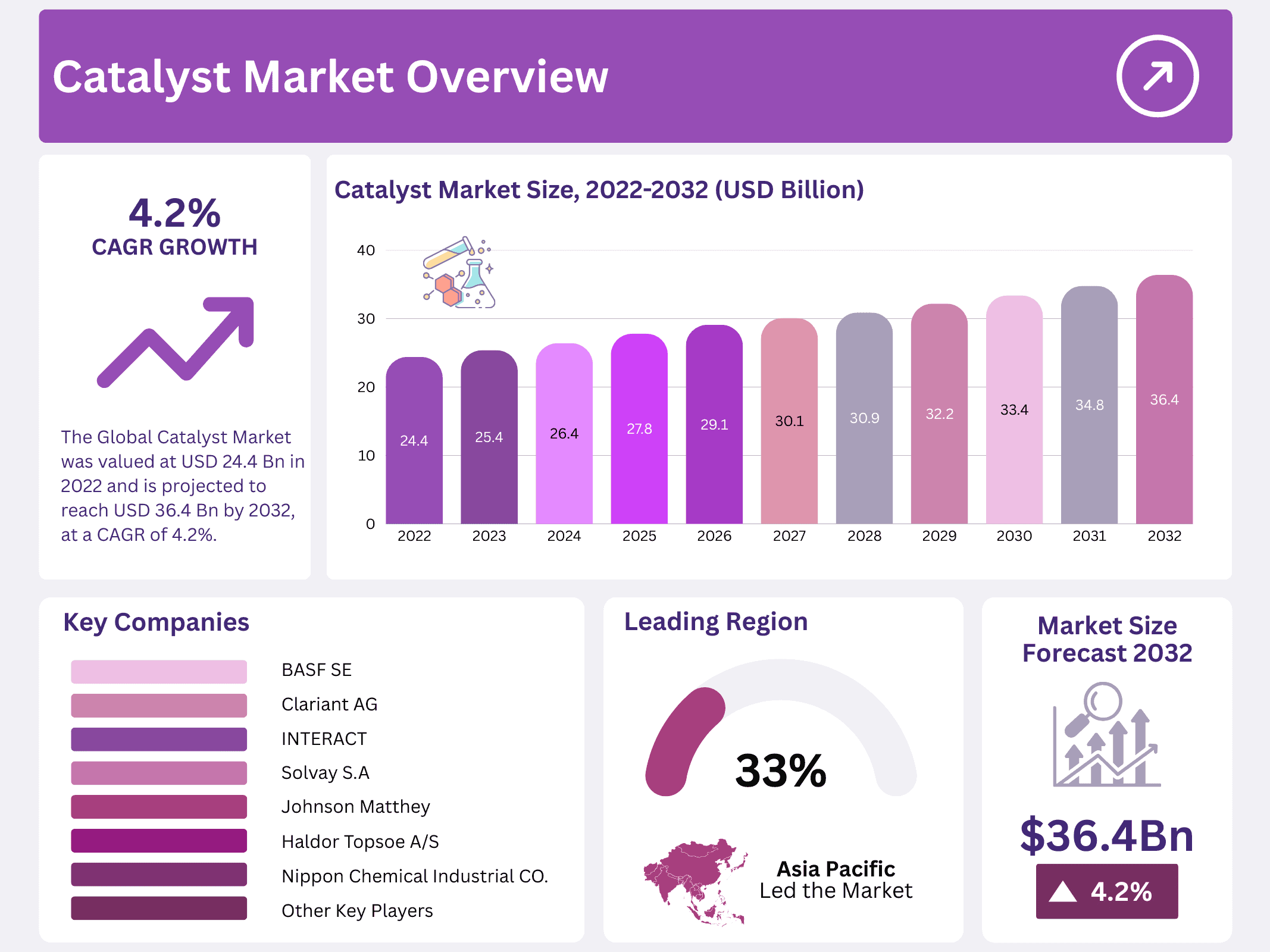

New York, NY – January 29, 2026 – The Global Catalyst Market was valued at USD 24.4 billion in 2022 and is projected to reach USD 36.4 billion by 2032, expanding at a CAGR of 4.2% during the forecast period. Catalysts play a vital role across chemical industries by accelerating reaction rates and improving process efficiency, making them essential for large-scale industrial production.

Catalysts are unique because they speed up chemical reactions by lowering the activation energy without being consumed in the process. After use, they can be recovered, cleaned, and reused, which makes them highly economical. The market offers a wide range of catalyst types, including metals, zeolites, enzymes, and organometallic materials, each suited to different industrial needs.

Zeolites—porous, hydrated aluminosilicates—are among the most commercially valuable catalysts due to the distinctive crystal structure that allows them to act as molecular sieves. Meanwhile, metal-based catalysts dominate industrial applications because the free valence electrons in metals facilitate reaction pathways effectively. Together, these catalyst classes support major sectors such as petrochemicals, refining, polymers, and environmental applications.

Key Takeaways

- The Global Catalyst Market was valued at USD 24.4 billion in 2022 and is projected to reach USD 36.4 billion by 2032, at a CAGR of 4.2%.

- Chemical compounds dominated the market with a 38.3% share, driven by the extensive use of sulfuric acid, calcium carbonate, and similar materials.

- The heterogeneous catalysts segment held the largest share at 72.1%, favored for ease of handling, cost-effectiveness, and efficient product separation.

- Chemical synthesis applications led the end-use segment with a 26.3% share, supported by critical processes like the Haber process, Contact process, and ammonia-to-nitric-acid conversion.

- Asia Pacific accounted for the largest regional share of 33.7%, primarily driven by China’s dominance in the automotive, petrochemical, and polymer industries.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 24.4 Billion |

| Forecast Revenue (2032) | USD 36.4 Billion |

| CAGR (2023-2032) | 4.2% |

| Segments Covered | By Raw Material- Chemical Compounds, Metals, Zeolites, and Others; By Product- Homogenous and Heterogeneous; By Application- Petroleum Refineries, Chemical Synthesis, Environmental, Polymers, and Petrochemicals. |

| Competitive Landscape | CIECH SA, Ciner Group Resources Corporation, Genesis Energy L.P., GHCL Limited, Lianyungang Soda Ash Co. Ltd, NIRMA LIMITED, Sisecam Group, Solvay S.A, Shandong Haihua Group Co. Ltd, Tata Chemicals Limited, FMC Corporation, Novacap Group, DCW Limited, OCI COMPANY Ltd., Tronox Limited, SEQENS Group, and Other Key Players. |

Key Market Segments

Raw Material Analysis

Chemical compounds dominated the segment with a 38.3% share, driven by the extensive use of sulfuric acid, calcium carbonate, and other key chemicals in catalyst production. Metals also form an essential part of catalyst synthesis. Materials such as titanium dioxide, aluminum oxide, and alumina are commonly used to create metal-based catalysts.

These synthesized metal catalysts are especially important in accelerating lipid oxidation reactions, such as those seen in dairy processing. Zeolites represent another significant raw material category, valued for their porous structure that supports catalysis, adsorption, and ion exchange. Their ability to accommodate various ions makes them suitable for multiple industrial applications, whether naturally sourced or chemically synthesized.

Product Analysis

The heterogeneous segment held a dominant 72.1% share, supported by its ease of handling, cost-effectiveness, and efficient product separation. Common materials like sulfated zirconia exemplify widely used heterogeneous catalysts. These benefits are expected to drive stronger adoption in biodiesel production over the coming years.

Homogeneous catalysts—such as boric acid, hydrochloric acid, phosphoric acid, and p-toluene sulfonic acid—offer excellent performance in specific industrial reactions. However, they often generate higher levels of toxic waste, prompting industries to seek greener alternatives. The emergence of biodegradable homogeneous catalysts, particularly Methane Sulfonic Acid (MSA), has helped address environmental concerns while maintaining catalytic efficiency.

Application Analysis

Chemical synthesis led the segment with a 26.3% share, supported by its essential role in processes such as the Haber process, the Contact process, and ammonia-to-nitric-acid conversions. These reactions rely heavily on catalysts to ensure optimal functionality, cost efficiency, and consistent output.

Growing demand for catalysts in chemical synthesis is fueled by their high functional group tolerance and affordability. Beyond chemical production, catalysts also play a pivotal role in petroleum refining—especially in cracking feedstock to improve product quality. Catalyst use enhances hydrocracking efficiency, reduces energy consumption, and supports process optimization, contributing significantly to the growing demand within the refining industry.

Regional Analysis

Asia Pacific held the largest value share of 33.7% in 2022, driven primarily by China’s strong position in the automotive, petrochemical, and polymer industries. The country hosts a significant concentration of chemical and plastics manufacturing companies, making it a global hub for production. Favorable factors such as rising domestic demand, competitive manufacturing costs compared to the U.S. and EU, and increasing FDI inflows across emerging economies like India and Vietnam continue to strengthen the region’s catalyst market outlook.

North America followed as the second-largest market, supported by stringent low-sulfur and automotive emission mandates that require advanced environmental catalysts. The region is experiencing growing demand for catalysts to convert heavy crude into lighter fuels such as gasoline, diesel, and kerosene. Additionally, ongoing expansion in Mexico’s oil, gas, and chemical sectors contributes positively to the market’s overall development.

The Middle East and Africa accounted for a 6.5% market share, presenting strong opportunities for petroleum refining catalysts. The presence of major refining hubs in Saudi Arabia, Kuwait, Oman, and Qatar creates a favorable environment for catalyst consumption. Rising domestic demand for polymers—driven by growth in construction, pharmaceutical, and packaging industries—continues to encourage regional manufacturers to increase petrochemical and polymer production.

Top Use Cases

- Building Serverless Web Applications: Catalyst lets developers create complete web apps without managing servers. You can build the backend with functions and data storage, then host the frontend securely. This approach speeds up development for simple tools like task managers or dashboards, allowing quick launches and easy scaling as user needs grow.

- Handling Data Processing Tasks: Developers use Catalyst for jobs like moving data between systems, cleaning records, or creating image thumbnails. Event-driven functions trigger automatically when new data arrives, making operations smooth and reliable. This helps businesses manage large data flows efficiently without complex setups.

- Running Scheduled Tasks: Catalyst scheduler runs background jobs at set times, such as generating reports or updating records weekly. It handles routine work like sending notifications or processing batches automatically. This keeps applications running smoothly and saves time for teams focused on core business activities.

- Creating Secure Serverless APIs: With Catalyst, you expose backend logic through protected REST APIs. The platform adds security features and controls access for internal or external apps. This makes it simple to connect services or share data safely, supporting modern app integrations without heavy infrastructure.

- Developing Intelligent AI Solutions: Catalyst integrates AI tools to add smart features, like photo tagging or text analysis. Developers build apps that understand content or automate decisions using built-in AI services. This brings advanced capabilities to everyday applications, helping businesses offer more personalized and efficient experiences.

Recent Developments

1. Albemarle Corporation

- Albemarle is expanding its single-site catalyst technology, particularly for hydrocracking and resid upgrading, to help refiners process heavier crudes and improve yields. They are innovating in digital catalyst services to optimize performance. Recent focus includes sustainability-linked catalyst development for cleaner fuels and circular economy applications.

2. Apache Corporation

- As an upstream oil and gas producer, Apache’s direct catalyst developments are limited. Its operational developments focus on advanced drilling and data analytics to improve efficiency. Any catalyst-related news would involve its partners or suppliers in refinery operations, not proprietary catalyst technology from Apache itself.

3. BASF SE

- BASF recently launched its CircleStar star-shaped catalyst for ammonia production, significantly improving efficiency and reducing energy use. They are also advancing catalysts for battery recycling and sustainable methanol production from CO2, emphasizing the transition to a low-carbon economy and circularity in their catalyst portfolio.

4. Clariant AG

- Clariant’s Catofin catalyst technology is seeing global demand for propane dehydrogenation (PDH) to produce propylene. They launched the ElyIQ digital service to maximize catalyst performance. A key recent development is the successful startup of a major PDH unit in China using their tailored catalysts, supporting the growing polymer market.

5. Clariant International Ltd.

- Developments align with the parent company, focusing on commercializing sustainable catalyst solutions. Recent highlights include the Sunliquid technology for cellulosic ethanol and innovations in Fischer-Tropsch catalysts for sustainable aviation fuels (SAF), driving the bio-economy and carbon-utilization projects.

Conclusion

Catalyst stands out as a flexible cloud platform that simplifies app building for developers and businesses alike. Its serverless design, easy integrations, and AI support make it a strong choice for creating modern solutions quickly. Overall, Catalyst empowers teams to focus on innovation rather than technical hurdles, driving faster growth in competitive markets.