Quick Navigation

Overview

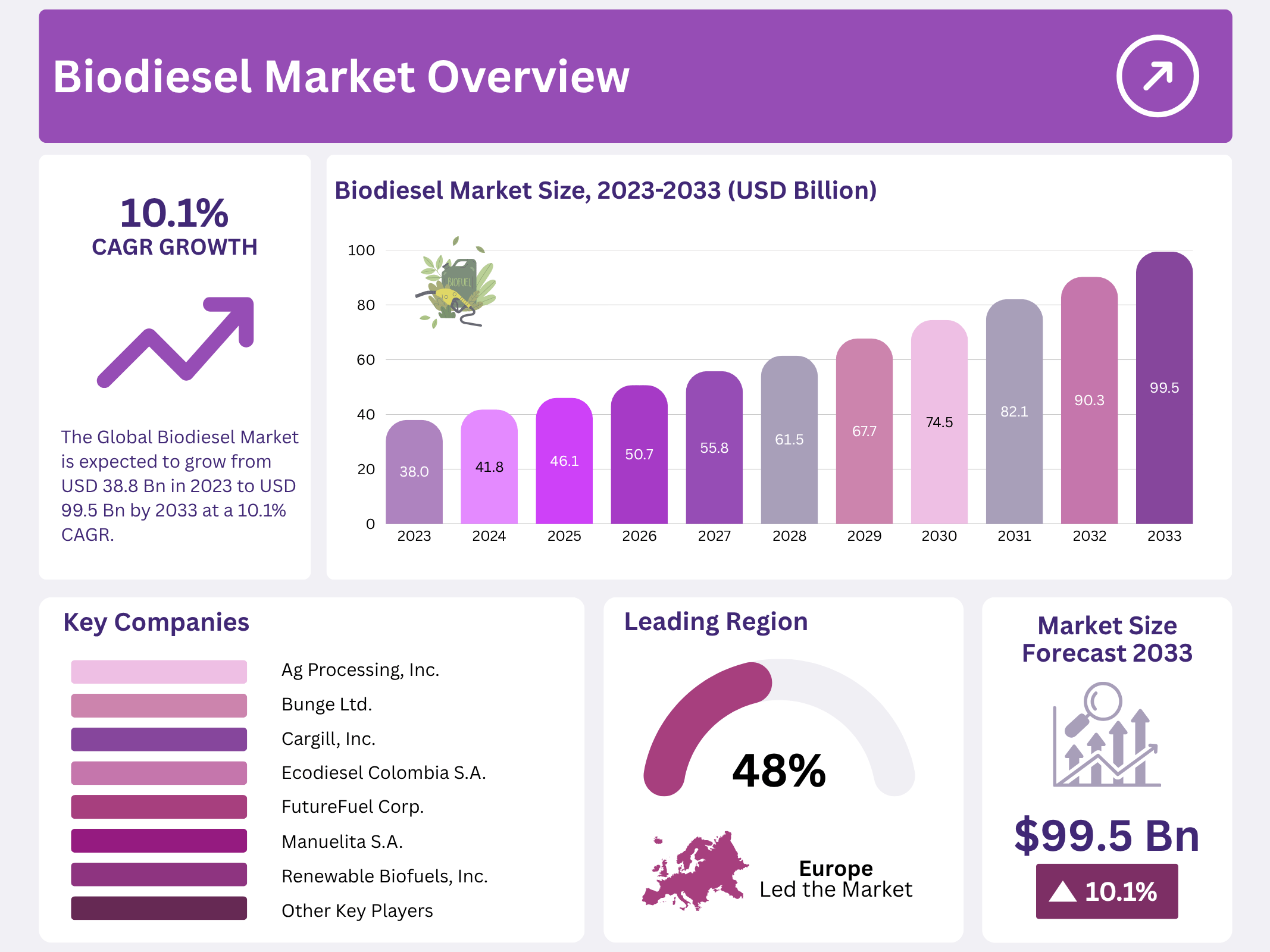

New York, NY – October 20, 2025 – The Global Biodiesel Market is projected to reach USD 99.5 billion by 2033, up from USD 38.8 billion in 2023, growing at a CAGR of 10.1% between 2023 and 2033. This strong growth reflects the rising global demand for renewable, cleaner fuel alternatives amid efforts to cut greenhouse gas emissions and reduce dependence on fossil fuels. Governments and industries alike are promoting biodiesel use as part of decarbonization strategies in the energy and transportation sectors.

Biodiesel substitute fuels are gaining popularity as they are renewable, clean-burning, and can be used in existing diesel engines without modification. These fuels are derived from vegetable oils, animal fats, and agricultural feedstocks, offering an eco-friendly solution with minimal infrastructure changes. Their versatility and ease of adoption make them a cost-effective and sustainable option for countries seeking to transition toward low-carbon energy systems.

The biodiesel market’s expansion is also fueled by its growing adoption in automotive and power generation applications. Numerous local and regional suppliers operate in this space, resulting in a highly fragmented marketplace that fosters competition and innovation. As policies encouraging biofuel blending intensify and technological advances improve production efficiency, biodiesel is expected to play a major role in the global renewable fuel landscape over the coming decade.

Key Takeaways

- The Global Biodiesel Market is expected to grow from USD 38.8 billion in 2023 to USD 99.5 billion by 2033 at a 10.1% CAGR.

- Vegetable oil, primarily palm oil, held over 72% of the feedstock market share in 2023.

- Indonesia and Thailand supplied over 80% of global palm oil for biodiesel, mainly for European imports.

- Fuel applications dominated in 2023, accounting for over 60% of the biodiesel market share.

- Europe led the global biodiesel market in 2023 with a 48% share, driven by biofuel policies.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 38.0 Billion |

| Forecast Revenue (2033) | USD 99.5 Billion |

| CAGR (2024-2033) | 10.1% |

| Segments Covered | By Feedstock (Vegetable Oils and Animal Fats), By Application (Fuel, Marine, Automotive, Power Generation, Agriculture, and Other Applications) |

| Competitive Landscape | Ag Processing, Inc., Archer Daniels Midland Company (ADM), Bunge Ltd., Cargill, Inc., Eco Diesel Colombia S.A., FutureFuel Corp., Manuelita S.A., Renewable Biofuels, Inc., TerraVia Holdings, Inc., Wilmar International Ltd. |

Key Market Segments

Feedstock Analysis

In 2023, vegetable oil dominated the feedstock market, capturing over 72% of the market share, making it the primary ingredient in production processes. It was the leading contributor to revenue, though its availability and costs vary by region. Palm oil, widely used for biodiesel production, is particularly prominent in countries like Indonesia and Thailand. These two nations accounted for over 80% of global palm oil production, supplying the majority of feedstock imported by European countries for biofuel production.

Application Analysis

In 2023, fuel applications held a dominant position, representing over 60% of the market share and generating significant revenue. Biofuel, emitting fewer volatile organic compounds (VOCs) than traditional diesel, offers substantial benefits to the industry. The marine sector is expected to increasingly adopt this product, with its demand projected to grow at a robust compound annual growth rate (CAGR) through the forecast period. Additionally, rising agricultural mechanization is anticipated to further boost demand.

Regional Analysis

In 2023, Europe held a 48% share of the global biodiesel market, driven by its early adoption of bio-based fuels and government policies prioritizing the replacement of carbon-emitting energy sources. Europe has consistently been the largest biodiesel market, with Germany leading in feedstock production, boosting regional demand.

The Asia-Pacific region is projected to experience significant growth in biodiesel consumption from 2023 to 2032, with Thailand emerging as a key market due to increasing demand for diesel-powered vehicles. Rising production is expected to drive global market growth during this period. However, competition for palm oil from the food industry may constrain expansion. Government initiatives promoting green fuels and reduced reliance on crude oil will continue to support market growth.

Top Use Cases

- Transportation Fuel: Biodiesel serves as a clean drop-in alternative for diesel engines in cars, trucks, and buses, blending easily with regular diesel without needing engine changes. It cuts harmful tailpipe smoke and helps fleets meet green rules, making it ideal for busy city transport where air quality matters. This use boosts fuel options while supporting local economies through farm-based feedstocks.

- Heating Oil: In homes and buildings, biodiesel blends replace traditional oil for boilers, warming spaces with less soot and easier cleanup. It’s a smart switch for colder regions, as it burns steadily and fits existing heaters. This application eases the shift to renewables, cutting winter fuel worries and promoting cozy, eco-friendly living without big upgrades.

- Agricultural Machinery: Farmers power tractors and harvesters with biodiesel made from crop leftovers like soybean oil, creating a full-circle system where fields fuel the tools that tend them. It keeps rural work running smoothly, lowers exhaust risks near crops, and ties agriculture to green energy trends, helping sustain food production with a lighter environmental touch.

- Railway Engines: Trains run on biodiesel mixes to haul goods and passengers over long routes, slashing rail emissions and noise in key corridors. It’s a reliable choice for heavy-duty lines, blending with diesel for steady performance. This use expands rail’s green appeal, easing cargo shifts from roads and supporting efficient, low-impact logistics networks.

- Industrial Equipment: Factories use biodiesel in generators and heavy machines for steady power, especially in remote sites where clean fuel cuts downtime from clogs. It handles tough jobs like mining or construction with fewer spills and odors. This application fits growing needs for sustainable operations, helping industries meet safety standards while powering progress.

Recent Developments

1. Ag Processing, Inc. (AGP)

AGP is expanding its biodiesel production capacity and integrating renewable diesel feedstocks. A major project at its St. Joseph, MO facility aims to increase output and improve feedstock flexibility to process a wider variety of lower-carbon intensity oils. This underscores their commitment to growing their renewable fuels platform and meeting the rising demand for cleaner energy sources in the agricultural sector.

2. Archer Daniels Midland Company (ADM)

ADM is strategically pivoting its biofuel investments towards renewable diesel. While remaining a major biodiesel player, the company is focusing on sustainable aviation fuel (SAF) and renewable diesel partnerships, such as its planned project with Marathon Petroleum. This shift leverages ADM’s oilseed processing strength to produce low-carbon feedstocks, positioning them at the forefront of the next generation of biofuels beyond traditional biodiesel.

3. Bunge Ltd.

Bunge is expanding its integrated value chain for renewable fuels through its merger with Viterra. This creates a larger global network for sourcing and processing oilseeds. Bunge is also partnering with Chevron to produce renewable feedstocks, directly supplying the growing renewable diesel sector. This positions Bunge as a key supplier of lower-carbon intensity feedstocks for both biodiesel and renewable diesel production.

4. Cargill, Inc.

Cargill is investing heavily in the renewable fuels ecosystem, focusing on feedstock innovation and supply. Recent developments include expanding its soybean processing capacity in the U.S. to meet demand for biofuel feedstocks. Cargill is also exploring new lower-carbon oils, such as from canola, and partnering with clean tech firms to advance the production of sustainable aviation fuel (SAF), which often uses similar feedstocks as biodiesel.

5. Ecodiesel Colombia S.A.

Ecodiesel Colombia, a key player in South America, continues to focus on producing biodiesel from palm oil. Recent developments likely involve adhering to national biodiesel blending mandates and pursuing sustainability certifications for their palm oil feedstock. Their operations are central to Colombia’s strategy of replacing fossil fuels in the transportation sector, emphasizing the regional importance of biodiesel in reducing emissions and promoting energy independence.

Conclusion

Biodiesel as a bright spot in the shift to greener energy, blending everyday needs with planet-friendly gains. It turns simple farm and waste materials into versatile fuel that fits right into our current setups, easing worries over dirty air and scarce resources. With smarter ways to make it and stronger pushes from rules that favor clean choices, biodiesel promises wider reach in daily life—from roads to factories. Its real strength lies in building a loop where what we grow and toss becomes power we trust, paving a smoother path to a balanced, forward-looking energy world without leaning too hard on old habits.