Quick Navigation

Overview

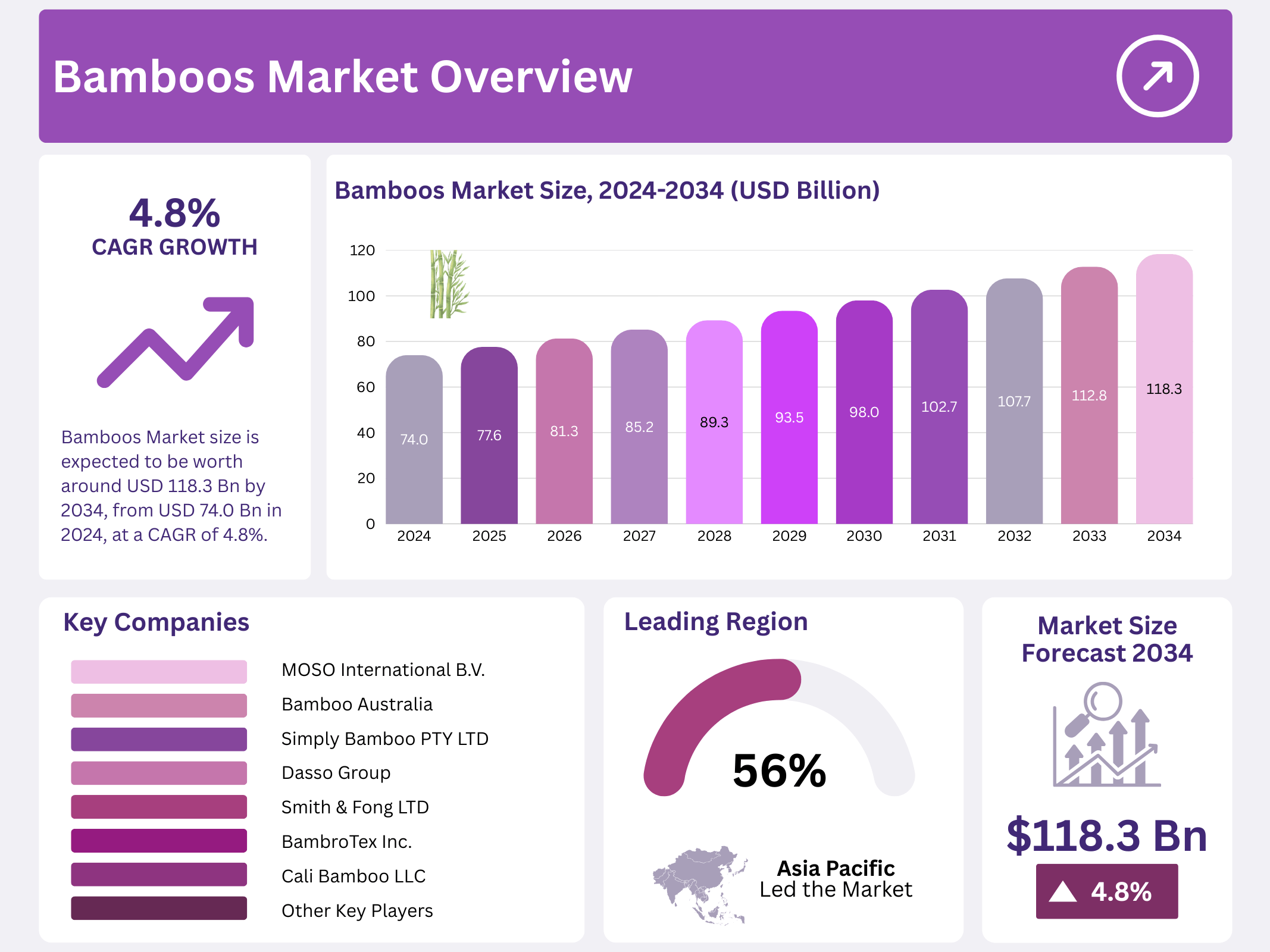

New York, NY – September 12, 2025 – The Global Bamboos Market is poised for steady growth, with its size expected to rise from USD 74.0 billion in 2024 to approximately USD 118.3 billion by 2034, reflecting a compound annual growth rate (CAGR) of 4.8% during the forecast period from 2025 to 2034.

Market growth is fueled by bamboo’s increasing recognition as both an eco-friendly and economically viable resource. Known for its rapid growth, adaptability, and broad range of uses, bamboo has become an essential material across multiple industries, including construction, furniture, textiles, and paper manufacturing. Bamboos belong to the Poaceae (grass) family and are distinguished as woody, perennial, evergreen plants. They thrive in warm, humid climates and are distributed widely across tropical, subtropical, and mild temperate regions.

Globally, bamboo covers a vast ecological range, occurring from 47° S to 50° 30′ N latitude and at altitudes ranging from sea level to 4,300 meters. For optimal growth, bamboo typically requires temperatures between 8°C and 36°C, annual rainfall of at least 1,000 mm, and high atmospheric humidity. Structurally, bamboo resembles trees, with a rhizome-based root system, woody hollow culms, branching nodes, and specialized sheathing organs that support rapid vertical and horizontal expansion.

Globally, bamboo diversity is impressive, with 1,678 species across 123 genera. The highest concentration is found in Asia, particularly along the southern and southeastern regions, stretching from India and China to Japan and Korea. Significant bamboo populations are also present in Africa, Australia, and Madagascar, while in the Western Hemisphere, they extend from the eastern United States down to Chile and Argentina. Notably, South America hosts a rich variety of native bamboo species, contributing to its global importance.

Key Takeaways

- The Global Bamboo Market is projected to grow from USD 74.0 billion in 2024 to USD 118.3 billion by 2034, at a 4.8% CAGR.

- Tropical bamboo leads with over 44.3% market share due to its versatility and sustainability.

- The culm’s method holds a 43.3% market share for its sustainability and efficient regrowth.

- Drip irrigation dominates with a 48.4% share for water efficiency and precise nutrient delivery.

- Bamboo furniture accounts for 29.2% of end-use demand, favored for its strength and eco-friendliness.

- APAC leads with 56.2% market share (USD 41.5 billion), driven by high production and government support.

Analyst Viewpoint

From an investment perspective, the bamboo market offers a promising yet nuanced landscape. This is fueled by increasing demand for sustainable materials in construction, furniture, textiles, and packaging. Consumers are increasingly seeking eco-friendly products, and bamboo’s rapid growth and renewability make it an attractive alternative to traditional materials.

Technological advancements, such as engineered bamboo products, are expanding their applications and market reach. However, investors should be aware of potential risks, including supply chain inconsistencies and competition from alternative materials. Ensuring sustainable harvesting practices and quality control is essential to maintain market credibility and consumer trust.

Consumer insights reveal a strong preference for products that align with environmental values. Bamboo’s versatility and aesthetic appeal have made it popular among eco-conscious consumers. Regulatory environments are increasingly supportive, with governments promoting green building practices and sustainable materials. However, inconsistent regulations and policy ambiguities in some regions can pose challenges.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 74.0 Billion |

| Forecast Revenue (2034) | USD 118.3 Billion |

| CAGR (2025-2034) | 4.8% |

| Segments Covered | By Type (Tropical, Herbaceous, Temperate), By Cultivation Method (Culms, Rhizomes, Seeds, Others), By Irrigation Method (Drip Irrigation, Flood Irrigation, Rainwater Irrigation), By End-Use (Furniture, Scaffolding, Engineered bamboo, Pulp and Paper, Charcoal and Activated Carbon, Handicrafts, Textile, Others) |

| Competitive Landscape | MOSO International B.V., Bamboo Australia, Bamboo Village Company Limited, Shanghai Tenbro Bamboo Textile Co., Ltd, Simply Bamboo PTY LTD, Xiamen HBD Industry & Trade Co., Ltd, Dasso Group, Smith and Fong Limited, ANJI TIANZHEN BAMBOO FLOORING CO. LTD, Fujian HeQiChang Bamboo Product Co., Ltd., BambroTex Inc., Cali Bamboo LLC, Oceans Republic, EcoPlanet Bamboo, Kerala State Bamboo Corporation Ltd (KSBC) |

Key Market Segments

By Type

Tropical bamboo led the market with over 44.3% share, driven by its versatility and sustainability. Its rapid growth, strength, and flexibility make it ideal for construction, furniture, and textiles, especially in humid, high-rainfall regions. Naturally pest- and disease-resistant, it requires minimal chemical treatments, enhancing its eco-friendly appeal. Growing environmental awareness and advancements in cultivation and processing are expected to sustain its dominance, increasing demand in both developed and developing markets.

By Cultivation Method

Culm cultivation dominated with a 43.3% market share, favored for its sustainability and efficiency. Harvesting mature bamboo stalks without harming the root system ensures high-quality output for construction, handicrafts, and furniture. Its cost-effectiveness and alignment with sustainable practices bolster its popularity. As eco-friendly trends grow, culm cultivation is poised to expand, reinforcing its market leadership.

By Irrigation Method

Drip irrigation held a 48.4% share in bamboo cultivation, valued for its water efficiency, precise nutrient delivery, and compatibility with bamboo’s needs. Compared to flood or sprinkler systems, it boosts yield and quality, making it the preferred method. With water scarcity concerns and government subsidies promoting sustainable farming, drip irrigation is set to rise, solidifying its market dominance.

By End-Use

The furniture segment accounted for over 29.2% of bamboo demand, driven by bamboo’s strength, sustainability, and aesthetic appeal. Its fast regrowth and eco-friendly properties make it a popular alternative to traditional wood for flooring, decor, and outdoor furniture. Tightening deforestation regulations, affordable pricing, and innovations like laminated and engineered bamboo are fueling its growth. The furniture industry is expected to continue leading bamboo consumption as brands and consumers prioritize sustainable materials.

Regional Analysis

Asia-Pacific (APAC) leads with a 56.2% share and a USD 41.5 Billion market value.

The Asia-Pacific (APAC) region dominates the global bamboo market, commanding a 56.2% share with a market value of USD 41.5 billion. This leadership stems from robust production, diverse commercial uses, and strong governmental backing for sustainable alternatives to timber and plastic. Eco-conscious consumer trends and rising demand for sustainable materials have boosted bamboo use in APAC, particularly in flooring, furniture, packaging, and textiles.

Emerging exporters like Vietnam and the Philippines leverage low production costs and global trade networks to strengthen their market presence. In Japan and South Korea, premium bamboo products for architecture and lifestyle applications are increasingly popular, enhancing market value. Favorable agro-climatic conditions and a skilled workforce support cost-effective, large-scale production.

APAC is poised to maintain its market dominance throughout the forecast period. The surge in bamboo-based textiles, driven by eco-aware consumers and fashion brands, has created new revenue opportunities. APAC’s combination of abundant natural resources, advanced industrial capabilities, supportive policies, and cultural affinity for bamboo solidifies its position as the global hub for bamboo production and consumption.

Top Use Cases

- Construction and Structural Applications: Bamboo is widely used in construction due to its strength and flexibility. It’s utilized for flooring, roofing, scaffolding, and even entire houses. Its rapid growth and sustainability make it an eco-friendly alternative to traditional building materials.

- Furniture and Handicrafts: Bamboo is crafted into a variety of furniture pieces like chairs, tables, and beds. Its natural aesthetic and durability also make it ideal for handicrafts such as baskets, lampshades, and decorative items.

- Textiles and Fibers: Bamboo fibers are processed into soft, breathable fabrics used in clothing, bedding, and towels. These textiles are known for their antibacterial properties and are a sustainable alternative to conventional fabrics.

- Paper and Pulp: Bamboo is a source for producing paper products, including writing paper, tissues, and toilet paper. Its fast growth rate makes it a renewable resource for the paper industry.

- Food and Beverage Products: Bamboo shoots are consumed as a nutritious vegetable, rich in fiber and low in calories. Additionally, bamboo is used in the production of beverages like bamboo tea and even alcoholic drinks.

Recent Developments

MOSO International B.V.

- MOSO has recently launched X-treme Bamboo Pro, a breakthrough material combining bamboo with polymers for high-load applications. The Dutch company secured contracts to supply this innovative product for European urban infrastructure projects. Their R&D team is pioneering fire-resistant treatments for bamboo construction materials, addressing a key industry challenge.

Bamboo Australia

- The company has expanded its plantation operations in Queensland, responding to growing demand for carbon sequestration projects. They’ve introduced a new line of antibacterial bamboo fabrics for medical applications, partnering with local healthcare providers.

Bamboo Village Company Limited

- This Asian leader has commissioned Asia’s largest automated bamboo processing facility in Vietnam, capable of producing engineered bamboo panels monthly. They’ve signed an MOU with IKEA for sustainable furniture materials and launched a blockchain-based supply chain tracking system.

Shanghai Tenbro Bamboo Textile

- Tenbro patented a new moisture-wicking bamboo fiber blend outperforming cotton in athletic wear. The company secured contracts with three major European sportswear brands and opened a new production facility in Jiangsu Province, doubling its capacity.

Simply Bamboo PTY LTD

- The Australian innovator launched a carbon-negative bamboo flooring line, achieving full Cradle to Cradle certification. Their recent partnership with Bunnings Warehouse expanded distribution nationwide, while their R&D team developed a proprietary anti-scratch coating technology for bamboo surfaces.

Conclusion

The Global Bamboo Market is experiencing significant growth. This surge is driven by increasing demand for sustainable and eco-friendly materials across various industries, including construction, furniture, textiles, and packaging. Bamboo’s rapid growth, renewability, and versatility make it an attractive alternative to traditional materials like wood and plastic. Technological advancements in bamboo processing are enhancing product quality and expanding its applications, while supportive government policies are promoting its cultivation and use.