Quick Navigation

Overview

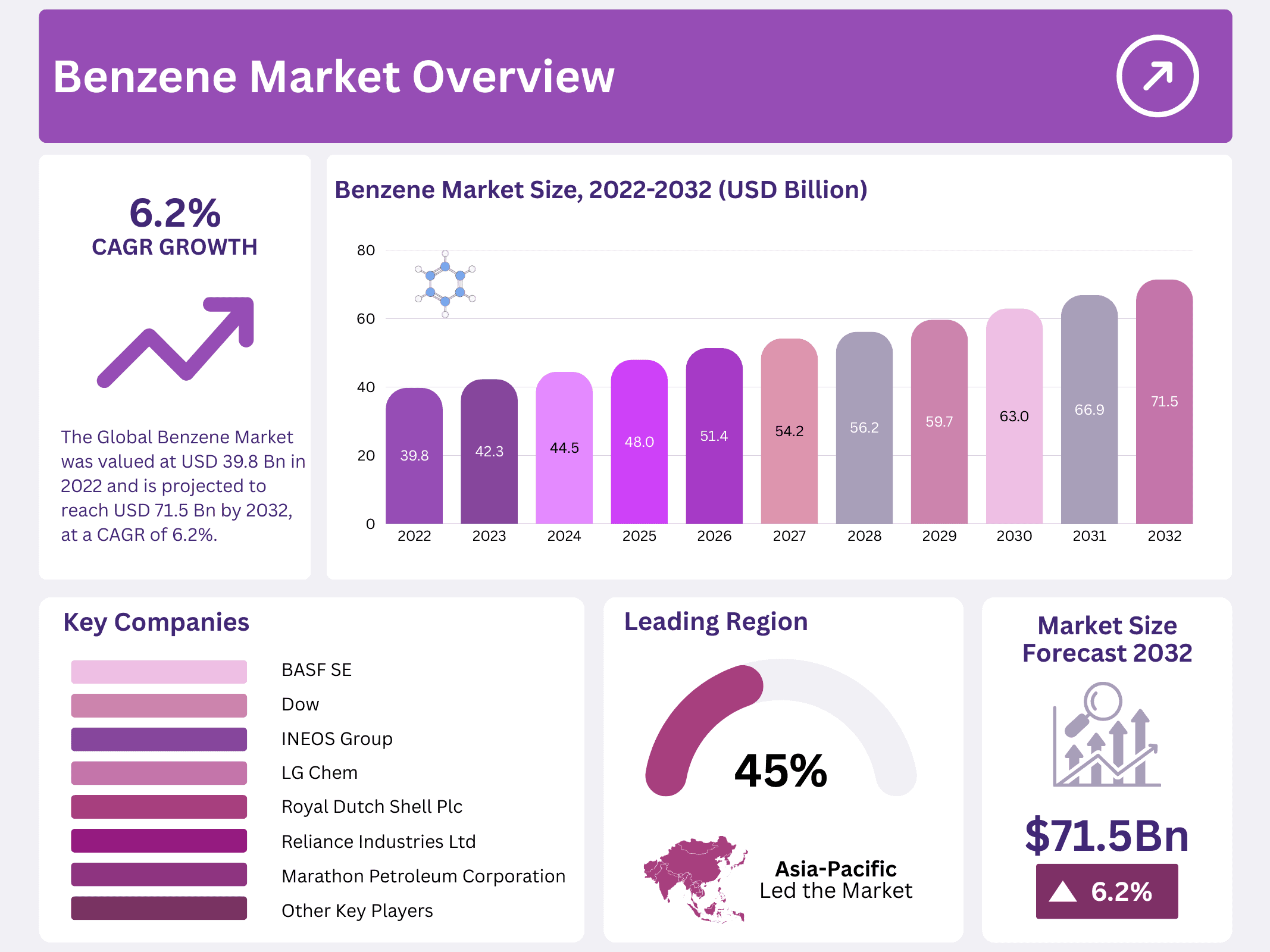

New York, NY – February 05, 2026 – The Global Benzene Market was valued at USD 39.8 billion in 2022 and is projected to reach USD 71.5 billion by 2032, reflecting a steady CAGR of 6.2% from 2023 to 2032. This growth outlook highlights the expanding role of benzene across major industrial applications and the rising importance of downstream chemical sectors that rely heavily on benzene derivatives.

Benzene is a colorless, highly flammable liquid used extensively as a fundamental feedstock within the chemical industry. It serves as a key starting material for producing a wide array of essential products, including rubber, synthetic fibers, plastics, pharmaceuticals, and detergents. Its versatility and broad industrial relevance make benzene one of the most critical petrochemical intermediates in global manufacturing.

Market dynamics are closely tied to the overall health of the global chemical industry, along with shifts in demand-supply patterns. Benzene prices remain notably volatile due to influences such as fluctuations in crude oil and natural gas prices, geopolitical developments, and changes in production or consumption levels. These factors collectively shape the short- and long-term performance of the benzene market.

Key Takeaways

- The Global Benzene Market was valued at USD 39.8 billion in 2022 and is projected to reach USD 71.5 billion by 2032, at a CAGR of 6.2% from 2023 to 2032.

- Ethylbenzene remains the dominant derivative segment throughout the forecast period, primarily used to manufacture styrene for plastics, resins, and synthetic rubber.

- Catalytic reforming leads the manufacturing processes with a 49% revenue share, making it the most influential production method.

- Major applications of benzene include plastics, solvents, chemical intermediates, surfactants, rubber manufacturing, detergents, and lubricants.

- The Asia-Pacific region plays a critical role, accounting for 45% of global chemical manufacturing in 2021.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 39.8 Billion |

| Forecast Revenue (2032) | USD 71.5 Billion |

| CAGR (2023-2032) | 6.2% |

| Segments Covered | By Derivative-Ethylbenzene, Cumene, Alkylbenzene, Cyclohexane, Nitrobenzene, and Other Derivatives; By Manufacturing Process-Catalytic Reforming, Toluene Disproportionation, Toluene Hydrodealkylation, Pyrolysis, Steam Cracking of Naphtha, and From Biomass; By Application-Plastics, Solvent, Chemical Intermediates, Surfactants, Rubber Manufacturing, Detergents, Explosives, Lubricants, Pesticides, and Other Applications; By End-user Industries-Packaging, Pharmaceuticals, Agriculture, Constructions, Textiles, and Other End-User Industries |

| Competitive Landscape | The Dow Chemical Company, BASF SE, INEOS Oxide, Shell Plc., Adeka Corporation, Huntsman International LLC., LyondellBasell Industries, Archer Daniels Midland Company, Global Bio-Chem Technology Group Co., Ltd., DuPont Tate & Lyle Bio Products LLC, Temix International S.R.L., Other Key Players |

Key Market Segments

By Derivative Analysis

Based on derivatives, the global benzene market is segmented into ethylbenzene, cumene, alkylbenzene, cyclohexane, nitrobenzene, and other derivative categories. Ethylbenzene remains the dominant segment throughout the forecast period. This derivative is a clear liquid primarily utilized in manufacturing styrene, a key building block for plastics, resins, and synthetic rubber used across automotive, packaging, and consumer goods industries.

The cumene segment is projected to witness the fastest growth, supported by rising phenol and acetone production. Cumene, also a colorless liquid, is an essential intermediate in the production of these chemicals, which further serve applications in adhesives, laminates, pharmaceuticals, and plastics.

Alkylbenzenes serve as a critical raw material for detergents and surfactants, widely deployed in industrial cleaning, personal care products, and household detergents. Nitrobenzene, a pale-yellow compound, acts as a precursor to aniline, which is extensively used in the manufacture of dyes, pharmaceuticals, and several specialty chemicals.

By Manufacturing Process Analysis

The benzene market is segmented by manufacturing processes such as catalytic reforming, toluene disproportionation, toluene hydrodealkylation, pyrolysis, steam cracking of naphtha, and biomass-based production. Catalytic reforming leads the market with a 49% revenue share, making it the most influential segment.

Catalytic reforming converts hydrocarbon feedstocks into high-octane aromatic compounds, including benzene, making it central to the refining and petrochemicals landscape. Toluene disproportionation allows the conversion of toluene into benzene and xylenes, improving output efficiency.

Pyrolysis, another key process, breaks down larger organic molecules into simpler compounds. In benzene production, this method involves heating petroleum feedstock at high temperatures in an oxygen-free environment. Steam cracking of naphtha and emerging biomass-derived routes also contribute to the expanding production base of benzene.

By Application Analysis

Benzene finds extensive use across numerous applications, including plastics, solvents, chemical intermediates, surfactants, rubber manufacturing, detergents, explosives, lubricants, pesticides, and other industrial fields. It is a core feedstock in the production of widely used plastics such as ABS, nylon, and polystyrene. As a solvent, benzene enables the processing of resins, oils, and waxes in multiple industries.

Surfactants derived from benzene, such as alkylbenzene sulfonates, are essential components of cleaning agents and household detergents. Alkylbenzenes also serve as base oils in lubricants and motor oils. Several adhesives, coatings, fragrances, and specialty chemicals depend on benzene-derived intermediates, reinforcing its importance in both industrial and consumer product markets.

By End User Analysis

Key end-user industries in the benzene market include packaging, pharmaceuticals, agriculture, construction, textiles, and several other sectors. Benzene-derived polymers like polystyrene and ABS are widely used in packaging applications, ranging from food containers to consumer product packaging.

The pharmaceutical industry relies heavily on benzene derivatives such as phenol for drug manufacturing. In agriculture, benzene-based intermediates support the production of herbicides and pesticides used to safeguard crop yields. The construction sector utilizes benzene-derived chemicals in insulation materials, coatings, adhesives, and sealants.

Regional Analysis

The rising demand from key end-use industries—such as chemicals, packaging, automotive, and pharmaceuticals—continues to strongly support benzene market expansion. The International Institute for Sustainable Development reports that the Asia-Pacific region accounted for 45% of global chemical manufacturing in 2021, highlighting its critical role in global supply chains.

Across the Asia-Pacific, countries like China, India, South Korea, and Japan remain both major producers and high-volume consumers of benzene. China stands out as the leading consumer, recording USD 2,785,449 in benzene imports, while South Korea emerged as one of the largest exporters, reaching USD 2,254,945 in exports in 2021.

China’s growing dependence on benzene is closely linked to its expanding automotive and construction sectors. Benzene and its derivatives are widely used in coatings, paints, adhesives, and flooring materials. As reported by the National Bureau of Statistics of China, the country’s construction industry achieved an output value of approximately USD 4,091 billion in 2021, underscoring the scale of industrial activity fueling benzene consumption.

Top Use Cases

- Plastics Production: Benzene acts as a vital ingredient in making styrene, which turns into polystyrene and other plastics for packaging, toys, and electronics. This use drives market growth as companies seek lightweight, cost-effective materials that improve product design and meet rising consumer demands for durable goods in everyday life.

- Synthetic Fibers Manufacturing: By converting to cyclohexane, benzene helps create nylon and polyester fibers used in clothing, carpets, and ropes. Industries value these for their strength and flexibility, boosting demand in fashion and home furnishings markets where versatile textiles enhance comfort and performance in various applications.

- Detergents and Cleaners: Benzene forms the base for surfactants like alkylbenzene sulfonates, essential in household detergents and industrial cleaners. This application supports the cleaning sector by providing effective formulas that tackle dirt easily, appealing to consumers and businesses focused on hygiene and efficiency in daily operations.

- Pharmaceutical Synthesis: Serving as a solvent and starting material, benzene aids in producing drugs and medical compounds for treatments. The healthcare market relies on it for developing reliable medications, fostering innovation in therapies that address health issues and improve patient outcomes across global populations.

- Rubber and Lubricants Creation: Benzene contributes to synthetic rubber and lubricants used in tires, seals, and machinery. Automotive and manufacturing sectors benefit from its role in enhancing durability and smooth operation, driving steady demand for materials that support reliable performance in transportation and industrial equipment.

Recent Developments

1. Dow

- Dow is advancing its circular benzene initiatives, focusing on bio-based and chemically recycled feedstocks. In 2024, they announced a new agreement to secure mass-balanced benzene derived from plastic waste pyrolysis oil for their downstream assets. This supports their goal to transform waste and renewable feedstock into circular chemicals. Their focus is on reducing the carbon footprint of aromatic value chains.

2. INEOS Group

- INEOS has invested in expanding its benzene and derivative capacities at its Antwerp site. A recent key development is the successful commissioning of a new Paraxylene plant in 2023, which is closely integrated with its benzene production. This investment strengthens their integrated aromatic chain in Europe, aiming to meet stable demand despite market volatility, with a focus on efficient, large-scale production.

3. LyondellBasell Industries

- LyondellBasell is progressing its Circulen portfolio for circular chemicals, which includes benzene. They have successfully produced benzene using advanced recycling feedstocks at their European cracker. In 2023, they also completed the sale of their US Gulf Coast ethylene oxide & derivatives business, which included benzene-related assets, to focus on integrated chemical sites.

4. BASF SE

- BASF is researching sustainable benzene production, including projects to produce aromatics from renewable resources. A notable 2024 development is their “ChemCycling” project, which aims to produce benzene from pyrolysis oil derived from mixed plastic waste. They are also working with partners to develop low-carbon “biomass balance” benzene for more sustainable value chains like nylon.

5. Shell plc

- Shell is leveraging its refinery-petrochemical integration to supply benzene. A major recent development is the start-up of its new, larger pyrolysis oil upgrader unit at the Shell Energy and Chemicals Park Singapore in 2023. This unit processes plastic waste into chemical feedstocks, including a potential pathway to circular benzene, supporting their broader chemicals and renewables strategy.

Conclusion

Benzene stands out as a foundational chemical with broad appeal across industries, fueled by its role in essential products like plastics and textiles. The market shows a shift toward regions with expanding manufacturing, emphasizing sustainable methods to align with environmental concerns and evolving consumer expectations for safer, innovative applications.