Quick Navigation

Introduction

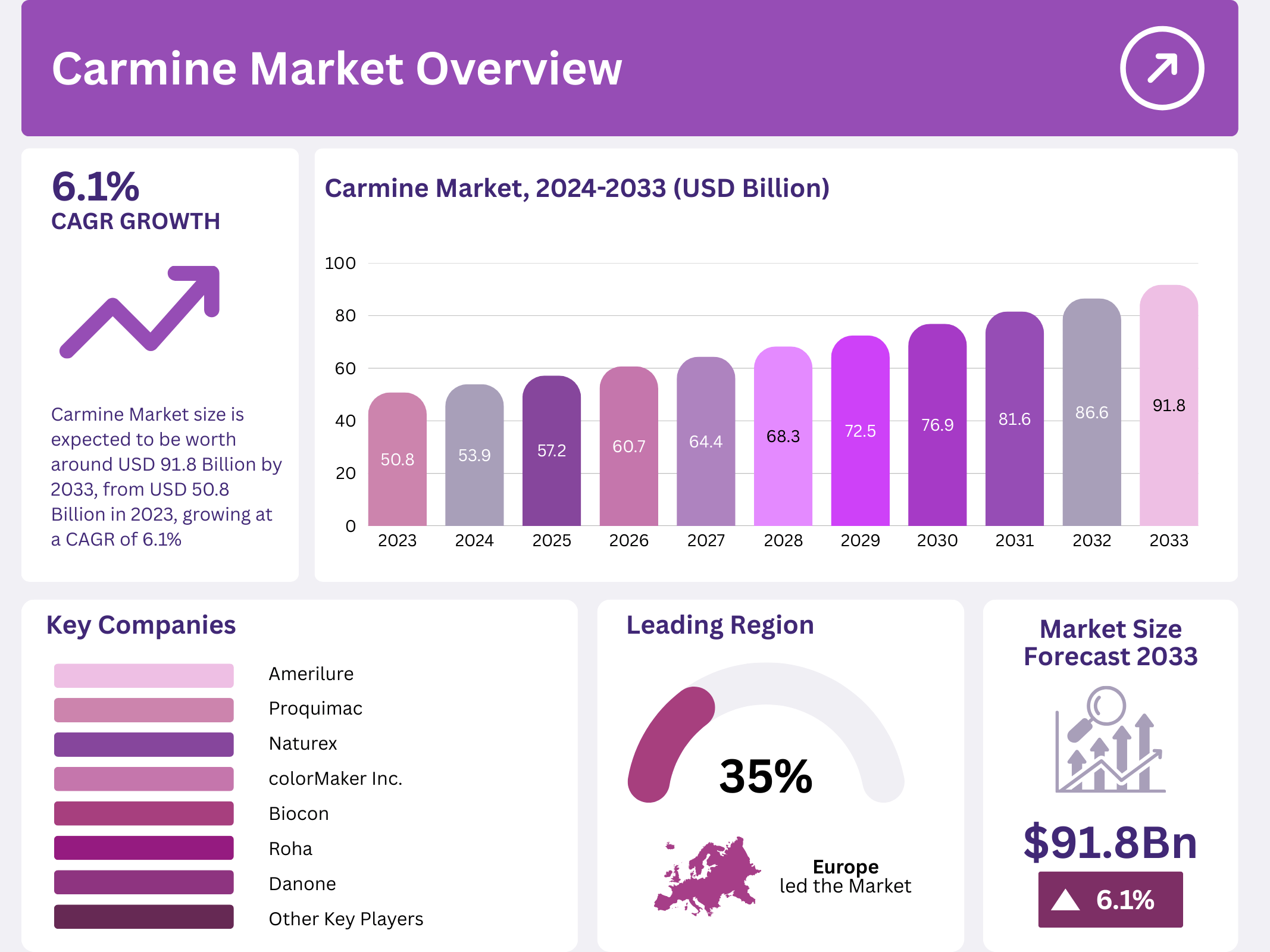

The global Carmine market is projected to grow from USD 50.8 Billion in 2023 to USD 91.8 Billion by 2033, growing at a CAGR of 6.1% during the forecast period from 2024 to 2033. Carmine, a natural red pigment derived from cochineal insects, is widely used in the food, beverage, cosmetic, and pharmaceutical industries. Its vibrant color, heat stability, and natural origins contribute to its increasing demand across various sectors.

As the preference for natural food additives and clean-label products continues to rise, carmine is seeing expanding usage, especially in food and cosmetics. This growth is supported by regulatory trends that favor natural colorants, along with consumer demand for transparency and sustainability in product ingredients.

Key Takeaways

- The Carmine Market was valued at USD 50.8 Billion in 2023 and is expected to reach USD 91.8 Billion by 2033, with a CAGR of 6.1%.

- In 2023, Liquids dominated the form segment with 45.7%, owing to their versatility and ease of application in various industries.

- In 2023, Food Processing led the end-use industry segment with 36.2%, due to high demand for natural colorants in processed foods.

- In 2023, Europe dominated the market with a 35.0% share, valued at USD 17.78 Billion, due to strict regulations favoring natural additives.

Market Segmentation Overview

By Form:

The Carmine market is categorized into powder, liquid, crystal, and granules. Liquid Carmine holds the largest share at 45.7% due to its easy integration and efficient production processes. This form is ideal for products like beverages and cosmetics, where consistency and smooth blending are essential. Powdered Carmine is commonly used in applications requiring precise color measurement, such as baking mixes and spice blends.

By End-Use:

The food processing sector dominates the Carmine market, accounting for 36.2% of the share. Carmine is a crucial ingredient in processed foods, offering both color and stability. Additionally, the growing preference for clean-label, natural food ingredients is propelling demand. Other key sectors include beverages, cosmetics, and pharmaceuticals, where Carmine is used for color enhancement in products like drinks, lipsticks, and tablets.

Drivers

Rising Demand for Clean Label Products:

The growing consumer preference for natural, safe, and recognizable ingredients is a key driver of the Carmine market. As consumers become more health-conscious and aware of the ingredients in their products, demand for natural colorants like carmine is expected to continue rising. Carmine serves as a trusted alternative to synthetic dyes, aligning with the clean-label movement.

Expansion of the Cosmetics and Pharmaceutical Sectors:

The use of carmine in cosmetics and pharmaceuticals is another significant growth factor. As natural and organic ingredients gain traction in beauty and wellness products, Carmine has become a preferred choice for coloring agents in items like lipsticks, blushes, and pharmaceutical tablets. Its vibrancy and stability under heat and light make it ideal for these industries.

Use Cases

Food Processing:

In food processing, Carmine is a vital colorant in products such as confectionery, dairy, and meat products. Its ability to retain color under heat and light exposure makes it a preferred option for food manufacturers looking to maintain appealing product visuals. It also serves as a safe and reliable natural alternative to artificial colorants.

Cosmetics and Pharmaceuticals:

Carmine’s use extends beyond food into cosmetics and pharmaceuticals. In cosmetics, it is widely used for lipsticks, blushes, and other beauty products. In the pharmaceutical industry, it is applied as a colorant in tablets and capsules. As the demand for natural ingredients grows in both sectors, Carmine is becoming more valuable for its vibrancy and stability.

Major Challenges

Ethical and Cost Concerns:

Carmine is derived from cochineal insects, which raises ethical concerns for consumers and manufacturers committed to vegan or cruelty-free standards. The production process is labor-intensive, making Carmine more expensive than synthetic alternatives. These issues could limit its adoption, particularly in industries with strict ethical sourcing policies.

Supply Chain Vulnerabilities:

The Carmine market faces supply chain challenges due to its reliance on cochineal insect production. Climate change and agricultural practices in key producing countries such as Peru, Mexico, and Chile can affect the availability of raw materials. These factors make the market vulnerable to fluctuations in supply and pricing, potentially impacting production costs.

Business Opportunities

Emerging Markets Expansion:

Emerging markets, particularly in Asia-Pacific and Latin America, present substantial growth opportunities for Carmine producers. As consumer awareness of natural and organic ingredients increases in these regions, the demand for Carmine is expected to rise. Expanding distribution channels and establishing production facilities in these regions can help capture new market segments.

Sustainable Extraction and Plant-Based Alternatives:

The development of more sustainable and efficient extraction processes is a key opportunity for the Carmine market. Companies are investing in R&D to reduce the environmental impact of Carmine production, which aligns with growing consumer demand for eco-friendly products. Additionally, the innovation of plant-based red colorants offers an ethical alternative to Carmine, tapping into the vegan and cruelty-free market.

Regional Analysis

Europe holds the largest share of the Carmine market at 35.0%, valued at USD 17.78 Billion. The region’s stringent regulations favor natural ingredients, encouraging the use of Carmine in food and cosmetics. The increasing demand for clean-label products and consumer awareness of health and wellness trends further boost the market’s growth in Europe.

North America is a significant market for Carmine, driven by the rising consumer preference for natural food colorants in the region. The clean-label trend, along with increasing demand for sustainable and natural ingredients, supports Carmine usage in food and cosmetics. The strong regulatory framework and health-conscious population further contribute to the region’s growth.

Recent Developments

- In August 2022, Danone acquired a majority stake in Happy Family, an organic baby food producer, strengthening its portfolio of clean-label products. This acquisition aligns with the growing market trend toward organic and natural food products, which often utilize Carmine for color.

- In June 2022, Fermentalg and DDW, part of Givaudan, reached the final milestone for the Galdieria Blue Extract, an acid-stable natural blue color for food and beverages. This new product innovation marks an important step toward diversifying natural colorant offerings in the market.

Conclusion

The Carmine market is poised for significant growth, driven by consumer demand for natural ingredients and the increasing adoption of clean-label products across various industries. As regulatory trends and health-conscious behaviors continue to favor natural additives, Carmine will maintain its position as a preferred coloring agent in food, beverages, cosmetics, and pharmaceuticals. Despite challenges related to cost, ethics, and supply chain management, the market offers ample opportunities for innovation and expansion, especially in emerging markets and sustainable practices.