Quick Navigation

Overview

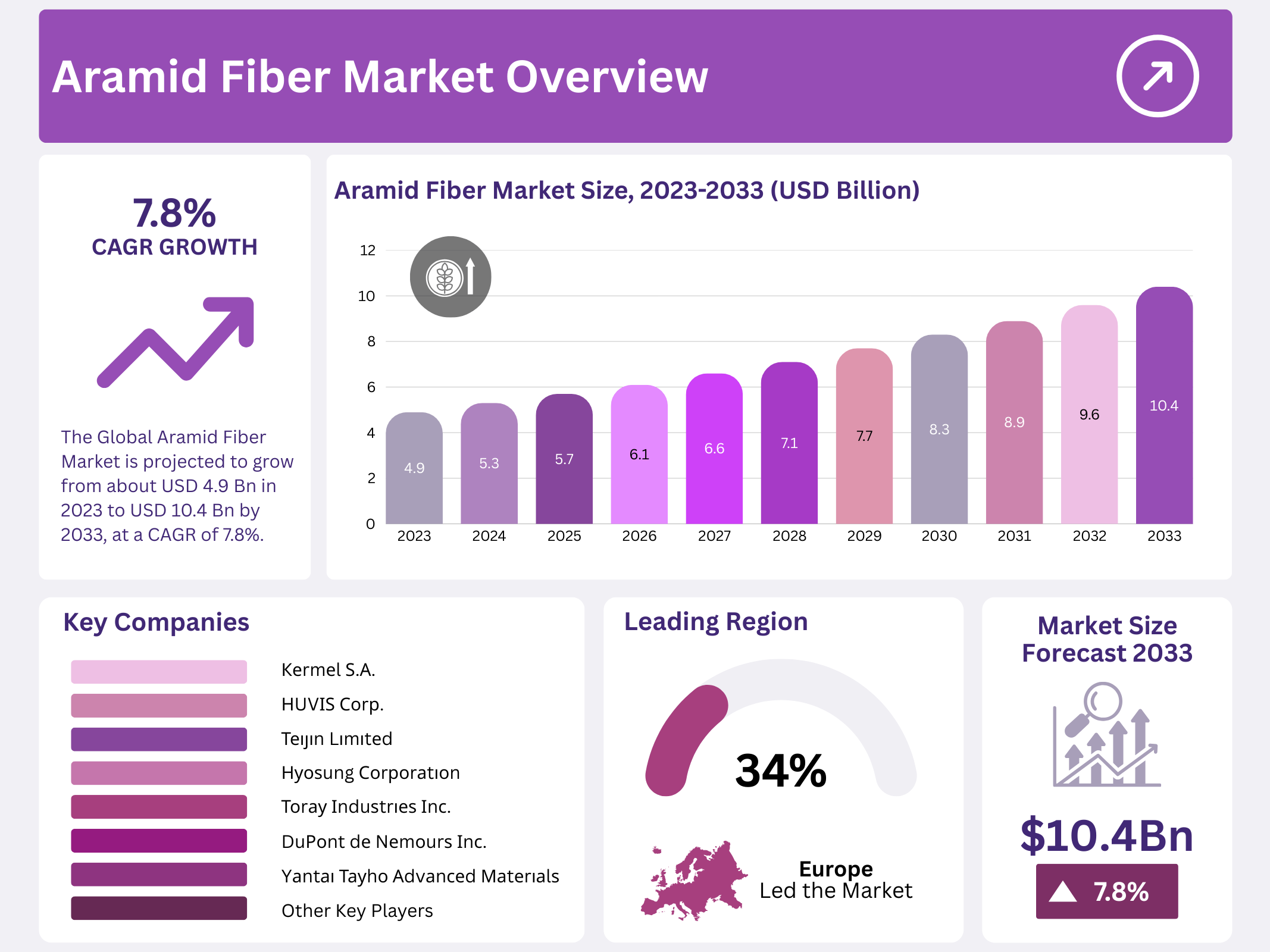

New York, NY – December 22, 2025 – The Global Aramid Fiber Market is projected to see strong long-term growth over the coming decade. Market value is expected to reach around USD 10.4 billion by 2033, up from approximately USD 4.9 billion in 2023. This steady expansion reflects the increasing importance of high-performance materials across multiple industrial applications.

During the forecast period from 2023 to 2033, the market is anticipated to grow at a healthy CAGR of 7.8%. Aramid fibers are valued for their exceptional strength, heat resistance, and durability, making them suitable for demanding environments where safety and performance are critical.

Market growth is mainly driven by rising demand from industries such as oil and gas, manufacturing, and healthcare. In oil and gas, aramid fibers are used for protective clothing and reinforcement materials, while manufacturing relies on them for lightweight and high-strength components. In healthcare, their use in protective gear and medical equipment further supports sustained market expansion.

Key Takeaways

- The Global Aramid Fiber Market is projected to grow from about USD 4.9 billion in 2023 to USD 10.4 billion by 2033, at a CAGR of 7.8%.

- Para-aramid products dominate the market, expected to hold around 75.1% revenue share from 2023 to 2032, thanks to superior strength and tensile properties.

- The Security and Protection segment leads the market with a 35.5% revenue share from 2023 to 2032, driven by demand for bullet-resistant and protective gear.

- Europe’s aramid fiber market is set to grow at a rate of about 34.9%, fueled by infrastructure projects and strict worker safety regulations.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 4.9 Billion |

| Forecast Revenue (2033) | USD 10.4 Billion |

| CAGR (2024-2033) | 7.8% |

| Segments Covered | By Crust Type (Thin Crust, Thick Crust, Stuffed, Others), By Type (Non-Veg, Veg), By Toppings (Meat, Vegetables, Cheese, Others), By Size (Large, Regular, Extra-large), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others) |

| Competitive Landscape | DuРоnt dе Nеmоurѕ Іnс., Yаntаі Тауhо Аdvаnсеd Маtеrіаlѕ Со. Ltd, Теіјіn Lіmіtеd, Нуоѕung Соrроrаtіоn, Тоrау Іnduѕtrіеѕ Іnс. (Тоrау Сhеmісаlѕ Ѕоuth Коrеа Іnс.), Кеrmеl Ѕ.А., Коlоn Іnduѕtrіеѕ, НUVІЅ Соrр., Other Key Players |

Key Market Segments

Product Analysis

Para-aramid products held a dominant position in the aramid fiber market in 2021 and are expected to account for a revenue share of about 75.1% during the period from 2023 to 2032. Growth of this segment is supported by the material’s excellent strength-to-weight ratio, high modulus behavior, and superior tensile strength, which make it highly suitable for demanding industrial applications.

Para-aramid fibers offer outstanding ballistic performance, supported by low elongation at break, strong chemical resistance, and excellent heat and flame resistance. These properties are expected to drive demand over the forecast period. In addition, high cut resistance and durability have increased their use across aerospace, security, personal protection, and friction material applications, further supporting segment expansion.

Meta-aramid fiber is typically produced using wet spinning technology, where fibers are spun in a chemical solution to form semi-crystalline structures. These fibers can withstand extreme tensile stress and temperatures reaching up to 400°C, even under flame exposure. As a result, meta-aramid fibers are widely used in high-temperature environments, including industrial protective clothing and thermal insulation applications.

Application Analysis

The Security and Protection segment accounted for the largest share of the aramid fiber market and is expected to grow at a revenue-based rate of around 35.5% from 2023 to 2032. This growth is driven by rising demand for bullet-resistant body armor, protective apparel, and stab-resistant products such as helmets and gloves across defense and law enforcement sectors.

In the aerospace industry, aramid fibers are increasingly used in critical components such as wing structures, landing gear doors, fuselage sections, and leading and trailing edge panels. High adoption is supported by the material’s superior strength, impact resistance, and lightweight characteristics, which help improve fuel efficiency and structural performance.

Aramid fibers are also widely used as a safer alternative to asbestos in sealing and friction products. They are commonly applied in brake pads, clutch plates, high-temperature hoses, gaskets, and seals. Growing demand for durable, heat-resistant, and environmentally safer materials is expected to support continued market growth in these applications over the forecast period.

Regional Analysis

The European aramid fiber market is expected to grow at a revenue-based rate of around 34.9%. This growth is mainly supported by a rising number of renovation and infrastructure upgrade projects across the region, along with strict regulations focused on improving worker safety in industrial environments. Strong enforcement of occupational safety standards continues to encourage the use of high-performance protective materials.

Increasing geopolitical tensions are also creating new growth opportunities for aramid fiber, as military spending continues to rise in major economies such as China and India. Alongside defense investments, expanding construction, manufacturing, and healthcare activities are expected to further boost product demand during the forecast period, particularly for protective and reinforcement applications.

In North America, demand is expected to be supported by safety standards set by the American National Standards Institute (ANSI). These standards emphasize the use of certified personal protective equipment, including gloves, helmets, and protective clothing. Compliance with such regulations is likely to remain a key driver for aramid fiber adoption, contributing positively to market growth in the region.

Top Use Cases

Protective Clothing and Gear:

- Aramid fiber is widely used in making bulletproof vests, helmets, and gloves for police and military personnel due to its high strength and resistance to impacts. It also appears in firefighting suits that withstand extreme heat and flames, providing essential safety for workers in hazardous environments like oil rigs or chemical plants.

Aerospace Components:

- In the aerospace industry, aramid fiber reinforces aircraft parts such as wings, fuselages, and engine components because of its lightweight nature and ability to handle high stress without breaking. This helps improve fuel efficiency and durability in planes and spacecraft, making flights safer and more reliable.

Automotive Applications:

- Aramid fiber strengthens tires, belts, and hoses in vehicles, offering better resistance to wear and heat from high-speed driving. It’s also used in brake pads and body panels to reduce weight while maintaining toughness, leading to vehicles that perform better and last longer on the road.

Marine Equipment:

- For marine uses, aramid fiber is ideal for ropes, sails, and hull reinforcements on boats and ships, as it resists corrosion from saltwater and provides strong tensile strength against waves and winds. This enhances the safety and longevity of vessels in commercial fishing or yachting activities.

Construction and Infrastructure

- Aramid fiber composites are applied in building bridges, buildings, and seismic reinforcements to boost resistance against earthquakes, fires, and corrosion. This makes structures more resilient in harsh weather or disaster-prone areas, supporting long-term stability and reducing maintenance needs over time.

Recent Developments

1. DuPont de Nemours Inc.

DuPont continues to focus on innovation and sustainability for its Kevlar aramid fiber. Recent developments include advancements in lightweight, high-strength materials for electric vehicle battery protection and personal armor. The company is also investing in circular economy initiatives, exploring recycling technologies to process aramid fiber waste and reduce environmental impact.

2. Yantai Tayho Advanced Materials Co., Ltd

As China’s leading aramid producer, Tayho is aggressively expanding capacity. The company completed a major expansion of its para-aramid (Technora-type) production lines in 2023, significantly increasing its global market share. It is also developing new applications in optical fiber cables, automotive hoses, and protective textiles to meet growing domestic and international demand.

3. Teijin Limited

Teijin has launched new, sustainable aramid products under its Twaron brand. Key developments include the introduction of “Twaron Carbon Neutral” fibers and ultra-lightweight, high-tenacity yarns for next-generation composite materials. The company is also enhancing its recycling system, converting used aramid into materials for automotive and electronics applications to support a circular economy.

4. Hyosung Corporation

Hyosung is a key player with its “Teron” para-aramid brand. Recent news highlights a major capacity expansion in South Korea, aiming to double production by 2025 to capture more of the global tire cord and industrial materials market. The company is also researching advanced aramid nanofibers for high-tech applications in energy and electronics.

5. Toray Industries Inc. (Toray Chemicals Korea Inc.)

Toray advances its “HM-aramid” meta-aramid fiber, focusing on high-temperature filtration and safety apparel. Recent developments include new fiber grades with enhanced flame resistance and durability for industrial workwear. The company is also innovating in hybrid materials, combining aramid with other high-performance fibers for specialized protective gear and aerospace components.

Conclusion

Aramid Fiber is a versatile material driving innovation across multiple industries by combining strength, lightness, and durability. Its growing adoption in safety gear, transportation, and infrastructure highlights its potential to meet rising demands for advanced, reliable solutions in a world focused on efficiency and protection.