Quick Navigation

Overview

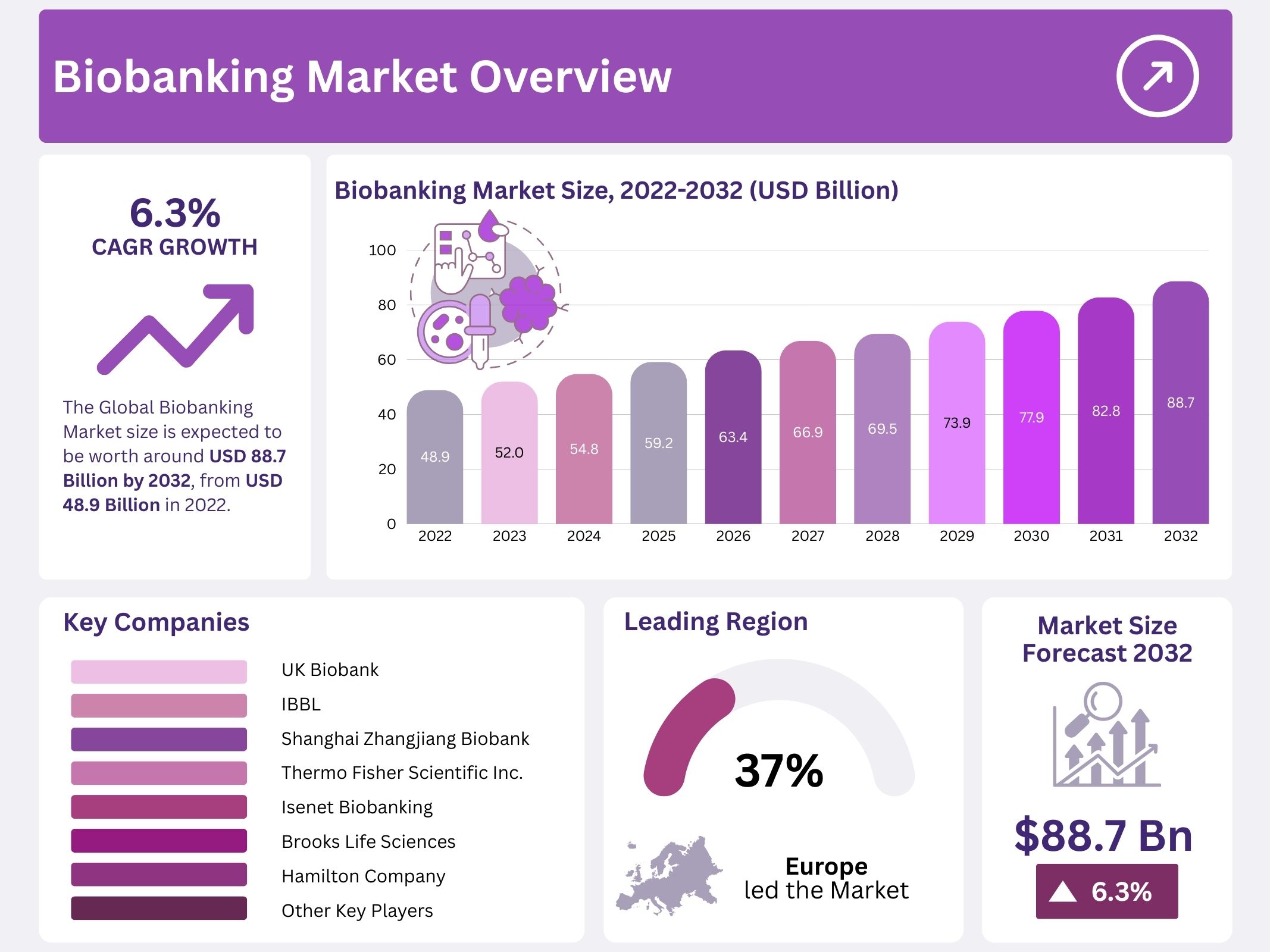

The Global Biobanking Market is projected to reach USD 88.7 billion by 2032, growing at a compound annual growth rate (CAGR) of 6.3% from USD 48.9 billion in 2022. Several factors contribute to this market expansion, with technological advancements and the growing demand for personalized medicine playing crucial roles. These advancements enable biobanks to support research in precision medicine, drug development, and disease prevention.

One of the most significant drivers of market growth is the rapid progress in biotechnology and genomics. Technologies such as next-generation sequencing (NGS) allow for detailed analysis of biological samples. This, in turn, supports precision medicine and targeted therapies by providing better insights into genetic data. As these technologies become more affordable and accessible, biobanks are able to store and process vast amounts of genetic information, further advancing medical research and treatment options.

Personalized medicine is another factor fueling the demand for biobank services. Personalized treatment approaches require detailed molecular data to tailor healthcare solutions to individual patients. Biobanks store these biological samples, which are essential for developing custom treatments. As the pharmaceutical industry increasingly invests in personalized medicine, the demand for diverse, well-maintained biobanks continues to rise. This growing need is expected to drive further market expansion.

Investment from both the public and private sectors also supports the growth of biobanks. Governments, academic institutions, and private enterprises are funding large-scale biobank initiatives like the UK Biobank and the U.S. All of Us Research Program. These investments facilitate the development of new treatments and improve public health outcomes. Additionally, private sector investments, particularly from pharmaceutical companies, contribute to identifying biomarkers and therapeutic targets, accelerating research and development in the healthcare industry.

Technological and Collaborative Advances in Biobanks

Technological advancements are also enhancing the efficiency of biobanks. Innovations in sample storage and management, such as automation, cloud computing, and advanced inventory systems, are improving biobank operations. These technologies ensure that biological samples remain accessible and intact over time, which is critical for long-term studies. Moreover, advancements in cryopreservation techniques help preserve sensitive biological materials, such as stem cells, ensuring their viability for future research.

The expansion of collaborative research initiatives is another important factor driving the biobanking market. Biobanks provide researchers with access to standardized, high-quality biological samples, which enables global collaborations. These partnerships, often involving multiple institutions and countries, are crucial for scientific progress. By offering access to diverse populations and rare disease samples, biobanks are becoming key players in accelerating discoveries in areas such as genetics, epidemiology, and clinical research.

Regulatory support and ethical frameworks are evolving to ensure biobank operations are compliant with privacy laws, such as the General Data Protection Regulation (GDPR) in Europe. This regulatory clarity fosters public trust in biobanks, ensuring ethical collection, storage, and use of biological samples. Ethical standards and transparency in biobank operations encourage greater participation and support from the public, further promoting market growth.

Finally, global healthcare challenges, such as the rising prevalence of chronic diseases and emerging infections like COVID-19, highlight the critical role of biobanks in medical research. Biobanks help identify risk factors, biomarkers, and therapeutic targets, contributing to the development of preventive measures and treatments. As healthcare systems worldwide strive to address these challenges, the demand for biobank services is expected to continue growing, cementing the industry’s central role in advancing healthcare.

Key Takeaways

- Market Growth: The biobanking market is projected to reach USD 88.7 billion by 2032, driven by a compound annual growth rate (CAGR) of 6.3% from 2022.

- Health Challenges: The rise in untreatable diseases is driving an increase in biobank sample collection to support future medical research and therapeutic development.

- R&D Investments: Rising investments in healthcare and research are accelerating market growth, contributing to the expansion of biobank infrastructure and capabilities.

- Equipment Dominance: Biobanking equipment, especially for sample storage, leads the market due to the growing demand for secure, long-term preservation solutions.

- Blood Sample Demand: Blood samples, prized for their DNA and RNA content, are predominantly used in non-cancer research applications, fueling increased demand in biobanks.

- Life Sciences Lead: Life science applications continue to drive the biobanking market, with significant contributions from research in genetics, pharmacology, and disease biology.

- Sustainability Focus: Biobanks are increasingly prioritizing sustainability, ensuring long-term funding and stability while meeting market demands for ethical and environmentally-conscious practices.

- European Leadership: Europe remains the global leader in the biobanking market, supported by established infrastructure, advanced research networks, and robust biobank operations.

Regional Analysis

Europe holds the dominant position in the global biobanking market, with a significant revenue share of 32.5%. This dominance can be attributed to well-established biobanks in Nordic countries such as Sweden, Denmark, and Norway. For example, approximately 40% of Iceland’s population has contributed DNA to biobanks, which are securely stored. The continuous contributions and sample availability are driving the market growth in Europe. The pharmaceutical industry’s ongoing research and development (R&D) efforts also support this growth, further cementing Europe’s market leadership.

North America ranks second in the global biobanking market, with its strong presence in clinical trials conducted by research institutions and pharmaceutical companies. Additionally, technological advancements have led to the rise of virtual biobanks, increasing efficiency and accessibility. The region benefits from continuous investments in biobank infrastructure, enhancing its market potential. These factors contribute to North America’s steady position in the market, making it a key player in global biobanking growth over the forecast period.

In contrast, the Asia-Pacific region is expected to experience the highest compound annual growth rate (CAGR) during the forecast period. This growth is driven by rising investments in well-established biobanks and increased sales of blood and cell samples for research purposes. However, regions such as the Middle East & Africa, and Latin America, are likely to see slower growth due to lower investments and ethical concerns regarding biobank management. These challenges hinder the market development in these regions, limiting their contribution to the global biobanking industry.

Segmentation Analysis

The Global Biobanking Market is primarily segmented into consumables, equipment, and software & services. Among these, the equipment category is expected to dominate the market. This is driven by the increasing demand for biobanking devices, as the number of biobanks and bio-samples requiring storage continues to rise. Biobank equipment is crucial for preserving samples efficiently, ensuring long-term viability for research and clinical use, particularly with the growing number of biological samples being stored globally.

In terms of sample storage, the blood segment holds the largest market share. Blood samples are essential due to their high RNA and DNA content, which are vital for research activities. The increasing prevalence of infectious diseases and the rising need for blood sample collection, storage, and distribution are fueling the demand. Furthermore, academic medical institutions and pharmaceutical companies are the primary users of blood samples. Blood is used extensively in non-cancerous research, constituting 85% of the demand within the industry.

The life sciences sector leads the biobanking market, driven by the rising need for sample distribution to pharmaceutical R&D and academic institutions. Scientists’ demand for diverse bio-specimens to tackle complex diseases, such as cancer and Alzheimer’s, is expanding. Additionally, regenerative medicine is anticipated to grow rapidly in the coming years, particularly in clinical trials. The sector is heavily reliant on biobank samples for advancing personalized medicine and therapeutic solutions. Consequently, the regenerative medicine market is expected to see a significant increase in demand for biobank samples.

Key Players Analysis

The global biobanking market is consolidated, with several prominent players supporting its growth. Biobanks are classified into various types, such as population-based, disease-specific, and cell-specific banks. Biobank Graz, a publicly-funded biobank, has approximately 20 million samples in its collection, which are distributed to academic institutions worldwide. It utilizes automation technology for sample distribution, positioning itself as a major biomedical research center. The global market is also supported by biobanks with extensive storage and distribution strategies, which further contribute to its expansion.

Key players like Promega Corporation, Qiagen N.V., Bay Biosciences LLC, and VWR Corporation lead the biobanking sector with innovative solutions. Other notable companies in the market include Biokryo GmbH, TTP Labtech Ltd, and Merck KGaA. These organizations provide cutting-edge technology and services for sample storage and distribution, enabling advancements in biomedical research. With their strategic investments, they continue to expand the biobanking infrastructure globally, enhancing market reach and operational capabilities.

Major biobank players such as UK Biobank, IBBL, and Shanghai Zhangjiang Biobank play significant roles in shaping the market landscape. Additionally, companies like Thermo Fisher Scientific Inc. and Brooks Life Sciences provide essential biobanking services. The market is further supported by key players like Hamilton Company, ASKION, and Isenet Biobanking. These companies contribute to the expansion of biobanking infrastructure, pushing the market forward by increasing sample storage capacities and improving distribution strategies.

Market Key Players

- UK Biobank

- IBBL

- Shanghai Zhangjiang Biobank

- Thermo Fisher Scientific Inc.

- Isenet Biobanking

- Brooks Life Sciences

- Hamilton Company

- ASKION

- Other Key Players.

Conclusion

In conclusion, the global biobanking market is experiencing significant growth, driven by advancements in biotechnology, genomics, and personalized medicine. The increasing demand for precision healthcare and the rising need for diverse biological samples to support research in drug development, disease prevention, and treatment options further accelerate this growth. Technological innovations in sample storage and management, coupled with strong investments from both public and private sectors, are enhancing biobank efficiency and accessibility. The market’s future is promising, with continued expansion in key regions like Europe, North America, and Asia-Pacific, positioning biobanks as crucial players in advancing global healthcare and medical research.

Get in Touch with Us:

Market.us (Powered By Prudour Pvt. Ltd.)

Address: 420 Lexington Avenue, Suite 300, New York City, NY 10170, United States.

Contact No: +1 718 874 1545 (International), +91 78878 22626 (Asia).

Email: [email protected]

View More

Biomaterials Market || Biohacking Market || Biosensors Market || Biotechnology Market || Biopharmaceuticals Market || Biosimulation Market || Biodefense Market || Bioinformatics Services Market || Bioprosthetics Market || Biopreservation Market || Biophotonics Market