Quick Navigation

Introduction

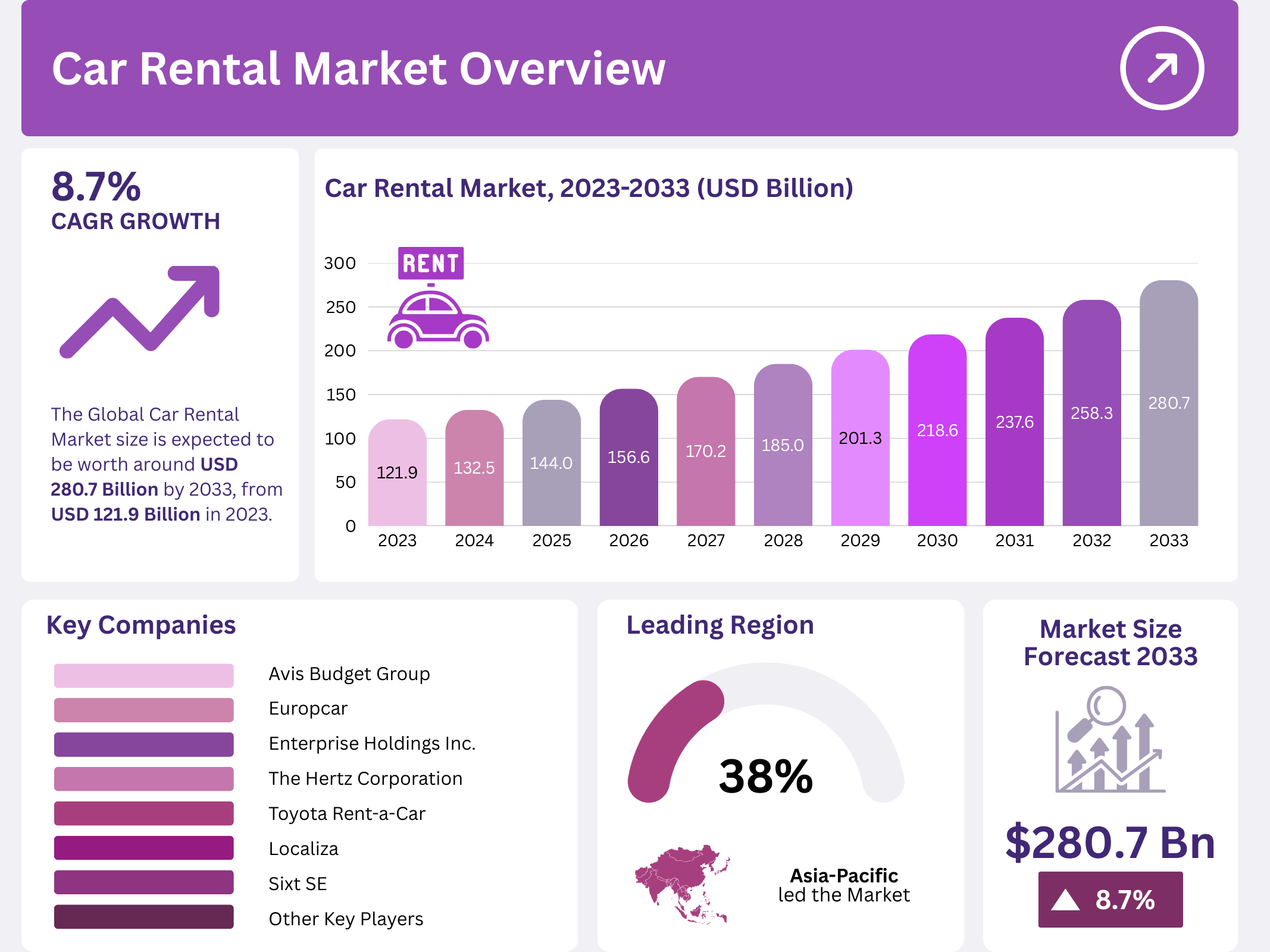

The global car rental market is poised for significant growth, projected to reach USD 280.7 billion by 2033, from USD 121.9 billion in 2023, reflecting a compound annual growth rate (CAGR) of 8.7% during the forecast period from 2024 to 2033. This growth is fueled by increasing demand for flexible, short-term transportation solutions, with key drivers such as the rising adoption of car-sharing services, technological advancements, and eco-friendly rental options. The market is characterized by a diverse range of players offering a variety of rental services tailored to both leisure and business travelers, creating new opportunities for growth in this dynamic sector.

Key Takeaways

- The global car rental market is expected to grow from USD 121.9 billion in 2023 to USD 280.7 billion by 2033, at a CAGR of 8.7%.

- Economical cars dominate the car type segment with 34.3% share.

- Airport transport holds a dominant position in the rental category, commanding 40.1% market share.

- The Asia Pacific region leads the market with 38.0% share, followed by North America and Europe.

Drivers

- Expansion of Car-Sharing Services: The rise in car-sharing models allows consumers to access vehicles for short-term use, meeting the demand for cost-effective, flexible transportation. This trend, combined with the adoption of electric vehicles (EVs), enhances the appeal of car rentals, particularly among environmentally conscious consumers.

- Technological Advancements: The integration of online booking platforms and mobile applications has simplified the car rental process, making it more convenient for customers to access rental services anytime and anywhere. Additionally, the use of electric and hybrid vehicles is expected to drive further growth in the eco-conscious market.

- Increase in Travel: Both business and leisure travel are on the rise, particularly following the global pandemic recovery. The growing number of travelers increases demand for car rental services, especially in tourist destinations and business hubs.

Use Cases

- Leisure Travelers: Tourists prefer car rentals for convenience, flexibility, and affordability, especially in popular destinations like Florida and California.

- Business Travelers: Corporate clients often rely on car rentals for efficient, professional transport, and rentals are often integrated into business travel packages with airlines and hotels.

- Urban Commuters: In urban areas, where car ownership is costly, rental services provide a practical solution for short-term needs such as commuting, errands, or casual outings.

Major Challenges

- High Operational Costs: Car rental companies must manage the costs associated with maintaining a fleet of vehicles, insurance, fuel, and compliance with government regulations, which can significantly increase operational expenses.

- Intense Competition: The market is highly competitive, with numerous global and regional players vying for market share. Additionally, the rise of ride-hailing services, like Uber and Lyft, has intensified competition by providing consumers with an alternative to traditional car rentals.

- Fluctuating Fuel Prices: The volatility of fuel prices affects the cost structure of car rental companies, making it challenging to maintain stable pricing models for customers.

Market Segmentation Overview

- By Car Type: The dominant segment is economical cars, which hold a significant market share due to their affordability and fuel efficiency. Other vehicle types such as executive cars, luxury cars, SUVs, and MUVs cater to specific customer needs, such as those seeking more comfort, luxury, or larger capacities for group travel.

- By Rental Category: Airport transport remains the leading rental category, representing 40.1% of the market. The local usage and outstation segments continue to serve urban commuters and tourists who need transport outside city limits.

Business Opportunities

- Adoption of Self-Driving Cars: The integration of autonomous vehicles presents a new frontier for the car rental market, allowing for service models that reduce the need for drivers and expand customer options.

- Emerging Markets: As disposable incomes rise in emerging markets, such as those in Latin America and Asia Pacific, there is an increasing demand for affordable rental solutions. This opens a wide range of growth opportunities for car rental companies.

- Luxury Travel: The growing demand for premium and luxury vehicles presents an opportunity for rental companies to cater to affluent travelers who seek high-end experiences.

- Subscription-Based Models: With the growing popularity of flexible, short-term rental options, subscription-based services that allow users to access cars on demand without long-term commitments are becoming a viable option.

Regional Analysis

- Asia Pacific Dominates: The region holds 38.0% of the car rental market share, driven by the booming tourism industry in countries like China, India, and Japan. The rising urban middle class and their increasing demand for affordable, flexible transportation options continue to drive market growth.

- North America: North America’s car rental market is strong, with high demand from both domestic and international tourism. The U.S. alone accounted for approximately 48 million rentals in 2023, with projections suggesting 52 million by 2028.

- Europe: Europe maintains a steady market, particularly in popular tourist destinations such as Western and Southern Europe. The well-established infrastructure and steady flow of travelers contribute to the region’s stability in the market.

- Latin America & Middle East: Emerging markets such as Brazil and Mexico are seeing an increase in car rental demand driven by rising tourism and the expanding middle class. The Middle East, led by countries like the UAE and Saudi Arabia, is growing due to business and tourism activities.

Recent Developments

- Enterprise Mobility: In October 2024, Enterprise Mobility expanded its presence in Asia-Pacific by opening new locations in Thailand, catering to the growing tourism demand.

- Moosa Rent a Car: In October 2024, Moosa Rent a Car launched in Dubai, offering rentals without deposits, focusing on affordability and ease of access for tourists and expatriates.

- Eco Mobility: In September 2024, Eco Mobility expanded its corporate car rental services to 10 new cities across India, meeting the increasing demand for business mobility solutions.

Conclusion

The global car rental market is on a strong growth trajectory, driven by expanding travel, car-sharing services, and the adoption of electric vehicles. With increasing competition and evolving consumer preferences, rental companies must focus on innovation, sustainability, and customer experience to remain competitive. As the market continues to evolve, new technologies, emerging markets, and customer-centric services will provide significant opportunities for businesses to capitalize on and expand their presence globally.