Quick Navigation

Introduction

The global automotive plastics market is entering a transformative era, driven by rising demand for lightweight, durable, and sustainable vehicle components. As manufacturers prioritize efficiency, plastics continue to reshape modern automotive engineering. Additionally, ongoing innovations in polymer science support enhanced vehicle performance and environmental compliance.

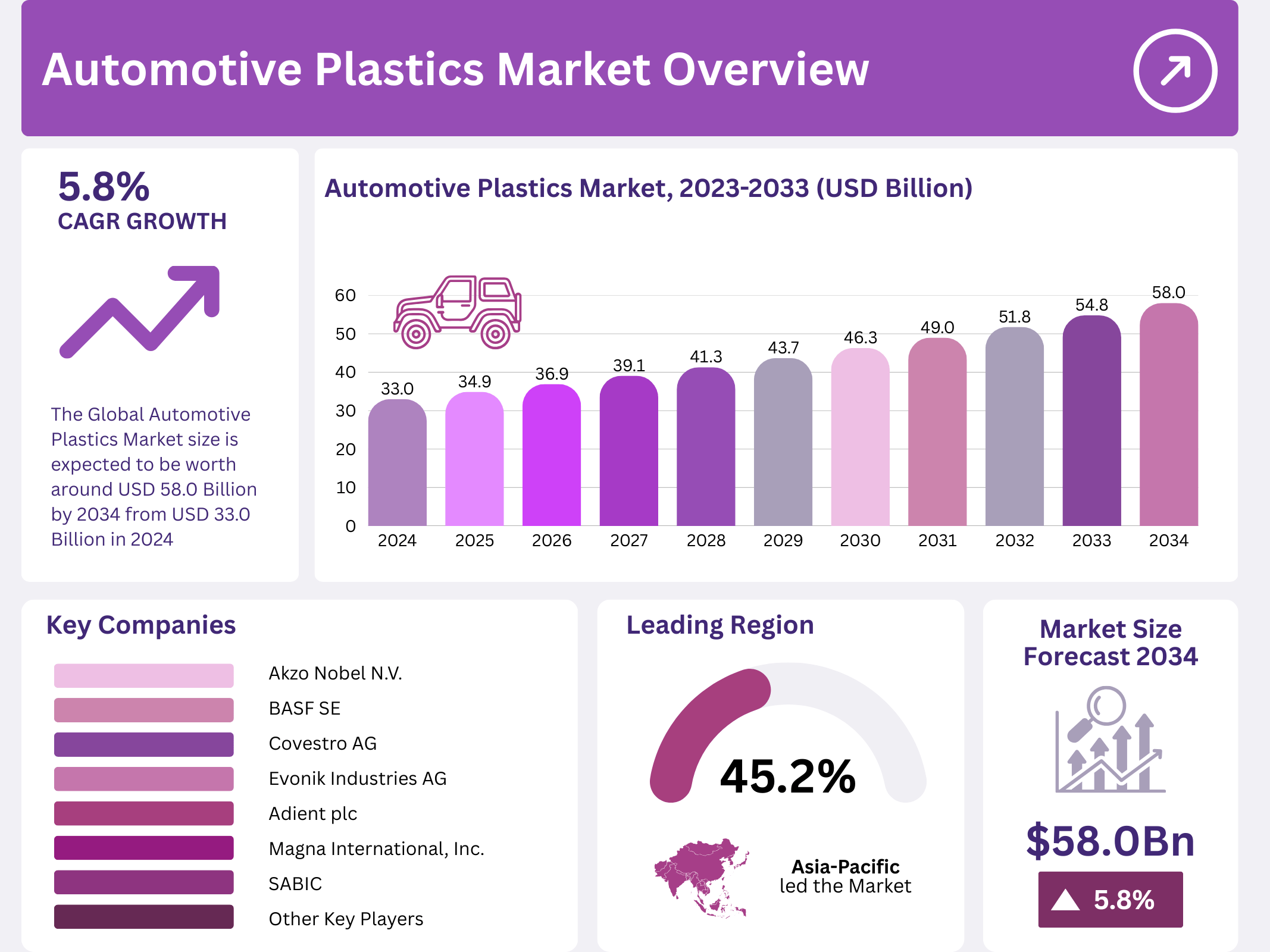

Moreover, the market is forecast to grow significantly, reaching USD 58.0 Billion by 2034 from USD 33.0 Billion in 2024. This upward trajectory is fueled by stricter emission norms, increased electric vehicle adoption, and consumer demand for high-performance materials. Furthermore, automakers are leveraging plastics to improve fuel efficiency and reduce production costs.

Simultaneously, key industry players are accelerating research into advanced and bio-based plastics, strengthening their competitive positions. As a result, the sector continues to expand with new applications across interior, exterior, and powertrain components. Consequently, automotive plastics are becoming indispensable to next-generation mobility solutions.

Transitioning forward, the market’s evolution aligns with global sustainability trends. Manufacturers are adopting recyclable materials and smart plastics, enabling improved lifecycle management. Therefore, automotive plastics remain central to innovation strategies across the automotive value chain.

Additionally, the shift toward electric and autonomous vehicles amplifies the importance of lightweight polymers. These materials help offset battery weight, enhance design flexibility, and support integration of advanced technologies. Overall, the automotive plastics market stands poised for sustained and dynamic growth.

Key Takeaways

- The Global Automotive Plastics Market is expected to grow from USD 33.0 billion in 2024 to USD 58.0 billion by 2034, at a CAGR of 5.8% during the forecast period.

- Polypropylene (PP) dominates the market with more than 33.1% share in 2024.

- Injection Molding captures over 53.9% of the market in 2024.

- Interior Furnishing holds more than 43.2% share in 2024.

- Passenger Cars represent over 39.3% of total market share in 2024.

- Asia Pacific leads the market with 45.2% share, valued at USD 14.9 billion in 2024.

Market Segmentation Overview

By Product Type

Polypropylene (PP) remains the leading material due to its cost efficiency, chemical resistance, and lightweight nature. Additionally, materials such as ABS, PU, PVC, and PC play essential roles across interior trims, structural components, and lighting systems, supporting enhanced durability and design flexibility.

By Process Type

Injection molding dominates production, offering accuracy and scalability for mass-manufactured automotive components. Meanwhile, blow molding and thermoforming continue to expand in applications requiring hollow structures and large-surface parts, contributing to manufacturing versatility.

By Application

Interior furnishing holds the largest segment share as automakers increasingly emphasize comfort, aesthetics, and safety. Furthermore, applications extend across powertrains, electrical systems, exteriors, and chassis components, showcasing plastics’ adaptability to demanding automotive environments.

By Vehicle Type

Passenger cars account for the highest plastics consumption due to extensive use in dashboards, bumpers, and interior panels. Additionally, electric vehicles (BEV, PHEV, FCEV) and commercial vehicles continue to adopt lightweight plastics to improve energy efficiency and payload capacity.

Drivers

Growing Demand for Lightweight Materials: Automakers worldwide seek solutions that reduce vehicle weight and improve fuel efficiency. Plastics replace heavier metals without compromising durability, enabling better emissions compliance and improved vehicle performance.

Rapid Electrification of Vehicles: Electric vehicles require lightweight materials to compensate for heavy battery systems. Plastics enhance energy efficiency, thermal management, and component integration, supporting broader EV adoption.

Use Cases

Advanced Interior Components: Plastics enable stylish, ergonomic, and durable interiors, supporting dashboards, seating systems, and trims with enhanced design flexibility and reduced cost.

Under-the-Hood Applications: Heat-resistant polymers such as nylon and PBT are widely used in engine covers, air intake manifolds, and electrical housings, ensuring long-term performance under extreme temperatures.

Major Challenges

Volatility in Raw Material Prices: As plastics are derived from petroleum, fluctuations in crude oil prices disrupt cost planning and affect overall supply chain stability, challenging manufacturers.

Environmental and Recycling Constraints: While plastics offer performance benefits, recycling complexities and disposal concerns create regulatory and sustainability challenges that require industry-wide innovations.

Business Opportunities

Adoption of Bio-Based Plastics: Growing sustainability mandates are accelerating demand for renewable materials. Bio-based plastics reduce carbon emissions and enhance circular economy initiatives across automaking.

Integration of Smart Plastics: Embedding sensors and functional features into plastic components opens opportunities for connected vehicles, enabling real-time monitoring, enhanced safety, and autonomous capabilities.

Regional Analysis

Asia Pacific: With strong automotive manufacturing hubs in China, Japan, and India, the region dominates global demand. Rapid industrialization, EV production expansion, and increasing lightweighting initiatives drive sustained growth.

Europe: Strict environmental regulations and a strong push toward recycled plastics fuel innovation in sustainable materials. European automakers continue adopting eco-friendly polymers to meet emission and circularity targets.

Recent Developments

- In March 2023, BASF introduced Ultramid® Deep Gloss, a high-gloss interior material first used in Toyota Prius mold-in-color components.

- In October 2024, Celanese showcased advanced engineered materials for EVs at the Battery Show in Detroit, emphasizing safety and sustainability.

- In 2025, Röchling Automotive and Mercedes-Benz introduced a lightweight thermoplastic rooftop beam for the CLE Cabrio, enhancing weight reduction and aesthetics.

- In 2024, GM and EVgo surpassed 2,000 public fast chargers across the U.S., accelerating EV infrastructure deployment.

- In 2024, OKE Group acquired Polymerica/Global Enterprises, expanding manufacturing capabilities across North America and Eastern Europe.

Conclusion

The global automotive plastics market is poised for strong growth as automakers increasingly prioritize lightweighting, sustainability, and advanced vehicle technologies. With rising EV adoption and continued innovations in polymer science, plastics will remain vital to future mobility solutions. By embracing bio-based materials, smart plastics, and efficient manufacturing processes, industry players can unlock new opportunities and strengthen their competitive edge in a rapidly evolving automotive landscape.