Quick Navigation

Overview

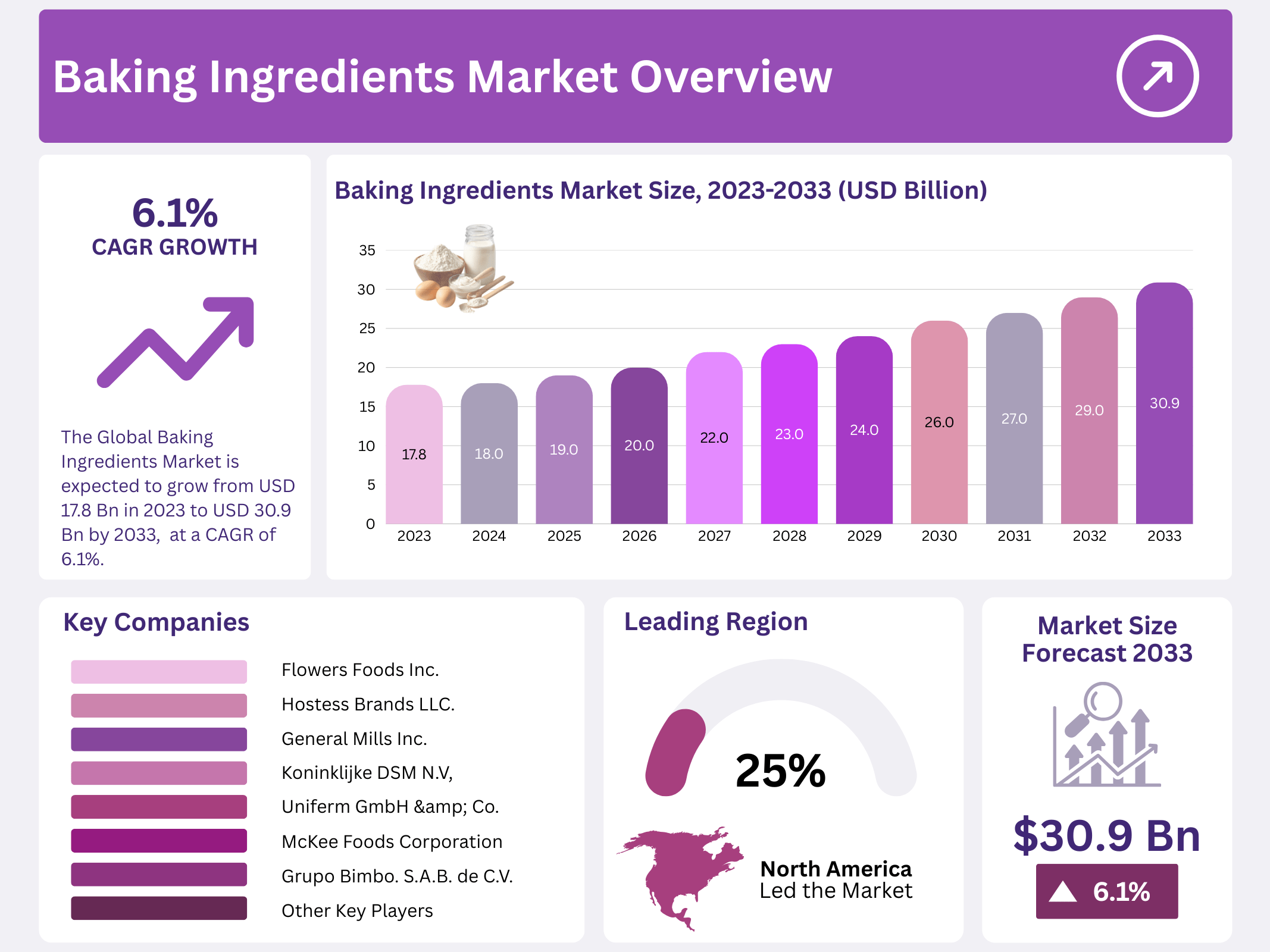

New York, NY – December 16, 2025 – The Global Baking Ingredients Market is set for steady expansion over the coming decade. The market is projected to reach around USD 30.9 billion by 2033, up from USD 17.8 billion in 2023, reflecting a healthy CAGR of 6.1% during the forecast period from 2023 to 2033. This growth highlights the rising importance of baking ingredients across both commercial and home-baking applications worldwide.

One of the main drivers behind this growth is the shift in consumer eating habits. Urban lifestyles, growing preference for convenience foods, and increased consumption of bread, cakes, cookies, and specialty baked items are pushing bakeries to diversify their product offerings. Artisanal and premium baked goods are also gaining popularity, encouraging manufacturers to invest in high-quality and functional baking ingredients.

Additionally, demand for longer shelf-life baked products is supporting market expansion, especially in packaged and ready-to-eat categories. At the same time, consumers are becoming more ingredient-conscious, creating strong demand for natural, clean-label, and minimally processed baking ingredients. This trend is encouraging suppliers to develop innovative formulations that balance shelf stability, taste, and nutritional appeal.

Key Takeaways

- The Global Baking Ingredients Market is expected to grow from USD 17.8 billion in 2023 to USD 30.9 billion by 2033, at a CAGR of 6.1% during 2023–2033.

- BakingPowderandMixes dominate with 46.0% revenue share, driven by convenience and clean-label trends.

- Bread is the leading application segment, holding over 46% market share due to daily staple.

- North America leads regionally with 25.6% revenue share, fueled by demand for processed and packaged bakery items.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 17.2 Billion |

| Forecast Revenue (2033) | USD 30.9 Billion |

| CAGR (2024-2033) | 6.1% |

| Segments Covered | By Product Type (Emulsifiers, Yeast, Enzymes, Baking Powder & Mixes, Oils, Fats, and Shortenings, Colors & Flavors, Starch, Preservatives, Others), By Application (Bread, Cookies and Biscuits, Cakes and Pastries, Rolls and Pies, Other End-Uses) |

| Competitive Landscape | Flowers Foods Inc., Hostess Brands LLC., McKee Foods Corporation, Grupo Bimbo. S.A.B. de C.V., Uniferm GmbH & Co., Koninklijke DSM N.V., General Mills Inc., Associated British Foods Plc., Other Key Players |

Key Market Segments

Product Type Analysis

Baking Powder and Mixes held a leading position in the global baking ingredients market, accounting for about 46.0% of total revenue. These products are widely used as core ingredients in bakery formulations, providing essential carbohydrates, proteins, and vitamins. Growing consumer interest in organic and clean-label foods is further supporting demand, particularly for wheat-based baking powders, which are perceived as healthier options due to their lower saturated fat content and more natural positioning.

Enzymes are expected to emerge as one of the most in-demand ingredient categories during the forecast period, following oils, fats, emulsifiers, and leavening agents. Asia Pacific is anticipated to be the largest consumer of enzymes, supported by rapid expansion in bakery manufacturing and rising consumption of packaged baked goods across the region. Increased focus on process efficiency and product consistency is also encouraging bakeries to adopt enzyme-based solutions.

Other functional ingredients, including leavening agents and emulsifiers, are projected to record steady growth over the forecast period from 2023 to 2032. These ingredients play a critical role in improving flavor, texture, volume, and shelf stability of baked products, making them essential for both industrial and artisanal bakery applications.

Application Analysis

Bread remained the dominant application segment in 2023, capturing more than 46% of the global baking ingredients market share. Its dominance is supported by high daily consumption, affordability, and strong demand across both developed and developing economies. Bread continues to be a staple food, ensuring consistent demand for baking ingredients used in its production.

The popularity of bread is further reinforced by advancements in production technologies that enhance nutritional value while keeping costs low. These innovations are especially important in price-sensitive markets, where affordable and nutritionally improved bread products meet the needs of large consumer populations.

Cakes and pastries represent the fastest-growing application segment for baking ingredients. Rising demand for convenient snack foods, combined with improved cold-chain infrastructure and freezer availability in retail stores, is boosting consumption of frozen pastries, cookies, and related products. Meanwhile, the cookies and biscuits segment is benefiting from food processors expanding and diversifying their product portfolios to tap into the growing demand for indulgent and ready-to-eat bakery items.

Regional Analysis

North America held a leading position in the global baking ingredients market in 2023, accounting for 25.6% of total revenue. This dominance is largely driven by changing consumer lifestyles and strong demand for processed and packaged foods. Bakery products continue to be staple food items across both North America and Europe, supporting consistent consumption of baking ingredients across industrial and retail bakery channels.

At the same time, rapid innovation within the food processing sector is reshaping regional markets. Manufacturers are introducing new packaged and ready-to-eat bakery products that meet growing demand for convenience foods across Europe, North America, and parts of Asia. Improvements in processing technology, shelf-life extension, and product variety are encouraging higher adoption of baking ingredients across these regions.

Asia Pacific is expected to witness the fastest growth in the baking ingredients market over the coming years. As markets in North America and Europe reach maturity, global bakery growth is increasingly shifting toward emerging economies. According to the Indian Bakers Federation, biscuits remain the most consumed bakery product in India, followed by sliced bread, cakes, pastries, and brownies.

Top Use Cases

- Home Baking Convenience: Busy families often turn to baking mixes and simple ingredients like flour and baking powder to whip up quick treats at home. These essentials make it easy for beginners to create fluffy cakes or soft cookies without hassle, fostering a fun, creative outlet for everyday cooking that brings joy to family gatherings and saves time on meal prep.

- Commercial Bread Production: Bakeries rely on versatile flours and leavening agents to craft daily loaves that meet high demand from cafes and stores. These ingredients ensure consistent texture and rise, allowing producers to experiment with whole grains or sourdough styles, keeping shelves stocked with fresh, appealing options that cater to everyday consumer needs for hearty staples.

- Healthy Functional Treats: Consumers seeking wellness choose ingredients like fibers, proteins, and natural grains to bake indulgent yet nutritious goods. This approach lets home bakers and small shops create clean-label muffins or bars that support better digestion and energy, blending taste with health benefits to satisfy the growing call for smarter snacking choices.

- Gluten-Free Innovations: People with dietary needs embrace alternative flours and binders to develop safe, tasty baked items like pies and breads. These ingredients enable inclusive product lines in markets and homes, offering fluffy results without compromise, and helping brands expand their reach to health-conscious shoppers who value variety and accessibility in daily diets.

- Premium Exotic Desserts: Artisanal bakers use specialty sugars, exotic nuts, and emulsifiers to craft luxurious pastries inspired by global flavors. This elevates cafe menus with unique twists like spiced cakes or fruit tarts, drawing in adventure-seeking customers who crave elevated experiences, while encouraging creative experimentation in both professional and hobbyist settings.

Recent Developments

1. Flowers Foods Inc.

Flowers Foods launched its “Spring Into Better Baking” campaign, emphasizing clean-label ingredients and plant-based options under its Nature’s Own brand. They are actively reformulating products to reduce sodium and sugar while expanding keto-friendly and protein-rich bread lines. The company highlights its commitment to simple, sustainable ingredients.

2. Hostess Brands LLC.

Following its acquisition by Smucker’s, Hostess is leveraging its new parent’s supply chain and distribution for ingredient sourcing. Recent focus includes introducing limited-edition seasonal variants and innovating with formats like mini-snacks, which require specific ingredient adjustments for texture and shelf-life. The integration aims to drive cost synergies and product innovation.

3. McKee Foods Corporation

Mckee Foods (maker of Little Debbie) is responding to demand for simpler ingredients by removing high-fructose corn syrup and artificial flavors from many recipes. They are investing in sustainable sourcing initiatives for core ingredients like wheat and oils. Innovation focuses on portion-controlled packs and introducing whole-grain options in their product lines.

4. Grupo Bimbo. S.A.B. de C.V.

Grupo Bimbo is aggressively pursuing its regenerative agriculture goals, sourcing key wheat and corn ingredients from farms using sustainable practices. They launched a global innovation hub to develop next-gen ingredients for healthier, low-carbon footprint products. This includes investing in alternative proteins and fiber-enriched baking solutions.

5. Uniferm GmbH & Co.

Uniferm, a specialist in sourdough bases and yeast, is expanding its portfolio of clean-label fermentation ingredients. Recent developments include new dry sourdough concentrates for consistent, long-lasting flavor and reduced acidification time. They are also focusing on gluten-free solutions and ingredients that support “free-from” label claims for industrial bakers.

Conclusion

Baking Ingredients are the quiet heroes powering a vibrant industry that mirrors shifting lifestyles and tastes. From quick home comforts to bold commercial innovations, these basics fuel endless creativity while adapting to demands for cleaner, more inclusive options. Expect a continued push toward natural, versatile blends that make baking accessible and exciting, strengthening connections between producers, bakers, and eager eaters in an ever-evolving food landscape.