Quick Navigation

Introduction

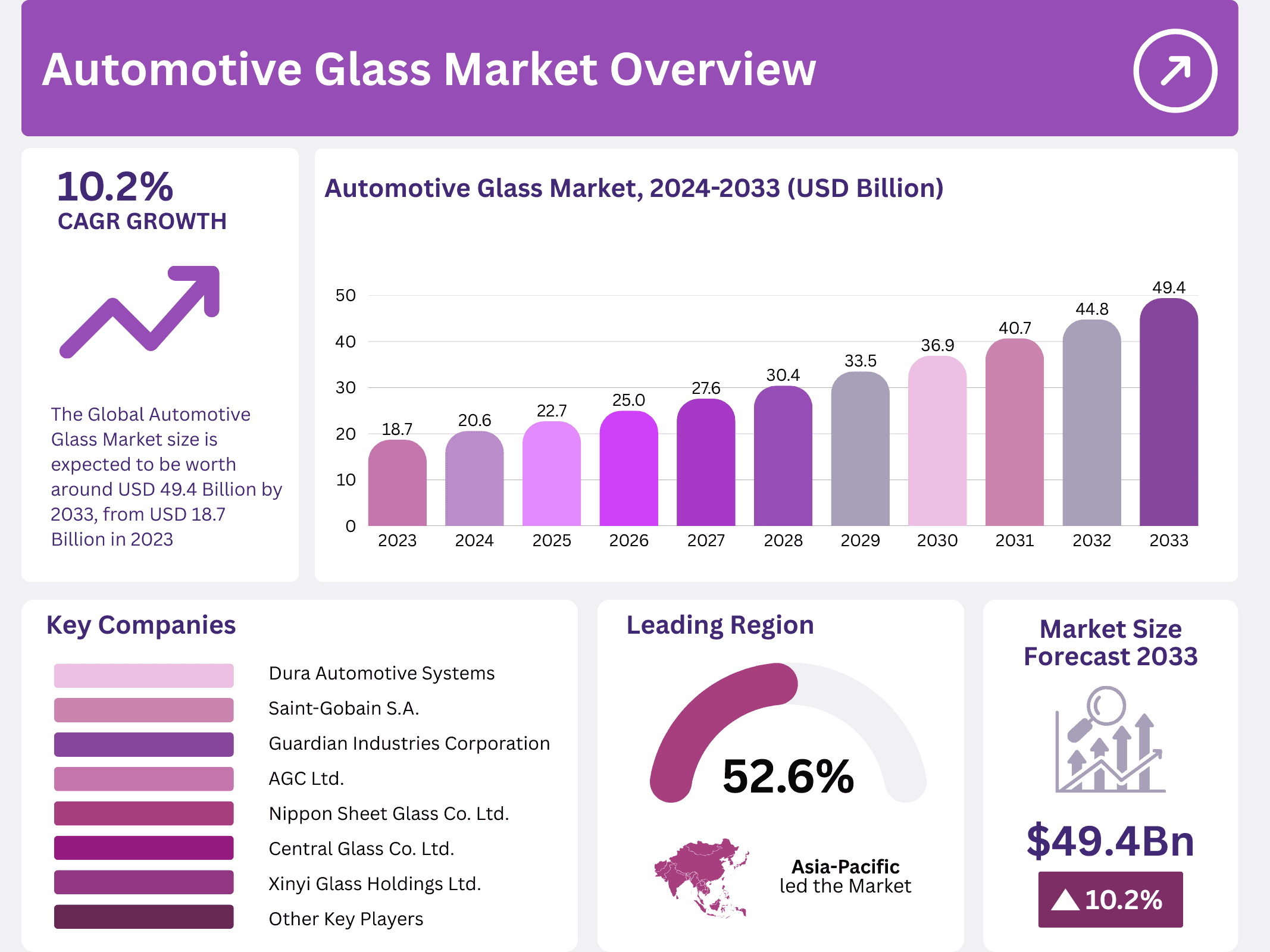

The global automotive glass market is entering a phase of accelerated transformation, driven by technological innovation, rising vehicle production, and evolving safety standards. Valued at USD 18.7 billion in 2023, the market is projected to reach approximately USD 49.4 billion by 2033, reflecting a strong compound annual growth rate of 10.2% over the forecast period.

Automotive glass plays a critical role in modern vehicle design, ensuring visibility, structural strength, and passenger protection. Windshields, side windows, rear windows, and sunroofs are no longer passive components. Instead, they are becoming active enablers of safety, comfort, and energy efficiency as vehicles integrate advanced electronics and sensor-based systems.

Moreover, the rising global vehicle fleet continues to fuel steady demand for automotive glass across both original equipment manufacturing and aftermarket replacement channels. According to international automotive bodies, over 1.4 billion vehicles are currently in operation worldwide, reinforcing the long-term replacement and servicing requirements for glass components.

In parallel, automakers are increasingly adopting advanced driver assistance systems and smart mobility technologies. As a result, automotive glass must now support cameras, LiDAR sensors, and heads-up displays, thereby elevating its functional complexity. This shift is redefining the role of glass suppliers within the automotive value chain.

Furthermore, electrification and sustainability initiatives are reshaping material selection and design priorities. Lightweight, energy-efficient, and recyclable glass solutions are becoming essential as manufacturers align with emission targets and consumer expectations. Consequently, automotive glass manufacturers are intensifying collaboration with automakers and technology providers.

Overall, the automotive glass market stands at the intersection of safety innovation, digital mobility, and sustainable transportation. With strong regional production bases and continuous technological advancement, the market is positioned for robust expansion throughout the next decade.

Key Takeaways

- The Automotive Glass Market was valued at USD 18.7 billion in 2023 and is projected to reach USD 49.4 billion by 2033, growing at a CAGR of 10.2%.

- In 2023, Tempered Glass dominated the glass type segment with a share of 60.1%.

- Windshields led application demand with a market share of 34.1% in 2023.

- Electrochromic Glass accounted for over 83% of the technology segment in 2023.

- Suspended Particle Device (SPD) Glass is projected to grow at the fastest CAGR of 15.0%.

- Asia Pacific dominated the market with a 52.6% share, generating USD 9.84 billion in revenue.

Market Segmentation Overview

The automotive glass market is segmented by glass type, with tempered and laminated glass representing the core categories. Tempered glass leads adoption due to its high strength and safety performance, particularly in side and rear windows. Meanwhile, laminated glass remains essential for windshields because of its shatter-resistant properties.

By application, windshields command the largest share as they are integral to vehicle safety, structural integrity, and ADAS integration. At the same time, sunroofs and backlite segments are expanding steadily, driven by rising consumer preference for comfort, aesthetics, and premium vehicle features.

From a technology perspective, electrochromic glass dominates owing to its adaptive light-control capability and energy-saving benefits. In contrast, SPD and liquid crystal glass are gaining momentum, particularly in luxury and high-end vehicle models where instant light modulation enhances passenger comfort.

Vehicle type segmentation shows passenger cars as the primary demand contributor, supported by high global production volumes. Light commercial and heavy commercial vehicles also represent stable demand, especially in logistics, public transport, and infrastructure-driven economies.

In terms of distribution, original equipment manufacturers account for the majority of installations, as glass is fitted during vehicle assembly. Nevertheless, the aftermarket replacement segment continues to grow steadily due to accidents, wear, and vehicle aging.

Drivers

The surge in global vehicle ownership remains a primary driver for the automotive glass market. With over 1.4 billion vehicles in use globally, demand for both factory-installed and replacement glass continues to rise steadily across developed and emerging economies.

Additionally, the rapid integration of advanced driver assistance systems significantly boosts demand for high-quality automotive glass. In the United States alone, more than 90% of new passenger vehicles sold in 2023 were equipped with ADAS features, increasing the need for sensor-compatible glass solutions.

Use Cases

Automotive glass is increasingly used as a platform for ADAS and heads-up display technologies. High-precision windshields now support camera calibration, augmented navigation, and real-time driving alerts, improving road safety and driver awareness.

Another major use case lies in electric and premium vehicles, where panoramic roofs and solar-control glass enhance cabin comfort and energy efficiency. These solutions help reduce interior heat buildup, thereby lowering air-conditioning load and improving driving range.

Major Challenges

The high cost associated with advanced automotive glass production presents a notable challenge. Manufacturing laminated, tempered, and smart glass requires specialized equipment and processes, resulting in higher production and installation expenses.

Moreover, regulatory compliance across regions creates operational complexity. Automotive glass manufacturers must meet varying safety, environmental, and performance standards, which increases certification costs and extends product development timelines.

Business Opportunities

The rapid expansion of the electric vehicle segment offers strong growth opportunities. EVs frequently incorporate larger glass surfaces, such as panoramic roofs, creating increased demand for lightweight and thermally efficient automotive glass solutions.

Additionally, rising demand for aftermarket replacement and customization services opens new revenue streams. As the global vehicle fleet ages, opportunities for advanced replacement glass, including smart and solar-control variants, continue to expand.

Regional Analysis

Asia Pacific leads the global automotive glass market with a share of 52.6%, supported by large-scale vehicle production in China, Japan, and India. The region’s cost-efficient manufacturing base and growing EV adoption further strengthen its market position.

Meanwhile, North America and Europe remain significant markets due to strict safety regulations and high demand for premium vehicles. Strong research capabilities and early adoption of smart glass technologies continue to support steady regional growth.

Recent Developments

- In September 2024, PGW Auto Glass acquired PH Vitres d’Autos to expand its footprint in Eastern Canada.

- In June 2024, Asahi India Glass announced plans to expand laminated and tempered glass capacity to 10 million units by 2028.

- In July 2024, Saint-Gobain expanded its windshield recycling program across Europe to support circular economy initiatives.

- In June 2024, Borealis launched a glass-fiber reinforced polypropylene with 65% recycled content for automotive applications.

Conclusion

The global automotive glass market is evolving rapidly as vehicles become safer, smarter, and more energy-efficient. Supported by rising vehicle ownership, ADAS integration, and electrification trends, the market is set for sustained long-term growth. Manufacturers that invest in innovation, sustainability, and strategic partnerships are well-positioned to capitalize on emerging opportunities and shape the future of automotive mobility.