Quick Navigation

Overview

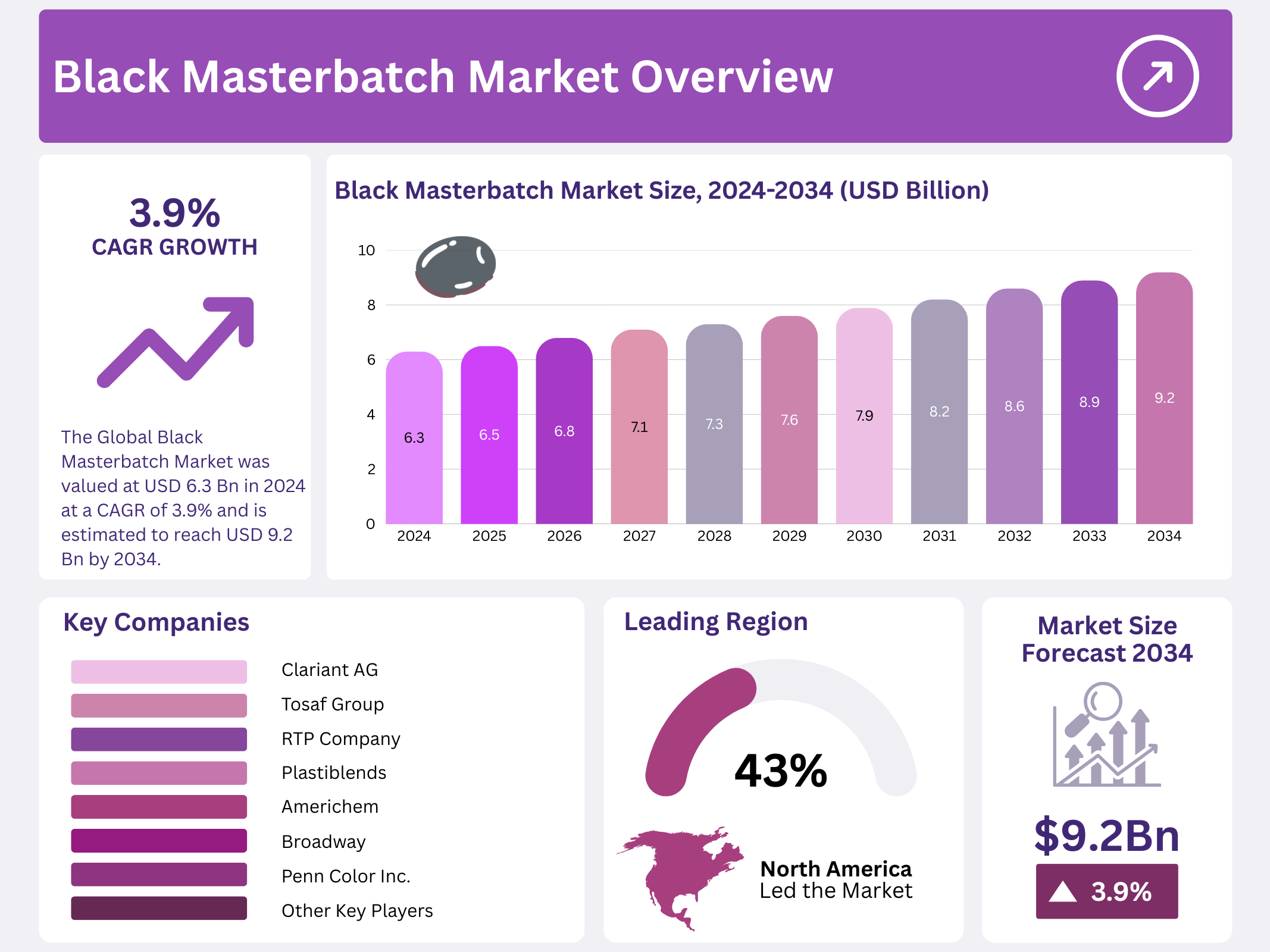

New York, NY – January 05, 2026 – The Global Black Masterbatch Market is expected to reach around USD 9.2 billion by 2034, up from USD 6.3 billion in 2024, growing at a CAGR of 3.9% from 2025 to 2034. Black masterbatch is a concentrated mixture of carbon black pigment and carrier resins, widely used in the plastics industry to achieve deep black coloration while improving material performance. It offers a cost-effective and efficient way to color plastic products without compromising processing ease or consistency.

Beyond coloration, black masterbatch delivers important functional benefits such as UV protection, heat resistance, enhanced opacity, and improved mechanical and electrical properties. These advantages make plastic products more durable, visually appealing, and suitable for demanding environments. Black masterbatch is extensively used across key industries, including automotive, electronics, construction, packaging, and agriculture, where long product life and reliability are critical.

The market continues to grow steadily due to rising demand for high-performance and UV-resistant plastic products. Manufacturers increasingly rely on black masterbatch to enhance product longevity, aesthetics, and overall quality while keeping production costs under control. Its versatility, combined with consistent demand from multiple end-use sectors, positions black masterbatch as an essential additive in plastics manufacturing, typically containing 15% to 50% carbon black, and supports ongoing market expansion worldwide.

Key Takeaways

- The Global Black Masterbatch Market was valued at USD 6.3 billion in 2024 at a CAGR of 3.9 % and is estimated to reach USD 9.2 billion by 2034.

- Solid accounted for the largest market share of 64.3%.

- Polypropylene (PP) accounted for the majority of the market share at 29.4%.

- Blow Molding accounted for the largest market share at 34.1%.

- Packaging accounted for the majority of the market share at 42.2%.

- North America is estimated as the largest market for Black Masterbatch with a share of 43.4% of the market share.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 6.3 Billion |

| Forecast Revenue (2034) | USD 9.2 Billion |

| CAGR (2025-2034) | 3.9% |

| Segments Covered | By Form (Solid, Liquid), By Polymer Type (Polypropylene (PP), Polyethylene (LDPE, LLDPE, HDPE), Polyvinyl Chloride (PVC), Polyethylene Terephthalate (PET), Polyamide (PA), Acrylonitrile Butadiene Styrene (ABS), Polystyrene (PS), Polyurethane (PUR)), By Application (Blow Molding, Roto Molding, Extrusion, Injection Molding), By End-Use (Packaging (Rigid Packaging, Flexible Packaging), Automotive (Interior, Exterior), Construction (Pipes & Fittings, Doors & Windows, Fences & Fenestrations, Siding), Agriculture, Consumer Goods, Textile, Others) |

| Competitive Landscape | Cabot Corporation, LyondellBasell Industries Holdings B.V., Clariant AG, Avient Corporation, Ampacet Corporation, Plastika Kritis S.A., Hubron International, Tosaf Group, RTP Company, Plastiblends, Blend Colours, Penn Color Inc., Americhem, Broadway, Global Colors Group, Other Key Players |

Key Market Segments

Forms Analysis

Solid Form Dominates the Black Masterbatch Market Due to Broad Industrial Usage

The black masterbatch market is segmented by form into solid and liquid variants. In 2024, the solid segment accounted for a dominant revenue share of 64.3%, reflecting its extensive adoption across multiple industries. Solid black masterbatches are widely used in plastics and packaging applications due to their ease of handling, long shelf life, and stable dispersion characteristics.

They are highly compatible with a wide range of polymers, making them suitable for mass-scale manufacturing. Additionally, solid masterbatches offer cost advantages and consistent color performance, which are critical for producing uniform, high-quality black plastic products across packaging, automotive, and consumer goods sectors.

Polymer Type Analysis

Polypropylene (PP) Leads Market Share Due to Versatility and High Consumption

Based on polymer type, the black masterbatch market is segmented into Polypropylene (PP), Polyethylene, Polyvinyl Chloride (PVC), Polyethylene Terephthalate (PET), Polyamide (PA), Acrylonitrile Butadiene Styrene (ABS), Polystyrene (PS), Polyurethane (PUR), and others.

In 2024, Polypropylene (PP) held a leading market share of 29.4%. This dominance is driven by PP’s excellent balance of cost efficiency, mechanical strength, chemical resistance, and ease of processing. PP is extensively used in packaging, automotive components, textiles, and household products, where black masterbatch enhances color depth, durability, and UV resistance. Its widespread industrial acceptance continues to support strong demand within the black masterbatch market.

Application Analysis

Blow Molding Dominates Due to Efficiency and High-Volume Production Capability

By application, the market is segmented into Blow Molding, Roto Molding, Extrusion, Injection Molding, and others. In 2024, blow molding captured a dominant share of 34.1%. This leadership is attributed to its extensive use in manufacturing hollow plastic products such as bottles, containers, and drums.

Blow molding offers high production efficiency, low material wastage, and the flexibility to produce complex shapes at scale. These advantages make it particularly suitable for industries such as beverages, pharmaceuticals, and consumer goods, where lightweight, durable, and cost-effective packaging solutions are essential.

End-Use Analysis

Packaging Emerges as the Largest End-Use Segment

The black masterbatch market by end use includes Packaging, Automotive, Construction, Agriculture, Consumer Goods, Textile, and others. In 2024, the packaging segment dominated with a substantial market share of 42.2%. This strong position is driven by rising demand for durable, visually appealing, and cost-efficient packaging materials used for food, beverages, and consumer products.

Black masterbatch plays a key role in improving color uniformity, opacity, and UV protection in packaging applications. Furthermore, the expansion of e-commerce, growing focus on sustainable packaging, and increasing need for product differentiation continue to reinforce packaging’s leading position in the market.

Regional Analysis

North America emerged as the leading region in the global Black Masterbatch market, accounting for 43.4% of the total market share. This dominance is primarily driven by strong demand from major end-use industries, including automotive, electronics, packaging, and construction. The region’s advanced manufacturing infrastructure and continuous technological advancements enable manufacturers to adopt high-performance black masterbatch solutions that deliver both functional benefits and enhanced visual appeal.

The automotive industry represents a major demand driver, as black masterbatch is widely used in producing durable and aesthetically refined vehicle components such as bumpers, dashboards, trims, and interior panels. The growing preference for sleek, modern vehicle designs further strengthens its adoption across automotive applications. North America also maintains a strong position in the electronics sector, supported by ongoing innovation and rising consumption of consumer electronics. Black masterbatch is commonly used in electronic housings, casings, and display components, where it provides UV resistance, mechanical strength, and premium surface finishes.

Top Use Cases

- Packaging Films & Bags: Black masterbatch is widely used to give plastic packaging a deep black color while strengthening the material. It improves resistance to sunlight and everyday wear, making bags and films more durable. This helps products stay protected during storage and transport, enhancing both appearance and functional performance for packaging manufacturers.

- Agricultural Mulch & Greenhouse Films: In agriculture, black masterbatch is added to mulch films and greenhouse covers. It provides consistent coloring and protects the plastic from UV damage caused by sunlight. The improved strength and stability help the films last longer outdoors, supporting better crop protection and weed control, which makes farming operations more reliable and cost-efficient.

- Pipes & Fittings: Black masterbatch is commonly used in manufacturing plastic pipes and fittings for water supply, drainage, and irrigation. The coloration helps block UV rays, reducing cracking and degradation when exposed to sunlight. This improves long-term performance and reliability of pipes in outdoor environments, making them a preferred choice for construction and agriculture sectors.

- Cables & Wire Insulation: In wire and cable production, black masterbatch is blended into the insulation material. This gives cables a uniform black color while boosting resistance to sunlight and environmental stress. It helps protect internal electrical components and extends the lifespan of cables used in outdoor and industrial settings, enhancing safety and durability.

- Automotive Interior & Exterior Parts: Automotive manufacturers use black masterbatch in dashboards, trims, bumpers, and other plastic components. It ensures a consistent black finish and improves resistance to heat, UV exposure, and wear. This leads to better visual appeal and longer life of interior and exterior parts, meeting the quality needs of vehicle makers and car owners alike.

Recent Developments

Cabot Corporation

- In October 2024, Cabot Corporation launched the ENHANCE MB Masterbatch series, focusing on performance and sustainability for flexible packaging. This launch followed their 2023 acquisition of Shenzhen Sanshun Industrial New Materials Co., Ltd., significantly expanding their black masterbatch capacity and technical capabilities in Asia-Pacific. The new series aims to improve recyclability in polyolefin films.

Clariant AG

- Clariant focuses on sustainable solutions with its PV Fast Black and Hydrocerol product lines for black masterbatches. Recent developments highlight concentrates that enhance the mechanical recycling of plastics by improving sorting through near-infrared (NIR) detection. They also continue to innovate in carbon black alternatives, responding to industry demand for more sustainable pigments in masterbatches for various applications.

Avient Corporation

- Avient has strengthened its black masterbatch portfolio through acquisitions, including the 2022 purchase of the assets and business of Magna Colours. Their recent innovations focus on high-performance black concentrates for demanding applications like automotive and agriculture, emphasizing durability and UV protection. They also develop solutions designed to be compatible with advanced recycling processes.

Ampacet Corporation

- Ampacet’s recent work in black masterbatch includes developing solutions for PCR (Post-Consumer Recycled) content applications. Their REC-NIR-B series is engineered for detection by NIR sorting systems, ensuring black-packaged products remain recyclable. They also launched the EcoBlack solution, a carbon black alternative designed to reduce the carbon footprint of black-colored flexible packaging.

Plastika Kritis S.A.

- The Greek manufacturer has expanded its production capacity for black masterbatches and invested in new, advanced twin-screw extrusion lines to enhance product quality and consistency. Their recent developments target the agricultural film and packaging sectors in the EMEA region, focusing on solutions that offer excellent dispersion, weathering resistance, and compatibility with sustainability directives.

Conclusion

Black masterbatch is a vital additive in the plastics industry that enhances product appearance, durability, and performance. By improving color consistency and protecting against sunlight and environmental stress, it enables plastic products to withstand tougher conditions over time. Across packaging, agriculture, construction, and automotive sectors, black masterbatch supports stronger, longer-lasting materials in everyday applications.